Payday Super

What Is Payday Super?

Under the current Superannuation Guarantee ("SG") regime, employers can make super contributions on a quarterly basis. Payday Super will change that. Starting 1 July 2026, employers will be required to pay SG contributions at the same time as salary or wages are paid — or no later than seven business days thereafter. There are very few exceptions to this seven-day rule, one limited exception being for new employees.

This reform is designed to:

- Minimise unpaid superannuation

- Increase transparency

- Support better retirement outcomes for Australian workers

The Treasury Laws Amendment (Payday Superannuation) Bill 2025 and the Superannuation Guarantee Charge Amendment Bill 2025 (collectively hereafter referred to as “the Bills”) received Royal Assent on November 6, 2025.

The Bills instruct the implementation of Payday Super from 1 July 2026. In parallel, the Australian Taxation Office (ATO) released Draft Practical Compliance Guideline (PCG) 2025/D5, outlining the risk-based approach it will take when allocating compliance resources during the regime’s first year.

A&M has followed the progression of the Payday Super legislation through the Australian Parliament and has released several thought leadership articles providing additional insights. For a more detailed discussion on Payday Super, please see our article Payday Super – Everything You Need to Know and our update Payday Super Receives Royal Assent.

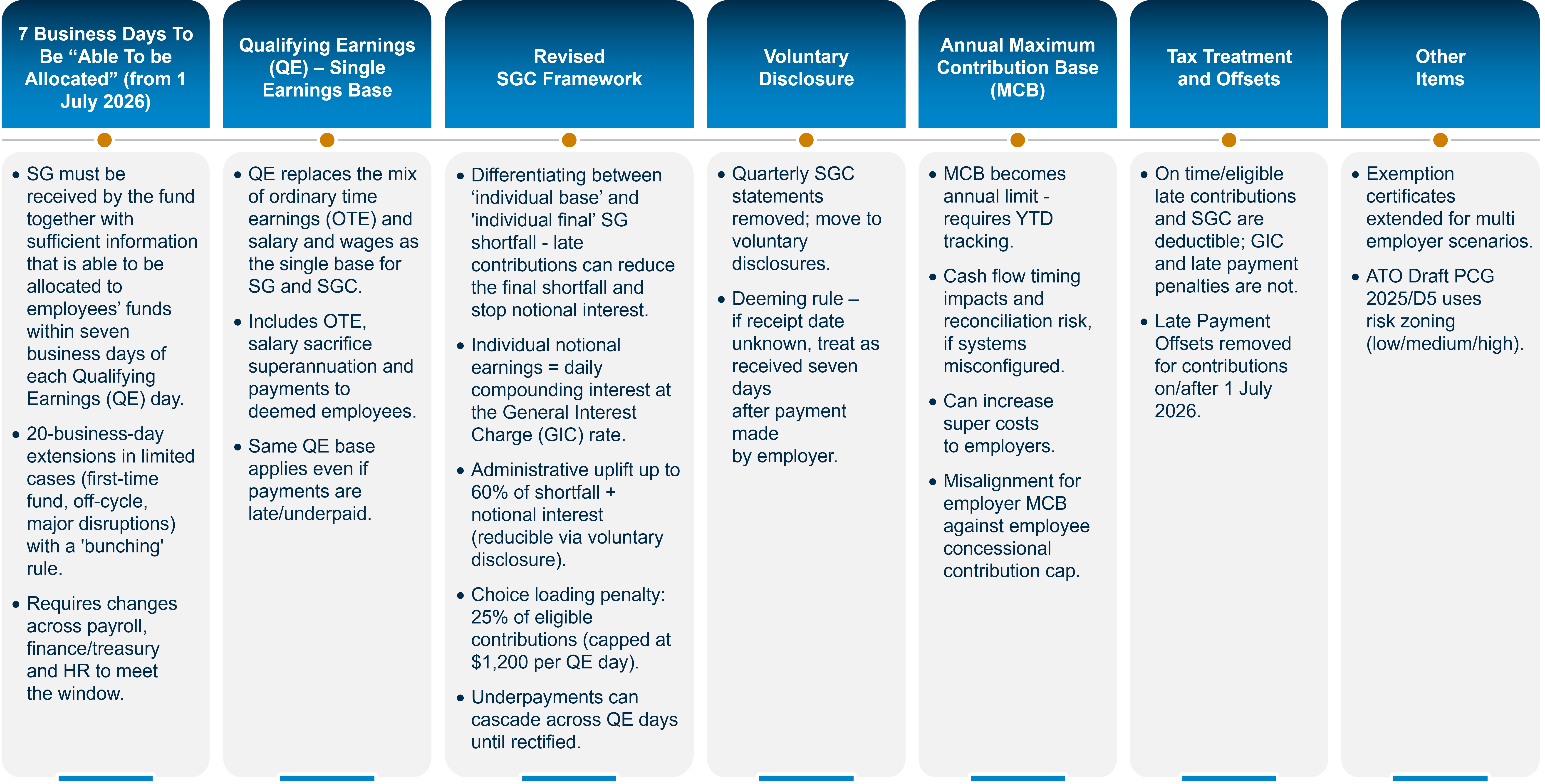

Summary of Key Changes

The changes to payday super are complex and wide-ranging. The following diagram summarises key changes you should be aware of:

For most employers, the key change will be ensuring superannuation contributions are able to be allocated within seven business days of the relevant qualifying earnings day. Achieving this requires careful planning and strong stakeholder alignment across the business, to ensure the end-to-end transition - from planning through implementation, and then ongoing monitoring and compliance - is executed effectively.

