MIDDLE EAST TAX ALERT | UAE | From VAT to Corporate Tax: How FTA’s Risk-Based Audits Will Shape Compliance in 2026

The UAE’s first Corporate Tax (CT) filing season for calendar-year businesses ended on September 30, 2025. In the final months, the Federal Tax Authority (FTA) urged taxpayers to file and pay early to avoid penalties. The FTA also warned that last-minute bank transfers could still be considered late if funds arrived after the deadline.

By comparison, Value Added Tax (VAT) has been part of the UAE tax system since 2018. Over seven years, the FTA has built a mature VAT audit framework with clear procedures and record-keeping rules. Because VAT and CT share the same procedural Law (the Tax Procedures Law and its Executive Regulation)[1] businesses should expect CT audits to follow a similar pattern: formal notices, strict “Business Day” deadlines, iterative queries, and data-driven selection.

Audit capacity is also expanding. The FTA’s 2024 Annual Report and a February 2025 update show 93,000 inspection visits in 2024 (a 135% increase from the previous year) powered by digital tools and analytics. That same infrastructure now supports post-filing CT reviews.

Risk Areas

The FTA’s Strategy 2023–2026 confirms that audits are risk-driven, not random. Enforcement and collection programs are driven by risk indicators, and the FTA’s ISO 31000 certification for risk management reinforces that this approach applies across all tax types.

In practice, this likely means that (ahead of the introduction of e-Invoicing in the UAE - considered below) the FTA will undertake analysis to reconcile data that is provided by taxpayers and look at tax holistically. For example:

- VAT vs CT Turnover Mismatch: If your VAT return shows AED 120 million in taxable supplies, but your CT return reports only AED 100 million in revenue, the FTA will likely flag this discrepancy and request an explanation.

- TP Adjustments vs VAT Treatment: If you make TP adjustments that reduce CT profit but do not adjust the corresponding VAT valuation (where required), this inconsistency could trigger a review.

- Reverse-Charge Positions: If intercompany transactions are priced aggressively for TP purposes but VAT reverse-charge entries do not align with the TP reporting figures, expect questions.

e-Invoicing

The upcoming introduction of e-Invoicing in the UAE will require businesses to issue, store, and report invoices electronically, enabling the FTA to access transaction data in real time. This shift will make it easier for the FTA to reconcile VAT and Corporate Tax filings, allowing them to quickly identify discrepancies. Businesses should ensure their systems are ready for e-Invoicing to maintain compliance and facilitate smoother, faster audits.

While the FTA retains discretion to conduct random audits, the sharp increase in VAT and Excise audits signals a clear shift towards systemic, risk-led enforcement, and that model now governs CT and TP reviews.

What Happens During an Audit?

