The Evolution of Tax Departments in the GCC

Introduction

The evolution of tax in the GCC is noteworthy, shaped by rapid economic and regulatory change. Historically, the landscape was simpler, with legacy regimes like Zakat in Saudi Arabia (1950s), Corporate Income Tax in Oman and other GCC countries targeting foreign or sector-specific entities. Businesses in the GCC operated mostly in a tax-free environment, with leadership shaped by this legacy. Therefore, most GCC-based companies had none or limited in-house tax capabilities at the GCC headquarters level.

The first big change happened when Value Added Tax (VAT) was introduced in UAE, KSA, Oman, and Bahrain. It caught many businesses off guard, and the rapid implementation timelines left businesses scrambling to comply, leading many to rely on external consultants. In many cases, consultants managed the entire VAT implementation process, often building little in-house tax capability and knowledge. At first, businesses typically relied on outsourcing or co-sourcing models for their compliance process. They then gradually started building up internal tax capabilities, usually by hiring a VAT specialist as a first step. However, many companies still operated without a separate tax department or function, where the VAT specialist reported directly to the finance heads.

The introduction of UAE Corporate Tax (CT) in 2023, changes in transfer pricing rules across multiple GCC countries, and the adoption of BEPS Pillar 2 rules have added a completely new dimension to the tax landscape. This directly impacts the (net) profitability of businesses and has transformed this region from a low-complexity tax environment to a mature tax landscape for most businesses. In this new world of tax with Corporate Tax and Pillar 2, MNEs in the GCC now must calculate, track, and report the Effective Tax Rate (ETR) on a jurisdictional basis – this is not just about paying tax, but also ensuring that the compliance process is standardized across all jurisdictions.

There is a wide-ranging and complex system impact, meaning businesses need the ability to collect, reconcile, and report tax figures accurately across multiple entities and jurisdictions. The process of tax disclosures and financial reporting is also impacted, as teams need to be on top of deferred tax accounting, new reporting requirements, and potential audit risks.

Impact on the business

Many tax leaders across the GCC describe their roles as being in a constant state of adaptation. We often hear from Regional Heads of Tax that there are so many changes happening and that they are constantly adapting and facing budget and resourcing constrains. This sentiment reflects the pace of regulatory transformation which has challenged the ability of in-house teams using traditional approaches.

Many organizations that once focused primarily on manual compliance processes are now actively expanding their teams by recruiting top-tier professionals with expertise in tax law, accounting, and technology. The introduction of initiatives such as e-invoicing and integrated contract filing reflect a shift toward data-driven enforcement. This transformation mirrors global trends we see in Europe but is happening at a much faster pace.

Tax functions in the GCC are entering a more strategic era. Concepts like tax insurance, data-driven risk scoring, and predictive audit targeting are beginning to gain traction. Tax teams are expected to act as business enablers. The Head of Tax is now expected to be shaping operational decisions, pricing models, and is more often brought to the table when it comes to market entry strategies.

Operating in a complex tax regime highlights the need for a more strategic approach to tax management. While CFOs are beginning to recognize the strategic importance of tax, most businesses in the GCC still have significant ground to cover. There are still businesses who must adapt to the new tax world where bookkeeping at times is still done with a commercial mindset that is no longer acceptable from a tax perspective (for example, free of charge rent or no interest on intercompany loans) or where business and personal expenses are not properly segregated or optimized from a tax perspective.

Leading a tax function in the GCC presents unique challenges. Teams are often multicultural, with professionals bringing diverse legal interpretations and tax philosophies shaped by their home countries. The dominant use of English in tax guidance contrasts with the underlying Arabic legal texts, leading to occasional ambiguity and literal interpretation. Navigating these dynamics while building local capabilities adds another layer of complexity for tax leaders in the region.

This complexity has made it clear that the tax function can no longer operate reactively or in isolation. To keep pace with this new environment, tax must evolve into a strategic function.

Tax as a Strategic Function

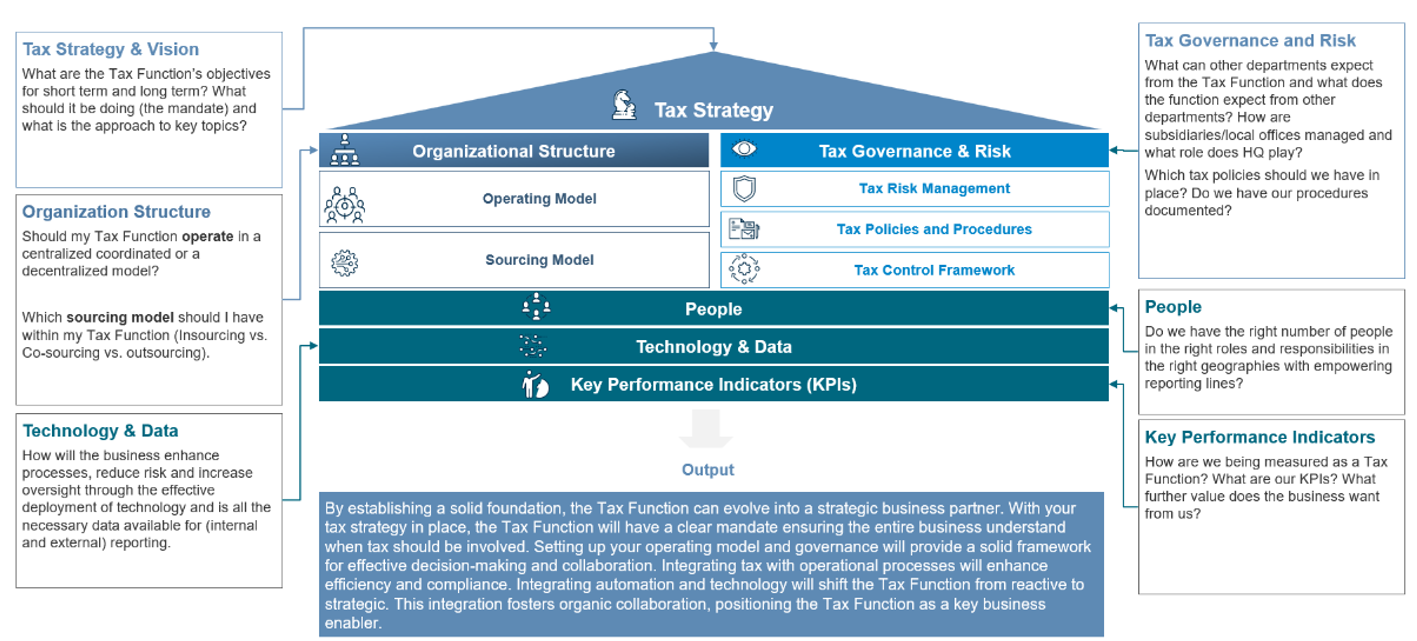

In-house Tax teams within GCC businesses have increased responsibilities and are steadily growing. However, tax teams are working hard to manage ongoing changes, which can make it difficult to focus on the tax function strategically. A solid tax function should build its foundations across all elements of the tax operating model as pictured below.

While each element warrants its own in-depth analysis, we've outlined below a few key starting points to consider when strategically evaluating your tax function:

Tax Strategy

This sets the direction of the function. The Tax Function should be aligned with the overall business model and strategy. In most cases, tax should not be just a compliance function. To be a successful element of the organization, tax must demonstrate how it adds value to the business. Tax must also understand how it should interact with (and influence) senior stakeholders like the CFO and other management/board members.

It is also critical for tax departments to articulate what its role is; what it will be responsible for and perhaps even more importantly, what it will not be responsible for. For example, will the tax function take responsibility of customs, payroll tax, etc.? See our article on the need for a Tax Strategy here.

Sourcing Model

Choosing the appropriate sourcing model is a strategic decision. Many GCC businesses have not considered a holistic approach across their business, with local (finance) teams often deciding whether they insource or outsource as well as which external party is used. The sourcing model should be aligned with your People strategy (both skillset and total number of resources) and impacts your technology needs. A streamlined approach can (for example through centralized outsourcing) also bring cost efficiencies (which is a great way to show how the tax function adds value to the business).

Operating Model

Reshaping Tax Operating Models

Businesses in the GCC have traditionally managed tax through decentralized finance teams, with local teams overseeing compliance at a country level. However, globalization and the introduction of Pillar 2 dictate a more centralized and coordinated approach. Companies need to review their tax operating models to ensure a consistent compliance, risk management and reporting across jurisdictions. Tax departments need to expand their in-house expertise in areas such as international tax, transfer pricing and tax transformation to navigate these changes successfully.

Now that GCC companies are creating tax capabilities at the headquarters level, many CFOs increasingly expect Heads of Taxes to have a better oversight of their foreign tax obligations and exposures as well. But this brings the question of how Middle East based tax professionals oversee the tax obligations in foreign countries, without having the ability to influence the way tax is handled at the local country level. This often leads to a miss match between expected responsibilities (for example, what happens when there’s a tax audit in another country) and the ability to act (e.g. not having the mandate and manpower to review local tax returns or to put the right controls in place).

Cross-Functional Collaboration Between Tax and other functions

Tax cannot operate in isolation. VAT impacts every transaction and obligations such as, Pillar 2 will require close collaboration with finance, IT and legal teams to ensure a coordinated approach. CFOs and senior tax executives will expect regular insights into the company’s global tax position, implying a greater involvement of tax professionals in strategic decision-making. Tax teams that are not connected to the rest of the business are often in reactive mode, as they are frequently brought in at the last minute on urgent matters such as a high value transaction.

Stronger Tax Governance is No Longer Optional

Key stakeholders such as CFOs, internal audit/audit committee have increasing requirements around tax governance. Tax leaders need to ensure that a structured and documented governance is in place to avoid compliance risks and financial penalties. Documenting tax policies and procedures become essential not only for compliance, but also to prevent any potential disputes with tax authorities. Internal controls also need to be in place to ensure that all tax obligations are met. The evolving regulatory landscape also requires tax teams to implement robust internal controls and auditing processes to prevent tax risks from escalating into financial liabilities or reputational damage.

Aside from the internal need for proper governance, Tax Authorities have started to put greater emphasis on looking into the internal governance and controls process. Many countries have moved away from traditional book audits, towards a more process driven approach whereby the authorities review the internal processes rather than just the output (tax returns, invoices, supporting documentation, etc.). In some countries, companies are expected to have their internal controls at an acceptable level and documented in a so called “Tax Control Framework”. With GCC countries moving towards an e-Invoicing regime, the traditional form of audit will be replaced by data driven reviews, which will free up the auditors to focus more on processes and controls.

Technology & Data

Tax authorities across the world are launching initiatives to gather more data from taxpayers, whether it’s real-time reporting or e-Invoicing. Additionally, there’s also the added complexity of Pillar 2 and the introduction of Corporate Tax and Transfer Pricing that requires the tax function to compile a lot more data than ever before. This puts an extra burden on in-house tax teams as tax is often a data consumer and remains therefore dependent on other teams within the business. However, it is often the tax team that is responsible for submitting data to tax authorities or to deal with non-compliance issues. Tax must navigate these complexities and should, for example, put in minimum standards by embedding tax controls within other business processes.

Choosing the right technology is also a complex topic within the tax landscape. There’s no single end-to-end solution across tax types and therefore, tax teams need to spend time to choose the right technology. With the rapid digital evolution in the modern world, more and more solutions are entering the market. In addition to these “off the shelf” tax technology solutions, tax should also make sure it understands its in-house capabilities and what is readily available for them to use in their current IT landscape. Technology is much more accessible, and affordable, than it was a couple of years ago and this is where the tax team can really make a difference. However, tax technology and data capabilities within GCC tax teams are still in the early stages of development.

Final remarks

The GCC tax landscape has undergone significant transformation in recent years. Tax teams have had to address legacy issues from a time when dedicated tax functions were not present, while also preparing for the introduction of Corporate Tax, Pillar 2, and e-Invoicing. This shift has placed considerable demands on in-house teams — many of which operate with limited resources and often without a dedicated budget.

Despite these challenges, it is clear that tax needs to play a more integrated role in business operations. The transformation is underway, and tax professionals in the GCC are at the forefront of this change. There is still much to be accomplished, and the journey is just beginning. In future publications, we will explore specific elements of this transformation in greater depth, offering insights and guidance to help your organization navigate this evolving tax landscape.