Middle East tax Alert | UAE | UAE e-Invoicing Consultation Paper | MoF Proposes Data Dictionary

The UAE Ministry of Finance (MoF) published an e-Invoicing public consultation paper which includes their proposed UAE e-Invoicing data dictionary on 06/02/2025 providing a structured and standardized catalog of all the data elements used to generate, exchange, process and report e-Invoices. In this article, we provide high-level insights into the expected UAE e-Invoicing regime and make recommendations for businesses that will be impacted by this new compliance obligation. We have already covered the UAE e-invoicing basics in a previous article so we will focus our analysis on the content the public consultation instead.

Our key highlights

It is important to note that the purpose of the consultation paper is to gather feedback from the UAE businesses and e-Invoicing providers. Therefore, it remains to be seen which of the elements, including the UAE data dictionary, will ultimately make it into the final legislation. The paper does however mention phrases such as 'mandatory fields'.

Based on the public consultation published, the following areas are important for businesses to take note of:

- The consultation paper confirms the statement already made on the UAE MoF website that the e-invoicing regime is applicable to businesses operating in the UAE regardless of their VAT registration status (and therefore one would assume regardless of their corporate tax registration too). It also explicitly mentions that exempt, zero-rated and out of scope transactions for VAT (i.e. transactions not subject to tax and thus no tax invoice is required to be issued) are also caught by the e-invoicing regime, in addition to the standard transactions where a tax invoice is required (including credit notes).

Financial services industry potential impact

- If adopted by UAE MoF, then this is expected to have a significant impact on businesses activities in the financial services industry, not just from a practical perspective (if we consider the time of supply rules, or just frequency of transactions), but also considering the overall infrastructure of a typical bank, as the proposed rules seem to conflict with global standards.

- More specifically, from a tax policy perspective, one of the reasons for not having to issue a tax invoice for exempt financial services tends to be that it is generally very difficult for a financial institution to calculate the exact margin earned on a specific moment in time on, for example, derivates, lending- or even FX products, as these can fluctuate significantly during the course of a day and even be loss-making if looked at on a transaction-by-transaction basis. This is also the reason why tax authorities tend to allow VAT reporting of exempt supplies to occur on a 'netting basis' (i.e. netting off similar profitable and loss-making margin-based transactions) – which would then conflict significantly with the currently proposed e-invoicing rules by UAE MOF.

- Similarly, given the fact that banks can have thousands of transactions daily (e.g. in the remittance/settlement space), typically a set of more relaxed rules around having to issue a tax invoice for zero-rated (cards) transactions. If going forward, these transactions now require an e-invoice, then that would mean a significant operational change for banks and other financial institutions.

- As follows from the above, these developments should be closely monitored by those businesses impacted, as the potential impact on internal systems could be significant.

- In earlier announcements, UAE MoF announced the proposed e-Invoicing model in the UAE will follow the Pan European Public Procurement Online (PEPPOL) based 5 corners e-Invoicing model for B2B and B2G transactions. This public consultation re-confirms this intention.

e-Invoice validation process

- In an update compared to previous announcements, the consultation indicates that both Corner Two (C2) and Corner Three (C3) would be required to transmit the Tax Data Document (TDD) to Corner Five (C5), whereas previously only C2 had this obligation. This essentially means a double validation, and a double transmission to C5 of any invoice sent through the PEPPOL network by both C2 and C3 before it becomes a valid e-invoice.

- There is no detail, however, on the mechanics involved if an invoice sent by Corner One (C1) is validated by C2, and therefore reported to C5 at the same time, but subsequently fails C3 validation, apart from the fact that C3 does not have to report the TDD to C5 in this scenario. This raises the question about how a validation disagreement between C2 and C3 would be resolved as the invoice from C1 would not be released to C5 until both C2 and C3 validate the invoice, hence potentially impairing the flow of the commercial transaction between C1 and C4.

- It also raises the question about what happens to the TDD reported by C2 to C5 but unvalidated by C3.

e-Invoicing use cases in the UAE

- A total of 16 ‘typical use cases’ for generating a (tax) invoice in the UAE have been listed which includes a breakdown of expected data points required to cover such scenarios:

- UAE Standard tax invoice. Mandatory and commonly used optional fields

- Supply under Reverse charge mechanism. Additional requirements beyond Use Case One

- ‘Zero rated supplies. Additional requirements beyond Use Case One

- Deemed supply. Additional requirements beyond Use Case One

- Disclosed agent billing. Additional requirements beyond Use Case One

- Summary tax invoice. Additional requirements beyond Use Case One

- Continuous supplies. Additional requirements beyond Use Case One

- Supply involving free trade zone. Additional requirements beyond Use Case One

- Supply through e-commerce. Additional requirements beyond Use Case One

- Exports. Additional requirements beyond Use Case One

- Margin scheme. Additional requirements beyond Use Case One

- Standard tax credit note Mandatory and commonly used optional fields

- Disclosed agent billing tax credit note Additional requirements beyond use case 12

- Commercial Invoice Mandatory and commonly used optional fields

- Self-billing and commonly used optional fields

- Self-billing tax credit note and commonly used optional fields

Standard fields for e-invoicing in the UAE

- The guide highlights that a total of 50 mandatory data points to issue a standard tax invoice. Out of those 50 fields, 15 fields are new and currently not required under the UAE VAT Law.

- When it comes to issuing an invoice related to an exempt or out-of-scope supply, a total of 49 mandatory data points are now required, 16 of them not currently covered in the UAE VAT law.

- We want to highlight the tax breakdown mandatory data points which are new and may prove a challenge for businesses who do not have enough details in their tax setup within their systems. Based on our practical experience, many businesses may struggle in their current VAT system setup to fulfil all the data fields required. This would include a master data exercise whereby businesses should ensure to update information of for example customers and product data. Similarly, VAT determination in systems should align with tax scenarios (tax category). Gaps need to be mitigated prior to the go live. We want to stress out that this can in practice be a very time-consuming exercise

Finally, it is important to note that depending on the scenario, the number of required data fields on an e-invoice can easily go up to 120 data points. Data elements can be 'mandatory', 'conditional' or 'optional', depending on the use case scenario.

The document confirms the importance of data, and the impact e-Invoicing will have on all businesses in the UAE. Once live, e-Invoicing will uncover all potential non-compliant documents and could prevent businesses from raising invoices to customers, as sellers and buyers’ commercial channels are linked through the e-invoicing five corner model.

Key considerations for businesses:

Ensuring to be able to raise a valid e-Invoice could be a challenge for businesses for several of the business scenarios, especially if they belong to a potentially high-risk industry and/or if they're not 100% aligned or abreast with the latest amendments with the current VAT legislation. For example:

- Zero rated supplies: Aviation, healthcare, education and financial services businesses (when engaging with overseas customers for their products) could be required to gather over 100 data elements for each zero-rated invoice. Typically, zero-rated supplies are a risk area for the Federal Tax Authority (FTA) and automatically flagged when auditing businesses as VAT isn’t charged and collected. In the case of a zero-rated supply, the reason for not charging VAT should be added to the e-Invoice, as well as a tax exemption reason code (no further details on the list of potential reason codes are given yet). This is a new requirement that businesses should implement in their systems.

- Deemed supplies: This is another area that has been treated with a light-touch and is often not considered for VAT purposes by businesses. These are especially prevalent in scenarios involving supplies made on ‘free of charge‘ basis, gifts or awards presented to employees, business partners (outside of the prescribed threshold limits). Deemed supplies are often handled through a manual invoicing process and may have implications on meeting all the required data fields.

- Self-billing: This is common for real estate businesses to raise and are sometimes not strictly reviewed because they have raised the documents themselves. However, this is especially a hot topic after the release of the public clarification by FTA, wherein, the FTA has emphasized the obligation for businesses to issue a valid tax invoice to itself, as recipient of the supply when importing goods or services from an overseas vendor. The requirement of self-billing on foreign purchases has been a practical challenge, and it is not yet a common standard for businesses to issue a self-billing tax invoice in the first place. With e-Invoicing, FTA will be able to reconcile self-billing invoices with declared amounts under the reverse charge / import boxes of the VAT return.

- Summary tax invoices: It could be quite easy for businesses especially financial institutions to assume that they may be out of scope of e-Invoicing. However, the document has explicitly listed down use case for zero rated and summary invoices. as such, e-Invoicing will highlight if summary invoices have been set-up erroneously.

