On 15 January 2026, the Thailand Board of Investment (BOI) announced a refreshed set of investment promotion measures, replacing programs that expired in 2025. These updates may be of importance to companies evaluating expansion opportunities, manufacturing upgrades, relocation decisions, or strategic joint ventures in Thailand.

Across industries, from advanced manufacturing and automation to EVs, mobility technologies, and high‑value R&D, Thailand’s renewed BOI framework offers stronger tax incentives, broader eligibility, and more investment‑friendly pathways. Most measures are open for applications from the first working day of 2026 through the last working day of 2027, with some expiring earlier.

Below is a summary of each measure and its strategic relevance.

Measures | Key Conditions and Incentives |

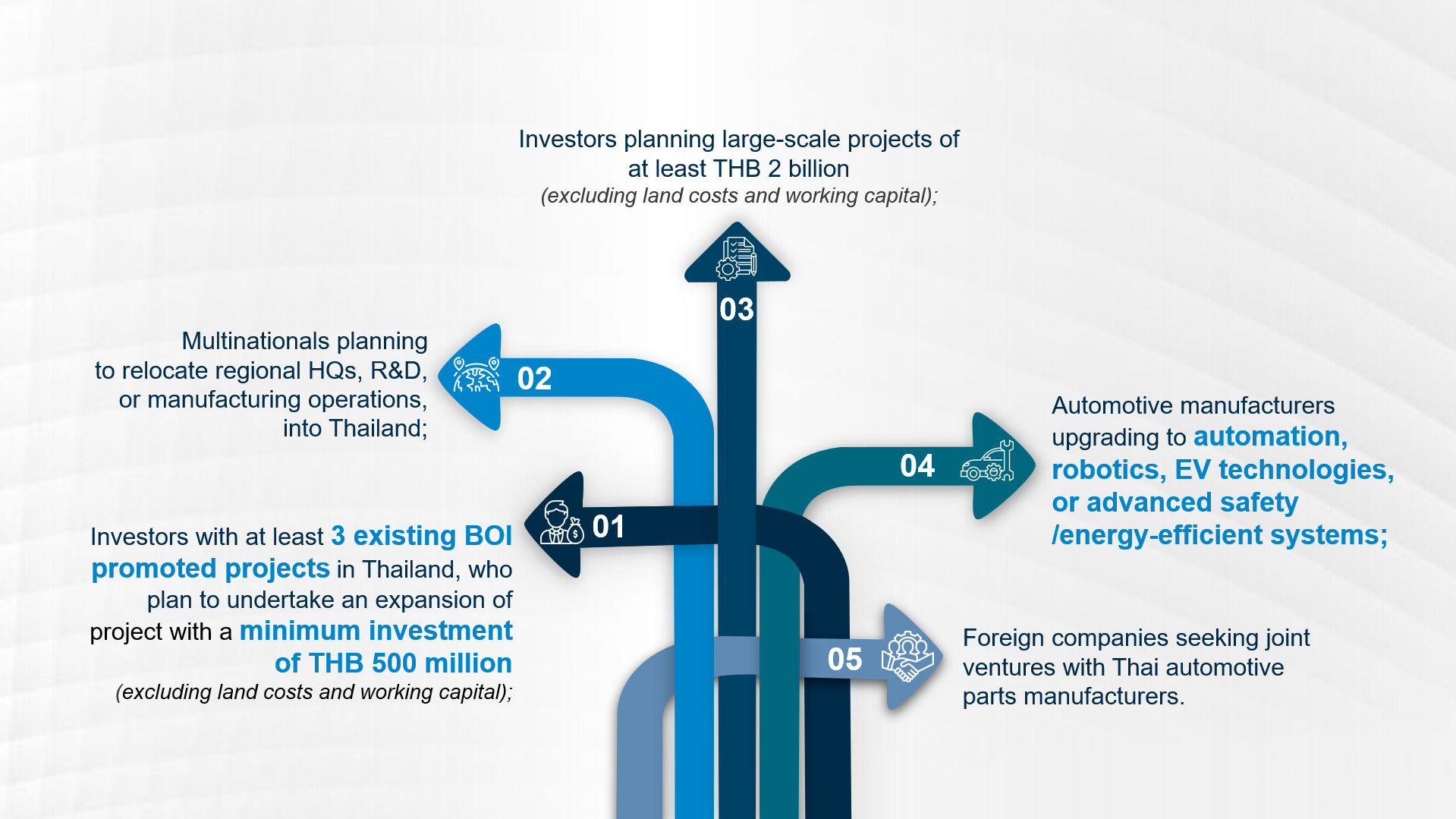

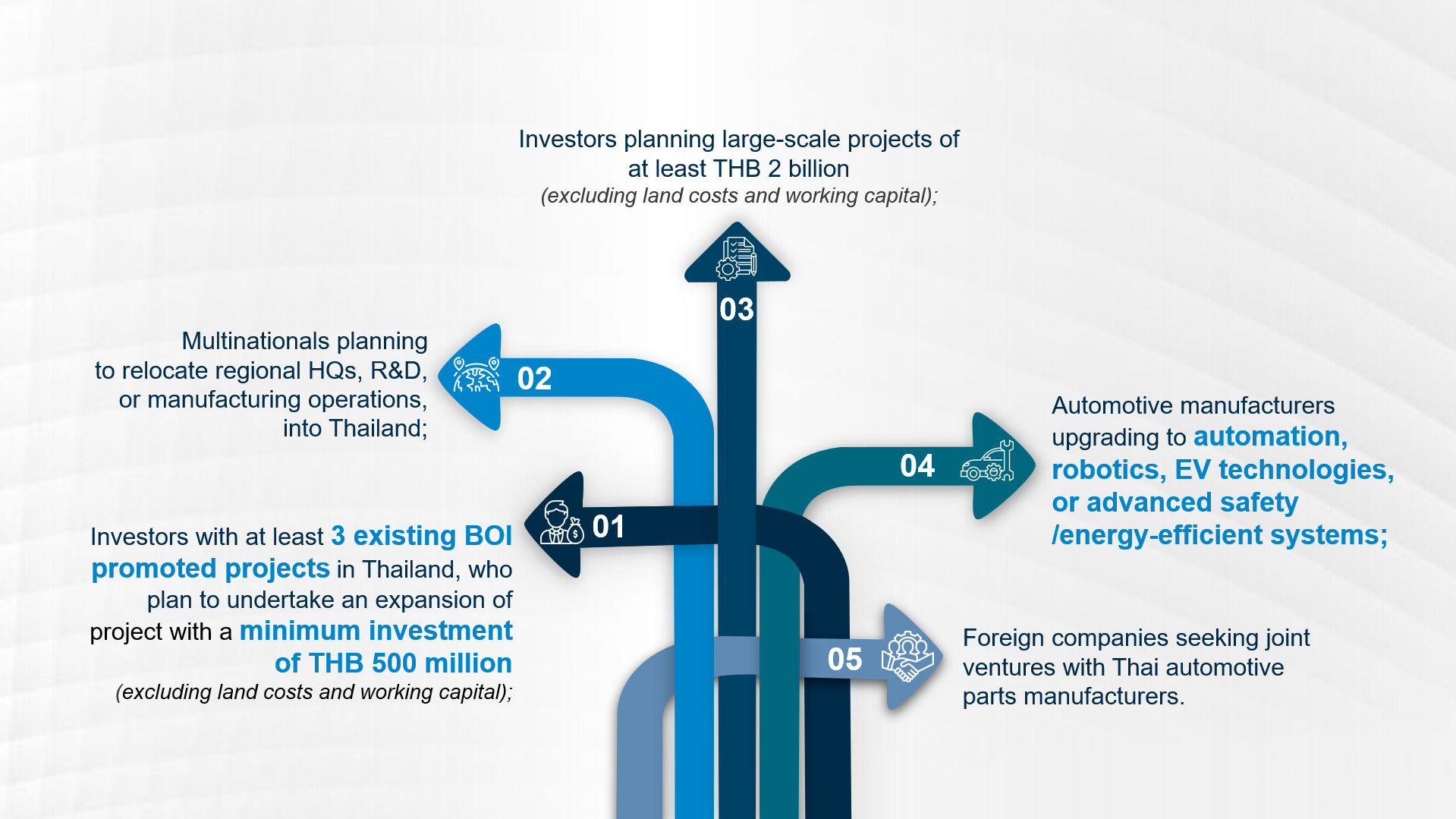

1. Measure for Retention and Expansion of Existing Production Bases | Key Conditions - Applicants must be existing BOI-promoted companies with at least 3 promoted projects within the past 15 years with a combined approved investment value of at least THB 10 billion (excluding land costs and working capital).

