RESTRUCTURING TAX SERVICES

A&M’s Restructuring Tax Services team supports restructuring teams, creditors and distressed companies with expertise in the bespoke tax solutions focused on preservation of as much value as possible. The team identifies means and opportunities through which historic tax attributes may be safeguarded, and unnecessary tax leakage prevented.

WHY OUR CLIENTS CHOOSE US

Expertise

We offer deep tax experience in distress, insolvency and M&A situations. This has allowed us to provide services that identify savings opportunities and guide companies through restructuring. We are happy to lead the tax workstream in circumstances where there are numerous affected parties.

Holistic Offering

Unique in the Australian market, A&M’s in-house capabilities are able to lead restructuring and insolvency actions while also providing relevant tax expertise that can assist these processes to maximize tax outcomes and create a value proposition for any disposals.

Network

A&M’s Restructuring Tax Services team can connect companies looking to sell assets with interested buyers.

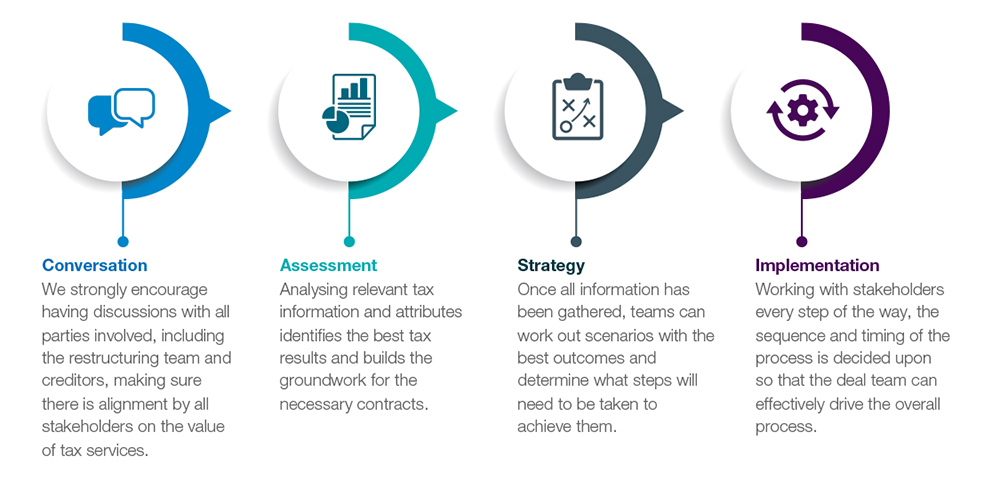

THE A&M TAX APPROACH

THE A&M DIFFERENCE

SAVINGS

An effective restructuring tax strategy can result in hundreds of millions of dollars in savings, often in cash — an important outcome favourable to creditors involved.

CERTAINTY

By engaging with the Australian Tax Office early in a restructuring or insolvency, dialogues can be opened and rulings or assurance on expected outcomes can remove uncertainty from the process.

COMPLIANCE

Tax payments are often the first casualty when companies are unable to repay debts, but having a tax plan can identify savings opportunities and ensure requirements are still met.