- Supply involving free trade zone: Businesses operating in free zones could be required to gather over 95 data elements for each related invoice. This will require a change of free-zone businesses, that have traditionally raised mainly zero-rated and/or commercial invoices.

- Valid tax document: With the advent of e-Invoicing mandates, it becomes pertinent for the businesses to ensure that they comply with the technical requirements so as to not miss out on timely recovery of input tax credit and hence near real time reporting of the transactions.

Our Recommendation to get ready

The release of the Data Dictionary has underlined the importance of assessing the impact of e-Invoicing to your business and eliciting cross-functional requirements. This is the only way to ensure all stakeholders are represented and a compliant solution is implemented for finance, tax and IT.

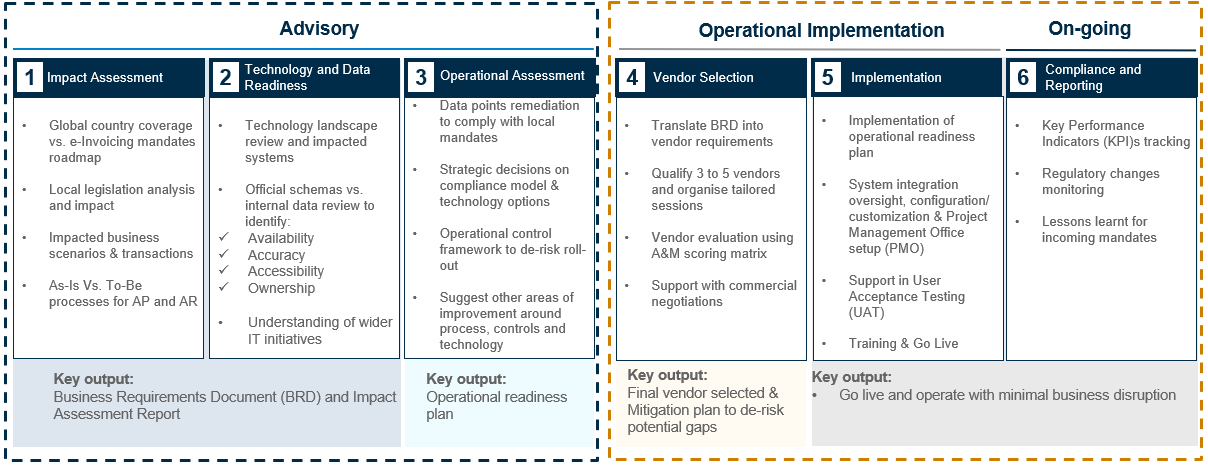

A&M has developed a standard approach to get operationally ready for e-invoicing based on our experience in other jurisdictions:

Businesses should

- Understand the impact of e-Invoicing to your organization and ensure that all business scenarios are well identified and accurately mapped. UAE MoF are mandating compliant document flows. We anticipate it won't be possible to raise a tax credit note without referencing to the original tax invoice. We must look deeper than simply at our transaction scenario mapping, since e-Invoicing is managed at a document level and not transactional one.

- Assess the full system landscape to highlight where documents could be raised ad-hoc or as work-a-rounds. Understand where the required data is stored and how it is interfaced between systems.

- It will only be possible to raise a sales invoice to your clients if all 8 'buyer' data elements are accurately stored within your master data records. Be mindful that it may require time and efforts to collect this information from your buyer if you have any gaps in your current master data. The following data points are required:

- Buyer's name

- Buyer's legal registration number

- Buyer's tax identification number

- Buyer's postal address

- Buyer's address line 1

- Buyer's city

- Buyer's country sub-division

- Buyer's country code

- HSN codes will also become mandatory in the future. While we wouldn’t recommend picking this up with highest priority, you should still be planning to update your item master data records.

- Zero rated, exempt and outside of scope transactions/documents will all require reason codes to support not charging or remitting VAT. Businesses should evaluate your VAT determination process, and confirm correct VAT codes and treatments are being applied. Tax categories codes will be flagged by the new digital e-Invoicing process.

Get in touch with one of our experts listed above to begin your journey towards e-invoicing readiness in the UAE.