The Hydrogen Fuel Cell Market and Its Automotive Applications

This edition of the Automotive Industry Spotlight will focus on the hydrogen fuel cell market and potential growth in its automotive applications.

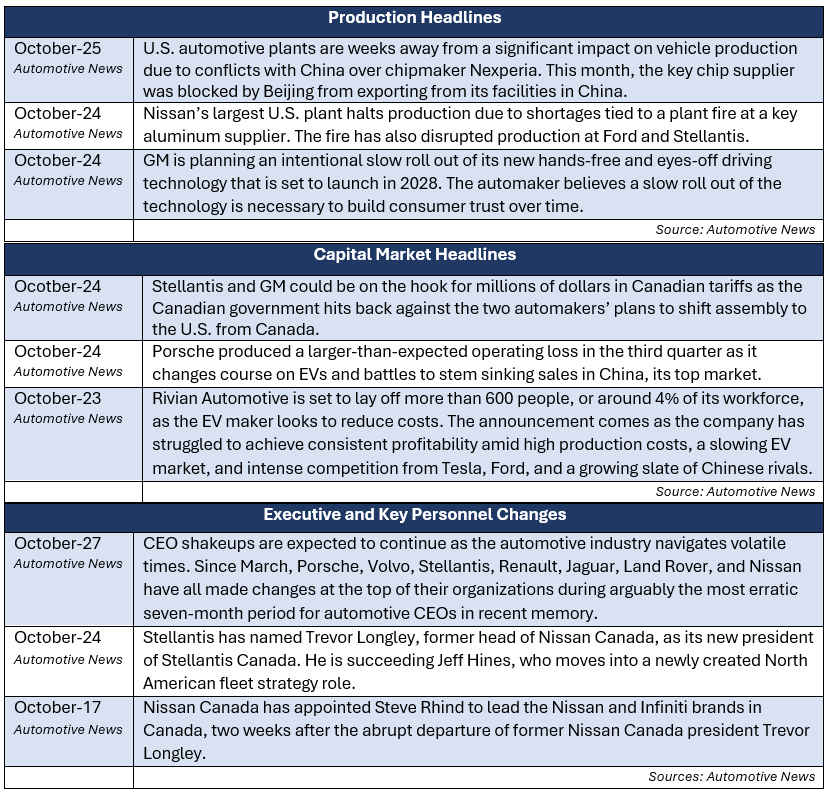

In industry news, an aluminum supplier’s plant fire is causing production disruptions at Nissan, Ford, and Stellantis. GM and Stellantis could be facing millions of dollars in Canadian tariffs as the automakers plan to shift assembly from Canada to the US. Broader automotive industry CEO shakeups are expected to continue as the industry navigates through volatile times, as seen over the last year.

In regulatory news, Ford announced a recall of nearly 1.5 million vehicles relating to rearview camera display issues. The National Highway Traffic Safety Administration (NHTSA) has launched a preliminary probe into the safety of select Waymo Robotaxis. Stellantis is recalling nearly 300,000 vehicles in the U.S. due to a detached shifter cable that may cause a vehicle to roll away.

Industry Focus: Hydrogen Fuel Cell Technology

Hydrogen Fuel Cell Overview

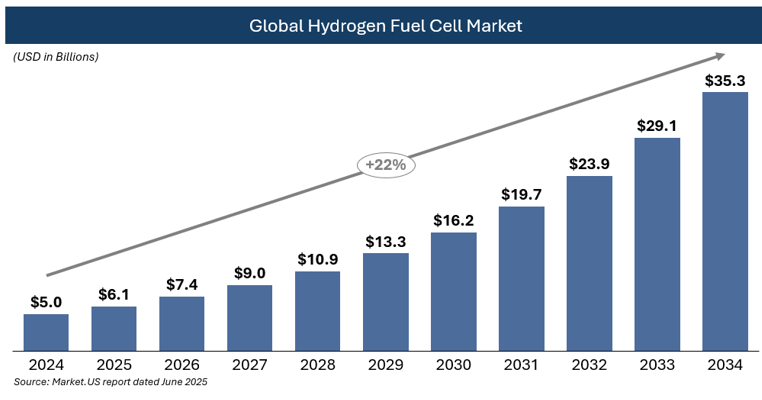

Hydrogen fuel cell vehicles (HFCVs) generate electricity onboard by combining hydrogen and oxygen in a fuel cell stack, producing only water as a byproduct. Unlike conventional battery-electric vehicles (BEVs or EVs), HFCVs offer rapid refueling and longer driving ranges, making them particularly attractive for heavy-duty, high-utilization, and commercial applications. Adoption has historically been constrained by limited fueling infrastructure, high capital costs, and the complexity of producing and distributing low-carbon hydrogen at scale. However, the broader hydrogen fuel cell (HFC) market is projected to expand substantially over the next decade from approximately $6 billion in 2025 to more than $35 billion by 2034 [1], creating a more favorable environment for growth in automotive use cases.