Payday Super - Key Considerations

The Payday Super – Key Considerations wheel outlines the key areas employers should assess as they transition to Payday Super. It helps stakeholders identify what will change, where risks may arise, and what actions are required to support a smooth and compliant transition.

Payday super will require improved payroll processes. Specific factors to consider and flag include:

- Consideration of current timeframe for payment “able to be allocated”

- Manual processes (can these be automated?)

- Treatment of bonus cycle/out of cycle payments

- Current pay cycle frequency

- Current bounce-back processes

- Current process for ATO voluntary disclosures (noting this will change on 1 July)

Payday super will require coordination with stakeholders, such as payroll software providers and even clearing houses. Specific factors to consider include:

- Current SLAs with clearing houses

- Dependencies and timelines with external payroll providers

Getting super paid correctly from day one requires good onboarding practices. Consider current onboarding procedures for:

- Employees

- Contractors

- High-income earners: especially with the MCB changes and if an exemption certificate may be required.

Take the time to compare the definitions of ‘qualifying earnings’ and ‘ordinary time earnings’ and see if the pay code configuration on source systems is correct.

Payday super will also require some changes to STP reporting, as QE is now the base of calculation.

Payday super affects every employer and almost every employee. Keep them up to date in this transitional period between now and 1 July, especially if they want to make changes to their superannuation account. Also consider:

- Special communications for employees affected by the MCB change

- Communications relating to bonuses/commissions and how the MCB could affect that.

Contractors represent hidden and often unknown risk to a business. Ensure that contractors are onboarded promptly and that the internal finance/tax team has a position on whether superannuation is payable for their services.

Underpinning each of these key considerations is governance and technology. Employers will need integrated and automated payroll-to-payment processes to ensure superannuation is calculated accurately each pay cycle, exceptions are appropriately managed, and contributions are funded and paid on time. Clear governance (including defined roles, controls, approvals, reconciliations, and monitoring) is critical to maintain auditability, manage vendor and process-change risk, and demonstrate ongoing compliance as organisations transition to more frequent superannuation payments.

What should employers do to prepare for this change?

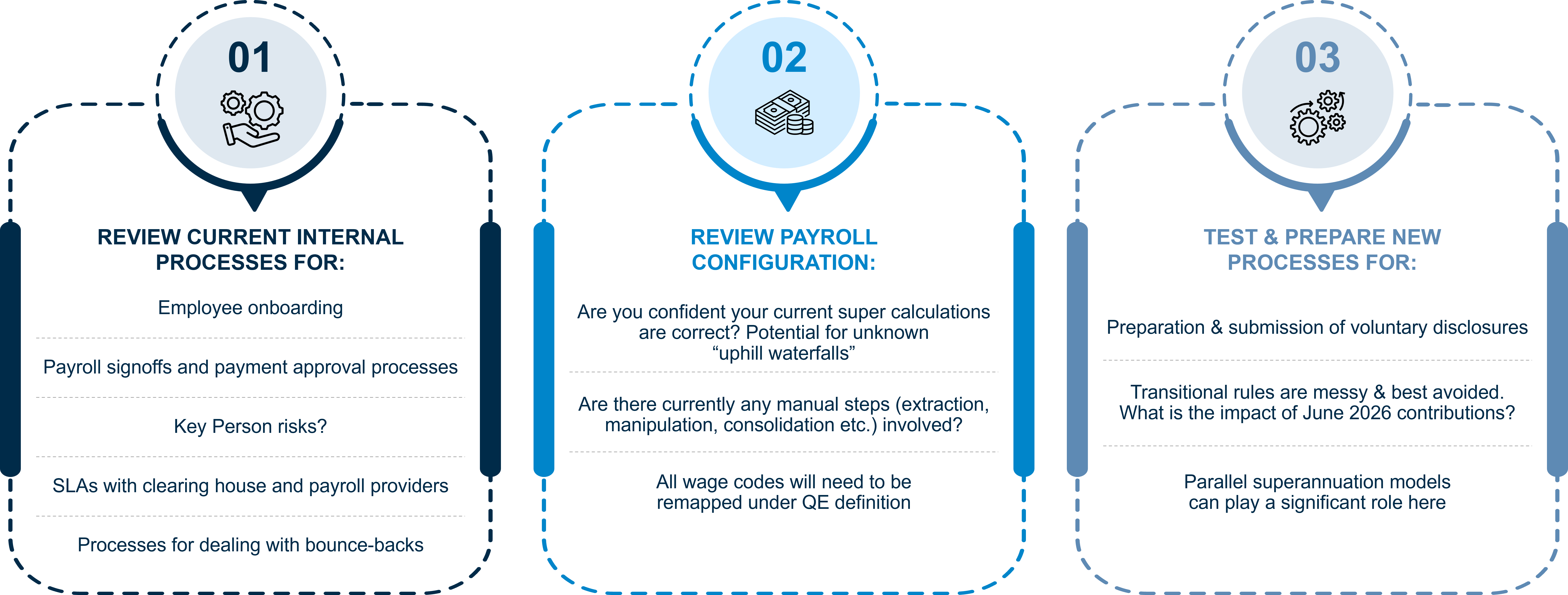

Payday Super is only a few months away, and employers should begin reviewing and updating their payroll systems, end-to-end processes and approval controls now. Taking action early will help ensure compliance with the new payment timing requirements and provide time to identify and remediate any historical shortfalls - reducing the risk of exposure under the revised Superannuation Guarantee Charge (SGC) framework. Employers should already be thinking about these three areas: