Tariff Turbulence: SCOTUS Invalidates IEEPA Powers for Imposing Global Tariffs

In a 6-3 decision released on February 20, 2026, the U.S. Supreme Court issued a landmark decision in Learning Resources Inc. v. Trump (consolidated with Trump v. V.O.S. Selections Inc.) ruling that President Trump does not have the authority to use the International Emergency Economic Powers Act (IEEPA) of 1977 to impose sweeping global tariffs. The Court held that IEEPA, intended for national emergencies, does not grant the president the power to set taxes or duties without explicit congressional approval. The Court affirmed the Federal Circuit decision, which affirmed, in part, the Court of International Trade decision.

The Supreme Court’s decision effectively restrains presidential trade powers, creating significant uncertainty for global business models and ongoing negotiations as the administration explores alternative measures. Companies should prepare for a rapidly shifting trade landscape and monitor for administrative or legislative responses. This alert summarizes the key takeaways from the Court’s finding and outlines practical considerations for companies.

Key Aspects of the Ruling

- IEEPA’s Grant of Authority: The Court struck down the drug trafficking tariffs applicable to certain countries and the "reciprocal” tariffs that had been applied to nearly all U.S. trading partners. The majority opinion, written by Chief Justice John Roberts, stated that IEEPA’s grant of authority to "regulate... importation" does not include the power to impose tariffs or taxes.

- Constitutional Limits: Tariffs are treated as taxes under Article 1, requiring clear congressional authorization.

- Applicability: The Supreme Court did not attempt to limit its decision by applying it only prospectively, which could create a refund opportunity for importers.

Refunds: What We Know and What’s Uncertain

- Refund Process: The mechanics of refund procedures will likely be determined by the Court of International Trade (CIT).

- Potential Exposure: Public reporting suggests the government’s refund liability could range from $150 billion to as high as $1 trillion.

- Administrative Challenges: The CIT, in a December 15, 2025 decision, confirmed that it “has ‘the explicit power to order reliquidation and refunds where the government has unlawfully exacted duties.’” That is important because upon liquidation—the final determination of duties by U.S. Customs and Border Protection—importers have a limited amount of time to file a protest. Subsequently, the CIT stayed proceedings for any cases that were unassigned or filed after December 23, 2025, until the Supreme Court’s decision.

A&M Insight: Because retroactivity remains unresolved, companies will likely need to (or plan to) affirmatively file refund claims with the CIT rather than expect automatic refunds. Companies should begin compiling documentation of tariff payments immediately. However, the prospect of refunds raises another layer of complexity: many companies passed some or all of these tariffs on to customers. If refunds are issued, will companies be obligated, or pressured, to share them? Will customers then seek refunds from suppliers or retailers or potentially file class action litigation claims? This raises questions about allocation across supply chains and could create significant administrative headaches, especially where multiple tiers of suppliers and customers are involved.

