February 7, 2025

Swiss Safe Harbor Intercompany Interest Rates for 2025

Safe harbor interest rates for intercompany financing in CHF and foreign currencies

Background

- On 28/29 January 2025, the Swiss Federal Tax Administration (SFTA) published its safe harbor interest rates for intercompany loans and advances for the year 2025. These interest rates are generally accepted as being at arm’s length by the Swiss tax authorities without any further proof by the taxpayer and apply retroactively from 1 January 2025 until 31 December 2025.

- If a Swiss taxpayer wishes to engage in intercompany financing activities without the burden of demonstrating compliance with the arm’s length nature of the interest rates applied to the Swiss tax authorities, the taxpayer should apply the safe harbor interest rates. These provide for a maximum rate where the Swiss resident entity is the borrower and a minimum rate where it is the lender for intercompany loans denominated in CHF or foreign currencies.

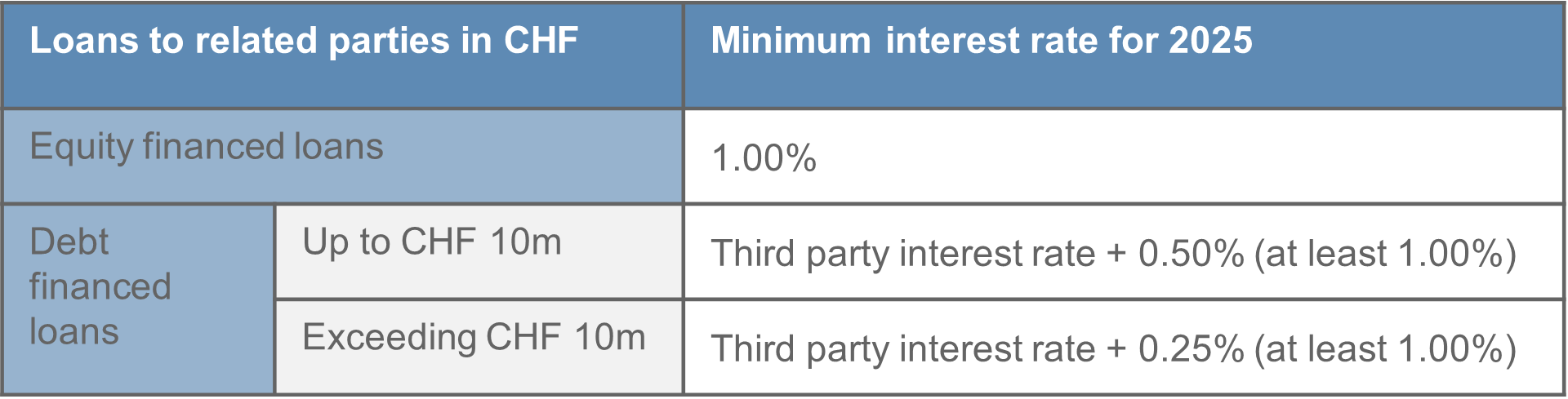

Safe harbor interest rates for I/C loans and advances in Swiss Francs

- The minimum interest rate for intercompany loans denominated in CHF granted from Swiss resident entities to shareholders or related parties are as follow:

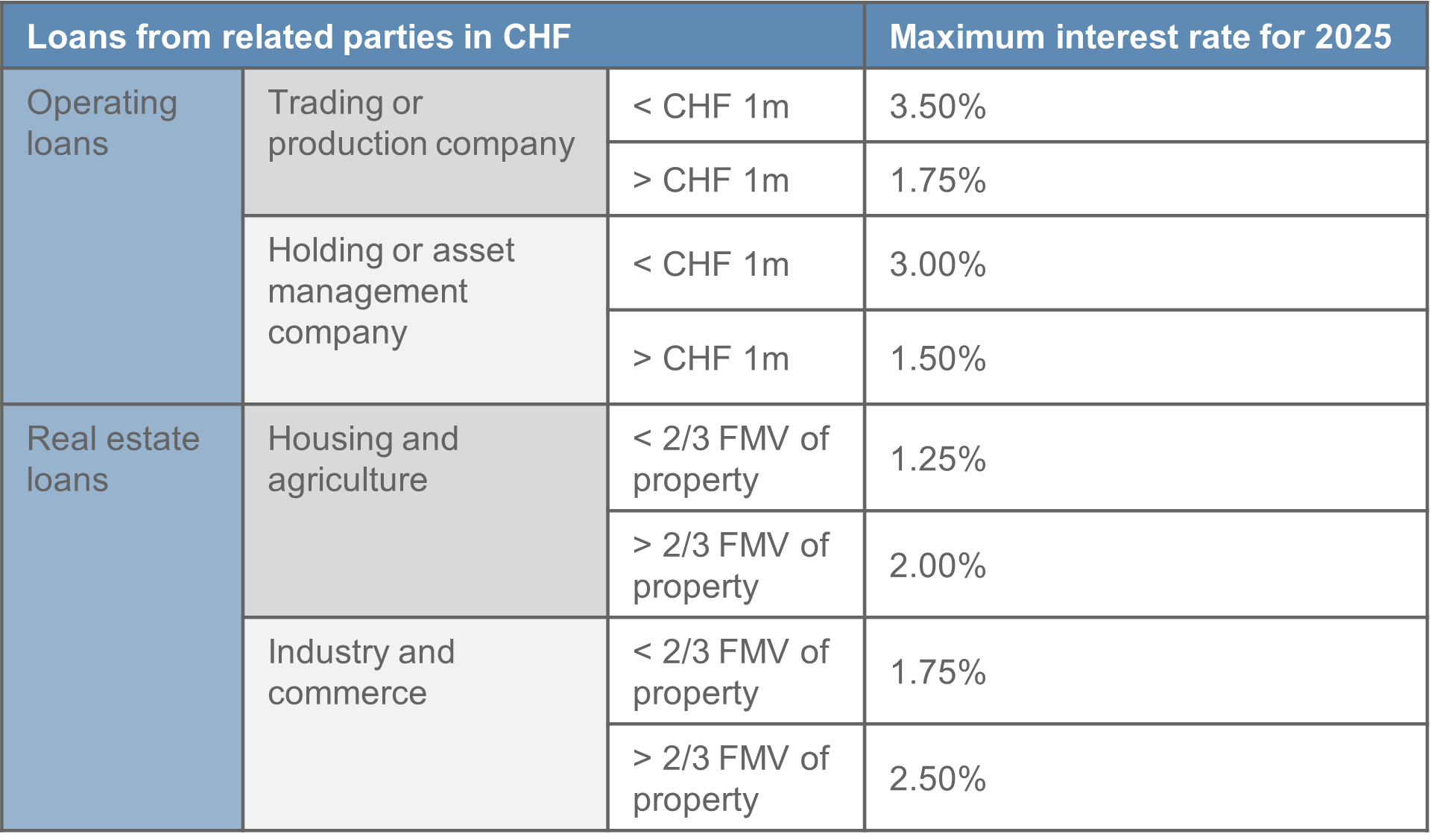

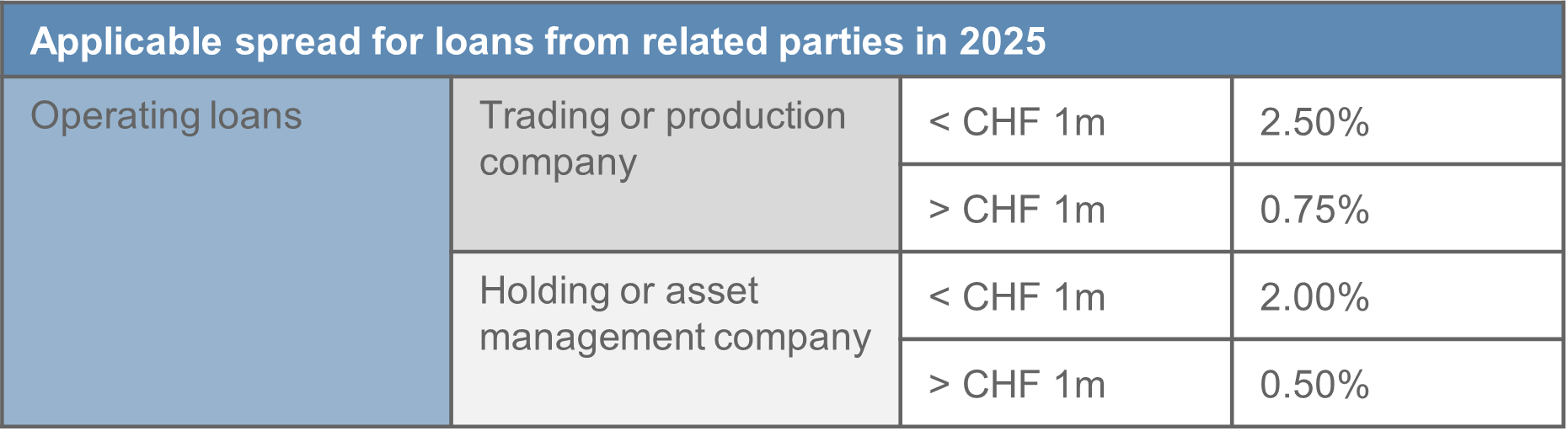

- The maximum interest rate for intercompany loans denominated in CHF received from shareholders or related parties by Swiss resident entities are as follow:

Safe harbor interest rates for I/C loans and advances in foreign currencies

