Dutch Dividend Withholding Tax Exemption for ‘Tax-Exempt’ Investors

For several years, an already adopted Dutch dividend withholding tax exemption that can be applied at source for certain ‘tax-exempt’ investors was pending effectiveness. The Dutch Ministry of Finance has recently issued a Royal Decree that this withholding tax exemption will now become effective on 1 January 2024. This exemption can be relevant for, for example, Dutch and foreign pension funds, foundations, governmental bodies, sovereign wealth funds and endowments. The criteria to qualify for the exemption at source are broadly the same as the criteria for the existing Dutch dividend withholding tax exemption that has to be effectuated via a reclaim procedure. The benefit of an exemption at source is of course that it takes away the cashflow disadvantage that exists in a reclaim procedure.

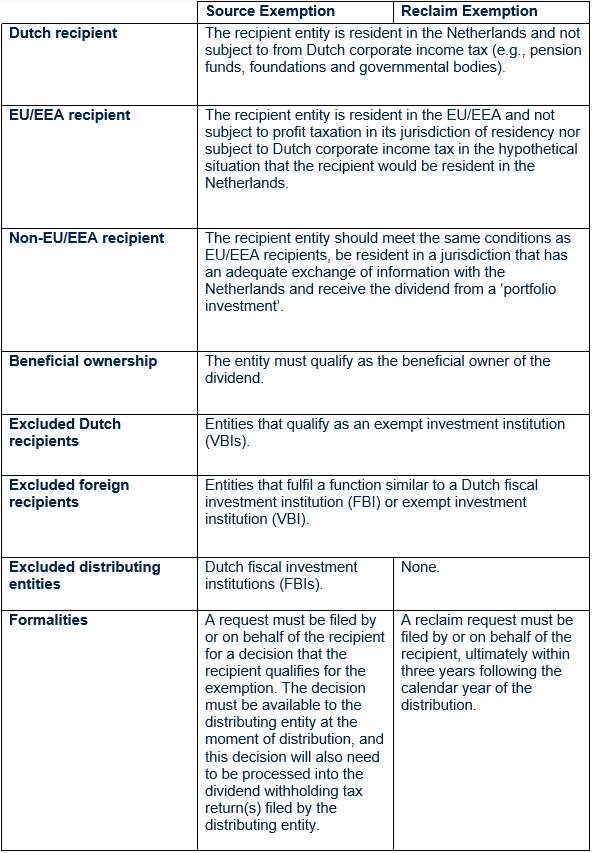

Conditions of the source and reclaim exemptions

The Dutch dividend withholding tax exemptions can be applied subject to the requirements listed below. This overview of requirements is limited to items typically relevant in a fund context and does not cover all technicalities.

A closer look at certain key conditions

Not subject to Dutch corporate income tax – The recipient entity cannot be subject to Dutch corporate income tax. For an entity resident outside the Netherlands, this is tested in a hypothetical situation that the entity would be resident in the Netherlands. Entities that are not subject to Dutch corporate income tax include, but are not limited to, pension funds that are subjectively exempt, foundations that are outside the scope of Dutch corporate income tax and certain governmental bodies that are either outside the scope of Dutch corporate income tax, subjectively exempt or exempt for certain categories of income. This needs to be assessed on a case-by-case basis. For foreign pension funds, the Dutch State Secretary of Finance has issued a set of cumulative criteria* to determine whether there is sufficient comparability with a Dutch pension fund. Without sufficient comparability, a foreign pension fund cannot be subjectively exempt from Dutch corporate income tax. These criteria are specific to Dutch pension schemes, which raises the question whether they conflict the with EU freedoms (e.g., the freedom of establishment or free movement of capital).

Not subject to profit taxation outside the Netherlands – The requirement that an entity resident outside the Netherlands should not be subject to profit taxation in its jurisdiction of residence, shortly put, includes entities that are outside the scope of corporate income tax, as well as entities that are subjectively exempt. It could technically also include entities that are subject to a 0% corporate income tax rate. For governmental bodies, it can include entities that are partially exempt provided the dividend can be allocated to the entity’s exempt income.

Excluded Dutch and foreign entities – Dutch entities that qualify as a VBI, as well as entities resident outside the Netherlands that fulfil a ‘similar function’ as a VBI or FBI are excluded recipients. The VBI and FBI are investment vehicles that are (effectively) exempt from Dutch corporate income tax. What constitutes a similar function is undefined. However, the main function of a VBI and FBI is to facilitate collective investing (i.e., by mitigating an additional layer of corporate income taxation at the level of the VBI or FBI, which would not have been due in case the investors in a VBI or FBI would have held the underlying investments directly). Whether a foreign entity has a similar function needs to be assessed on a case-by-case basis.

Formalities – The initiative to apply the exemption at source in principle lies with the investor, as the recipient will first need to obtain a decision from the Dutch tax authorities confirming its eligibility. This decision should subsequently be provided to the distributing entity.

The criteria to qualify for the exemption at source are broadly the same as the criteria for the existing Dutch dividend withholding tax exemption that has to be effectuated via a reclaim. The source exemption is therefore most interesting for ‘tax-exempt’ investors that want to mitigate the cashflow disadvantage connected to the current reclaim procedure. Both the reclaim and source exemption can be of interest to ‘tax-exempt’ investors that do not qualify for an exemption from Dutch dividend withholding tax under a double tax treaty concluded by the Netherlands. This is typically concerns ‘older’ double tax treaties that do not yet contain provisions specifically aimed at pension funds.

How can A&M help?

A&M can help investors assess their eligibility for the Dutch dividend withholding tax exemptions and assist with the filing of the relevant requests with the Dutch tax authorities. If you would like to discuss the possibilities for your investments, please feel free to get in touch with your usual A&M adviser, Roel de Vries or Nick Crama.

*Dutch comparability criteria for foreign pension funds

- The purpose of the entity must, exclusively or almost exclusively (at least 90%), be to take care of employees, their spouses or partners, and (foster) children up to 30 years for the consequences of age, death or work disability.

- The activities of the entity are in accordance with the before-mentioned purpose (the activity requirement) of Article 3 of the Dutch Corporate Income Tax Decree 1971.

- The entity complies with the profit allocation requirement, which means that the benefit of profits should be allocated to the beneficiaries of the pension scheme(s).

- The entity is not a pension fund for so-called shareholder-employees.

- The pension scheme is based on collectively organized solidarity. The collective and solidarity principles should, amongst others, be included in the profit allocation to the beneficiaries of the pension scheme(s).

- There is, in principle, an obligation for employees to participate and to be insured (to assure and protect pension entitlement for employees).

- The pension scheme foresees in a retirement pension, survivors’ pension and/or disability pension, as agreed upon between employee and employer based on a pension agreement.

- Foreign fiscal, social and employment legislation may differ with respect to, for example, retirement age and the accrual rate. However, a condition is that it is, and should remain linked to labor and income continuation. This entails: (1) that the pension accrual is linked to the length of the contract of employment and to the compensation for the labor performed and (2) that the pension payments are being granted with the purpose, on an ongoing basis, to provide lifelong care for the beneficiary, or in the event that the beneficiary passes away, the lifelong care of the surviving relatives or income compensation due to incapacity for work.

- The pension scheme must include a buy-off restriction, however, pensions that have only been built up for a limited amount are exempted from this restriction. This exemption for small pensions has been introduced to relieve small pension funds from (relatively) high administrative costs in relation to low pension build up.

- The pension itself consists of multiple payments in cash. A one-time capital payment (lump-sum) at the date of retirement does not negatively impact the comparability with a Dutch pension fund provided the capital payment should be utilized, directly and mandatorily, to purchase / convert to the lump-sum into multiple retirement payments. Another utilization is prohibited.

- There is no pension arrangement / possibility for entrepreneurs to join the pension scheme. Entrepreneurs are persons who are not under a labor contract (self-employed). An exemption exists for pension arrangements for entrepreneurs, which are linked to a pension scheme that the person was previously in as an employee. This requirement has been relaxed to allow pension schemes that (a) are aimed at certain industries or professions, not being schemes that are open to all self-employed persons, (b) whereby the self-employed persons are mandatorily required to participate in the scheme and (c) meet all the other comparability criteria whereby ‘self-employed persons’ can be read for ‘employees’.

- The foreign pension scheme does not fall within the scope of the social security system of the respective jurisdiction.