- Expansion projects must have an investment value of at least THB 500 million (excluding land costs and working capital).

Submission Window - Applications can be submitted from the first working day of 2026 to the last working day of 2027.

|

2. Measure for Comprehensive Business Relocation | This measure applies to the following manufacturing projects: - New manufacturing investment projects; or

- Existing BOI-promoted manufacturing projects whose CIT exemption period has not yet expired.

Item | New Manufacturing Investment Projects | Existing BOI-Promoted Manufacturing Projects | | Key Conditions | - The application for the manufacturing project must be submitted together with an International Business Center (IBC) project.

- Establishment of a Research and Development (R&D) center is optional.

- The IBC and/or R&D activities must commence operations and/or generate income within 1 year from the issuance of the BOI promotion certificate.

| - The existing project must add IBC activities or invest in a new IBC.

- Establishment of a R&D center is optional.

- The IBC and/or R&D activities must commence operations and/or generate income within 1 year from the approval date of the project amendment.

| | Incentives | - Normal CIT exemption period of up to 8 years, depending on the type of manufacturing activity.

- Additional 3 years ofCIT exemption after expiration of normal CIT exemption period for the manufacturing project when combined with an IBC.

- Additional 5 years of CIT exemption after expiration of normal CIT exemption period for the manufacturing project when combined with an IBC and a R&D center.

- Non-tax incentives.

| - Same incentives as new investment projects.

| | Remark: The total period of CIT exemption shall not exceed 8 years. | | Submission | - The same company may submit applications for all projects simultaneously, or entities within the same corporate group may submit separate applications for the manufacturing, IBC and/or R&D projects.

| - Same requirements as new investment projects.

|

Submission Window Applications can be submitted from the first working day of 2026 to the last working day of 2027. |