Administration’s Response Anticipated

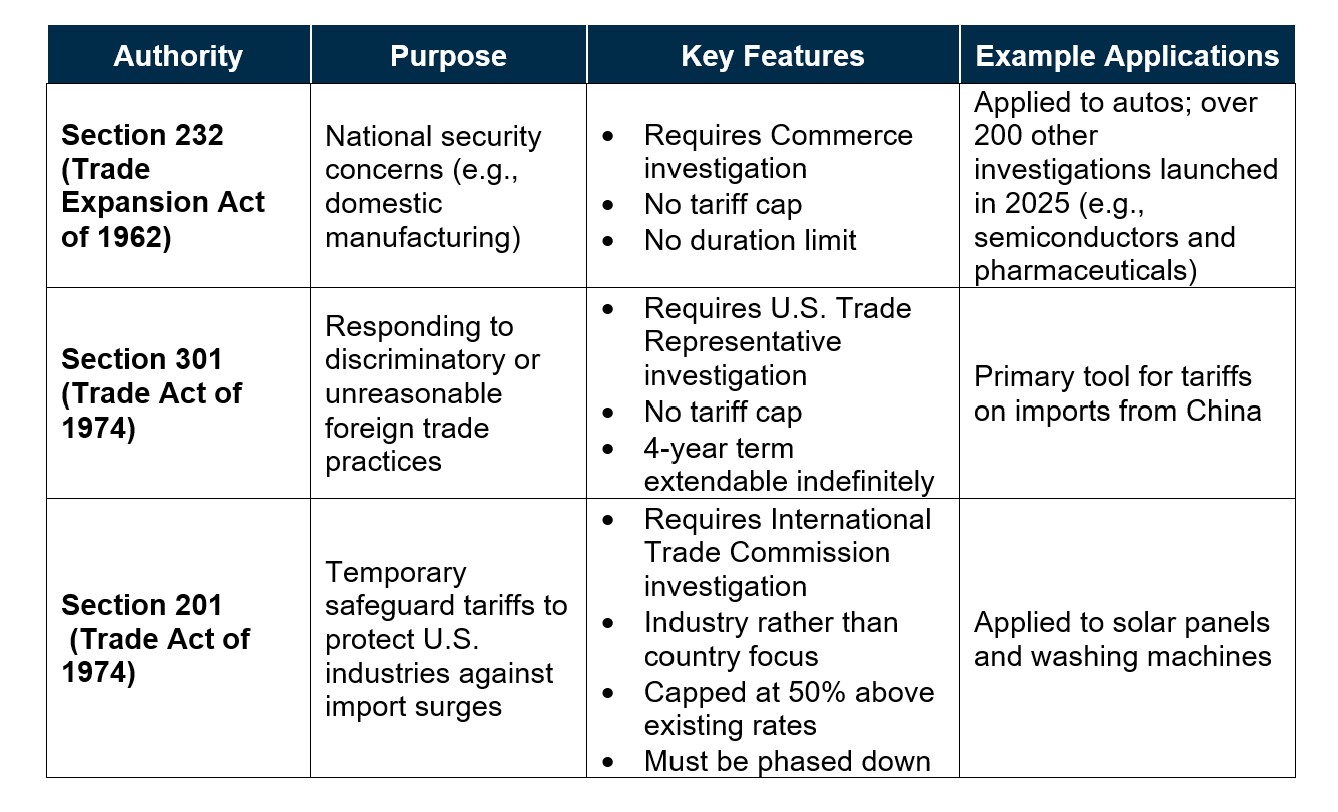

Prior to the Supreme Court’s decision, the administration signaled that it would move quickly to replace the IEEPA tariffs in the event the Court held for the plaintiffs. While the precise mechanism remains unclear, various statutory provisions are available including:

In addition, the President could impose temporary tariffs without an investigation—capped at 15% and limited to 150 days—to address “international payments problems” under Section 122 of the Trade Act of 1974.

A&M Insight: The administration’s response may in part be dependent on the status of formal trade investigations, which are not publicly released. This creates great uncertainty around both timing and scope for replacing the IEEPA tariffs. Businesses should anticipate that any new tariffs could be limited, such as to specific products or targeted at certain countries, and incorporate this uncertainty into supply chain planning and monitor developments.

In late breaking news today, President Trump announced that he will impose 10% “global” tariffs under Section 122 of the Trade Act of 1974.

A&M Tax Says

The Court’s decision marks a pivotal shift in U.S. tariff authority, reinforcing the separation of powers. However, it leaves the business community facing profound uncertainty—particularly regarding potential refunds and alternative tariff measures. The Court’s decision will probably not affect the recently negotiated trade agreements with other countries, recognizing that tariffs may be imposed under other statutes.

Companies should prepare for complex administrative challenges, possible litigation over refund allocation, and evolving regulatory responses. Strategies adopted to mitigate IEEPA tariffs—such as nearshoring, supply chain diversification, and the use of free trade zones (FTZs) and bonded warehouses—should be reassessed. Proactive scenario planning is essential as the administration will respond to the Court’s opinion, and close monitoring of legislative and administrative developments will be critical.

A&M’s integrated multi-dimensional trade and tax team is ready to help you navigate these turbulent times and plan strategically, whether you are assessing refund opportunities, re-evaluating historic tariff reducing strategies, or looking to develop new strategies to address this evolving landscape.