Alpha Beneath the Asphalt: Tapping Into Underground Water Infrastructure’s Trillion Dollar Opportunity

Introduction

North America's underground water infrastructure, which includes drinking water, wastewater, and stormwater systems, is entering a sustained, multi-decade renewal cycle. This is largely driven by aging assets, regulatory pressure, climate resilience requirements, and years of deferred maintenance. While historic funding programs from federal and provincial governments are accelerating near-term capital deployment, a persistent funding gap of hundreds of billions of dollars means that renewal activity will extend well beyond current policy cycles. Against this backdrop, customers (utilities) are increasingly adopting cost-efficient and low-disruption rehabilitation over full replacements, which is expanding the role of trenchless and specialized service providers. For private equity and infrastructure investors, the market presents a unique mix of steady and predictable cash flows, visible near-term growth prospects, and attractive platform-building and consolidation opportunities across a fragmented landscape.

Key Drivers of Sustained Demand in North America

The fundamental demand drivers of underground water infrastructure, namely, aging infrastructure, regulatory and public health pressure, and climate resilience, are consistent across the US and Canada.

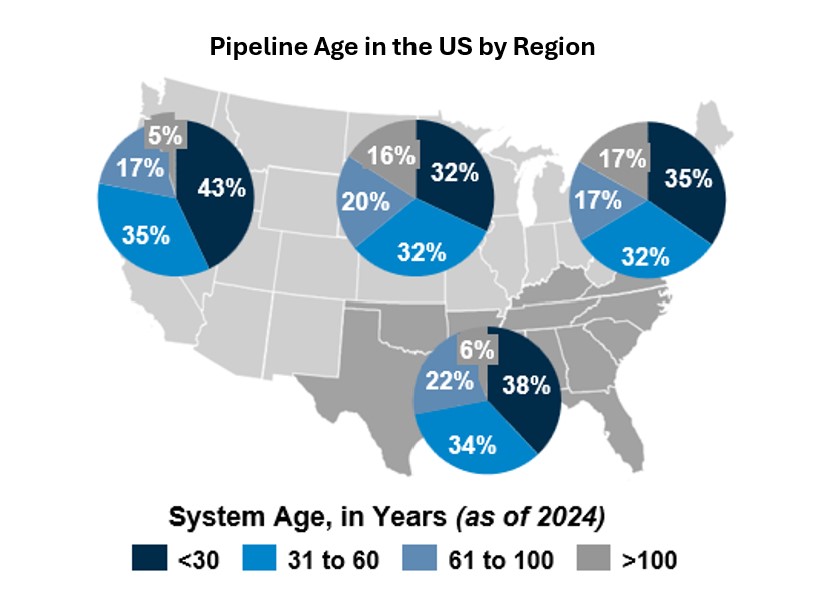

Aging Infrastructure – A substantial share of North America’s buried water and wastewater systems are operating close to or beyond original design life. In the US, the average age of pipes is over 45 years, with large segments of networks in both countries exceeding 60 to 100 years. Increasing break rates, leaks, and service disruptions are pushing utilities to move from reactive repairs to planned rehabilitation and replacement.

Regulatory and Public Health Pressure – Increasing scrutiny and tighter standards, including mandates for replacing lead service lines, emerging PFAS standards, and limits on wastewater discharge, are forcing utilities to modernize assets and enhance their monitoring and treatment capabilities.

Climate Resilience – With increasing flood risk and more frequent extreme weather events, the need for resilient, adaptable underground water infrastructure, particularly stormwater and sewer systems, is growing.

Public Infrastructure Funding Tailwinds Anchoring Near-Term Demand

The US is currently experiencing the largest funding cycle for water infrastructure in its history. The Infrastructure Investment and Jobs Act (IIJA) commits around $83 billion for drinking water, wastewater, and stormwater systems over several years. Added support from the Inflation Reduction Act and State Revolving Fund programs further enhances the visibility for near-term demand, particularly in aging urban centers and climate-stressed regions.

In Canada, the national infrastructure renewal needs are estimated to be between C$150 billion and C$190 billion over the next decade, with drinking water and wastewater taking up the biggest share. Federal programs such as the Investing in Canada Infrastructure Program (ICIP) and the C$2 billion Clean Water and Wastewater Fund (CWWF) are accelerating investments in rehabilitation, modernization, and compliance across municipalities.

For investors, these initiatives establish multi-year backlogs, reduce volume volatility, and provide strong confidence for achieving near-term revenue growth.

