MIDDLE EAST TAX ALERT | UAE | Pillar 2 Legislation

On the 6th of February 2025, the United Arab Emirates (“UAE”) released the legislation introducing a Domestic Minimum Top-up Tax (“DMTT”) for multinational enterprises (“MNEs”), through the publication of Cases, Provisions, Conditions, Rules, Controls, and Procedures on the Imposition of Top-up Tax on Multinational Enterprises (“the Law”). This release is a further demonstration of global alignment and commitment to the Organization for Economic Cooperation and Developments (‘‘OECD’’) inclusive framework (‘‘IF’’) to introduce a global minimum tax (“GMT”) of 15% on large internationally operating groups.

We have provided below a detailed overview of the key provisions of the Law, alongside working examples.

Executive Summary

The Law is broadly aligned with the OECD’s Inclusive Framework (“IF”). Some of the key highlights include:

- Confirmation on the scope of the UAE Pillar 2 rules, including the different categories of Constituent Entities, such as Joint Ventures (“JVs”), Permanent Establishments (“PEs”) and Minority Owned Constituent Entities (“MOCEs”). The Law also includes several entity level exclusions, such as an exclusion for Government Entities (and Sovereign Wealth Funds).

- The rules also provide well needed clarity on the following beneficial provisions:

- Globe income / loss adjustments (i.e. dividend & equity gain exclusions and many more);

- Quantification of adjusted covered taxes and the interaction of deferred tax adjustments;

- Application of available CbCR Transitional Safe Harbours and future permanent simplification methods;

- Inclusion of the Substance Based Income Exclusion; and

- Availability of 18 GloBE elections to be implemented within the Law

- The law provides for specific treatments under Pillar 2 for corporate reorganisation, restructuring and asset & liability deals. Along with rules to determine tax basis for tax attributes incurred prior to the inception of the rules for the fiscal year of transition.

- The law provided much needed clarity on the UAE Pillar 2 compliance requirements and deadlines, with both the filing of the Top-up Tax return and payment of Top-up Taxes having to be done within 15 months after the FY or 18 months after the transitional year.

- Details on the Pillar 2 registration with the Federal Tax Authority are still to be issued.

- Based on our review and understanding that these rules align with the OECD Guidance, we would expect the UAE to apply a Qualifying DMTT (“QDMTT”). This could make available the compliance optimizations under the QDMTT Safe Harbour.

- The Law also allows for further provisions to be added in line with the OECD’s IF. This could mean the future introduction of an Income Inclusion Rule (“IIR”) and Under Tax Profits rule (“UTPR”) within the UAE in the future.

- Immediate take away: We expect many MNE Groups have assessed the initial impact of the rules but now these impacted groups need to provide attention to the operational obligations these rules will create with the increased data requirements and reporting obligations. In many cases, for jurisdictions who have already implemented these rules, we have seen a dramatic shift in the role of business functions as part of the readiness process for Pillar 2. These UAE rules provide a clear mandate for MNE Groups, operating in the UAE, to invest in better understanding their current data and resource capabilities and what remediation strategies, such as the need for extensions to current data systems or the introduction of new technology, to assist MNE Groups in the technical and operational readiness for both local tax provisioning and Pillar 2 compliance and financial reporting.

Technical analysis

What is the scope of the DMTT?

The following entities (“In-Scope Entities”) will be within the DMTT scope:

- Constituent entities located in the UAE that are members of an MNE group which has consolidated revenues exceeding EUR 750 million for at least two of the four preceding fiscal years (“FYs”).

- Joint Ventures (and their subsidiaries) located in the UAE to match the, if their Ultimate Parent Entity (“UPE”) is the UPE of an MNE Group which has consolidated revenues exceeding EUR 750 million for at least two of the four preceding FY.

Please note adjustments will be required if the FY is not 12 months. In these cases, the EUR 750 million threshold is proportionally adjusted length of the FY.

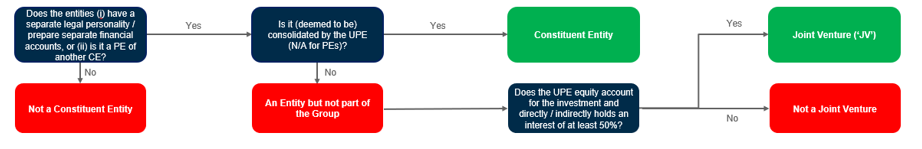

What qualifies as a Constituent Entity of an MNE group?

- A Constituent Entity includes any Entity consolidated within a group or any Permanent Establishment of the Main Entity of a Group.

- Permanent Establishments are treated separately for reporting and tax purposes from their Main Entity and other Permanent Establishments.

- Specific treatments are provided for unique classification entities such as Joint Ventures, Minority Owned Constituent Entities, Stateless Entities and Non-Material Constituent Entities.

How do I identify my Parent Entity?

- The Ultimate Parent Entity (“UPE”) is the Entity that holds a controlling interest in any other Entity and is not itself controlled by another Entity.

- A Main Entity may also serve as an Ultimate Parent Entity, provided it has Permanent Establishments in multiple jurisdictions.

Are there any exclusions for certain entities?

In line with the OECD’s IF the Ministry of Finance (“MoF”) have identified the following entity exclusions from the UAE’s DMTT scope:

(1) Government entity; (2) International organizations; (3) Non-profit organizations; (4) Pension funds; (5) investment funds that are UPEs; and (6) real estate investment vehicles that are UPEs.

Some majority owned subsidiaries of the abovementioned Excluded Entities may also benefit from this exclusion, as follows:

- where at least 95% of the value of an Entity is owned (directly or through a chain of Excluded Entities) by one or more Excluded Entities mentioned above (other than a Pension Services Entity) and where that Entity: (i) operates exclusively or almost exclusively to hold assets or invest funds for the benefit of the Excluded Entity or Entities; and/or (ii) only carries out activities that are ancillary to those carried out by the Excluded Entity or Entities.

- where at least 85% of the value of an Entity is owned (directly or through a chain of Excluded Entities), by one or more Excluded Entities mentioned above (other than a Pension Services Entity) provided that substantially all of the Entity's income is Excluded Dividends or Excluded Equity Gain or Loss that is excluded from the computation of Pillar 2 Income or Loss.

- Entities owned 100% by Non-profit Organizations can be classified as Excluded Entities under certain revenue conditions, especially when the revenue of Non-profits and Excluded Entities is disregarded.

Permanent Establishments of Main Entities considered Excluded Entities will follow the same exclusions as their parent entities.

Please note that, when assessing whether an MNE group exceeds the EUR 750 million threshold mentioned above, the revenue of any Excluded Entity shall also be taken into account. Also note that MNEs can elect not to treat an Entity as an Excluded Entity.

Sovereign Wealth Funds (‘SWF’) – How are they defined and effected?

- The UAE Law defines SWFs as Governmental Entities for the purposes of these rules. In doing so, Sovereign entities classified as government entities cannot be Ultimate Parent Entities.

- If such a SWF holds a controlling interest in another Entity, that Entity would become the Ultimate Parent Entity for the group, with the conditions applied at this Entity level rather than as the level of the SWF.

How is the Top-up Tax calculated for UAE DMTT purposes?

How is the Pillar 2 Income or Loss quantified?

Starting point

- Pillar 2 Income or Loss for each Constituent Entity is based on its Financial Accounting Net Income or Loss for the FY, adjusted for specified items (described below).

- The Financial Accounting Net Income is determined based on standalone financial statements prepared in line with IFRS (International Financial Reporting Standards). If using IFRS for the consolidated financial statements is impractical, another acceptable financial accounting standard may be used, provided it meets specified criteria, including reliable information and proper adjustments for any permanent differences.

Adjustments

- Financial Accounting Net Income or Loss is adjusted for specific items to calculate Pillar 2 Income or Loss. The key adjustments include:

- Excluded Dividends – dividends or other distributions received or accrued in respect of an Ownership Interest, except for: (a) a Short-term Portfolio Shareholding (i.e., Ownership Interest that carries rights to less than 10% of the profits, capital, reserves or rights and that has been economically held for less than one year), and (b) an Ownership Interest in an Investment Entity that opts for the Taxable Distribution Method Election (as per Article 7.4. of the Law).

- Excluded equity gains or losses – the gain, profit or loss included in the Financial Accounting Net Income or Loss of the Constituent Entity arising from: (a) gains and losses from changes in fair value of an Ownership Interest, except for a Portfolio Shareholding (i.e., Ownership Interest that carries rights to less than 10% of the profits, capital, reserves or rights); (b) profit or loss in respect of an Ownership Interest included under the equity method of accounting; and (c) gains and losses from disposition of an Ownership Interest, except for a disposition of a Portfolio Shareholding.