Automotive Applications

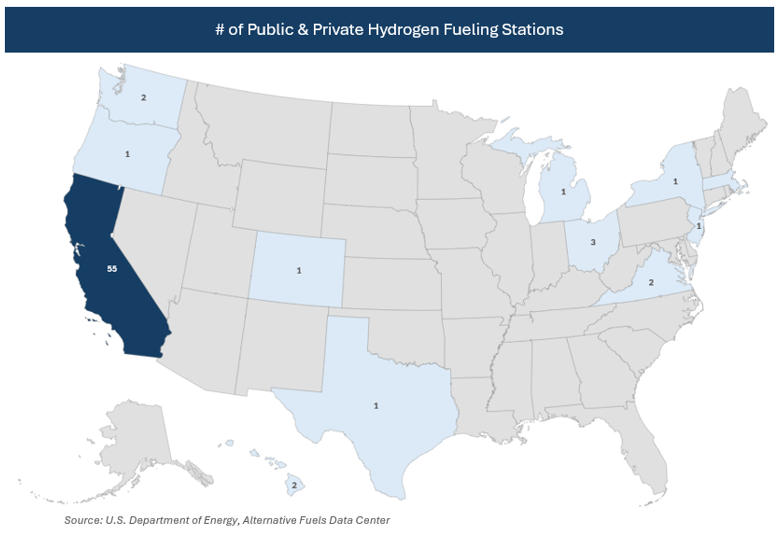

Original equipment manufacturers (OEMs) are keeping hydrogen on the strategic roadmap. Toyota continues to offer its Mirai sedan, while BMW has announced plans to bring a hydrogen version of the iX5 SUV to market in 2028. These efforts, along with pilot programs across North America, Asia, and Europe, underscore hydrogen’s potential role as a complement to BEVs. Infrastructure, however, remains the critical bottleneck. Permitting hurdles, high upfront costs, and uneven station deployment continue to slow progress even as governments provide incentives and fleet decarbonization mandates drive interest in HFC applications. Beyond consumer offerings, automakers are advancing early-stage programs for hydrogen applications in commercial fleets, long-haul trucking, and public transit where HFC technology could provide advantages in range and refueling time. While retail adoption may remain limited in the near term, broader commercialization in fleet use cases could help establish the scale needed to bring down costs, improve refueling networks, and normalize the technology for future consumer uptake. Over time, HFCVs could emerge as a parallel pathway to electrification, supporting an ecosystem where both BEVs and HFCVs anchor greener mobility offerings.

Moving Forward

For automakers and suppliers, hydrogen is unlikely to displace BEVs in the near term, but it is emerging as a complementary pathway in the energy transition. Heavy-duty trucks, buses, and specialized fleets may provide viable use cases, while passenger car adoption will depend on consumer demand, infrastructure density, and cost parity of green hydrogen. The strategic challenge will be balancing investment across propulsion technologies without stranding capital. As the hydrogen ecosystem matures, companies that maintain optionality and develop hydrogen-ready capabilities could capture niche markets, influence regulatory outcomes, and benefit from first-mover positioning in what may become an increasingly relevant segment of the mobility landscape.

Sources:

[1]. Market.US: Hydrogen Fuel Cells Market. (https://market.us/report/hydrogen-fuel-cells-market/)

Additional October insights are included below.

Industry Update

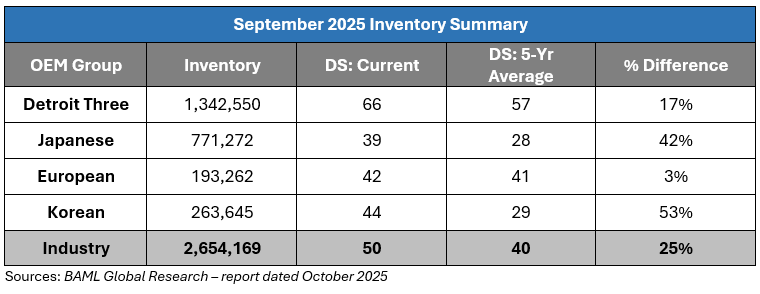

September inventory levels ended at 2.65 million units, a 154,000-unit increase from August. Days’ supply closed at 50, approximately 25% above the five-year average. The month-over-month increase in absolute inventory levels was evident across all major OEM groups.

Regulatory Landscape

Ford Recall: Ford announced the recall of nearly 1.5 million vehicles in the U.S. The recall is related to an issue with the rearview camera image display and covers various models produced between 2015 and 2019. [1]

Waymo Robotaxi Safety Investigation: The NHTSA said it opened a preliminary probe into approximately 2,000 Waymo self-driving vehicles after reports that the company’s robotaxis may have failed to follow traffic safety laws around stopped school buses. The probe is the latest federal review of self-driving systems as regulators scrutinize how driverless technologies interact with pedestrians, cyclists, and other road users. [2]

Dodge Dart Recall: Stellantis is recalling nearly 300,000 vehicles in the U.S. because a detached shifter cable may cause a vehicle to roll away, the NHTSA said. The recall covers the 2013-2016 Dodge Dart and only around 2% of the recall population is expected to have the defect. [3]

Regulatory News Source:

[1]. Automotive News: Ford to recall nearly 1.5 million U.S. vehicles for rearview camera image display (https://www.autonews.com/regulation-safety/an-ford-recall-15-million-rearview-camera-issue-1022/)

[2]. Automotive News: U.S. investigates Waymo robotaxis over safety around school buses (https://www.autonews.com/regulation-safety/an-nhtsa-probes-waymo-1020/)

[3]. Automotive News: Stellantis to recall nearly 300,000 Darts in U.S. because vehicle may roll away (https://www.autonews.com/regulation-safety/an-stellantis-dodge-dart-recall-rollaway-risk-1015/)

Stay connected to industry financial indicators and check back in November for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive