CORPORATE TAX ADVISORY & COMPLIANCE SERVICES

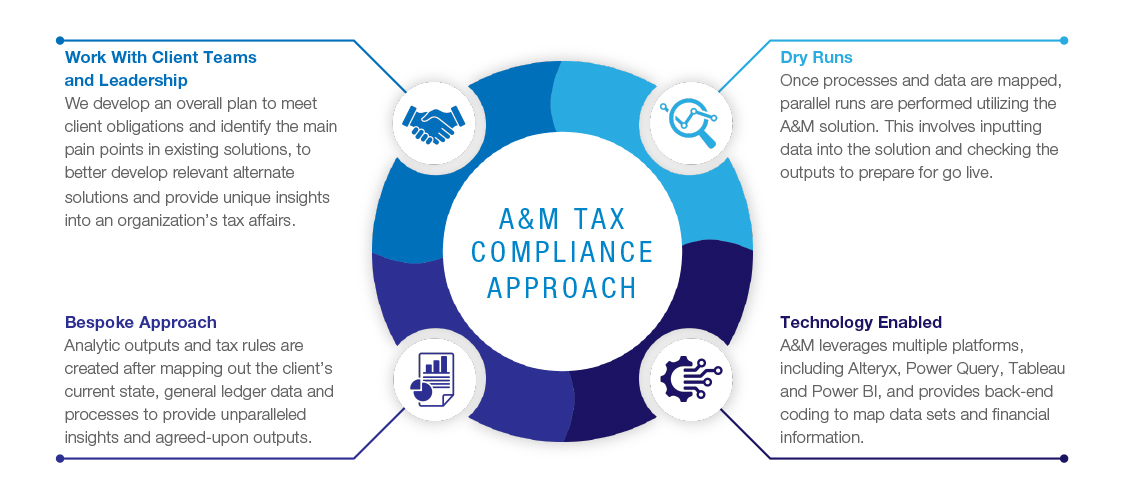

A&M’s Corporate Tax Advisory, Compliance and Technology team delivers bespoke advisory and technology-enabled tax compliance services. By using innovative tax technology and leveraging automation to reduce manual work, drive efficiencies and improve capacity, we allow both clients and A&M employees to focus on value-add activities. The team brings expertise across both tax and technology to deliver on strategy and execute increasingly complex tax needs — including periodic trust distribution and tax provision reviews, complex tax advisory matters and income tax return preparation and lodgments.

WHY OUR CLIENTS CHOOSE US

Senior Leadership

A&M’s engagements are all directly led by senior leadership. This hands-on approach not only allows A&M to provide deep industry experience but also facilitates the efficient delivery of services, eliminating the red tape more junior teams can get trapped in.

Independence

A&M is a non-audit firm, giving us autonomy and the freedom to act quickly and support our clients without either actual or perceived conflicts with auditing financial statements.

Combination Of Technology And Tax Expertise

Solely relying on technology will not address all of the challenges faced by tax teams dealing with a high volume of complex reporting requirements. A&M’s experience in tax compliance and our breadth of specialists allow us to implement technology-enabled tax solutions and build long-term partnerships with clients.

THE A&M DIFFERENCE

CREATE VALUE

By improving the efficiency and effectiveness of the tax function, staff can be redeployed to perform more value-added tasks. We give finance and tax functions an opportunity to accelerate efficiencies, positioning them to be value creators.

MITIGATE RISK

With unprecedented shifts in global tax regulations, organizations — especially those with high volumes of compliance requirements — may struggle with risk management within their tax functions. Leveraging automation can allow organizations to better address the complex risk environment, reducing human error and remaining compliant with tax regulatory body requirements.

KEEP PACE WITH DIGITAL TRANSFORMATION

Digital transformation is rapidly changing as technologies such as AI and machine learning evolve. We can act as an extension to client teams who want to utilize and incorporate new technology into their processes.

PROVIDE INDEPENDENT, EXPERT SERVICES

A&M’s Corporate Tax Advisory & Compliance Services team shares the firm’s transactional DNA. We have expertise in tax matters for newly acquired companies and experience in providing transparency and control to clients with intelligent technology.

Learn more about our CORPORATE TAX ADVISORY & COMPLIANCE SERVICES