A look into strategic realignment amid changing market dynamics

This edition of the Automotive Industry Spotlight will focus on recent key developments from original equipment manufacturers (OEMs) as they navigate tariff pressures and shifts in electric vehicle (EV) strategy.

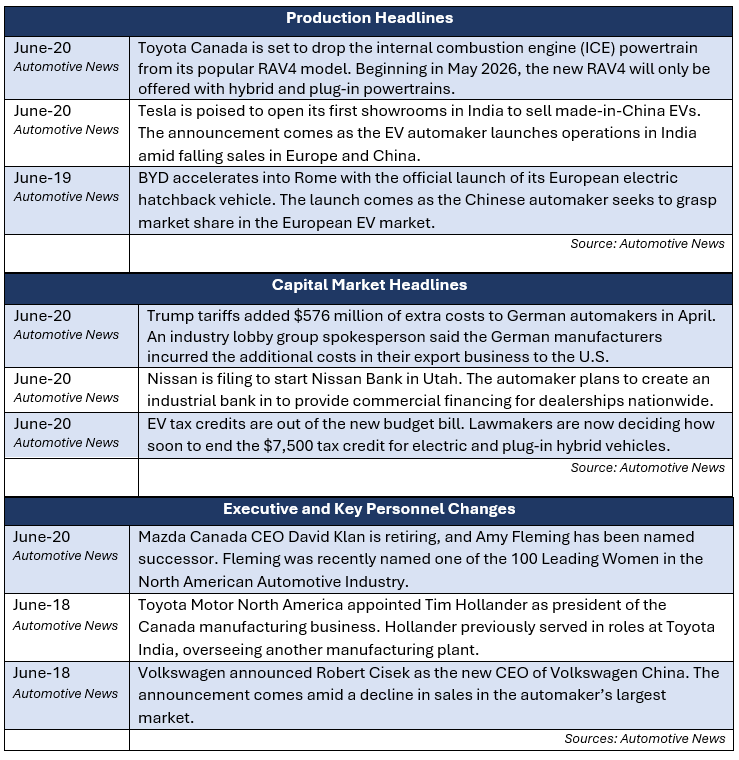

In industry news, Toyota Canada is set to drop the gasoline-powered RAV4 from the 2026 lineup in a pivot toward more electric and plug-in hybrid offerings. An estimated $576 million of costs were added to German auto manufacturers due to tariffs on exports to the U.S. Volkswagen China appointed a new CEO as sales slipped in the automaker’s largest market.

In regulatory news, Honda recalled nearly 260,000 vehicles related to potentially faulty brake pedals. The U.S. closed an engineering analysis of over two million Nissan vehicles after investigating rear suspension issues due to corrosion. President Trump signed bipartisan legislation passed by Congress repealing California’s planned 2035 ban on gasoline-powered car sales.

Industry Focus: Strategic Alignment

Brief Tariff Update

The automotive tariff environment continues to evolve, with its impacts increasingly being felt across the industry. While the core 25 percent tariffs on imported vehicles and components remain in place, limited relief on certain parts categories has offered some short-term cost mitigation for affected suppliers. The recent measures appear to be modest and focused on easing supply chain pressures but do not point to a significant policy pivot.

Looking ahead, the trajectory of U.S. trade policy, particularly ongoing discussions with China, the EU and North American partners, may play a more significant role in shaping the long-term tariff landscape. In particular, negotiations between the U.S. and China remain a key area of focus for the industry, given China’s central role in the production of EV batteries, rare earth materials and electronic components. Any movement toward a revised or expanded trade agreement could meaningfully alter the cost structure and sourcing strategies for U.S.-based OEMs and suppliers.

Key Strategic Announcements

Ongoing developments in tariff policy and EV strategy are prompting automakers to reevaluate their long-term plans. Rising costs, evolving consumer demand and increasing regulatory complexity have led several OEMs to adjust course, both in terms of production plans and manufacturing footprint. Recent announcements from General Motors (GM) and Audi reflect how the industry is beginning to adopt more flexible strategies aimed at hedging electrification risk and expanding domestic manufacturing to reduce exposure to tariffs and supply chain disruptions.

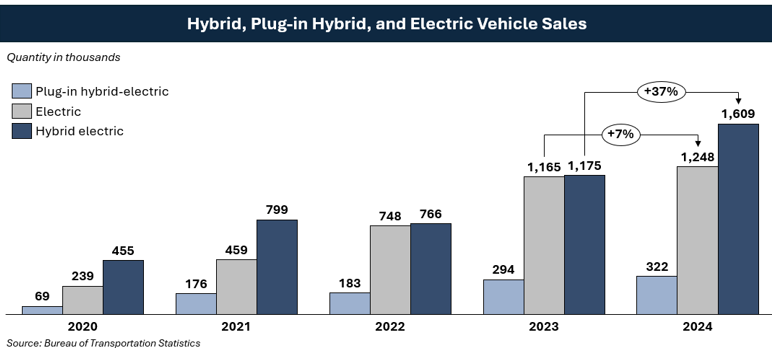

GM recently announced a $3.5 billion investment to expand hybrid and plug-in hybrid vehicle production at its Michigan facilities [1], a meaningful pivot from its earlier EV-exclusive ambitions. The move underscores a broader industry recognition that full electrification may take longer to materialize than once projected. By reinvesting in hybrids, GM is seeking to hedge against softer-than-expected EV demand while also aligning more closely with evolving consumer preferences and regulatory flexibility. While EV adoption continues to grow, hybrid platforms appear to be emerging as the middle ground for both consumers and manufacturers. The Michigan expansion is also a signal of GM’s commitment to domestic manufacturing, offering both operational advantages and a buffer against rising tariff exposure.

