Alvarez & Marsal Sees Thai Real Estate Distress on Trade Risk

US advisory firm Alvarez & Marsal Inc. sees the real estate sector the most at risk in Southeast Asia due to headwinds such as global trade frictions and a glut of residences.

“Several factors are contributing to rising real estate distress, particularly in Thailand,” said Alessandro Gazzini managing director at Alvarez & Marsal in Jakarta. “These include oversupply, the growing stock of household debt, relatively high interest rates, slower economic growth and limited access to new credit from banks.

Thailand had the highest ratio of financially distressed publicly traded companies in the region at the end of 2024, according to a report by Alvarez & Marsal. Southeast Asia’s second-largest economy is also among the hardest hit by US tariff increases, with a rate of 36%.

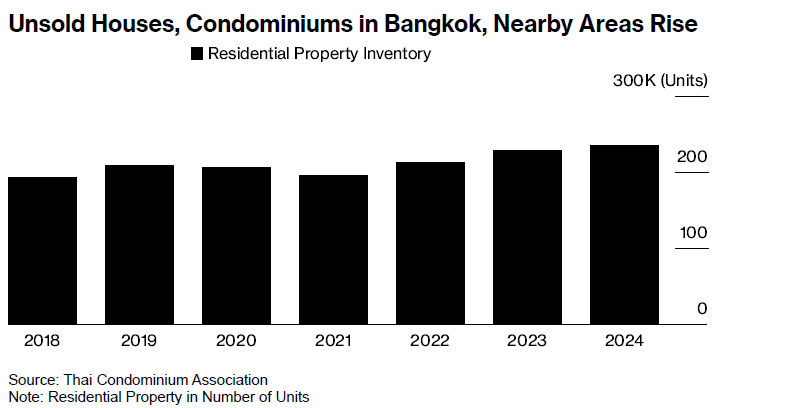

Property developers in the greater Bangkok area were saddled with about 235,000 unsold residential units at the end of last year, the most since data dating back to 2018, according to the Thai Condominium Association.

Uncertainties in global trade policy have pushed up companies’ borrowing costs, especially those of weaker firms. The average yield of Southeast Asian junk-rated borrowers shot up to almost 8.5% this month, the highest in nearly a year, according to a Bloomberg index.

US President Donald Trump’s on-again-off-again trade war has many Southeast Asian companies facing financial distress in 2025, especially in countries with higher exposure to global trade, Alvarez & Marsal’s Gazzini said. As a result of the rising distress, the corporate restructuring adviser is looking to increase headcount across Southeast Asia and Australia this year, he added.

“The global trade turbulence naturally doesn’t help, and so we would expect that this creates additional pressures for the Southeast Asian companies and their economies and their trade in the coming months,” Gazzini said. “We can safely say the amount of distress will be higher” in 2025.

This article is the Intellectual property of Bloomberg.