MIDDLE EAST TAX ALERT | UAE | Latest VAT law amendments for the upcoming UAE e-Invoicing implementation

The UAE Ministry of Finance (MoF) has published the amended VAT Executive regulations (Cabinet Decision No. 100 of 2025 to the Federal Decree Law No. 8 of 2017) which greatly impacts businesses that are coming under the radar of UAE e-Invoicing due to be rolled out in July 2026.

Tax document format (tax invoices and credit notes as prescribed under Articles 59 and 60) requirements have changed extensively and administrative exceptions granted by the Federal Tax Authority (FTA) are no longer available.

These amendments come at a time when businesses should revisit and align their current processes and issuing invoices to be ready for the incoming e-Invoicing mandate.

Summary of Key Updates:

Current reliefs provided will no longer be effective post UAE e-Invoicing roll out in July 2026. These are as follows:

- Simplified tax invoices (Art. 59(2), (5)):

Such formats will no longer be allowed for businesses covered under the UAE e-Invoicing scope. - Administrative exceptions provided by the FTA for not issuing tax invoices and/or tax credit notes (Art. 59(7)):

Businesses enjoying this relief currently will no longer be able to apply for this post UAE e-Invoicing roll out in July 2026. - Tax invoices for wholly zero-rated supplies (Art. 59(3)):

Currently, businesses are not required to issue a tax invoice where sufficient records are available to determine the nature of supply enjoying zero rated VAT treatment. Similar to items one and two above, this will no longer be applicable once UAE e-Invoicing mandates roll out. Businesses will need to issue a UAE schema compliant e-Invoices for such wholly zero-rated supplies.

A&M Comments:

- Businesses must start with immediate steps such as:

- Assess their current Order to Cash (O2C) process, billing systems and finance processes.

- Ensure customer master data is accurate and complete.

- Identify data touch points and gaps in the processes to align with the e-Invoicing requirements.

UAE businesses need to undertake the above steps to ensure they have a complete dataset for data validation by an Accredited Service Provider (ASP) which is one of the integral steps in the UAE e-Invoicing 5-corner model.

- Producing UAE compliant e-Invoices is crucial for businesses, whether for standard rated supplies or wholly zero-rated supplies to:

- Avoid ASP rejection

- Mitigate additional commercial cost of re-issuance of documents with complete information

- Ensure timely payment recovery from customers through seamless exchange on the UAE PEPPOL network.

- Since simplified tax invoice formats will no longer be effective post UAE e-Invoicing roll out, businesses must maintain complete and accurate customer master data (name, addresses, TRN) to issue a full tax document.

- This can be a challenging task, especially for retail businesses, who typically generate a high volume of simplified tax invoices for low value supplies (less than AED 10k).

- While as of today, the scope of UAE e-Invoicing and e-reporting is restricted to B2B and B2G transactions, we foresee B2C transactions coming into scope of the e-reporting mandate within the next five years. Then, the challenge of not being allowed to issue simplified tax invoices would increase dramatically.

- Similarly, businesses that were enjoying the administrative exceptions from issuing tax documents, must start gearing up to align their billing systems and customer master data as explained under item (one) above to generate UAE schema- compliant e-Invoices.

- The update regarding generating full tax documents for wholly zero-rated supplies, is a clear alignment with the zero-rated use case provided in the UAE e-Invoicing data dictionary. This is especially relevant for businesses whose core supplies are wholly zero-rated, such as healthcare or qualifying education. This ties back to the requirements of maintaining complete and accurate customer master data to be able to generate a compliant e-Invoice.

Final Thoughts for UAE businesses:

Overall, these amendments in the VAT legislation are a clear alignment with the e-Invoicing requirements published so far i.e. the UAE data dictionary (UAE PINT). For all the impacted businesses, it is a key reminder to start preparing today for the e-Invoicing roll out in July 2026.

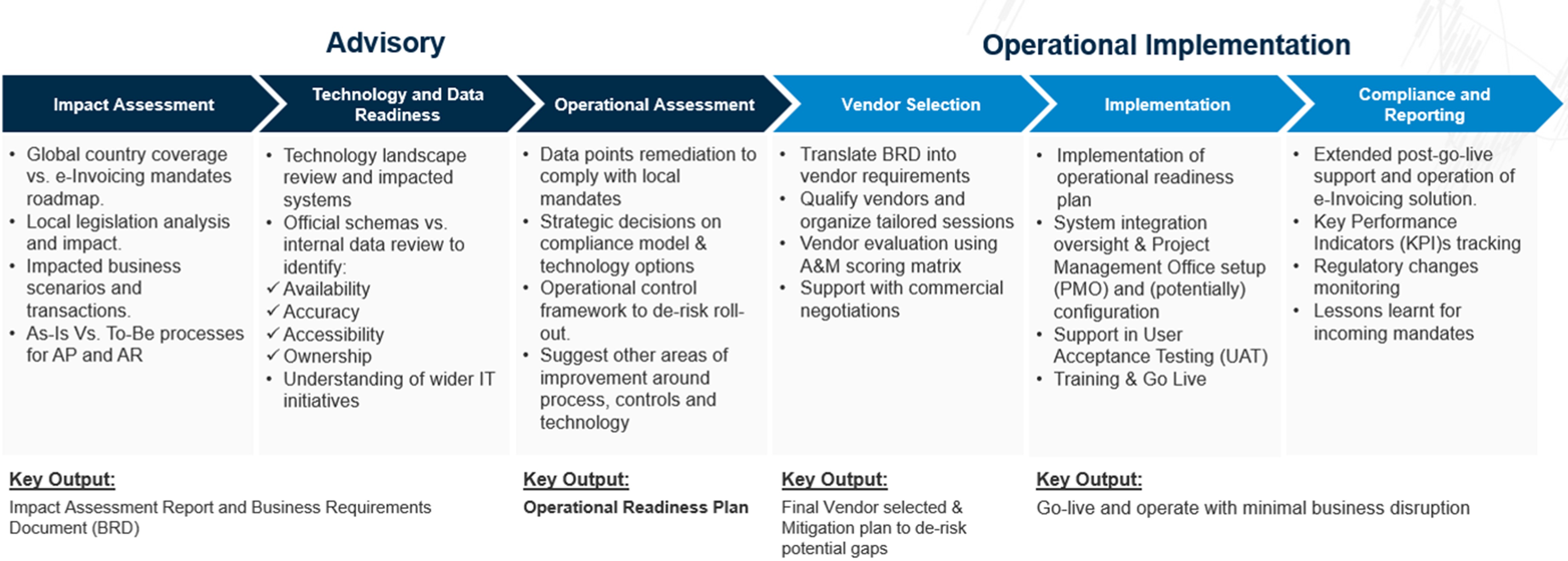

At A&M we have developed a standard comprehensive approach for operational e-Invoicing readiness:

Get in touch today with one of our experts.