Malaysia’s Forest City Single Family Office Incentive Scheme

A New Hub for Global Family Wealth Management

Malaysia has taken a significant step toward positioning Forest City, Johor, as a regional hub for wealth management with the introduction of the Single Family Office (SFO) Incentive Scheme under the Forest City Special Financial Zone (FCSFZ).

The initiative aims to attract ultra-high-net-worth individuals and family offices both from Malaysia and the rest of the world, seeking a competitive base in Southeast Asia for investment management, succession planning, and cross-border wealth structuring.

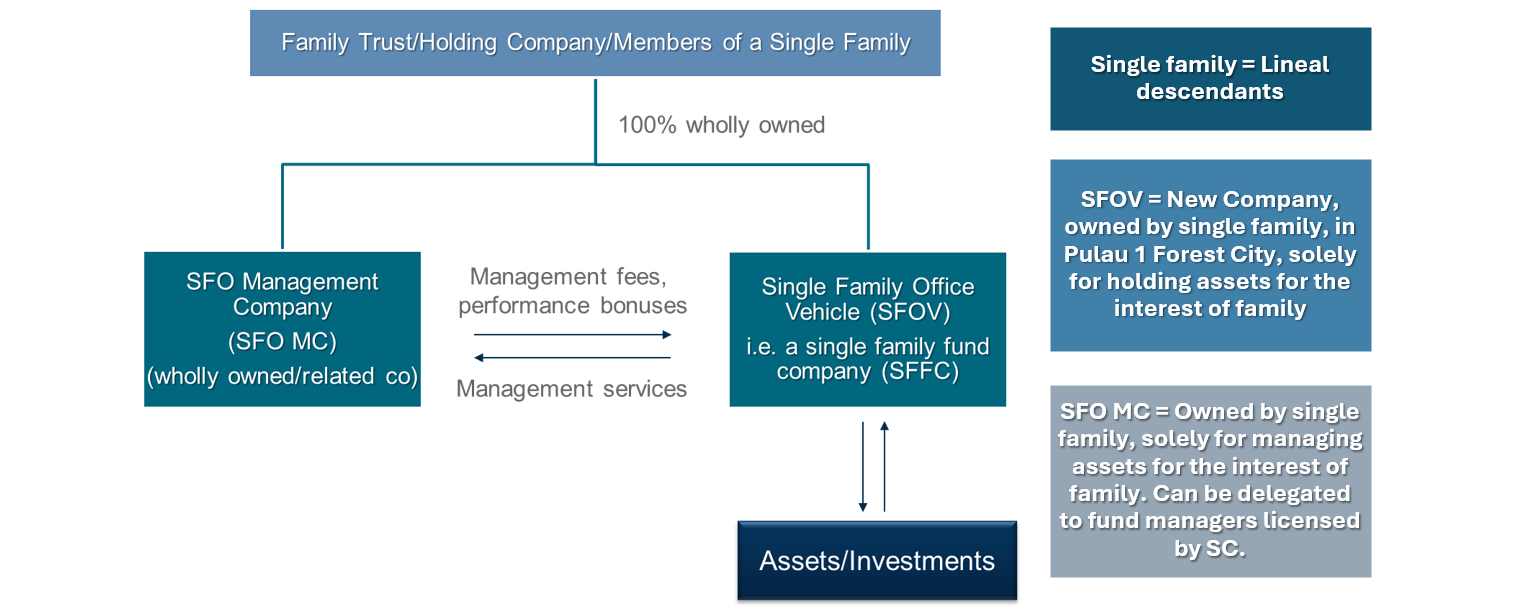

A. Overview of the SFO Structure

As per the Securities Commission’s (SC) framework[1], standard operating model of a single-family office under the incentive scheme could be as follows:

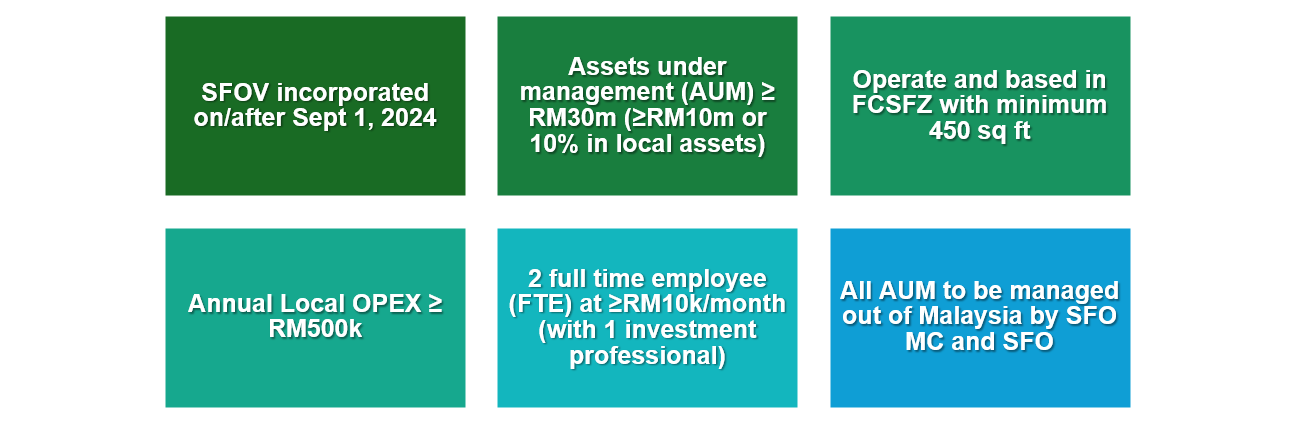

B. Eligibility and Preliminary Assessment

Before applying, families should undergo a preliminary eligibility review to ensure the structure and operations meet SC criteria. Based on the latest guidelines on the SFO Incentive Scheme released by the SC on 9 October 2025, some of the requirements to be met by the SFO for the first 10 years are:

Additional Conditions for subsequent 10-year exemption:

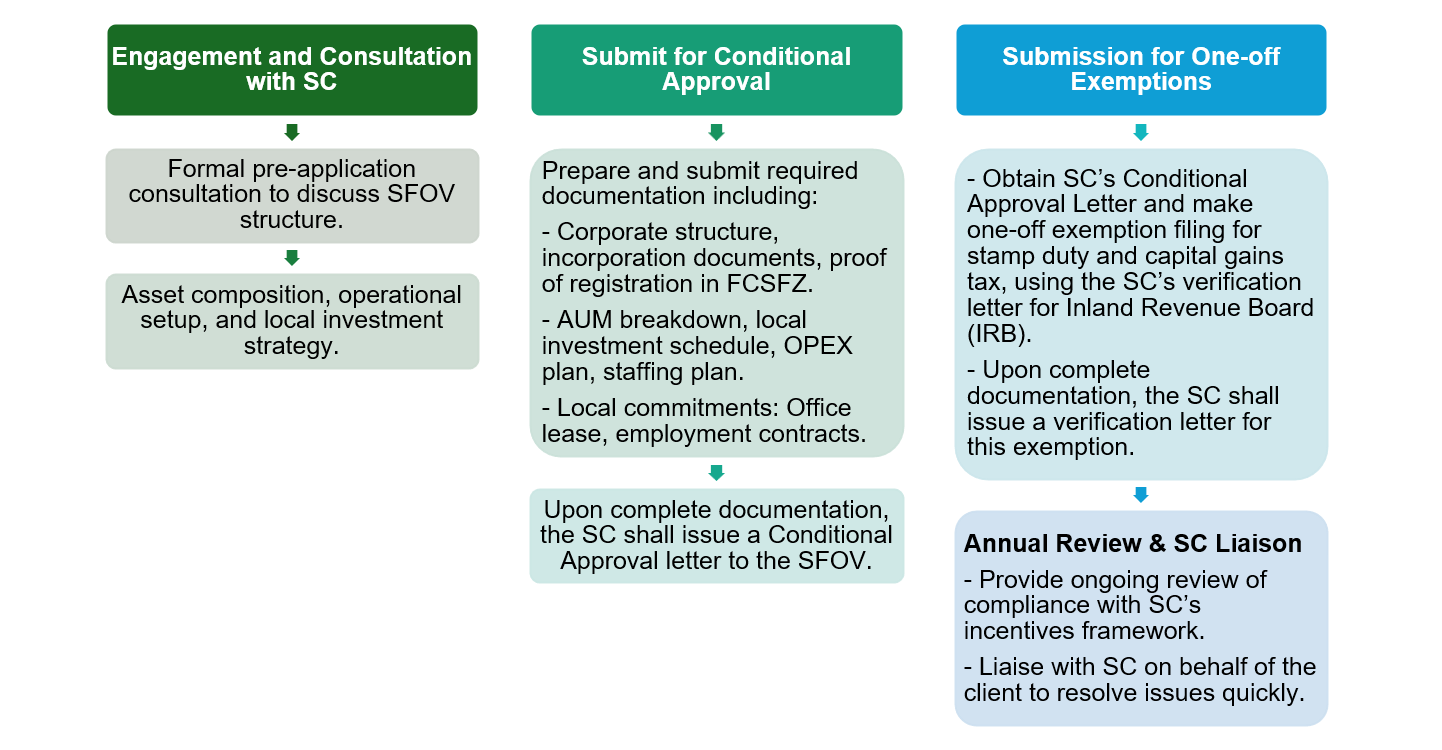

C. Application Process

D. Key Tax Incentives

Relevant details pertaining to various tax exemptions, reliefs and liberal visa regime are outlined below. The aim is to boost FCSFZ as a premier hub for SFOs, wealth management, and high-value investment activities.

No. | Title / P.U.(A) | Effective Period | Key Incentive/ | Applicable to/ |

1

| Income Tax (Single Family Office Incentive Scheme) Rules 2025 [P.U.(A) 350/2025]

| From 1 September 2024 (application period from 1 September 2024 to 31 December 2034)

| 0% tax rate on chargeable income for first 10 YAs and next 10 Yas.

| For a qualifying company carrying on qualifying SFO activities under SC approval. A qualifying company is a Single Family Fund Company (SFFC) which is:

|

2

| Income Tax (Single Family Office Incentive Scheme) (Exemption) Order 2025 [P.U.(A) 351/2025]

| From 1 September 2024 (for disposal made within the period from 1 September 2024 to 31 December 2034)

| Exemption from capital gains tax on share disposals.

| Disposal of unlisted Malaysian company shares to a Single Family Fund Company (as defined above) by entities wholly owned by a single family, within 12 months from the date the certification letter is issued to the SFFC by the Securities Commission.

|

3

| Stamp Duty (Single Family Fund Company) (Exemption) Order 2025 [P.U.(A) 352/2025]

| From 1 September 2024 to 31 December 2034

| Full stamp duty exemption on instrument of transfer of qualifying assets.

| Between a Single Family Fund Company (SFFC) and (i) a single family member, or (ii) an entity/trust wholly owned by them; must be executed within one year of SC certification

|

4

| Fast Track – Resident Pass Talent (FT-RPT)

| Same period as SFO scheme

| Residency of 10 years and renewable for another 10 years. Grants rights to start a business, pursue further study and employment in Malaysia, with privileges extended for spouse and children under 18. Dependents over 18 years old, parents and parents-in-law are eligible for a renewable one-year Social Visit Pass for up to five years.

| This would serve both family members and full-time foreign professionals working in the family office. At minimum, three FT-RPTs can be shared between family members working in the family office. May request more on a case-by-case basis. |

The SFO incentive marks a meaningful policy shift to attract private capital and deepen Malaysia’s financial sophistication. It offers a cost-efficient alternative to regional financial centres, with strong tax reliefs across income, capital gains, and property transfers which is regulatory oversight by the SC.

This initiative not only encourages the repatriation of private capital but also positions Malaysia as an attractive base in Southeast Asia for cross-border family offices seeking a dynamic environment for business growth.

How A&M Can Help

The SFO Incentive Scheme represents one of Malaysia’s most comprehensive wealth management initiatives to date. Families considering this route should evaluate:

- Long-term family office objectives for wealth and succession planning;

- Readiness to meet AUM and local substance thresholds; and

- Tax planning opportunities linked to the 0% income tax regime and capital gains exemptions.

If you need to deep dive into any aspects of the Single Family Office Incentive Scheme or discuss opportunities for doing business in Malaysia or FCSFZ, please contact us. Our team here at A&M can assist with pre-qualification reviews, application preparation, and liaison with the SC to ensure a seamless establishment process.

For more information, please contact us at Alvarez & Marsal Tax in Southeast Asia to help navigate your organization’s interest in the Single Family Office Incentive Scheme.

[1] Securities Commission Malaysia. 2025. Guidelines on Marketing and Distribution of Unit Trust Funds. Kuala Lumpur: Securities Commission Malaysia. https://www.sc.com.my/api/documentms/download.ashx?id=06aecaaf-fb52-45c3-b1b8-cd222878959c.