Payday Super Bills Received Royal Assent and Start Date Remains 1 July 2026

On 9 October 2025, the Treasury Laws Amendment (Payday Superannuation) Bill 2025[1] and the Superannuation Guarantee Charge Amendment Bill 2025[2] (collectively hereafter referred to as “the Bills”) were introduced to Parliament. These Bills have since passed both Houses and received Royal Assent on 6 November 2025.

The Bills passed in their proposed form and together they instruct the implementation of Payday Super from 1 July 2026. In parallel, the Australian Taxation Office (ATO) released Draft Practical Compliance Guideline (PCG) 2025/D5[3], outlining the risk-based approach it will take when allocating compliance resources during the regime’s first year.

The Maximum Contribution Base (MCB) will continue to operate as a ceiling on the maximum amount of superannuation contributions an employer is required to make for an employee. However, instead of being calculated on a quarterly basis, the MCB will now apply annually. As highlighted in our earlier analysis[4], applying the MCB on an annual basis is expected to create unintended adverse consequences for both employers and employees. These potential issues are discussed in detail below.

Although Payday Super won’t take effect until mid-2026, employers should begin reviewing and updating their payroll systems and approval processes now. Early action will help ensure compliance with the new timing requirements and allow time to identify and rectify any historical shortfalls, minimising the risk of triggering the revised Superannuation Guarantee Charge (SGC) framework.

