From Tax Benefits to Growth Potential: Why the United Arab Emirates Is the Ideal Hub for Asset Managers

Introduction

The United Arab Emirates (UAE) stands as one of the world's premier business hubs, distinguished by its strategic location, forward-thinking policies, economic resilience, and digital innovation. As a cosmopolitan nation where more than 200 nationalities coexist, the UAE has experienced remarkable economic growth, expanding 23-fold over the past 50 years, with continued momentum in both growth and innovation. Central to its appeal are some of the world’s most business-friendly and tax-efficient policies, consistently attracting companies and entrepreneurs alike.

For asset managers, the UAE offers unparalleled tax advantages and is an increasingly popular destination for optimizing financial operations and capitalizing on the nation's incentives. This is further evidenced by the regulatory framework of the Dubai Financial Services Authority (DFSA), the Financial Services Regulatory Authority (FSRA), the Dubai International Financial Centre (DIFC), and the Abu Dhabi Global Market (ADGM).These free zones have steadily developed regulatory environments that give global managers confidence in establishing a presence in the UAE, and their growth reflects how effectively the country has positioned itself for cross-border financial activity. As of October 2025, the DIFC and ADGM had over 8,000 and 11,000 actively registered companies respectively1,2, these developments solidify the UAE’s growing prominence as a global financial hub, drawing top-tier asset managers to its borders.

Beyond the tax advantages offered, the UAE’s rapid growth towards being a hub for global asset managers has been driven by a blend of capital depth and regulatory clarity. The country is home to the world’s most influential sovereign wealth institutions, including Mubadala, the Abu Dhabi Investment Authority, and Abu Dhabi Developmental Holding Company (ADQ) which collectively oversee more than USD 1.5 trillion in institutional capital. Alongside this, the UAE hosts a significant concentration of private wealth, with over 100,000 high-net-worth individuals, including twenty billionaires3, which reinforces its status as a magnet for global capital.

This ecosystem is further strengthened by a favourable tax framework, which continues to draw asset managers seeking efficient and stable onshore structures. Unlike other major financial hubs such as in the United Kingdom (UK) and the United States, where corporate tax (CT) rates typically range between 19% and 25% and personal income tax can exceed 40%, the UAE offers a highly competitive environment with a nine percent CT rate and zero percent personal income tax. The CT rate can be reduced to 0% under the Qualifying Free Zone Person (QFZP) regime, and certain exemptions and special regimes may apply under the Qualifying Investment Fund (QIF), Qualifying Limited Partnership (QLP) and Investment Management Exemption (IME) regimes (among others), as explained further in the section below.

The momentum is clearly reflected in market activity: ADGM recorded a 226% surge in Assets Under Management (AUM) in the first half of 20244, while DIFC saw the number of hedge funds operating from the centre rise to 85 in 20255. This is a 72% year-on-year increase, and major global players have taken note. Die Wertpapier Spezialisten ("DWS"), the EUR one trillion asset manager within Deutsche Bank Group, has deepened its regional footprint; UBS established a second office in ADGM; and firms such as St. James’s Place, Canaccord Wealth, State Street, and Blue Owl Capital have all expanded into the market6. This growing concentration of global managers continues to strength the UAE’s position as a primary destination for asset management activity.

This article serves as a roadmap for navigating the Direct Tax, Transfer Pricing (TP), and Value Added Tax (VAT) considerations for funds and asset managers seeking to establish a presence in the UAE.

Overview of Investment Funds

Investment fund activities in the UAE encompass a wide array of financial investment products that align with offerings in global markets. These funds are typically categorized into public and private funds. Public funds are accessible to the general public, allowing broader participation, while private funds are restricted to professional investors and are not available to the wider public.

Investment funds can be structured around specific investment themes, underlying assets, or sectors. In the UAE, funds invest in a diverse range of asset classes, including, but not limited to private equity, venture capital, private credit, infrastructure, real estate, money markets, and crypto tokens. Additionally, real estate investment funds hold a prominent presence. Other types of funds established in the UAE include hedge funds and Islamic funds, catering to various investment strategies and religious principles.

Additionally, investment funds in the UAE can be structured as either open-ended or close-ended. Similar to the structuring of other funds, open-ended funds operate with variable capital, which fluctuates as new units are issued, or existing units are redeemed. In contrast, close-ended funds have a fixed capital structure where units can only be redeemed upon the fund's expiration, unless regulatory approval is obtained to either increase or reduce the fund’s capital through new subscriptions or redeemed units.

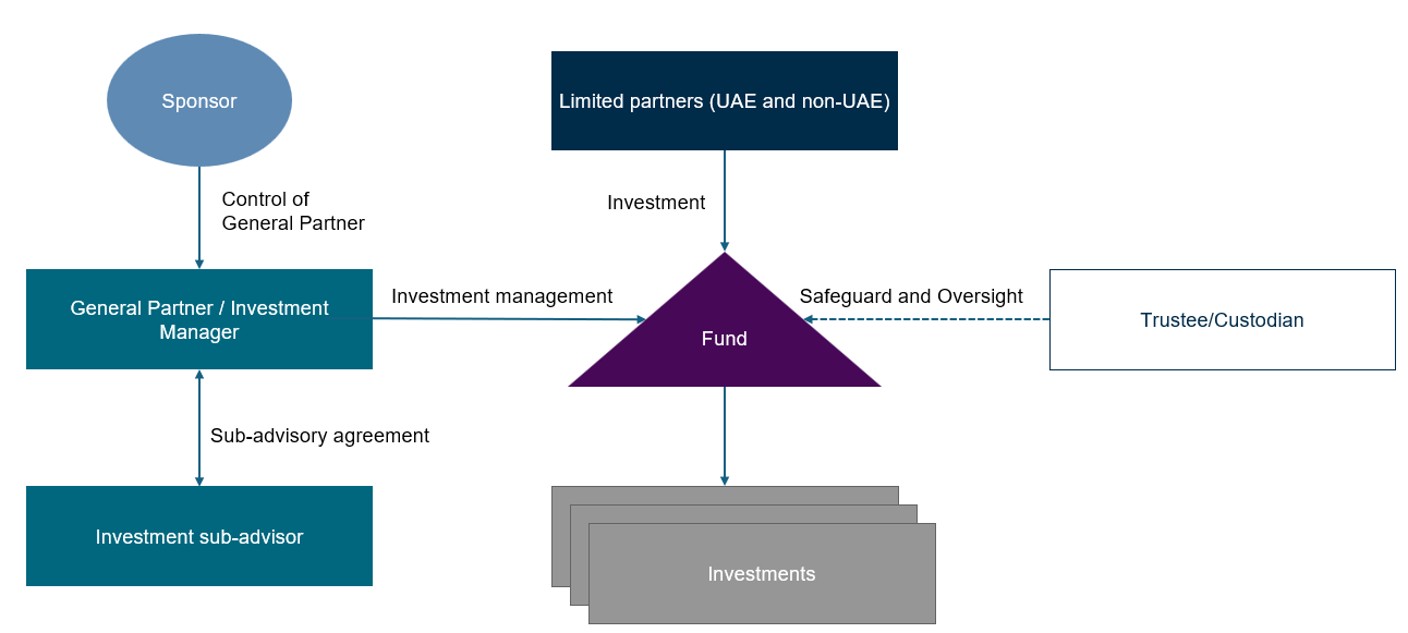

An investment fund typically appoints an asset manager responsible for making investment decisions on behalf of the fund, while adhering to a pre-established investment policy and procedures. The asset manager or advisor may delegate specific responsibilities to other group entities, known as investment sub-advisors, to manage portions of the activities. Additionally, some funds designate a custodian, general partner, or trustee to hold specific assets on behalf of the fund or its investors. These parties also perform various administrative tasks to support the management and operation of the fund.

A typical investment fund structure is as follows:

Investment Funds – United Arab Emirates Tax Treatment

Fund Level

In the UAE, the taxation of investment funds and their investors depend, prima facie, on whether the investment fund has separate legal personality from its investors. In the absence of separate legal personality, the investment fund is treated as a tax-transparent unincorporated partnership. This means that the investment fund is disregarded for tax purposes (i.e., is not subject to UAE CT) and that all of its assets, liabilities, income, and expenditure are attributed directly to its investors (in proportion to their share in the investment fund). In cases where the investment fund has separate legal personality from its investors, the fund may still be treated as tax transparent, provided that it meets the QLP regime conditions7. As a result, the UAE has achieved a tax-neutral effect for investors, who are taxed similarly to how they would be if they invested directly in the investment fund’s underlying assets.

However, even in cases where an investment fund is treated as tax opaque (i.e., is subject to UAE CT) – due to having separate legal personality from its investors and not having applied the QLP regime – the UAE CT Law also provides for two potential beneficial regimes:

- QIF – where an investment fund meets the criteria for a QIF, it may benefit from a tax exemption8. In addition, any UAE resident investors may also be eligible to exclude distributions from the QIF from their taxable income (effectively removing taxation at the investor level), in certain instances9

- QFZP – where an investment fund is incorporated in a UAE Free Zone, and certain conditions are met, the investment fund may be subject to a 0% UAE CT rate. This regime is detailed further below.

The multitude of beneficial tax regimes that UAE investment funds may avail from, clearly demonstrates the effort behind maintaining the UAE’s attractiveness for funds looking to establish themselves here, following the introduction of UAE CT at a federal level.

While the UAE offers significant advantages in terms of corporate tax, investment funds and asset managers must also consider the implications of VAT on their operations.

The UAE introduced VAT at a standard rate of 5% in 2018, applicable to most goods and services.

Funds are not typically required to be VAT-registered unless they independently carry out business activities that are taxable. Most investment funds fall outside the scope of taxable persons unless they directly supply taxable services.

One of the major costs for the funds, however, was the fund management fee paid by them, which historically was subject to 5% VAT if paid to a UAE fund manager, and the additional 5% VAT presented itself as a cost to the UAE funds.

However, with effect from November 15, 2024, the fund management services provided to UAE-licensed funds are now VAT-exempt. This means that if the fund is established in the UAE and is licensed by a competent UAE authority including the DFSA or FSRA, the fund management fee paid by the fund would not be subject to VAT.

An added benefit of the new exemption is that, even if the funds are paying the fund management charges to fund managers outside the UAE, the funds are not required to account for VAT under the reverse charge.

Beyond taxation, investment funds play a critical role in enhancing financial market liquidity by pooling resources from multiple investors and allocating them to diversified portfolios. Tax exemptions granted to such funds promote efficient capital allocation and trading activities within financial markets, thereby increasing overall liquidity. Additionally, these incentives encourage the development of innovative financial products and services, as asset managers are afforded greater flexibility to design vehicles that cater to diverse investor needs. This, in turn, fosters the evolution of investment strategies, stimulates the emergence of new markets, and enhances the competitiveness of the UAE’s financial ecosystem.

Tax and Transfer Pricing Considerations for Asset Managers Establishing Operations in the United Arab Emirates

Free Zone-based asset managers overseeing various types of funds in the UAE, such as actively managed funds or passively managed funds, may benefit from the 0% CT rate applicable to QFZPs mentioned above, provided specific conditions are met. These include the following:

- The asset manager derives “Qualifying Income”, which includes income derived from “Qualifying Activities” such as “Fund Management Services” and “Wealth and Asset Management Services”. These require that the asset manager is subject to regulatory oversight from a competent authority like the DFSA, the FSRA, or the UAE Central Bank.

- Any “Non-Qualifying Income” should not exceed five percent of the asset manager’s total revenues or AED five million, whichever is lower.

- The asset manager maintains adequate substance within the Free Zone (i.e., the asset manager carries out its core income-generating activities within the Free Zone). This includes maintaining adequate assets, full-time employees, and incurring an adequate level of operating expenditures in relation to its core income-generating activities.

- Businesses are also required to comply with the UAE TP rules. This includes conducting relevant TP studies, developing a comprehensive TP policy for their intercompany transactions, and maintaining contemporaneous TP documentation (i.e., policy document, local file, and master file). Such documentation ensures that all intercompany transactions are carried out in accordance with the arm’s length principle.

This encourages the development and growth of a thriving asset management ecosystem within the UAE.

Interplay of Transfer Pricing with Asset Management

Asset managers often operate within varying structures, which may result in the need to provide or receive certain services from group entities. These services can include, but are not limited to, providing asset management services by the GP directly to the fund, delegating certain asset management functions from the GP to an investment sub-advisor, procuring other services such as capital raising, research and analytics, and C-suite services from group entities. Additionally, asset managers typically require support for back-office functions, including human resources, administration, technology, finance, and accounting.

Commonly, the core value chain in asset management encompasses the following key activities:

- Investment Strategy: This involves establishing the overall investment strategy and identifying the specific categories of investments to be pursued, such as for example equity instruments, fixed income securities, or alternative investments.

- Deal Sourcing and Capital Raising: Identifying and generating opportunities for potential investments. This function includes raising capital by identifying potential investors and negotiation of funding terms.

- Investment Acquisition: Evaluating and approving investments, including assessing associated risks before entering transactions involving the purchase or sale of assets.

- Asset Management: Managing, monitoring, and enhancing the value of the assets under management.

- Divestment: Overseeing decisions related to asset sales and determining the optimal exit strategy for a given investment.

- Support Services: Providing essential operational assistance such as administration, compliance, and technology support.

Based on the functional profile of the asset manager and the critical activities performed within the value chain, the asset manager must ensure that the returns they receive are consistent with the arm’s length principle, as outlined in the UAE Transfer Pricing Guidelines.

Here are some examples of key intercompany transactions commonly undertaken within the asset management industry. However, it is important to note that the specific number and nature of these transactions may vary depending on the operational activities and structure of the organization, which could result in either more or fewer transactions being involved.

Common Intercompany Transactions

Assets Under Management Fees

In this transaction, the general partner (GP) typically enters a contractual arrangement with the fund to undertake asset management activities. The GP in most cases, will delegate the day-to-day management of the portfolio to a separate group entity (asset manager). The asset manager may either possess the necessary substance and key personnel to perform these functions internally or may choose to subcontract all or part of the asset management services to an investment sub-advisor. In most cases, the remuneration paid to the asset manager or sub-advisor is structured as a percentage of assets under management (AUM). Where both the asset manager and the sub-advisor are involved in providing asset management services, the AUM fee is generally split between the two parties based on their respective roles and responsibilities.

The precise fee structure, however, depends on the type of fund being managed. For example, management services provided to a private equity (PE) fund are typically compensated as a percentage of AUM, whereas services rendered to a real estate fund are more commonly remunerated based on a percentage of Gross Asset Value (GAV). Consequently, in this example, the benchmarking approach for assessing the arm’s length management fees will differ depending on whether the services relate to a PE fund or a real estate fund.

In certain situations, a detailed benchmarking analysis may not be necessary where the management fees are effectively borne by third-party investors. As outlined in the UAE Investment Funds and Investment Managers Corporate Tax Guide, when an asset manager enters an arrangement with a related investment fund, the management fees paid by the fund are ultimately borne by its investors. Where unrelated investors are willing to invest under the agreed fee structure, such fees are generally regarded as consistent with the arm’s length principle, as they reflect prevailing market conditions.

Capital Raising

Another key intercompany transaction to consider from a transfer pricing perspective is related to the capital-raising function. This function is critical, as it focuses on building and managing relationships with external investors to secure the necessary funding that enables the asset management process to take place. Activities involved in capital raising typically include meeting prospective investors and conducting roadshows to market investment opportunities effectively. It is vital that arm’s length remuneration is determined and allocated for this function. If there is a dedicated entity responsible for performing capital-raising activities, one of the ways such an entity could be remunerated is through a placement fee on the total capital raised in the initial year and a client relationship management fee equal to a percentage of assets under management for the remaining life of the fund. However, the methodology could differ depending on the value-added by the capital raising entity.

Financing

In certain cases, intra-group financing may be provided to the asset manager. These arrangements must adhere to the arm’s length principle and require a thorough examination of the contractual terms agreed upon with the related parties (e.g., issuance date, maturity date, currency, seniority, etc.). A comparison should then be made with similar agreements entered with independent third parties to determine whether the interest charged is at arm’s length.

Additionally, it is recommended to perform a debt-capacity analysis to assess whether the entity is excessively leveraged. This analysis would evaluate whether a portion of the debt should be recharacterized as equity. The evaluation generally entails an analysis of key financial ratios, including but not limited to interest coverage, debt-to-equity, and debt-to-income ratios. This review helps determine whether the entity exhibits signs of being excessively leveraged.

C-Suite Services and Back-Office Services

Other related party transactions to consider from a transfer pricing perspective include executive management services, research and analytics services, and back-office functions. Executive management services involve critical decision-making activities, such as those performed by investment committees regarding fund investments and other strategic management decisions related to the overall operations of the group.

Research and analytics services focus on providing support to asset managers through detailed analysis, such as identifying potential investments, analysing market trends, and providing recommendations on whether to proceed with specific investments.

Back-office functions, on the other hand, relate to administrative support, including but not limited to HR, accounting, and finance operations.

Typically, these services are remunerated based on a cost-plus methodology to reflect an arm’s length outcome. However, the methodology could differ depending on the nature of the services and the value add.

VAT Considerations for Fund Managers Establishing Operations in the United Arab Emirates

The fund managers in the UAE operate within a VAT regime that requires careful planning (apart from corporate tax benefits). The recent reforms have introduced significant relief for fund managers of UAE-licensed funds.

With effect from November 15, 2024, fund management services provided to funds licensed by UAE authorities including the DFSA or FSRA are exempt from VAT.

Subject to specific facts and circumstances, for services provided to non-UAE licensed funds or for activities such as advisory, consulting, and capital raising, VAT at five percent may apply unless the fund is established outside the UAE and where conditions of zero-rating an export of a service under the UAE VAT regulations are met.

International Tax Implications of Carried Interest

Carried interest refers to the share of profits earned by the GP in private equity, venture capital, and hedge funds. This mechanism serves as both a financial incentive and a compensation structure, directly tying the GP's earnings to the fund's performance. By aligning the GP's interests with the fund's overall success, carried interest encourages effective management and drives stronger investment outcomes.

Globally, carried interest income earned by asset managers is generally taxed by local authorities under special tax regimes that are lower than the general income tax rates. The table below highlights the different applicable tax rates for select jurisdictions across Europe, Asia-Pacific, and North America.

| Qualified for Carried Interest Tax Regime10 | Unqualified for Carried Interest Tax Regime | |

| Region | Jurisdiction | Maximum Capital Gains Tax Rate (%) | Income Tax Rate (%) |

Europe | France | 34 | 49 |

| Germany | 28.5 | 45 | |

| Italy | 26 | 52 | |

| Netherlands | 31 | 49.5 | |

| Spain | 27 | 54 | |

| United Kingdom | 3211 | 20 - 4512 | |

Asia-Pacific | Australia | 0-4513 | 4514 |

| Hong Kong SAR China | 0 | 17 | |

| Singapore | Exempt16 | 24 | |

| North America | USA | Capital Gains Rate: 23.8 - 37 | 37 |

Middle East | Oman | Income tax rate | 15 |

| Kuwait | Income tax rate | Foreign companies: 15%

Kuwaiti/GCC entities: 0%17 | |

| KSA | Income tax rate | foreign ownership: 20% 18 | |

| UAE | Income tax rate | 0 or 9 |

*The rates displayed on the table are indicative, consult local sources for detailed and up-to date rates.

The taxation of carried interest plays a pivotal role in determining the net returns realized by asset managers, directly influencing their profitability and overall incentives. This is particularly relevant in jurisdictions with higher tax rates, where carried interest may face significant tax liabilities, effectively reducing the net returns for fund managers. As a result, there is a growing global trend among asset managers to strategically relocate their operations to jurisdictions with more favourable tax regimes that allow for optimization of tax liabilities and improved net returns.

One such jurisdiction gaining attention is the UAE, which offers a highly favourable taxation landscape. Under the UAE’s tax framework, carried interest may qualify for a 0% tax rate if the entity meets the criteria of a QFZP19, as mentioned above, or for income-specific exemptions such as the Participation Exemption regime. However, even in cases where carried interest does not qualify for a preferential regime, the UAE may still represent a better alternative when compared to other jurisdictions with higher corporate tax rates, given its lower CT rate of nine percent. Further, generally, since carried interest is performance based, it is inherently considered to be at arm’s length from a TP perspective.

Globally, this shift highlights the strategic importance of tax efficiency in talent mobility and fund structuring, reinforcing the competitive advantage of low-tax environments.

Conclusion

The UAE has emerged as an attractive base for asset managers, largely because it offers a level of tax efficiency that traditional financial centres cannot match. The absence of personal income tax, together with a CT regime that supports QIFs, QLPs, and QFZPs, allows firms to retain more of the value they create. This is especially important for asset management activities and the receipt of carried interest, which is often heavily taxed elsewhere and can reduce the commercial viability of operating in those markets. Moreover, the new VAT exemptions introduced in the UAE for exempting fund management services, promote the UAE’s agenda to attract and retain top-tier funds and fund managers.

Relocating asset management functions to the UAE does more than reduce tax obligations. It anchors the business in a market that is stable, well-regulated, and increasingly influential in the global flow of capital. Asset managers benefit from operating in a jurisdiction that encourages growth, supports substance, and offers the infrastructure needed to scale. For many firms, the UAE is no longer a secondary option or an emerging alternative – it is the ideal hub for sustainable growth and long-term success.

Sources

- Dubai Financial Services Authority. “Dubai Advances Position as Middle East, Africa and South Asia’s Leading Global Financial Centre.” https://www.dfsa.ae/news/dubai-advances-position-middle-east-africa-and-south-asias-leading-global-financial-centre

- Abu Dhabi Global Market. “ADGM is the MENA Region’s Largest IFC with 11,128 Active Licences at the End of H1 2025.” https://www.adgm.com/media/announcements/adgm-is-the-mena-region-largest-ifc-with-11128-active-licences-at-the-end-of-h1-2025

- Abu Dhabi Global Market. “The Ideal Location for Asset Management Firms.” https://www.adgm.com/spotlight/asset-management

- Sidley Austin LLP. “Opportunities for Asset Managers Looking to Set Up in the United Arab Emirates.” https://www.sidley.com/en/insights/newsupdates/2024/09/opportunities-for-asset-managers-looking-to-set-up-in-the-united-arab-emirates

- Hedgeweek. “Hedge Fund Surge Powers Record H1 Growth at Dubai Financial Centre.” https://www.hedgeweek.com/hedge-fund-surge-powers-record-h1-growth-at-dubai-financial-centre/

- Outbound Investment Group. “Why Wealth Managers Are Moving to Dubai: The UAE’s Rise as a $1.5 Trillion Wealth Hub.” https://outboundinvestment.com/why-wealth-managers-are-moving-to-dubai-the-uaes-rise-as-a-1-5-trillion-wealth-hub/

- For an investment fund to apply the QLP regime, the following conditions need to be met: (a) the investment fund’s principal business or business activities are Investment Business; (b) the investment fund does not derive any income from Immovable Property located in the UAE; and (c) the main purpose of the investment fund is not to avoid UAE CT.

- For an investment fund to apply the QIF regime, the following conditions need to be met: (a) the investment fund or the investment fund manager is subject to the regulatory oversight of a competent authority in the UAE (or of a foreign competent authority in certain instances); (b) the interests in the fund are traded on a recognized stock exchange, or are marketed and made available sufficiently widely to investors; (c) the main or principal purpose of the fund is not to avoid UAE CT; (d) the investment fund’s principal business or business activities are Investment Business; (e) the investors must not have control over the day-to-day management of the fund; (f) the investment fund needs to provide its investors with all information, documents and data necessary for the purposes of calculating their taxable income for UAE CT purposes.

- No exclusion would apply in the following instances: (a) where the investment fund has less than 10 investors, and an investor owns 30% or more of the ownership interests in the fund; (b) where the investment fund has 10 or more investors, and an investor owns 50% or more of the ownership interests in the fund; and (c) where the fund invests in UAE real estate, and the value of such real estate is more than 10% of the total value of its assets.

- DLA Piper Intelligence. “Carried Interest Global Guide.” https://intelligence.dlapiper.com/carried-interest/

- United Kingdom. “Section 12, Finance Act 2025.” Enacted. https://www.legislation.gov.uk/ukpga/2025/8/section/12/enacted

- United Kingdom. “Section 2, Finance Act 2025.” Enacted. https://www.legislation.gov.uk/ukpga/2025/8/section/2/enacted

- https://titanwealthinternational.com/learn/capital-gains-tax-for-australian-expats/

- https://www.expat.hsbc.com/expat-explorer/expat-guides/australia/tax-in-australia/

- Hong Kong e-Legislation. “Hong Kong e-Legislation.” https://www.elegislation.gov.hk/hk/2021/9!en

- Singapore. “Income Tax Act 1947.” Valid as of November 28, 2025. Section 2, Section 14. https://sso.agc.gov.sg/Act/ITA1947?ValidDate=20251128&ProvIds=P14-#pr2-

- For Kuwaiti/GCC entities, carried interest may increase the Zakat base which is subject to Zakat at 1%. The carried interest may also be subject to a 1% contribution to the Kuwait Foundation for the Advancement of Sciences and 2.5% National Labour Support Tax (if listed).

- For Saudi/GCC entities, carried interest may increase the net adjusted profits for Zakat purposes which is subject to Zakat at 2.5%.

- Please note that it is unlikely carried interest could be classified as Qualifying Income when derived from transactions between Free Zone Persons and Non-Free Zone Persons (as it would be difficult to fit the GP’s activities within one of the prescribed Qualifying Activities). Carried interest is more likely to classify as Qualifying Income when derived from transactions between Free Zone Persons.