MIDDLE EAST TAX ALERT | UAE | A&M's view on advancing tax certainty in the UAE: The Federal Tax Authority’s comprehensive APA guidance

Overview

On December 30, 2025, the UAE Federal Tax Authority (FTA) released the Advance Pricing Agreements Corporate Tax Guide (CTGAPA1). This guide explains the procedural framework for taxpayers seeking tax certainty through Advance Pricing Agreements (APAs) in the United Arab Emirates (UAE). A&M’s analysis of the guidance and key takeaways are summarized below.

Key Highlights

1. Scope and Phased Implementation

- Initial Focus: The program initially focuses on Unilateral APAs (UAPAs).

- Effective Dates:

- Domestic UAPAs: Applications accepted from December 2025.

- Cross-Border UAPAs: Commencement date to be announced in 2026.

- Future Expansion: Details of bilateral and multilateral programs will be introduced at a later stage.

- Duration: APAs shall cover a minimum of three and a maximum of five tax periods. At this stage, they only cover prospective periods (i.e., no roll-back to prior years).

2. Eligibility and Materiality Threshold

To apply for an APA, qualifying taxpayers must meet the following criteria:

- Threshold: The total expected value of all covered controlled transactions must be at least AED 100 million for each tax period.

- Group-level: For tax groups, the AED 100 million threshold applies to the level of the tax group.

- Exclusions: Transactions falling under the OECD Guidelines[1] and UAE Transfer Pricing Guide[2] safe harbor provisions (e.g., low value-adding intra-group services) are excluded from both the APA scope and threshold calculation.

- Discretion: The FTA may still accept or reject applications below or above the threshold based on complexity and risk.

3. Process

The guide outlines a structured lifecycle for concluding an APA in the UAE.

| Stage | Action | Timeline |

| Stage 1: Pre-filing | Mandatory consultation to assess suitability. | 6–9 months indicative duration. |

| Stage 2: Application | Submission of a formal application and payment of a non-refundable fee. | Within two months of pre-filing approval. |

| Stage 3: Evaluation | FTA review, site visits, and negotiation of transfer pricing methodology. | Mutually agreed project plan. |

| Stage 4: Conclusion | Final signing and implementation of the agreement. | Subject to OECD best practices. |

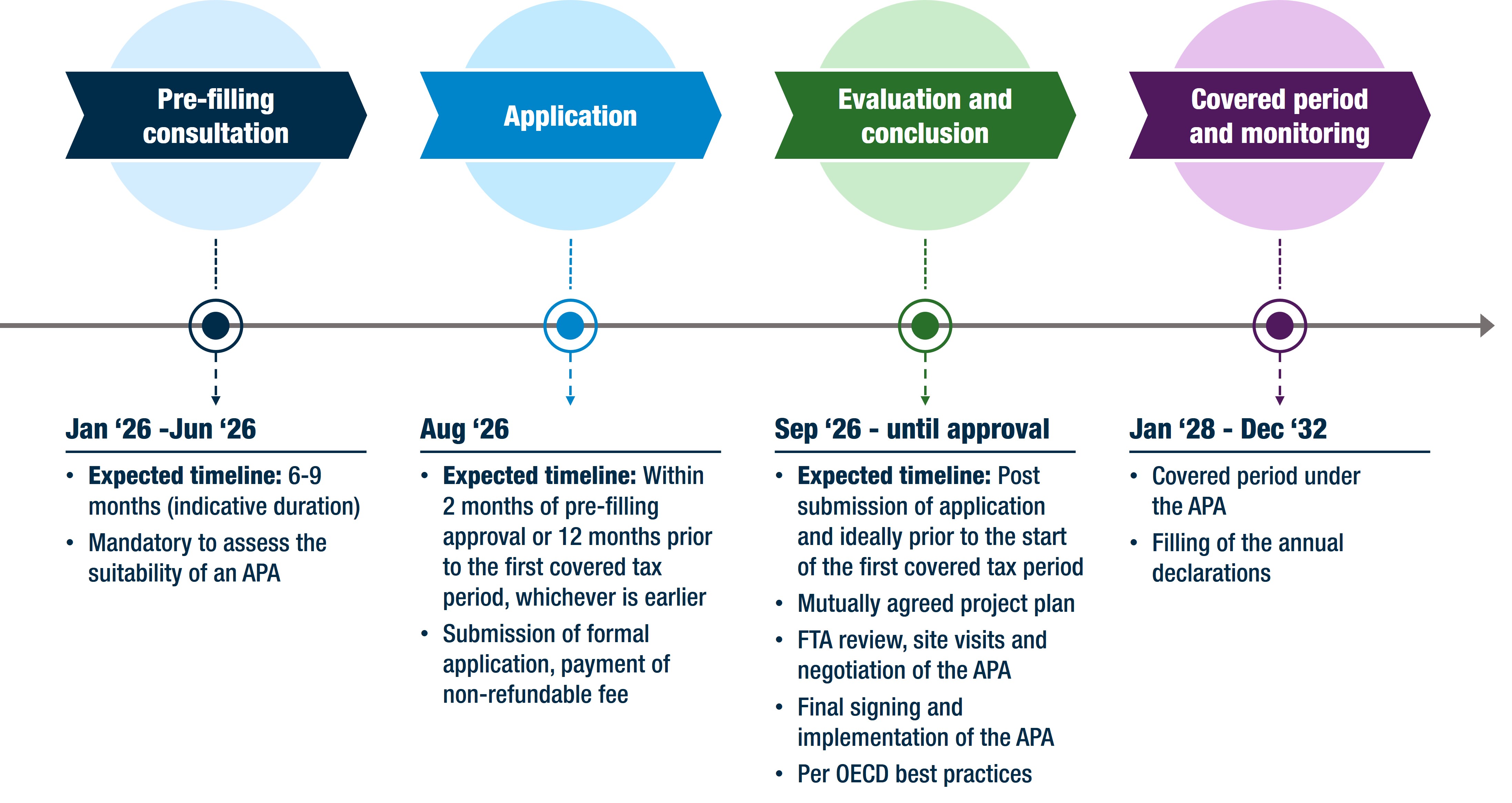

4. Illustrative Timeline

Given the above process, the following is an illustrative timeline that could be feasible for FY28 (assuming a December to January year-end) as the first covered tax period under an APA in the UAE.

5. Fees and Deadlines

- Application Fees:

- New Application: AED 30,000.

- Renewal of Existing APA: AED 15,000.

- Submission Deadlines: Applications must be submitted at least 12 months prior to the start of the first tax period to be covered.

6. Annual Compliance Requirements

Once an APA is signed, the taxpayer must file an APA Annual Declaration for each covered Tax Period. This must be submitted within 90 business days of the signed APA or by the Corporate Tax (CT) return due date, whichever is later.

7. A&M’s view

- Overall, the introduction of an APA regime in the UAE is a positive development, underpinning the UAE’s commitment to creating a stable investment climate and an environment that fosters tax certainty. Alongside the introduction of the UAE’s Mutual Agreement Procedure, they are both powerful proactive and reactive tools to reduce the risk of double taxation.

- While a UAPA provides certainty within the UAE, it does not bind foreign tax administrations and may still lead to double taxation if not carefully managed through future bilateral or multilateral APA channels.

- Given that only domestic UAPAs are currently permitted, the scope of application under the existing guidance is effectively limited to domestic transactions between entities subject to different tax rates (i.e., arrangements between Qualifying Free-Zone Person (QFZP) and mainland entities). At present, cross-border transactions are not eligible for UAPAs, and the effective date for their inclusion will be announced by the FTA during 2026.

- Interestingly, the APA guidance specifically mentions transactions within the UAE that could be between taxable persons with two different rates of corporate tax (e.g., Mainland entity vs. a QFZP). The pricing of related party transactions at arm’s length has been one of the critical factors to ensure that QFZP status is retained, and the APA could be of significant value to those availing the 0% CT rate.

- Additionally, the guidance also suggests that transactions that are eligible for any “tax incentives” could also be covered under the APA. While legislation on R&D tax credits is still to be released, this could be a pathway for related party transactions that impact any tax incentives to also be covered.

- The definition of controlled transactions in the guidance includes both related parties and connected persons. While not explicitly mentioned, this could mean that connected person transactions could be covered by the APA. The process for benchmarking connected person payments has been open to interpretation since the inception of the UAE TP legislation, and this could be a useful mechanism for certain taxpayers.

- Success in the APA process hinges on rigorous preparation and transparency. Robust TP documentation, timely communication, and intercompany agreements that accurately reflect operational realities are non-negotiable. In fact, the intercompany agreement will likely serve as the starting point for the FTA’s review, forming the foundation for assessing compliance and economic substance. For many groups in the region, this will mean the need to revisit (or prepare for the first time) robust intercompany agreements.

- From a practical experience perspective, businesses should approach APAs with a clear understanding of the FTA’s expectations and discretion. The FTA retains the right to reject an APA application under specific circumstances, including failure to meet the materiality threshold, submission of incomplete or misleading information, reliance on unreliable economic analysis, and significant gaps between contractual terms and actual conduct.

- Another practical consideration is the timeline as the APA application must be submitted within two months of receiving the FTA’s approval for the pre-filing consultation, or at least 12 months before the start of the first tax period to be covered under the APA – meaning, practically, the first covered period would realistically begin in 2028. For example, if the APA covered period starts in January 2028, the application must be submitted and the fee paid by December 2026.

- Taxpayers should weigh the cost of the application and associated consultant fees against the potential benefits. The decision should reflect whether the expected value of these benefits justifies the upfront and ongoing investment.

- Finally, while MAP and APAs are powerful reactive and proactive tools respectively, there is a growing trend of using tax insurance to cover TP and international tax risks. While in a traditional M&A context, this is increasingly being used by multinational enterprises outside of a deal process. This allows taxpayers to transfer the tax risk of potential audits and disputes to insurance companies, in exchange for a premium while ensuring appropriate analysis is carried out. Additionally, the timelines are commercially aligned, which can mean a significantly accelerated process. We will prepare a separate article on this in due course.