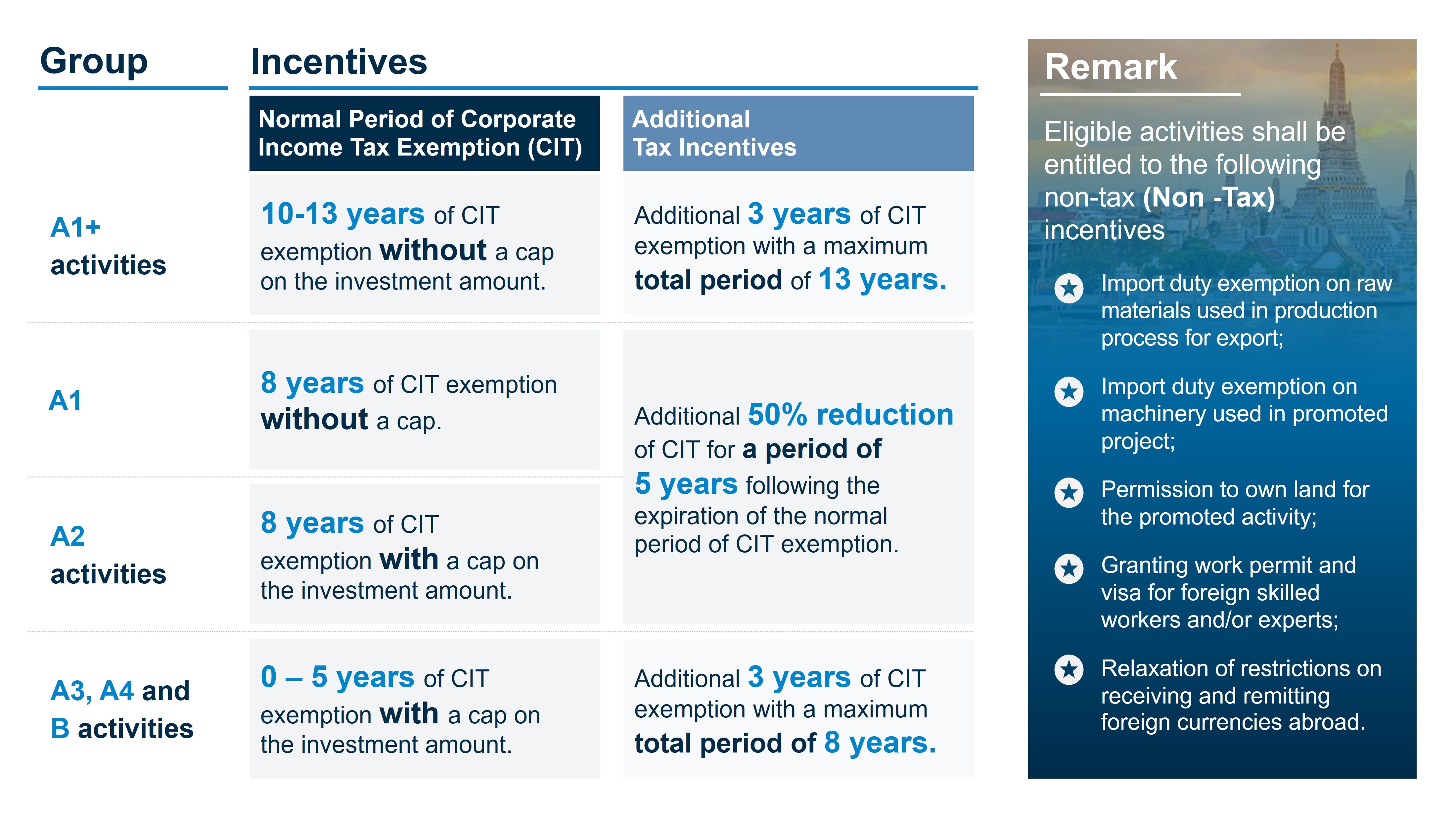

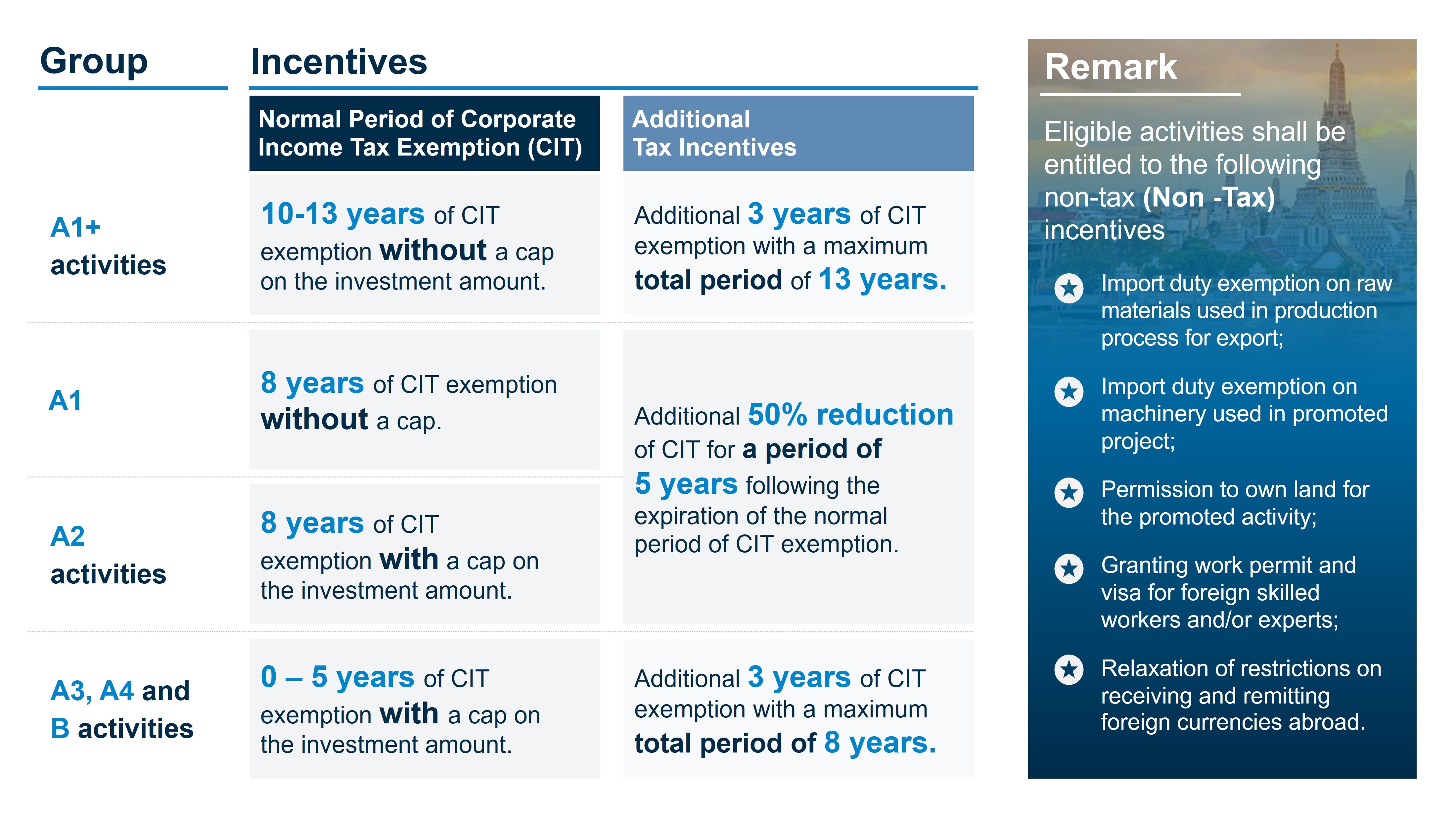

3. Measure to Stimulate Investment During the Economic Recovery Phase | This measure applies to all eligible activities in group A1, A2, A3 or A4, excluding: - Activities without a clearly defined operating location (e.g. air transport, maritime transport);

- Activities required to be located only in the Southern Border Provinces or Special Border Economic Development Zones; or

- Data Center projects and electricity generation projects.

| Key Conditions | - The proposed project must have actual investment of at least THB 2 billion (excluding land cost and working capital) and must be made within 12 months from the date of the issuance of BOI promotion certificate.

- Evidence of actual investment must be submitted within 18 months from the date of the issuance of the BOI promotion certificate.

| | Incentives | - Normal CIT exemption period of up to 8 years, depending on the type of promoted activity.

- Additional 50% CIT reduction for a period of 5 years starting from the expiration of normal CIT exemption period.

|

Submission Window Applications must be submitted by the last working day of 2026. |

4. Measure to Upgrade the Automotive Industry | This measure applies to both existing projects (with or without BOI promotion) and new investment projects under the following categories: - Category 3.6: General automotive manufacturing

- Category 3.8: Manufacturing of

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Hybrid Electric Vehicles (HEV)

- BEV Platforms for PHEV and HEV

| Key Conditions | - The proposed project must be an existing project, which may apply only if:

- The CIT exemption or reduction period has expired; or

- The project has never been entitled to a CIT exemption.

- The proposed project must have a new minimum investment of at least THB 1 million (excluding land and working capital).

- An automation and/or robotics investment plan must be submitted to support the production process.