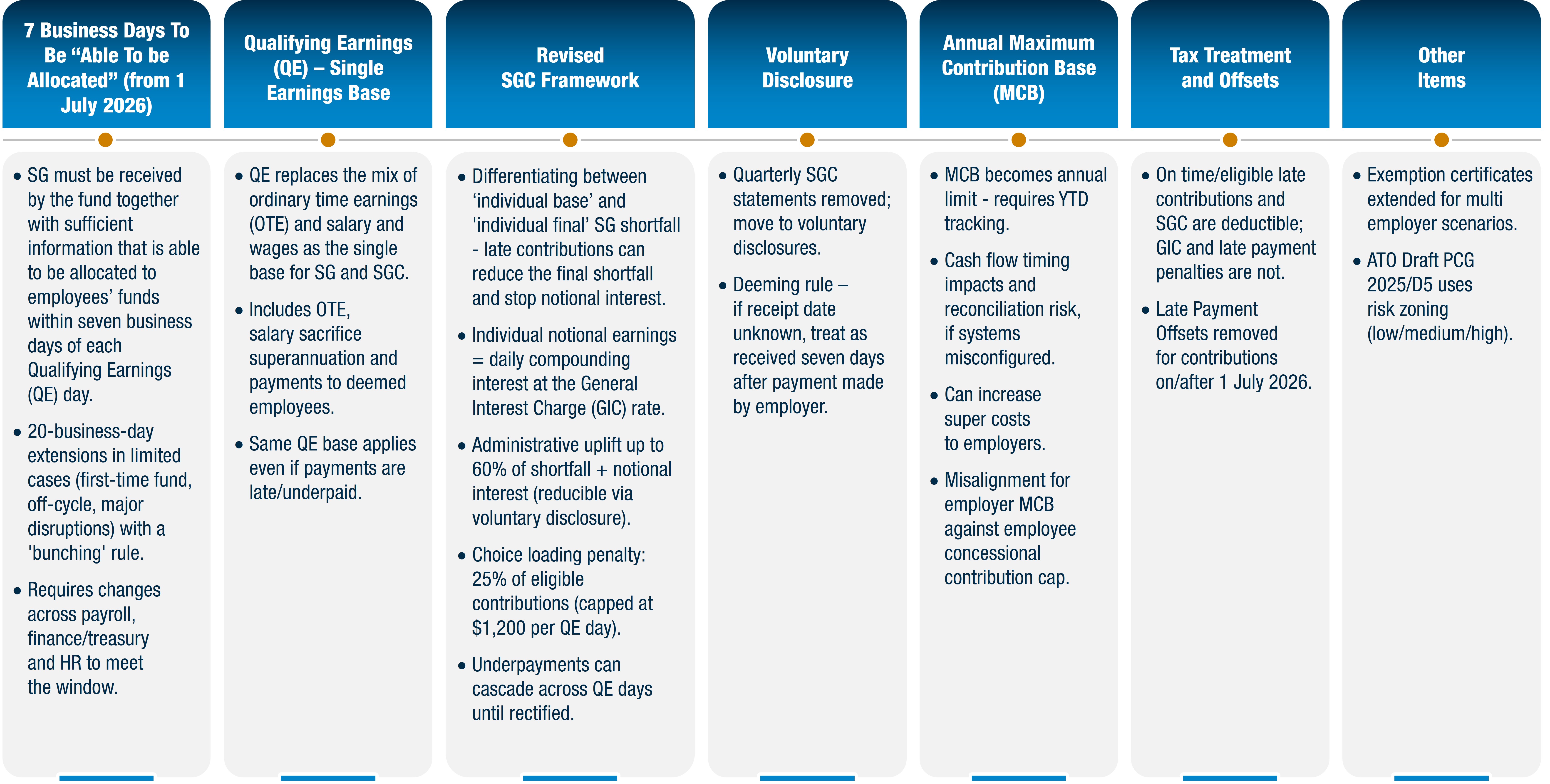

Summary of Key Changes

Key Readiness Actions

Next Steps and A&M Support

The introduction of the Payday Super regime signals a significant compliance and system transformation for employers. The changes will have implications across payroll, finance, HR, and governance functions.

A&M can assist employers to navigate these reforms through end-to-end readiness assessments, data mapping, system impact analysis, and policy updates.

If you would like to discuss how these reforms may impact your organisation, please reach out to a member of the A&M Employment Taxes team.

In Detail

Under the current system, contributions are generally required to be made by the 28th day following the end of each quarter. From 1 July 2026, contributions will instead be due within seven business days of each pay event, effectively moving super payments to a payday-aligned cycle.

That is, under the proposed legislation, employers will have seven business days to ensure that superannuation contributions are received by an employee’s nominated superannuation fund following each payday – referred to as “Qualifying Earnings” (QE) day. This is a critical change from the earlier Exposure Draft[5] that referred to calendar days (rather than business days) when calculating the payment window for Superannuation Guarantee (SG) contributions.

This change will substantially increase the required frequency of employer superannuation payments and require systemic changes across payroll, finance and treasury, and HR processes. Employers will need to ensure that payments are not only made on time but also received and able to be allocated to the employee’s superannuation account within the required timeframe.

To support the transition to QE day alignment, the Bills allow for an extended payment period of up to 20 business days in limited circumstances such as:

- First-time contributions to a new superannuation fund (either a new fund for a current employee, or a new fund for a new employee);

- Payments made outside the ordinary pay cycle; or

- Where large-scale external events disrupt payment processing (for example, system outages or natural disasters).

Notably, a “bunching” rule applies so that any subsequent QE day following an extended due date cannot fall earlier than the extended period allowed for the previous cycle.

The Bills replace the existing concepts of ‘ordinary time earnings’ (OTE) and ‘salary and wages’ with Qualifying Earnings (QE) as the sole earnings base for determining superannuation obligations. The definition of QE consolidates a number of provisions relating to payments for employees that are relevant for determining the SG amount for an employee. QE includes:

- An employee’s ordinary time earnings;

- Salary-sacrificed superannuation contributions; and

- Payments made to individuals deemed employees under the expanded employee definitions (for example, directors, certain contractors and entertainers captured for superannuation purposes).

For most employers, the QE base remains similar to the OTE earnings base (besides adjustments to the MCB), so determining how much an employer needs to contribute to avoid liability for the SGC is not fundamentally changing. However, employers will need to ensure their mapping is correct within STP2.0 to ensure correct reporting as QE.

QE does not include payments that are currently excluded from OTE such as overtime payments (payments for work performed during hours outside an employee's ordinary hours of work) and lump sum payments made on termination.

Under previous SG framework, ‘salary or wages’ was used to calculate an employer’s individual SG shortfalls if they were liable for the SGC. However, under the Payday Super framework, QE will be single earnings base for working out the individual SG amount required to avoid an SG shortfall and for calculating the amount of SG charge if an employer has an SG shortfall. That is, there is no change in the earnings base, even if contributions are not paid in full or on time.

The SGC framework which will determine the penalties and administrative consequences of late or missed SG payments has been significantly revised. The key changes focus on strengthening deterrence and aligning the SGC with the updated concept of QE. The updated SGC includes[6]:

- The Individual Final SG Shortfall: The Bills introduce the concept of an individual final SG shortfall, which will represent the unpaid or underpaid superannuation contributions at the time the SGC is assessed, calculated based on QE. Importantly, even if contributions are late, if they are made before an SGC assessment is issued, they can reduce the final shortfall and stop interest accruing, providing employers with an incentive to promptly correct errors before the ATO intervenes.

- Individual Notional Earnings: This is the interest component of the SGC - currently set at a flat 10% nominal interest rate. This will be replaced with a daily compounding interest rate calculated at the GIC rate. This change is designed to more accurately compensate employees for lost earnings and to align with other ATO interest frameworks. Importantly, the notional earnings component will cease accruing as soon as sufficient contributions have been made to reduce an employee’s final SG shortfall to nil, even if this is before the SG shortfall is assessed.

- Administrative Uplift: The Bills abolish the long-standing $20 administrative fee per employee per quarter and replace it with a new “Administrative Uplift” of up to 60% of the final SG shortfall plus notional interest. The uplift represents enforcement and recovery costs borne by the ATO and acts as a behavioural deterrent against non-compliance. Subject to the Regulations, the uplift can be reduced under certain circumstances, including where an employer makes a voluntary disclosure.

- New “Choice Loading” Penalty: Is introduced where employers fail to comply with fund choice obligations. The penalty equals 25% of the eligible contributions, capped at $1,200 per QE day. This measure underscores the government’s emphasis on employee choice and fund governance.

Under the new framework, employers will no longer lodge quarterly SGC statements when a shortfall arises. Instead, voluntary disclosures will be the primary mechanism for rectifying late or missed payments. This reform aims to simplify the current administrative process and encourage employers to self-correct errors proactively.

When completing the voluntary disclosure, employers will need to provide sufficient information to enable calculation of the notional interest component. Where an employer cannot confirm the date the amount was received by the relevant fund, the legislation introduces a deeming rule such that the contribution will be deemed to have been received seven days after payment was made by the employer. While this rule provides administrative certainty and ensures that late payments can still be reported accurately, it may overstate the notional interest payable by the employer.

Under the new rules, an accidental underpayment in one period will have flow-on implications for every QE day thereafter until rectified. The legislation prescribes that contributions are automatically allocated against an employee’s base shortfall in the order the are received, until the employee’s final shortfall is nil. As such, where there is an underpayment that results in an individual base SG shortfall in respect of the particular employee(s) on a QE day, the employer will therefore be liable for the SG charge. If the employer is unaware of the base shortfall and does not make a late contribution, the following contribution will be first allocated to the earlier QE day, therefore spurring a chain of base shortfalls until the original shortfall is identified.

Beyond the revised SGC framework, employers may face additional interest and penalties for failing to pay the assessed SGC within the prescribed time.

- General Interest Charge (GIC): this will apply to the entire unpaid SGC amount from the day after it becomes due until the liability is paid in full.

- Late Payment Penalty: If an SGC remains unpaid for 28 days after it becomes due, the ATO must issue a notice to pay. Failure to comply with that notice within the following 28 days may result in a late payment penalty of up to 25% of the unpaid amount, or up to 50% for repeated non-compliance.

Importantly, GIC does not accrue on the late payment penalty itself but continues to accrue on the underlying SGC debt. These rules emphasise the need for employers to monitor their superannuation remittances closely and ensure prompt payment to avoid cascading liabilities.

Under the Payday Super framework, the MCB will now apply annually.

The MCB caps the earnings on which employers must pay SG. It currently resets each quarter, (However, moving to an annual MCB means the cap applies across the full financial year, not quarter by quarter.

Under quarterly caps, large or irregular payments (bonuses/commissions) were naturally smoothed because the cap reset every quarter. With an annual cap, the calculation is driven by cumulative year-to-date earnings.

While this reform may appear administrative, it has far-reaching implications for both employers and employees. The following sections outline the expected outcomes and challenges.

Impact on Employers

- Cash Flow and Forecasting: SG for high-income earners will be frontloaded each year, with more payable early in the year. Once the cap is reached, SG contributions will cease for the remainder of the year. This will front-load cash flow pressure for employers that pay super on top of their base earnings and will increase headcount costs for roles with staff movement throughout the year.

- Systems and Process Changes: Payroll systems will need to be updated to track year-to-date earnings to automatically stop SG once the annual MCB is met and also automatically restart each new year.

- Risk if Misconfigured: Errors can cause over or under-payments, creating reconciliation work and SGC exposure, especially for large employers, multi-system environments, cross-border staff, or deferred pay (e.g., annual bonuses). Under the new rules, an accidental underpayment in one period will have flow-on implications for every QE day thereafter until rectified.

- Increased Costs: Employers will now need to pay superannuation on bonus payments that previously capped out at the quarterly limits, but are now below the annual total.

Impact on Employees

- Variable Net Pay: Employees with a fixed total remuneration package may have more of their income diverted to superannuation at the beginning of the year until they reach the annual cap. Those with large early-year bonuses/commissions may have a higher percentage diverted to superannuation, reducing their net pay. However, their net pay would then increase once they hit the annual cap, stopping SG for the rest of the year.

- Uneven Outcomes: New hires may not reach the annual cap with the new employer and receive SG on all earnings, leading to breaches of their personal superannuation caps or creating workforce inequities.

- Less Predictability: QE day-based SG and job changes within the year make annual SG outcomes harder to predict.

Administrative and Compliance Implications

Employers will need to implement more sophisticated payroll monitoring controls to ensure superannuation contributions cease precisely once the annual threshold is reached. Many payroll systems are configured for either monthly smoothing or quarterly MCB resets and may not natively support cumulative annual tracking.

The legislation also updates the income tax treatment of superannuation contributions to ensure consistency with the new SGC framework. Under the revised rules, on-time superannuation contributions, eligible late contributions, and the SGC itself will be tax deductible to employers. However, the GIC and late-payment penalties will remain non-deductible.

Another notable change is the removal of LPOs for contributions made on or after 1 July 2026. Transitional provisions ensure that contributions made before this date will continue to be subject to the existing tax treatment.

Where an employee switches employers during the year and may exceed their annual MCB as a result of the new employment, they may apply to the ATO for an employer shortfall exemption certificate. The existing “opt-out of super” process has been extended to allow employees who hold multiple jobs during the year to apply for their later employer to be exempt from making superannuation contributions, where they have already received sufficient contributions from another employer and are at risk of exceeding the annual concessional contributions cap (currently $30,000). It is worth noting however, that this will not prevent a transitional issue where employers can make superannuation contributions relating to 15 months of earnings (April 2026 – June 2027) all in FY27, resulting in employees breaching their concessional contribution caps and being subject to additional tax as a result.

ATO Draft PCG 2025/D5 – Compliance Approach

Released on the same day the Bills were introduced to parliament, the ATO’s Draft PCG 2025/D5 provides an insight into how the regulator intends to administer the new regime during the transitional year.

The Draft PCG introduces a risk-zoning model, categorising employer behaviours into low, medium, or high risk zones, depending on the extent and timeliness of compliance. Employers who promptly identify and rectify errors, maintain robust internal controls, and engage transparently with the ATO will generally fall into the low-risk category. Conversely, those demonstrating systemic lateness, poor governance, or limited remediation efforts will be classified as high risk and subject to heightened scrutiny and enforcement action.

Although the PCG guides the ATO’s compliance approach, it does not have the force of law. If the ATO becomes aware of a superannuation shortfall for a particular QE day, it remains legally obliged to apply the legislation, irrespective of an employer’s risk classification.