- Other adjustments include: Net taxes; Revaluation method gains; Asymmetric foreign currency losses; Policy disallowed expenses; Accrued pension expenses; and Excluded insurance reserves expenses.

- Stock-Based Compensation Election:

- A UAE Constituent Entity can choose to adjust stock-based compensation for the Pillar 2 Income or Loss calculation, based on its tax deductibility in the UAE.

- If the election is made, it applies for five years and must be consistently used for all UAE entities. Adjustments are required if the election is applied after some stock-based compensation has been recorded or if the election is revoked.

- Transactions Between Constituent Entities:

- Adjustments to Pillar 2 income or loss are required if intercompany transactions between entities in different jurisdictions are not recorded consistently or on an arm’s length basis.

- Losses from asset transfers between UAE entities must align with the arm’s length principle for the Pillar 2 calculation.

- Consolidated Accounting Treatment Election

- An UPE may elect to apply its consolidated accounting treatment to eliminate income, expense, gains, and losses from transactions between Constituent Entities that are located, and included in a tax consolidation group, in the UAE. This election is a Five-Year Election.

- Tax Credits:

- Qualified Refundable Tax Credits and Marketable Transferable Tax Credits are treated as income in the Pillar 2 calculation.

- Non-qualified refundable and non-marketable transferable tax credits are not considered income.

- Realisation basis election:

- UAE filing entities can elect to use the realization principle for computing gains or losses related to assets and liabilities subject to fair value or impairment accounting. This election:

- Excludes fair value or impairment gains and losses from the Pillar 2 calculation.

- Adjusts carrying values for depreciation, starting from the election year or asset acquisition date.

- Is a five-year election and applies to all constituent entities in the UAE. If revoked, adjustments are made based on the fair value at the time the election is revoked.

- UAE filing entities can elect to use the realization principle for computing gains or losses related to assets and liabilities subject to fair value or impairment accounting. This election:

Please note there are also specific adjustments for qualifying shipping income, allocations to permanent establishments and treatments for entities classified as flow-through entities.

How are the Pillar 2 Adjusted Covered Taxes quantified?

What are Covered Taxes?

Covered Taxes generally mean:

- Taxes recorded in the financial accounts of a Constituent Entity with respect to its income or profits or its share of the income or profits of a Constituent Entity in which it owns an Ownership Interest;

- Taxes imposed in lieu of a generally applicable corporate income tax; and

- Taxes levied by reference to retained earnings and corporate equity, including a Tax on multiple components based on income and equity.

How are Covered Taxes adjusted?

The Adjusted Covered Taxes shall be equal to the current tax expense accrued in its Financial Accounting Net Income or Loss with respect to Covered Taxes for the FY, adjusted by:

- the net amount of its Additions to Covered Taxes for the FY, which is the sum of:

- any amount of Covered Taxes accrued as an expense in the profit before taxation in the financial accounts;

- any amount of Pilar 2 Loss Deferred Tax Asset, if this election is opted for;

- any amount of Covered Taxes that is paid in the FY and that relates to an uncertain tax position where that amount has been treated for a previous FY as a Reduction to Covered Taxes; and

- any amount of credit, refund or the transferable amount in respect of a Qualified Refundable Tax Credit or of a Marketable Transferable Tax Credit that is recorded as a reduction to the current tax expense.

- the net amount of its Reductions to Covered Taxes for the FY, which is the sum of:

- the amount of current tax expense with respect to income excluded from the computation of Pillar 2 Income or Loss (as described above);

- any amount of credit, refund or the transferable amount in respect of a tax credit that is not recorded as a reduction to the current tax expense and that is not derived from a Qualified Refundable Tax Credit or Marketable Transferable Tax Credit;

- any amount of Covered Taxes refunded or credited to a Constituent Entity, or the amount received by the Constituent Entity for the transfer of a tax credit, that was not treated as an adjustment to current tax expense in the financial accounts, except where they are derived from a Qualified Refundable Tax Credit or a Marketable Transferable Tax Credit;

- the amount of current tax expense which relates to an uncertain tax position; and

- any amount of current tax expense that is not expected to be paid within three years of the last day of the FY;

- The Total Deferred Tax Adjustment Amount; and

- any increase or decrease in Covered Taxes recorded in equity or Other Comprehensive Income relating to amounts included in the computation of Pillar 2 Income or Loss that will be subject to tax under local tax rules.