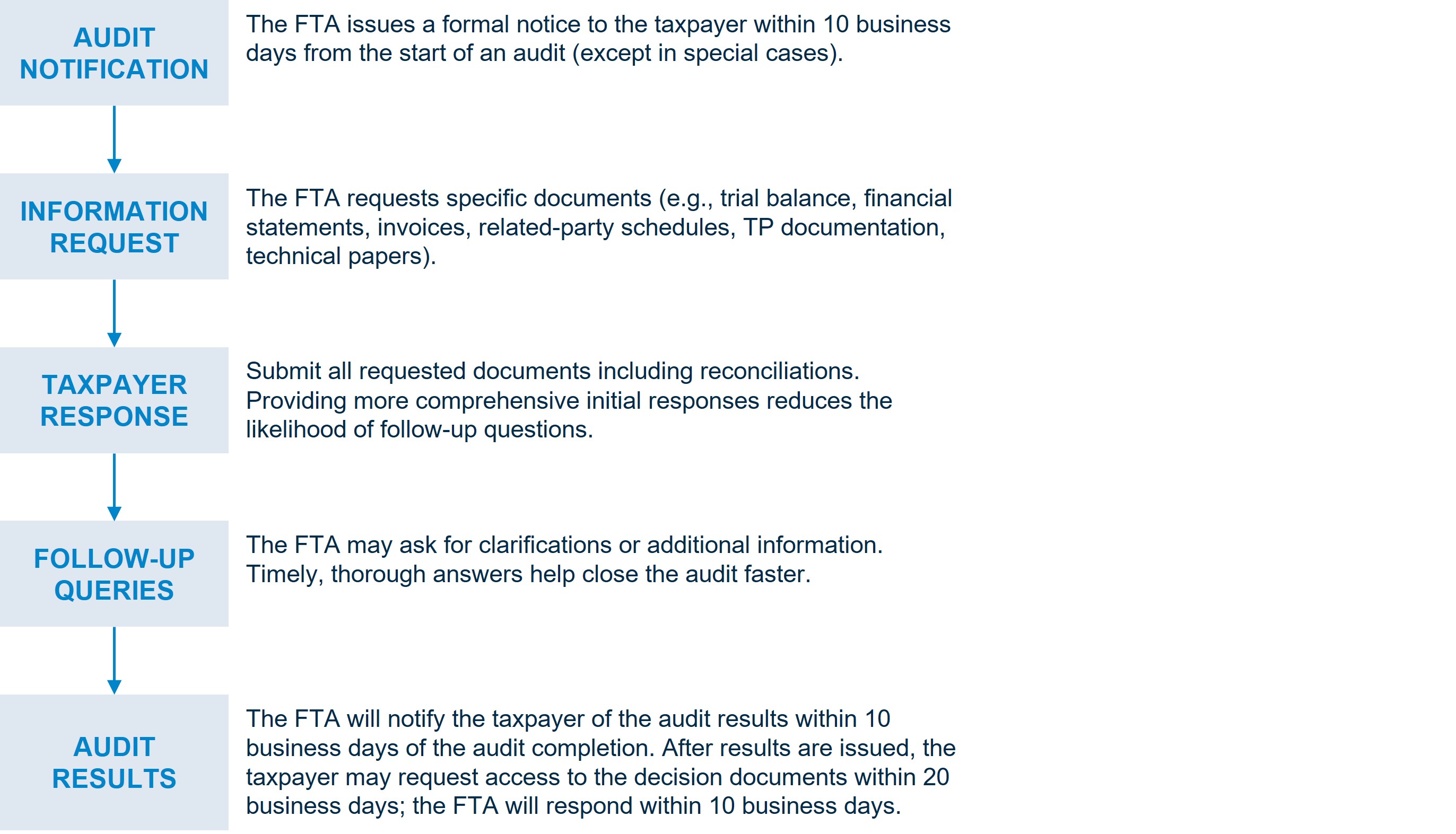

The FTA follows a structured process:

It’s essential to submit all requested documents, reconciliations, and explanations in your initial response. A complete and well-organised submission not only demonstrates taxpayer readiness but also reduces the likelihood of follow-up queries. If additional questions arise, responding promptly and thoroughly will help bring the audit to a close more efficiently.

In summary, the key to a successful audit lies in thorough preparation and accuracy. Taxpayers should ensure all records are accurate, responses are detailed, and deadlines set by the FTA are consistently met.

Penalties

Under the UAE Tax framework, administrative penalties are imposed for a range of compliance failures, such as late filing, late payment, or submitting incorrect returns. The penalty system is structured to promote voluntary compliance and timely correction of errors, rather than punish mistakes.

Update: Cabinet Decision No. 129 of 2025

In October 2025, the UAE Cabinet introduced significant changes to the penalties for violations of UAE Tax Laws. This new regime will come into effect on April 14, 2026. The key objectives are to simplify the penalty structure, encourage voluntary compliance, and ensure consistency across taxes. Businesses should use the transition period to consider their compliance processes.

Key Changes

- VAT and Excise penalties provisions are now aligned with CT penalties promoting fairness and uniformity.

- FTA adopts a forward-looking approach, encouraging proactive compliance by incentivising taxpayers to correct tax errors through Voluntary Disclosures (VD), fostering greater transparency and accuracy in tax reporting.

Penalty Table (CT/TP/VAT) From April 14, 2026

| Violation | Previous Penalty (Cabinet Decision No. 108 of 2021 for VAT and Excise Tax) | New Penalty (Cabinet Decision No. 129 of 2025 and Cabinet Decision No. 75 of 2023) | What’s Different? |

| Late payment of tax | 2% after due date + 4% monthly (max 300%) | 14% per annum, calculated monthly | Simplified to a flat annual rate and a significant reduction from the previous penalties that align to the CT penalties in the UAE |

| Incorrect tax return | AED 1,000 (first), AED 2,000 (repeat); exceptions apply | AED 500 unless corrected before the tax return deadline or no difference in tax due following a VD | Lowered penalty, with relief for prompt correction or voluntary disclosure |

| Voluntary Disclosure submitted | 5–40% (bracket-based, depending on years of delay) | 1% per month on the tax difference | Time-based monthly penalty replaces complex brackets |

| Failure to submit VD before audit notice | 50% fixed + 4% monthly | 15% fixed + 1% monthly | Significant reduction for fixed and monthly penalty |

Examples

So, from April 14, 2026, if a business has AED 100,000 of unpaid Corporate Tax, the following penalties will apply:

- If the business submits a VD 6 months after the original due date:

- Understatement Penalty (UP) = 1% × 6 months × AED 100,000 = AED 6,000

- Total due = AED 106,000

- If the FTA discovers the error during an audit after 6 months:

- Fixed Assessment Penalty (FAP) = 15% × AED 100,000 = AED 15,000

- UP = 1% × 6 months × AED 100,000 = AED 6,000

- Total penalty = AED 21,000

- Total due = AED 121,000

Examples of the VAT penalty changes can be found in our article here.

Despite the new penalty regime, Voluntary Disclosure is still significantly less costly than waiting for an FTA audit. The new regime is designed to reward proactive compliance and rapid correction of errors. If taxpayers identify errors, they should consider submitting a VD early instead of waiting for an FTA inquiry, as this can significantly reduce penalty exposure.

What This Means for You

Whilst, the first CT return was the beginning, it is not the end. If VAT audits over the past few years taught us anything, it is that the FTA expects a clean, reconcilable evidence trail. CT is now in that same lane, and the procedural expectations are already defined.

How A&M Can Help

Our team has supported clients in the UAE through the full audit cycle. In addition to handling FTA audit enquiries, we work closely with finance and tax teams to design audit-readiness frameworks, deliver targeted training, and implement robust documentation processes, in addition to advice about what to do if your business has an audit opened.

[1] The UAE Tax Procedures Law (Federal Decree‑Law No. 28 of 2022) and the Executive Regulation (Cabinet Decision No. 74 of 2023) govern how the FTA notifies, audits, assesses, and penalises all Federal taxes.