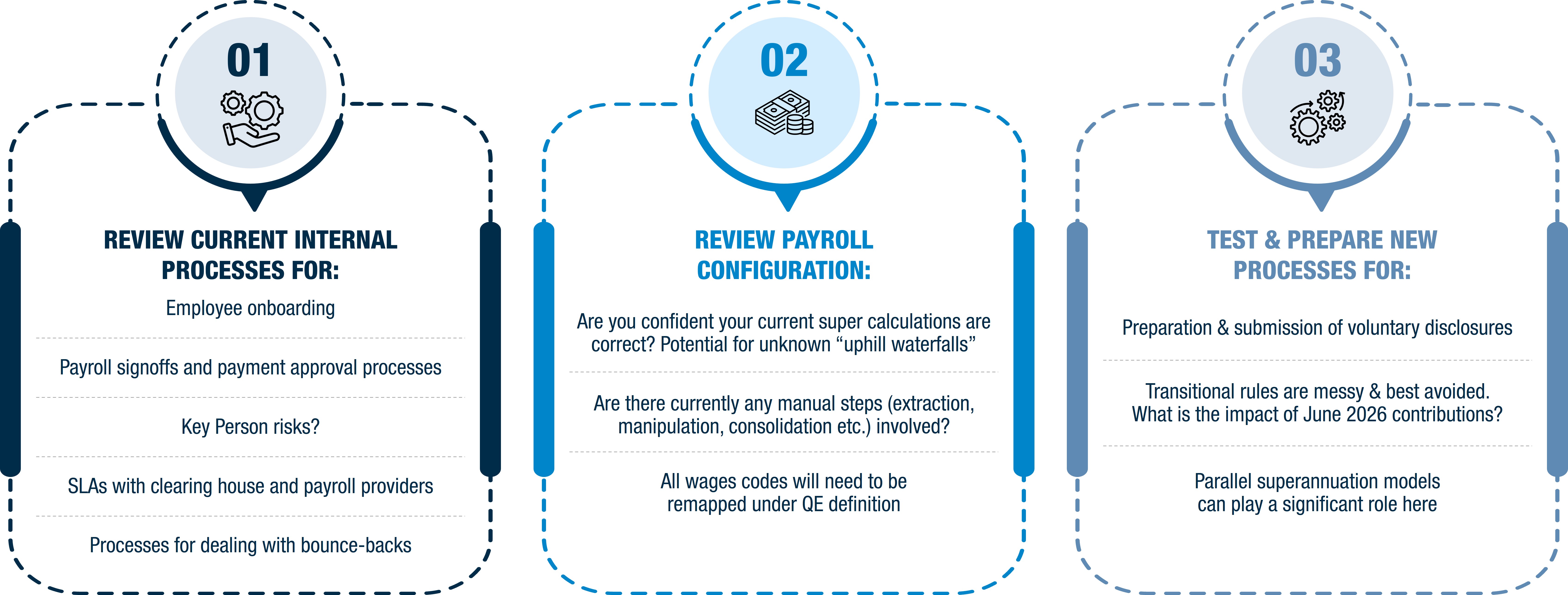

What Employers Should Do Now (Key Readiness Actions)

The Payday Super framework increases the importance of data integrity between payroll and superannuation clearing systems as the timing of payments, remittances, and fund allocations will now be scrutinised on a QE day basis. Any discrepancy could trigger SGC liabilities or administrative penalties under the new framework.

While the Payday Super changes will not apply until 1 July 2026, employers should begin preparing now. The lead time will allow sufficient opportunity to test payroll systems, update processes, and identify any historical exposures before the regime commences.

Employers should:

- Review payroll and finance systems to ensure superannuation contributions can be paid, received, and allocated to funds within seven business days of QE day.

- Identify and map all payment types in accordance with the new “Qualifying Earnings” definition.

- Update employee onboarding and fund-choice processes to ensure new employees’ fund details are obtained and verified prior to first QE day.

- Assess remittance and reconciliation procedures to ensure alignment between payroll, treasury, and superannuation teams.

- Consider data readiness for Single Touch Payroll (STP) reporting, which will play a critical role in ATO monitoring.

- Assess non-employee workers that fall within the extended definition of ‘employee’ that will be captured for Payday Super purposes.

- Engage with employees to explain the impacts on their cash flow, particularly around bonuses and work to find solutions in advance.

For many employers, early planning will not only ensure compliance but also deliver cash-flow visibility and operational efficiencies once super payments move to a near real-time cycle.

[1] Australia. Parliament. "Bill 25075b01: First Reading." https://parlinfo.aph.gov.au/parlInfo/download/legislation/bills/r7373_first-reps/toc_pdf/25075b01.pdf;fileType=application%2Fpdf.

[2] Australia. Parliament. "Superannuation Guarantee Charge Amendment Bill 2025." https://www.aph.gov.au/Parliamentary_Business/Bills_Legislation/Bills_Search_Results/Result?bId=r7374.

[3] Australian Taxation Office. "PCG 2025/D5: Practical Compliance Guideline." https://www.ato.gov.au/law/view/document?DocID=DPC/PCG2025D5/NAT/ATO/00001&PiT=99991231235958#A1.

[4] Amanda Spinks, Johann Blanco, and Daniel Dass. "Payday Super: Draft Legislation Released." Alvarez & Marsal, April 27, 2025. https://www.alvarezandmarsal.com/thought-leadership/payday-super-draft-legislation-released.

[5] Amanda Spinks, Johann Blanco, and Daniel Dass. "Payday Super: Draft Legislation Released." Alvarez & Marsal, April 27, 2025. https://www.alvarezandmarsal.com/thought-leadership/payday-super-draft-legislation-released.

[6] Section 19A of Treasury Laws Amendment (Payday Superannuation) Bill 2025