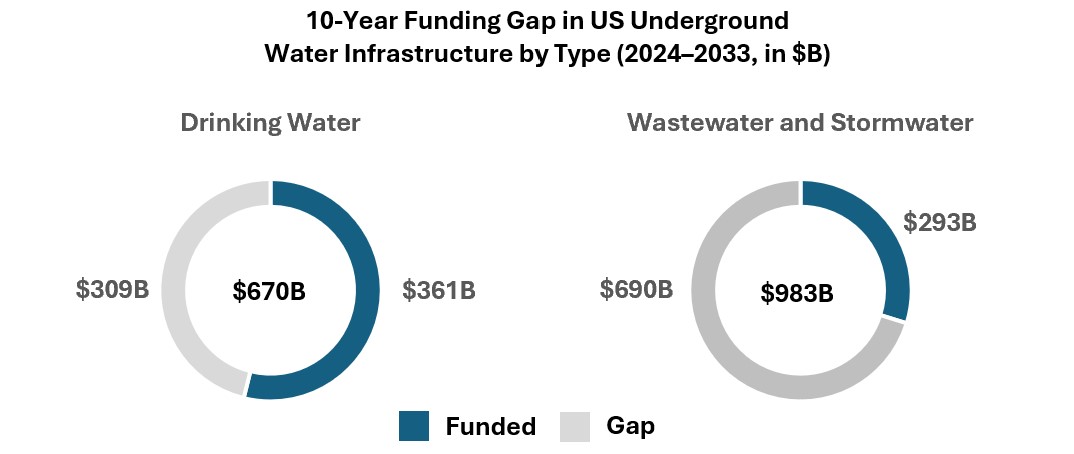

The Funding Gap: A Persistent Shortfall That Extends the Runway

Despite unprecedented public investment, underground infrastructure renewal needs in both countries continue to exceed the available funding by hundreds of billions of dollars. This ongoing shortfall:

- Extends the demand runway well beyond current federal funding cycles

- Accelerates the shift toward cost-efficient trenchless rehabilitation solutions (e.g., CIPP, sliplining, geopolymer) over full pipe replacement, as utilities seek to stretch limited capital

- Increases reliance on scaled, highly efficient and technologically advanced contractors

Market Characteristics Similar to Core Infrastructure

The rehabilitation of underground water infrastructure shares several key traits with core infrastructure assets:

Stable, Predictable Cash Flows (Noncyclical) – Water systems are mission-critical to public health, safety, and economic activity. Therefore, the demand for rehabilitation is nondiscretionary and largely insulated from economic cycles. Revenue streams for service providers are typically governed by contract-driven, multi-year municipal agreements, ensuring recurring income visibility.

High Barriers to Entry – Municipalities prioritize vendors with proven track records across technical capability, reliability, and safety. Competitive bids often require prequalifications, years of relevant experience and reference projects, certified teams, bonding capacity, and demonstrated quality assurance/quality control performance, which effectively restrict new entrants and reinforce incumbent advantages.

Downside Protection – Demand is shaped by structural factors such as asset age, regulatory requirements, population growth, and climate-related stresses. The essential nature of services makes rehabilitation programs highly resilient during economic downturns, providing recession-resistant demand.

Long-Term Renewal Cycles – Utilities are increasingly adopting long-term renewal strategies, usually rehabilitating or replacing 1%–2% of their network each year, which creates annuity-like pipelines for contractors. Service providers benefit from long-term rehabilitation cycles and recurring inspection requirements.

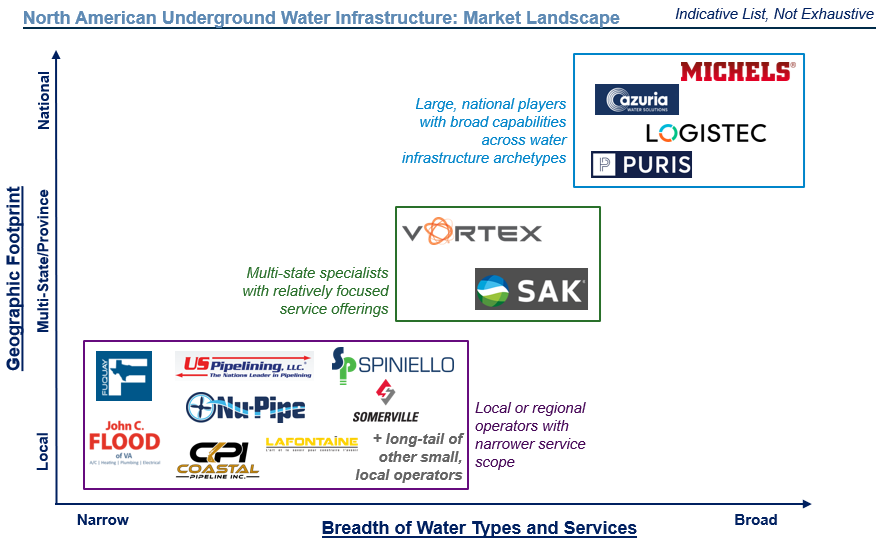

Market Landscape: Fragmentation Creates Consolidation Potential

The North American underground water infrastructure services market is highly fragmented, with only a handful of national platforms. Most operators are regional, focused on specific services, and limited in scale and technical breadth.

At the same time, customers increasingly seek providers who can deliver end-to-end, low-disruption, fully compliant renewal programs, particularly in dense urban settings. This is driving:

- Technology-enabled differentiation including accelerated adoption of trenchless rehabilitation methods such as CIPP and sliplining

- Material-driven advantages, where expertise in composite, HDPE, and geopolymer systems improve asset life, sustainability outcomes, and regulatory compliance

- A broader “pick-and-shovel” value chain opportunity across materials, equipment rental, robotics, and monitoring technologies

Value Creation Opportunities for Private Equity Investors

Private equity firms can unlock meaningful value through multiple levers:

Buy-and-Build Consolidation – The fragmented contractor landscape enables private equity sponsors to roll up complementary regional players into scaled multi-state platforms with stronger bidding capacities, brand recognition, and operational efficiencies.

Service Line Expansion – Platforms can enhance their capabilities by including services like geospatial inspections, leak detection, asset-condition monitoring, stormwater rehabilitation, and potable-water lining, capturing more lifecycle spending per customer and improving stickiness and retention.

Vertical Integration – Integrating upstream materials and technologies, such as liners, resins, curing systems, and robotic inspection tools, allow platforms to capture supplier margins, reduce cost volatility, and strengthen quality assurance and compliance.

Geographic Expansion – Targeted expansion into regions with higher rehabilitation backlogs (e.g., Northeast US, Eastern Canada) as well as high growth climate-stressed regions (e.g., Sun Belt, Western Canada) provide exposure to both regulatory and growth-driven demand.

Overall, these levers enable sponsors to transform regional contractors into scaled, multi-service, technology-enabled infrastructure services platforms.

Conclusion

Underground water infrastructure presents an opportunity to build scaled, high-growth platforms in a fragmented market that rely on essential services backed by long-lasting demand. The most promising opportunities will likely come from identifying and backing platforms with clear pathways for geographic expansion, service line diversification, and strategic consolidation across regional markets. As more capital flows into this sector, investors who combine sector conviction with granular demand, contract, and competitive diligence will be best positioned to capture the sector’s long-term upside.

Individual Pipeline Metrics

American Society of Civil Engineers. “2021 Report Card for America’s Infrastructure.” Accessed January 21, 2026.

US Funding Gap

American Society of Civil Engineers. “2025 Report Card for America’s Infrastructure.” Accessed January 21, 2026.

US Regional Pipeline Age and Investment Opportunities

Water Finance and Management. “Pipe Market Turns to New Materials to Address Aging Water Infrastructure.” February 19, 2020.

US New Construction/Rehabilitation Spending

Carpenter, Robert, editor. “26th Annual Municipal Sewer/Water Infrastructure Forecast & Market Analysis.” Underground Infrastructure, February 2023.

Carpenter, Robert, editor. “28th annual municipal sewer/water infrastructure forecast & market analysis: How long will the money flow?” Underground Infrastructure, February 2025.

State of Water Infra in Canada

Canadian Infrastructure. “2019 Canadian Infrastructure Report Card.” Accessed January 21, 2026.

Canada Funding Gap

Local Authority Services. “Water and Wastewater Expert Panel Report.” Accessed January 21, 2026.

Regional (Toronto, Montreal) Condition of Underground Water Infra

Freeman, Joshua. “Major water main break a reminder that city infrastructure needs constant upkeep: expert.” CTV News, January 28, 2023.

Martin, Alice. “Major water main break in Montreal telling of ageing infrastructure, says expert.” CTV News, August 16, 2024.