The Pillar 2 Loss Election – what does it mean?

- A Filing Constituent Entity in the UAE can opt for a Pillar 2 Loss Election instead of applying the rules in Article 4.4 (addressing temporary differences). This election establishes a deferred tax asset equal to the Net Pillar 2 Loss for the UAE, calculated by multiplying the loss by the 15% Minimum Rate.

- The balance of the deferred tax asset carried forward to future FYs and reduced by the amount used in each year. The asset must be used in subsequent years when there is Net Pillar 2 Income in the UAE. The usage is capped at either the lower of the Net Pillar 2 Income multiplied by the Minimum Rate or the available deferred tax asset.

- What happens if I revoke the election in the future? If the Pillar 2 Loss Election is revoked, any remaining deferred tax asset is reduced to zero, effective from the first day of the FY when the election is no longer applicable. The tax assets and liabilities are then recalculated according to other articles for the prior FY.

What is my filing requirement under this election? The Pillar 2 Loss Election must be filed with the first Pillar 2 Information Return or the first Top-up Tax Return of the MNE Group, whichever is earlier, or with both if required for the first FY the group has a Constituent Entity in the UAE.

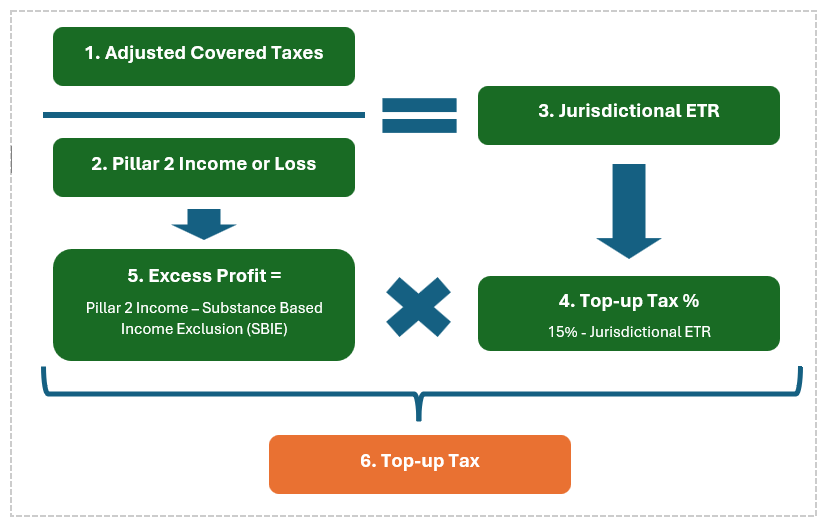

How is the Effective Tax Rate and Top-up Tax calculated?

Within the Law, Article 5 defines the determination of the Effective Tax Rate and the subsequent Top-up Tax due. This follows the principle as highlighted in the diagram above. However, please consider the below additional factors.

How does the Substance-Based Income Exclusion (“SBIE”) apply?

The Net Pillar 2 Income for the UAE shall be reduced by the SBIE to determine the Excess Profits, for purposes of computing the Top-up Tax as described above. The SBIE amount is the sum of the payroll carve-out and the tangible asset carve-out for each Constituent Entity, except for Constituent Entities that are Investment Entities, located in the UAE.

The payroll carve-out for a Constituent Entity located in the UAE is equal to 5% of its Eligible Payroll Costs of Eligible Employees that perform activities for the MNE Group in the UAE, except Eligible Payroll costs that are:

- capitalised and included in the carrying value of Eligible Tangible Assets;

- attributable to a Constituent Entity's International Shipping Income and Qualified Ancillary International Shipping Income that is excluded from the computation of Pillar 2 Income or Loss for the FY.

The tangible asset carve-out for a Constituent Entity located in the UAE is equal to 5% of the carrying value of Eligible Tangible Assets located in the UAE. Eligible Tangible Assets means:

- property, plant, and equipment located in the UAE;

- natural resources located in the UAE;

- a lessee's right of use of tangible assets located in the UAE; and

- a license or similar arrangement from the government for the use of immovable property or exploitation of natural resources that entails significant investment in tangible assets.

De Minimis Exclusion – A permanent safe harbour for non-material UAE entities

The application of the De Minimis Exclusion allows the Filing Constituent Entity in the UAE to elect for Top-up Tax to be deemed zero if specific conditions are satisfied. These include:

Eligibility for De Minimis Exclusion:

- The Top-up Tax for UAE-based Constituent Entities can be reduced to zero for a FY if:

- The Average Pillar 2 Revenue is less than EUR 10 million.

- The Average Pillar 2 Income or Loss is either a loss or less than EUR 1 million.

- This is an annual election, meaning it must be made each FY.

- The election does not apply to Stateless Constituent Entities (entities with no jurisdictional residence) with their financials excluded from the calculation for the de minimis exclusion.

Are there any exceptions to the rule?

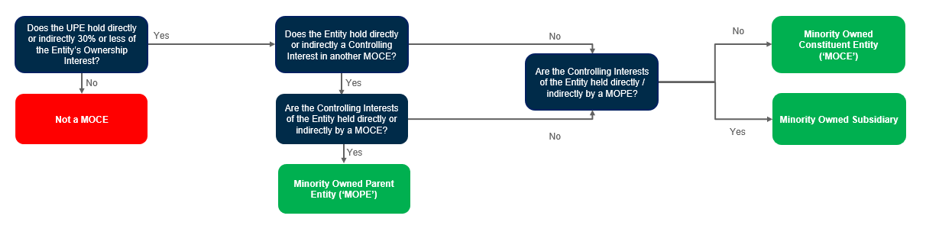

How does the DMTT apply to Minority-Owned Constituent Entities (“MOCEs”)?

What is a MOCE?

A MOCE is a Constituent Entity of the MNE Group where the UPE holds directly or indirectly 30% or less of its Ownership Interests.

How does the DMTT apply?

The computation of the Effective Tax Rate and Top-up Tax for the UAE shall apply as if MOCEs were a separate MNE Group, with respect to MOCEs that are members of a Minority-Owned Subgroup. In cases of an MOCE that is not a member of a Minority-Owned Subgroup, the Effective Tax Rate and Top-up Tax of a MOCE is computed separately, on an entity basis.

A Minority-Owned Subgroup means a MOPE and its Minority-Owned Subsidiaries.

How does the DMTT apply to Joint Ventures (“JVs”)?

What is a JV?

A JV is an Entity whose financial results are reported under the equity method in the Consolidated Financial Statements of the Ultimate Parent Entity provided that the Ultimate Parent Entity holds directly or indirectly at least 50% of its Ownership Interests.

How does the DMTT apply?

The Top-up Tax of a JV and its subsidiaries is computed as if they were Constituent Entities of a separate MNE Group and as if the JV was the UPE of the Group.

UAE Corporate restructuring and reorganization – Under the new Pillar 2 rules, what do I need to consider?

Definitions:

- Merger: A merger is where entities from separate groups come under common control to form a single group.

- Demerger: A demerger involves separating a group into two or more groups with separate ultimate parent entities.

How do mergers and demergers impact the revenue threshold test?

- Considerations on a group merger: When two or more groups merge, the consolidated revenue threshold of EUR 750 million is deemed to be met for the FYs prior to the merger if the total revenue of the combined entities equals or exceeds EUR 750 million. This applies to mergers that occurred in the past four FYs.

- Acquisition of a single constituent entity: If an entity that is not part of any group acquires or merges with a group, the consolidated revenue threshold is similarly deemed to be met if the combined revenue of the entities is equal to or greater than EUR 750 million.

- Demerger: If an MNE Group demerges into two or more groups, the threshold for the demerged Group is considered to be met:

- For the first FY after demerger: If the demerged group has revenues of EUR 750 million or more.

- For the second to fourth FYs: If the demerged group has at least two FYs with revenues of EUR 750 million or more.

Constituent Entities Joining and Leaving an MNE Group

- When a UAE entity joins or leaves an MNE Group due to changes in ownership (disposal / transfer / liquidation), the following would need to be considered under the UAE’s Pillar 2 rules:

- If an entity joins or leaves part way through a FY, it will be treated as part of the group for the relevant FY if any portion of its assets or income is included in the consolidated financial statements of the ultimate parent entity.

- The financial accounting net income and taxes of the target entity are considered for the year in which it joins or leaves the group.

- For subsequent years, the entity’s Pillar 2 Income or Loss and Adjusted Covered Taxes are determined based on the historical carrying value of assets and liabilities.

- Deferred Tax considerations - Deferred tax assets and liabilities that are transferred between MNE groups are accounted for by the acquiring group as though they had been controlled by the acquiring group from the outset.

- Change in controlling interest - If a controlling interest in an entity is acquired or disposed of, and a local jurisdiction treats it as an acquisition/disposal of assets, the acquisition or disposal is treated similarly under this decision.

What do I need to consider when transferring Assets and Liabilities as an MNE group?

- When a Constituent Entity disposes or acquires assets and liabilities:

- Disposing Entity: The gain or loss from the disposal is included in the computation of its Pillar 2 Income or Loss.

- Acquiring Entity: The acquiring entity uses the carrying value of the acquired assets and liabilities to compute its Pillar 2 Income or Loss.

- Unless the transfer falls within a GloBE Reorganisation. Under these circumstances, the following would apply:

- Disposing entities exclude the gain or loss from their Pillar 2 Income or Loss calculation.

- Acquiring entities use the disposing entity's carrying values, adjusted for any required changes under the domestic tax law.

How does the Transitional CBCR Safe Harbour apply?

For FYs that begin before 1 January 2027 and end before 1 July 2028, an MNE Group can elect for the Jurisdictional Top-up Tax of the UAE to be deemed as zero if:

- De minimis test: the MNE Group reports Total Revenue of less than EUR 10 million and Profit (loss) before Income Tax of less than EUR 1 million in the UAE on its Qualified Country-by-Country Report (“CBCR”) for the FY;

- Simplified ETR test: the MNE Group has a Simplified ETR that is equal to or greater than 16% (for FYs that begin in 2025) and 17% (for FYs that begin in 2026) in the UAE. The Simplified ETR is calculated by dividing the Jurisdiction's Simplified Covered Taxes by its Profit (Loss) Before Income Tax as reported on the MNE Group's Qualified CBCR; or

- Routine Profits test: the MNE Group's Profit (loss) before Income Tax in the UAE is equal to or less than the SBIE amount, for entities reported in the UAE in the CBCR.

How does the Simplified Calculations Safe Harbour apply?

This permanent Safe Harbour applies similar principles in terms of the simplification methods offered under the transitional CBCR Safe Harbour. However, the methodology and basis differ from the Transitional CBCR Safe Harbour by way of no longer considering CbCR data. Therefore, the permanent simplification method incorporates data from the Pillar 2 calculation, providing compliance reductions and optimizations, but maintaining the need to calculate elements of the Pillar 2 calculation.

Does the Law include Transitional Rules?

The Law includes transitional rules for the transitional FY (being the first year that the entity is subject to the Pillar 2 rules). These rules outline how tax attributes created prior to the inception of the Pillar 2 rules will be valued and adjusted going forward. Each MNE Group would need to assess these complex rules on a case-by-case basis.

How does the Initial Phase of International Activity exclusion apply?

The Top-up Tax shall be reduced to zero during the initial phase of an MNE Group's international activity, provided that none of the ownership interests of the Constituent Entities located in the UAE are held by a Parent Entity subject to a Qualified Income Inclusion Rule (“IIR”) in another Jurisdiction.

An MNE Group is in its initial phase of its international activity if, for a FY: (a) it has Constituent Entities in no more than six Jurisdictions; and (b) the sum of the Net Book Values of Tangible Assets of all Constituent Entities located in all Jurisdictions other than the reference Jurisdiction does not exceed EUR 50 million.

Does the DMTT provide for any elections?

There is a total of 21 Elections provided by the GloBE rules. We have listed below most of the Elections that have been adopted by the UAE:

- Excluded Entity Election

- Election to use the Realization Method

- Stock-Based Compensation Election

- Election to Spread Capital Gains

- Consolidation Election

- GloBE Loss Election

- Tax Transparency Election

- Taxable Distribution Election

- Unclaimed Accrual Election

- Distribution Tax Regime Election

- Substance-Based Income Exclusion Election

- Transitional Safe Harbour Election

- De minimis Election

- Portfolio Shareholding Election

- Foreign Exchange Hedge Election

- Excess Negative Tax Carry-Forward Election

- Debt Release Election

- Equity Investment Inclusion Election

Considerations for Top-up Tax Return Filing and when is the deadline?

- Each Constituent Entity and JV (including JV subsidiaries) located in the UAE shall file a Top-up Tax Return with the Federal Tax Authority.

- Each return may be filed by either the Constituent Entity, JV or JV Subsidiary itself or by one sole filing by the Domestic Designated Filing Entity on behalf of all UAE entities within the MNE Group.

- The Top-up Tax Return is due to be filed to the Federal Tax Authority (“f”) 15 months after the end of the Reporting FY (for periods after the first transition year)

- In the transition year (first FY in which the rules apply) the Top-up Tax return is due 18 months after the end of the first applicable FY.

As an example, if the year ended 31 December 2025 was the MNE Group’s first applicable FY for the UAE, the Top-up Tax return would be due 30 June 2027. If it was not the transition year, the return would be due 31 March 2027.

Payment of Top-up Tax – The relevant UAE constituent entity must pay any Top-up Tax due in UAE Dirhams. This payment is due on the same day as the Top-up Tax return (i.e. 15 months after the FY or 18 months after for the transitional year).

Registration – A UAE Entity that is subject to Top-up Tax under these rules and any Designated Filing Entity will be required to register with the Federal Tax Authority. The manner and timeline of this registration is still to be confirmed.

What considerations from the UAE Federal Decree-Law No. (47) of 2022 are imbedded within the Pillar 2 rules?

The new Pillar 2 rules imbed the already existing requirements under the following articles within the UAE Federal Corporate Tax Law:

- Article 50 - General Anti-abuse Rule

- Article 56 - Record Keeping

- Article 59 - Clarifications

- Article 60 - Assessment of Corporate Tax and Penalties

Please note for FYs beginning on or before 31 December 2026 but not Including a FY that ends after 30 June 2028, no penalties or sanctions shall apply in connection with the filing of a Top-up Tax Return or the Pillar 2 Information Return where the Federal Tax Authority considers that an MNE Group has taken reasonable measures to ensure the correct application of the provisions of this Decision.

The Minister, in the future, may determine how other provisions of Federal Decree-Law No. 47 of 2022 may apply to this Decision.

In conclusion, as the UAE Pillar 2 rules come into effect from January 2025, MNE’s with operations in UAE are encouraged to start the process of identifying the impact that these rules have on their local & global business. We advise this is done sooner rather than later due to the extensive changes to data collection, accounting and consolidation reporting these rules bring. MNE’s should consider their current data capabilities, the data points now required under the Pillar 2 rules, the organizations’ ability to identify and collate this data and any new technological needs to assist with automation for this new compliance burden.

Furthermore, the role of MNE’s business functions (such as finance & tax teams) would be subject to significant change by virtue of the introduction of Pillar 2 compliance and the end filing requirements. These rules add significant complexities to the accounting for single entity data in each jurisdiction of operation, how this data feeds up to the ultimate consolidation, the accounting standards applied within each jurisdiction and the tax accounting treatment for deferred taxes. MNE’s would be required to ensure appropriate upskilling of their key stakeholders or identification of where they will require third party support.

Due to the timing of the release of the UAE’s Pilla 2 rules, the UAE DMTT was not included in the Central Record of Pillar 2 Legislation with Transitional Qualified Status. Therefore, it is still unclear if the UAE’s DMTT will receive Qualified Status. However, based on our understanding that these rules align with the OECD Guidance, we would expect the UAE to apply a QDMTT. This could make available the compliance optimizations under the QDMTT Safe Harbour.

On a separate note, the Law allows for further provisions to be added in line with the OECD’s IF. This could mean the future introduction of a IIR and Under Tax Profits rule (“UTPR”) within the UAE in the future.

How can A&M help?

A&M has developed a detailed phased approach to support MNEs navigate the entire Pillar 2 readiness journey, as follows:

Phase 1 – Pillar 2 Technical Analysis

- Pillar 2 impact assessment

- CbCR safe harbour analysis

Phase 2 – Technology & Data Assessment

- Data Assessment

- Data Readiness (identification of any gaps)

Phase 3 – Operational Remediation (Organizational Readiness)

- Selection of compliance model

- Determining responsibilities of Business Functions

Phase 4 – Vendor selection

- Support with the section of a suitable Pillar 2 technology solution

Phase 5 – Solution Implementation

- Remediation support of any gaps identified

- Implementation of Pillar 2 solution

Phase 6 – Ongoing support

- Pillar 2 Compliance

- Pillar 2 ad hoc advisory

Please reach out to one of our Pillar 2 and Tax Technology experts within the A&M Tax Team if you have any questions or would like to discuss how this could impact you!