- An automotive product development plan must be submitted for utilizing one or more of the following technologies:

- Clean and energy-efficient technologies;

- Safety technologies;

- Intelligent mobility; or

- Other appropriate technologies.

| | Incentives | - CIT exemption for 3 years in one of the following cases:

- Equivalent to 50% of the investment value in automation and robotics (excluding land and working capital); or

- Equivalent to 100% of the investment value in automation and robotics (excluding land and working capital) provided that at least 30% of the machinery value involves linkages with or supports domestic automation machinery manufacturing.

- Non-tax benefits.

| Eligible Investment Value Calculation | 100% of Investment Value Eligible - Machinery and equipment

- The following software, IT systems, and cloud/data center services:

- Software or systems integrated with machinery for production control and support;

- AI, Machine Learning, Big Data, and Data Analytics;

- Enterprise management software developed or enhanced in Thailand and certified by relevant authorities; or

- Cloud or Data Center services located in Thailand.

50% of Investment Value Eligible - Enterprise management software:

- developed or enhanced in Thailand without certification; or

- developed overseas.

- Cloud or Data Center services located overseas.

|

Submission Window Applications can be submitted from the first working day of 2026 to the last working day of 2027. |

5. Measure to Promote Joint Ventures between Thai and Foreign Companies for Automotive Parts Manufacturing | This measure applies to the following categories: - Category 3.4: Manufacturing of engines, equipment, or parts; and/or

- Category 3.5: Manufacturing of vehicle parts

Item | New Manufacturing Investment Projects | Existing BOI-promoted Manufacturing Projects | | Key Conditions | - A new joint venture company (NewCo) between a foreign company and a Thai company must be established.

- The Thai company must hold at least 20% of registered capital of NewCo throughout the entire CIT exemption period.

- The Thai shareholders must

- have operated in the automotive or auto-parts industry for at least 3 years; and

- be at least 60% owned by Thai individuals.

- The project must have a new investment of at least THB 100 million (excluding land and working capital).

| - The project must be an existing BOI project with remaining CIT exemption period and amount at the time of applying for additional incentives.

- The company must have been 100% foreign-owned at the time of issuing the original BOI promotion certificate.

- The company must enter into a joint venture with the Thai company, and the Thai company must hold at least 20% of registered capital of the company from the amendment date of original BOI promotion certificate through the remaining CIT exemption period.

- The Thai shareholder must

- have operated in the automotive or auto-parts industry for at least 3 years; and

- be at least 60% owned by Thai individuals.

- The project must have a new investment of at least THB 100 million (excluding land and working capital).

| | Incentives | - Normal CIT exemption period of up to 8 years, depending on the type of manufacturing activity.

- Additional 3 years of CIT exemption.

- Non-tax incentives.

| - Remaining CIT exemption period under the existing BOI promoted project.

- Additional 3 years of CIT exemption.

- Non-tax incentives.

| | Remark: The total period of CIT exemption shall not exceed 8 years. |

Submission Window Applications can be submitted from the first working day of 2026 and the last working day of 2027. |

Who Stands to Benefit Most From Thailand’s BOI Updates?

Companies that are likely to benefit from Thailand’s BOI investment promotion measures include:

Companies should ensure their investment plans meet updated BOI criteria to maximize benefits and prevent application issues.

How Alvarez & Marsal Can Help

Alvarez & Marsal Thailand provides expert guidance to assist businesses with identifying and capitalizing on investment opportunities in Thailand. Our team of seasoned professionals provides a comprehensive range of services to support clients throughout all stages of applying for government incentives in Thailand, including the following:

- Feasibility study and evaluation of applicable incentives: review business and investment plans, conduct feasibility studies to assess eligibility for promoted activities, and provide practical insights to maximize the benefits of BOI incentives.

- Application and negotiation support: prepare investment promotion applications, compile the necessary supporting documentation, liaise with BOI officials, and monitor application progress to ensure a successful outcome.

- Compliance support after obtaining government incentives: provide post-approval supports, including BOI reports, training, project commencement, and assist in reviewing manufacturing processes to ensure compliance with the requirements for essential production processes, both under Thai regulations and those of export destination countries.

- BOI health check and BOI due diligence: assess compliance with BOI conditions to identify any potential risks and provide recommendations to mitigate issues and retain privileges.

- Advisory service related to government incentives: advise on government incentives, including program strategy, investment promotion transfer, and the restructuring plan and process of BOI promoted companies.

To learn more, reach out to Alvarez & Marsal Thailand and discover how we can assist your organization in getting ready for the new incentive framework and seeking investment opportunities in Thailand.

OBBBA and Financial Reporting: The Enactment Date Issue You Can’t Ignore

February 17, 2026

Apply ASC 740 enactment date rules to OBBBA changes. See retroactive impacts on M&A, DTAs/DTLs, examples, and 2026 modeling considerations.

From Tax Benefits to Growth Potential: Why the United Arab Emirates Is the Ideal Hub for Asset Managers

February 16, 2026

The United Arab Emirates (UAE) stands as one of the world's premier business hubs, distinguished by its strategic location, forward-thinking policies, economic resilience, and digital innovation.

Decoding Singapore Budget 2026: Spotlight on Key Tax Measures

February 13, 2026

See the latest commentary from our team of tax experts in relation to the Singapore Budget 2026.

DTA TP Working Group Clarifies Approach to Transfer Pricing Risk Analysis

February 12, 2026

The Transfer Pricing (TP) coordination group of the Dutch Tax Authorities (DTA) recently published an internal note, Opzet en aandachtspunten TP analyse, explaining how inspectors are expected to prepare and structure transfer pricing risk assessments.