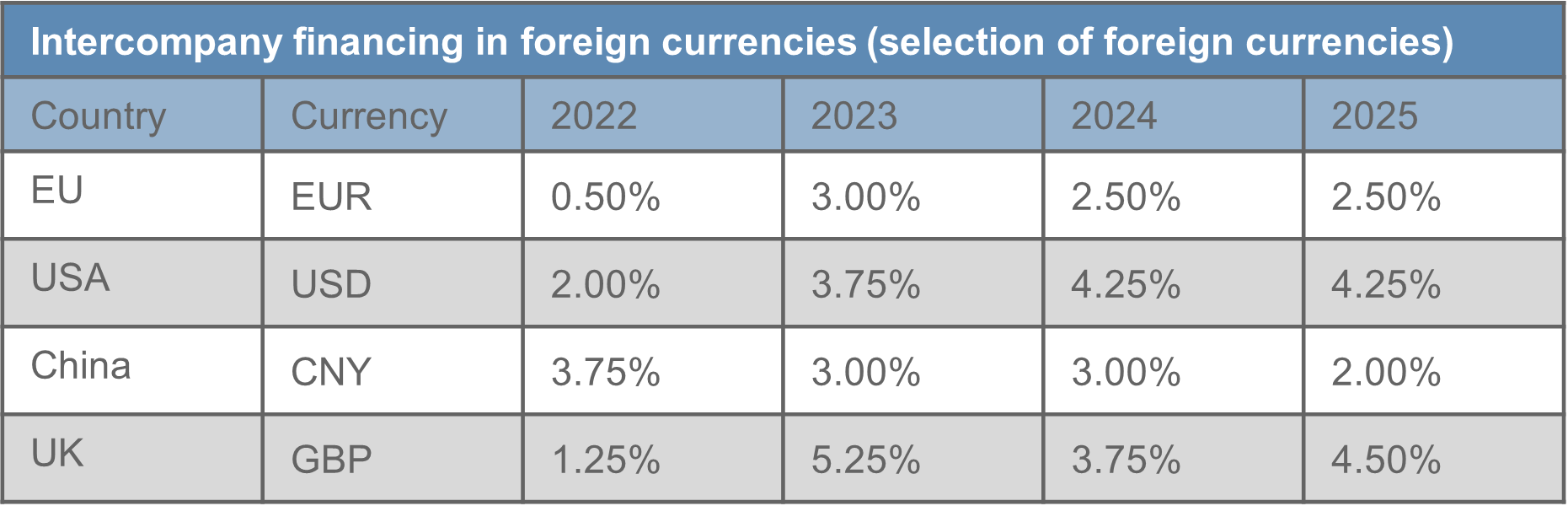

- The applicable minimum interest rates for intercompany loans denominated in selected foreign currencies granted by Swiss resident entities to shareholders or related parties are depicted in the table below.

- If the intercompany loan is debt financed a margin of 0.5% must be applied to the cost (third party interest rate). In case the minimum interest rate of a foreign currency would be lower than the minimum interest rate on intercompany loans denominated in CHF, a minimum interest rate of 1% must be applied.

- The maximum interest rate for intercompany loans denominated in a foreign currency received from shareholders or related parties by Swiss resident entities is calculated based on the interest rates shown in the table above plus the respective spread – whereas the spread amounts to the difference between the minimum and maximum safe harbor interest rate for intercompany loans denominated in CHF (depicted in the table below).

Simplified examples for I/C loans in USD

- In 2025 the applicable safe harbor minimum interest rate for an intercompany loan receivable with a nominal value of USD 10m of a Swiss resident trading company amounts to at least 4.25%.

- On the other hand, the applicable safe harbor maximum interest rate for an intercompany loan payable with a nominal value of USD 10m of a Swiss resident trading company in 2025 amounts to 5.175% (4.25% plus a spread of 0.925% (1 x 2.50% + 9 x 0.75%)/10). For simplification purposes the exchange rate for USD and CHF is considered 1:1 in this example.

Further considerations when applying safe harbor interest rates

Limitation on the application of safe harbor rates

- In a recent court decision, the Swiss Supreme Court has severely restricted the applicability of the safe harbor interest rates and declared them as only applicable for Swiss tax authorities, when the taxpayer applies them. In other words, the safe harbor interest rates are not considered one-sided binding for the Swiss tax authorities and the calculated arm’s length rate (effective arm’s length rate rather than the safe harbor rate) would be decisive for intercompany transactions. Especially in an M&A context, this raises additional challenges in the quantification of historical tax risks associated with intercompany financing. See our alert on this Swiss Supreme Court decision for further details.

- Negative tax consequences may arise if a Swiss resident entity does not comply with the safe harbor interest rates. The arm’s length exceeding interest expense paid may be requalified as hidden profit distribution or hidden capital contribution depending on the involved parties. Hidden profit distributions are added-back to the taxable income subject to Swiss corporate income tax as well as Swiss withholding tax at a rate of 35% (grossed up to 53.8% if not borne by the recipient) potentially reduced if treaty protection is available. The potential Swiss tax consequences should in any case be analyzed based on a case-by-case basis.

Swiss thin capitalization rules

- Generally, all Swiss tax resident companies must adhere to maximum debt financing rules (i.e., thin capitalization rules, which set forth applicable quotas per asset category based on the assets’ fair market values). If a company is undercapitalized (as set out in a circular issued by the SFTA), the Swiss tax authorities may requalify debt from related parties into hidden equity for Swiss tax purposes. Whereby debt from third parties guaranteed by related parties may also qualify as debt from related parties from a Swiss thin capitalization perspective.

- Hidden equity is subject to the Swiss annual capital tax and the quota of interest expenses allocated to hidden equity are generally not accepted as tax deductible for Swiss CIT purposes and considered as hidden profit distributions which are subject to Swiss withholding tax of 35% (53.8% grossed up) potentially reduced if treaty protection is available.

- In case a Swiss tax resident entity is undercapitalized and debt from related parties is requalified into hidden equity, the Swiss tax authorities use the maximum allowed amount of debt from related parties and multiply this with the maximum safe harbor interest rate. Only the interest expense exceeding this calculated amount is allocated to hidden equity and would be requalified as hidden profit distribution.

Assistance with intercompany financing

- Please contact the authors of this article directly to discuss any of the issues raised and to learn how A&M can help you.