Similarly, Audi, a subsidiary of Volkswagen, revealed that it is actively evaluating the construction of its first U.S. manufacturing plant [2], with potential investment estimates reaching $4.6 billion. This represents a strategic shift for the premium automaker, which has historically relied on imports to serve the American market. Establishing a U.S. production footprint would allow Audi to mitigate the impact of the 25 percent tariff on imported vehicles, enhance supply chain efficiency and improve price competitiveness. If finalized, the investment would place Audi alongside a growing list of global OEMs localizing production to reduce geopolitical risk and meet domestic policy expectations.

The Road Ahead

Looking ahead, the automotive sector is continuing to adapt to changing market dynamics. The once-universal EV rush is now being tempered by real-world constraints from infrastructure limitations to consumer hesitation and policy uncertainty. A few trends to watch in the coming months include:

- The rise of the hybrid “middle ground”: OEMs are revisiting hybrid and plug-in hybrid platforms not as transitional technologies but as long-term pillars of their lineup. This shift could redefine development roadmaps across major players.

- Tariff policy as a long game: While recent relief measures have provided temporary cost mitigation, automakers are still navigating considerable uncertainty around long-term trade strategy. Broader reforms may hinge on ongoing negotiations with China and other key partners, which could reshape the trajectory of automotive tariffs in the months ahead.

- Strategic supply chain rewiring: Expect more announcements from companies seeking to localize key operations and hedge EV risks, especially in light of continuing trade tensions and policy changes.

While the momentum behind electrification isn’t going away, the industry is clearly recalibrating. For now, flexibility both in production strategy and regulatory positioning appears to be the name of the game.

Sources

[1]. Wall Street Journal: GM Plans $4 Billion Investment to Boost U.S. Manufacturing (https://www.wsj.com/business/autos/gm-plans-4-billion-investment-in-u-s-manufacturing-cf66fe5a?mod=Searchresults_pos3&page=1)

[2]. Auto News: Audi could build plant in U.S. to placate Trump, report says (https://www.wsj.com/business/autos/gm-plans-4-billion-investment-in-u-s-manufacturing-cf66fe5a?mod=Searchresults_pos3&page=1)

Additional insights are included below.

Industry Update

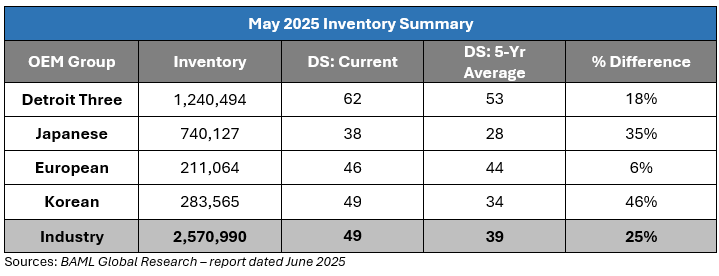

May inventory levels ended at 2.57 million units, a 62,000-unit decrease from April. Days’ supply closed at 49, approximately 25 percent above the five-year average. The decrease in inventory levels was evident across all major OEMs.

Regulatory Landscape

Honda Recall: Honda recalls approximately 259,000 vehicles in the U.S. for defective brake pedals. A brake pedal pivot pin may not have been staked properly, which could increase the risk of a crash or injury. The recall affects the Pilot, Acura MDX and Acura TLX models. [1]

The National Highway Traffic Safety Administration Closes U.S. Nissan Investigation: The investigation of over two million Nissan vehicles comes to a close after the completion of an engineering analysis. The analysis was conducted to determine if certain rear suspension parts would separate from the chassis due to corrosion. Nissan implemented a new design in 2018 to improve the durability of affected parts. [2]

Trump Signs Bipartisan Law Repealing California Gas-Car Ban: President Trump signed into law bipartisan legislation passed by Congress that repeals California’s regulation aimed at banning the sale of new gasoline-powered vehicles by 2035. The move reverses a high-profile emissions mandate that had been challenged by several automakers and energy industry groups, who viewed the original timeline as overly ambitious and difficult to implement under current market and infrastructure conditions. [3]

Regulatory News Source

[1]. Automotive News: Honda recalls 259,033 vehicles in U.S. for defective brake pedals (https://www.autonews.com/honda/an-honda-recall-brake-pedals-0618/)

[2]. Automotive News: U.S. closes engineering analysis on more than 2 million Nissans (https://www.autonews.com/nissan/an-nissan-probe-closed-0618/)

[3]. Automotive News: Trump repeals California gas-car ban as auto industry applauds; higher car tariffs floated (https://www.autonews.com/manufacturing/suppliers/an-trump-tariffs-california-ban-0612/)

Stay connected to industry financial indicators and check back in July for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive