What Is Operational Transfer Pricing (OTP) and Why Should You Care?

1. Introduction

The global tax and transfer pricing landscape has evolved rapidly over the past few years, placing greater emphasis on transparency and disclosure, and leading to a wave of new compliance and regulatory requirements.

In the wake of BEPS 2.0, there is significant commitment from global tax authorities to implement measures to tackle tax avoidance, fairly reallocate taxing rights, and ensure a substance-driven distribution of global profits.1

Jurisdictions in the Middle East have largely embraced many of these initiatives, including joining the OECD’s Inclusive Framework (IF), adopting Country-by-Country Reporting (CbCR), introducing formal transfer pricing legislations, and implementing new Corporate Income Tax (CIT) regimes.

The region has also seen a robust adoption of Pillar 2 (i.e. the Global Minimum Tax) with a higher uptake anticipated this year.

The BEPS initiative and subsequent legislative developments have led to a seismic shift in corporate tax transparency, and a central theme across these new regulations is the obligation for taxpayers to maintain, access, and report large amounts of accurate and tax-sensitized data to ensure compliance. Through all our conversations with multinational enterprise (MNE) groups, one of the most common pain points discussed is the access to data to drive quick and correct decision making.

As MNEs, their supply chains, and global footprints continue to expand and increase in complexity, the need to manage financial, operational, and master data across the organization is more pronounced than ever before.

Failing to do so could likely result in significant time, resource, and cost burdens, or even penalties (due to inaccurate compliance). From a transfer pricing perspective, access to reliable data is at the heart of ensuring arm’s length outcomes and avoiding the risk of tax authority audits arising from incorrect application of transfer pricing policies.

In this article, we explore why a fit-for-purpose OTP framework (using automation and bespoke technology solutions) is not only an effective way to tackle the ‘data’ problem, but also an avenue to achieve significant process, governance and cost efficiencies along the way.

2. What is OTP and What Are the Benefits?

Put simply, OTP offers real-time visibility and control over intercompany transactions, ensuring that transfer pricing decisions are accurately reflected in day-to-day operations. By proactively monitoring margins and prices, MNE groups can minimize year-end adjustments, streamline compliance, and reduce the risk of costly disputes.

Figure 1 – Typical OTP lifecycle

By its very nature OTP requires granular, real-time tracking of intercompany transactions and margins. To implement OTP, MNE groups often need to break down costs and revenues at a detailed level by product, service line, geography, or legal entity to ensure that transfer prices reflect the true economic substance. This level of detail inherently produces segmented financial data, because OTP systems capture the specific components (e.g., direct labor, materials, overheads) that go into each transaction, enabling more accurate and insightful reporting. Specifically, for MNEs with complex value chains, access to segmental data can enable granular allocation of revenues and costs across business units or functions, resulting in more accurate benchmarking outcomes as well as profitability assessments.

Moreover, an effective OTP framework leverages robust data integration strategies connecting enterprise resource planning (ERP), business intelligence (BI), and analytics platforms to generate accurate revenue, cost, transactional pricing and margin data. The data in-turn becomes a key enabler when coupled with bespoke TP technology solutions which can help automate TP processes around cost allocations, price setting, margin monitoring and compliance tracking, as examples.

As a result, the same data flows that feed OTP calculations can be used to generate segment-specific P&Ls, margin analyses, or performance dashboards in near-real time. This continuous feedback loop ensures that each business unit’s financial results are accurately reported and easily accessible, driving better decision-making and ultimately supporting both compliance and operational excellence.

Beyond compliance, OTP drives tangible operational benefits. With near-real-time data and analytics, companies can make timely adjustments to support consistent profit allocations and optimize their supply chains. The insights generated can help cross-functional teams from finance and tax to operations and IT to collaborate more effectively, ensuring that the transfer pricing function complements broader commercial goals.

OTP also helps demonstrate alignment of transfer pricing outcomes with the economic substance of business activities, a growing expectation from both regulators and stakeholders in today’s post-BEPS world. This proactive approach not only strengthens audit readiness but can also improve overall tax governance, providing a credible foundation for discussions with tax authorities.

Ultimately, OTP can foster a more resilient global business model, allowing multinational enterprises to adapt quickly to shifting market conditions while maintaining confidence in their transfer pricing frameworks. By adopting a proactive OTP strategy, MNE groups can ensure that their transfer pricing policies are not just theoretical frameworks but seamlessly embedded into their daily operations.

3. Key Themes Driving OTP Adoption

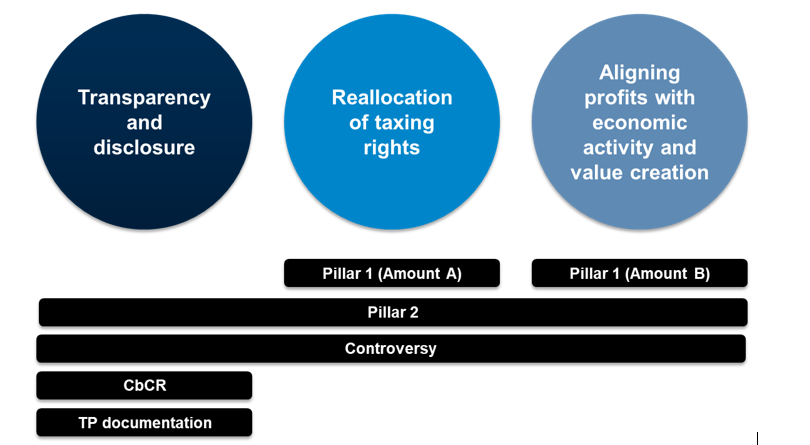

Several global themes are currently driving the adoption of OTP across MNE groups as illustrated below.

Figure 2 – Drivers of OTP Adoption

Transparency and disclosure, reallocation of taxing rights, and aligning profits with economic activity and value creation are central themes of the OECD BEPS 2.0 project, that have catalyzed the development and implementation of global initiatives such as Pillar 2 and Pillar 1 – Amount B. These, coupled with current macroeconomic trends, changing workplace dynamics and rapid technology adoption have created a strong use case for implementing OTP, as outlined below.

Complex, globalized supply chains

As companies expand globally, the volume and complexity of intercompany transactions has significantly increased (e.g., cross-border goods transfers, services, intangibles, financing, etc.). Managing large amounts of data and coordinating transfer prices across multiple jurisdictions in real time is necessary to ensure consistent margins, reducing the need for extensive year-end adjustments.

Digital transformation and data analytics

Advances in data management systems (e.g., ERP integration, automated data feeds, analytics platforms) make it possible to track, analyze, and adjust transfer pricing positions continuously. The use of analytics and AI tools allows finance and tax teams to predict potential transfer pricing risks, optimize margins, and model “what-if” scenarios before transactions happen.

Cost and risk management

OTP can help minimize large year-end true ups that may lead to unexpected tax liabilities or compliance burdens. By keeping transfer prices aligned with policy in real time, MNE groups can reduce the likelihood of disputes, penalties, and lengthy audits.

Convergence of tax, finance and operations

Today’s transfer pricing demands cross-functional input from finance, supply chain, operations, and IT which necessitates a more holistic, operationalized approach. OTP ensures that transfer pricing reflects commercial reality rather than sitting in isolation as a purely tax or compliance function.

The need for agility and scalability

Shifts in economic conditions (e.g., exchange rates, commodity prices, market demand) require swift adjustments to maintain consistent transfer pricing outcomes. An operational approach, supported by robust systems and processes, is more easily scaled as a company enters new markets or undergoes restructuring.

In summary, the adoption of operational transfer pricing is driven by the need to align transfer pricing methodologies more closely with real-world business operations, mitigate compliance and audit risks in a post-BEPS environment, and harness the power of data analytics to manage and adjust transfer prices proactively.

4. Implementation Challenges

Implementing or adopting OTP can be challenging because it touches so many facets of an organization – tax, finance, supply chain, IT, and more. Below are some of the main challenges companies face when embarking on OTP initiatives:

Systems integration and data management

Large MNE groups often use different (ERP) systems across countries or business units, making it difficult to harmonize data at the granular level of detail required to achieve policy-aligned TP outcomes. Ensuring consistent, accurate, and real-time data feeds requires a robust data governance framework, which can be complex and resource-intensive to establish.

Complexity of business models and changing regulatory landscape

Different product lines, services, or supply chain flows can result in heterogeneous transfer pricing policies/models that are hard to operationalize with a single approach. To add, global regulatory landscapes (e.g., BEPS, local country rules) continue to evolve, requiring frequent policy updates that must be reflected in operational systems.

Organizational silos and change management

OTP requires finance, operations, tax, and IT to collaborate closely. Misaligned goals or communication gaps can slow down or derail implementation. Not all teams are familiar with the principles of transfer pricing, making it critical to invest in training and to bridge knowledge gaps.

Moving from year-end true ups to real-time monitoring often involves redefining roles, responsibilities, and workflows across multiple departments. Even the best systems and policies won’t succeed without user buy-in, most often from the highest levels within an organization. Employees need to understand the reasons for OTP and how it impacts their day-to-day tasks.

Legacy IT systems

Legacy and heterogenous IT systems across the organization may lack or only have limited out-of-the-box TP functionality. This often presents a critical decision point for many MNE groups – should they adapt to the existing IT landscape using an external (O)TP technology solution or should they fundamentally go back to the drawing board and rearchitect their ERP landscape.

The latter option may require significantly more time and resources to implement whereas the former may ostensibly deliver most, if not all the benefits quicker and at a much lower cost.

Regardless, any chosen approach must be flexible enough to integrate into the as-is setup with minimal disruptions, and scalable enough to support the organization’s growth strategy.

Cost-benefit argument

The cost of upgrading or integrating IT systems, hiring new talent, and training existing staff can be substantial. It can be difficult to quantify the exact return on investment (e.g., reduced audit risk, real-time margin visibility) and justify these expenditures to key stakeholders.

By addressing these challenges, particularly the integration of systems, the alignment of cross-functional teams, and the institutionalization of change, MNE groups can more effectively adopt OTP and realize its benefits in minimizing risk, enhancing compliance, and improving global operational efficiency.

5. Identifying the Low-Hanging Fruit

When moving towards an OTP framework, it can be daunting to tackle every intercompany process or system requirement at once. To build momentum and ease the overall implementation, it’s helpful to focus on ‘low-hanging fruit’ – quick wins and foundational steps that can be implemented relatively easily to demonstrate value and pave the way for broader OTP adoption. We’ve summarized some useful pointers below.

Leverage existing data and systems

Rather than implementing new and costly solutions from the outset, look for opportunities to use existing ERP/systems functionality or reporting modules to track target margins on a near-real-time basis. For example, some profitability management solutions can also be leveraged for Transfer Pricing purposes. Create easily accessible dashboards (e.g., within your existing BI or analytics tool) that pull data from existing finance or operations systems to compare actual vs. budgeted transfer prices and margins.

Focus on high-risk/value transactions

Pinpoint the product lines, services, or intercompany flows that are either high in value or more likely to attract regulatory scrutiny. Focus your initial OTP efforts on these areas for maximum impact and ROI. Where possible, consolidate or standardize the transfer pricing policy for the most critical transactions to reduce complexity and ease automation.

Incremental improvements

Clearly identify which data fields (e.g., cost elements, revenue breakdowns, operational metrics) are essential for calculating and monitoring transfer prices in the initial instance. Assign accountability for data quality and reporting in a few critical areas. Over time, you can expand these data governance practices to broader functions or regions.

Proof of concepts are helpful

Start operationalizing transfer pricing in a region or business unit that has relatively stable processes and supportive leadership to demonstrate a successful proof of concept. Use lessons learned from the pilot, such as required system enhancements or process/training needs to refine your approach for subsequent pilots.

Leverage existing cross-functional initiatives

If there are already cross-functional task forces (e.g., supply chain optimization, finance transformation), slot in OTP requirements or considerations. This way, OTP requirements are socialized within the organization and become part of a broader initiative, minimizing additional overhead. Focus early training on the basics of transfer pricing mechanics, margin analysis, and operational impacts, rather than launching a large-scale education effort immediately.

Build basic real-time controls

Define thresholds (e.g., target margins, acceptable variances, etc.) and automated alerts that trigger reviews when actuals deviate significantly from target. This can often be accomplished in existing ERP systems or using BI dashboards with minimal customization. This can be supported by a clear, concise escalation procedure for dealing with exceptions (e.g., who reviews and approves, how changes are communicated to finance, tax, and operations, etc.).

Communicate early wins

Even small improvements (e.g., reduced quarter-end adjustments, fewer data errors) can demonstrate the value of OTP to stakeholders. Sharing success stories from a small pilot can help secure resources and support for broader OTP implementation across the organization.

By focusing on these more achievable steps (e.g., leveraging existing systems, targeting critical transactions, and piloting simple controls), you can demonstrate quick wins, build confidence, and establish the foundation for a more comprehensive OTP framework.

6. What About the Elephant in the Room – Pillar 2?

Under Pillar 2, MNE groups need to calculate their effective tax rate (ETR) on a jurisdiction-by-jurisdiction basis to determine if they fall below the 15% global minimum tax.

A robust OTP framework will allow access to a reliable, transaction-level view of how profits are allocated. This granular data ensures that calculations of local ETR are based on consistent, accurate information, reducing the risk of under or over-reporting for Pillar 2 purposes.

Real-time access to data can provide continuous insight, enabling early-detection if certain entities may dip below the minimum tax threshold. With advance warning, tax functions can assess whether to adjust operational or intercompany pricing arrangements, prepare for top-up tax liabilities, or take other strategic measures.

Pillar 2 requires detailed and consistent financial and tax data across all entities in the group. OTP frameworks embed transfer pricing policies within the organization’s operational processes, meaning data needed for Pillar 2 compliance (e.g., profit allocation, taxes paid, intercompany transaction volumes, etc.) is readily available and collected more consistently, allowing it to be consolidated easily. This reduces manual work, enables straightforward audit trails, and lowers the risk of errors in Pillar 2 reporting.

There are positive spillover effects for other tax compliance initiatives as well (e.g., CbCR), supporting MNE groups to maintain uniform data across both. Since many jurisdictions use similar frameworks and data points for multiple BEPS-related initiatives, a single OTP platform that harmonizes how transfer prices are calculated and documented enables consistency across filings, leading to fewer mismatches or disputes.

7. Conclusion

If recent regulatory and legislative developments are any indication, OTP represents both a compliance necessity and a strategic opportunity for MNE groups, notwithstanding size.

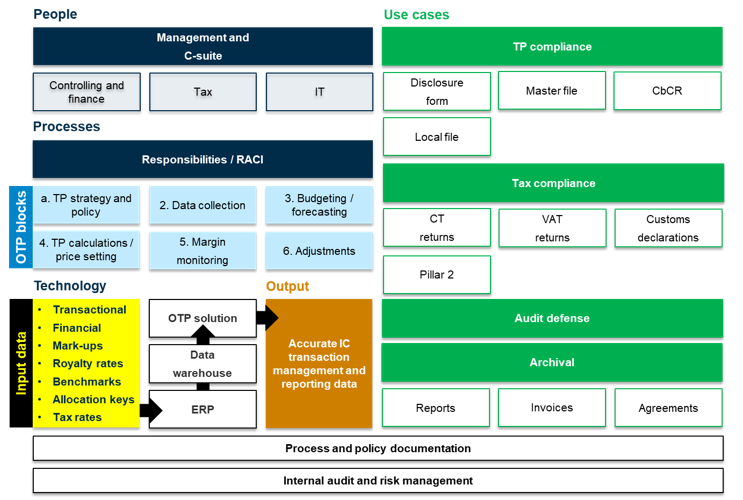

Figure 3 – A typical OTP framework

Implementing an effective OTP framework offers MNEs a decisive edge in today’s intricate tax landscape. With obligations like CbCR, Pillar 2, and Amount B (soon) demanding entity-level, tax-sensitized data, organizations need robust systems and processes to ensure accurate, real-time visibility of intercompany transactions.

By embedding transfer pricing policies into the day-to-day mechanics of ERP systems, OTP not only provides consistent, high-quality data for tax authorities worldwide, but also affords an integrated governance structure that mitigates the risk of compliance failures and any surprises.

Ultimately, operationalizing transfer pricing policies enables businesses to adapt swiftly to evolving regulations, maintain transparent records that defend against disputes, and continue driving sustainable, compliant growth across global markets.

As OTP becomes an increasingly strategic priority, we hope this article has provided some useful perspectives. Please reach out to A&M’s Middle East Tax team to discuss how we can help you embark on your OTP journey.