Employer Compliance – Spring Statement 2023 update & Reporting Expenses and Benefits

In this article for employers, we have highlighted the key aspects of the Chancellor’s Spring Statement and summarised how this will affect employers.

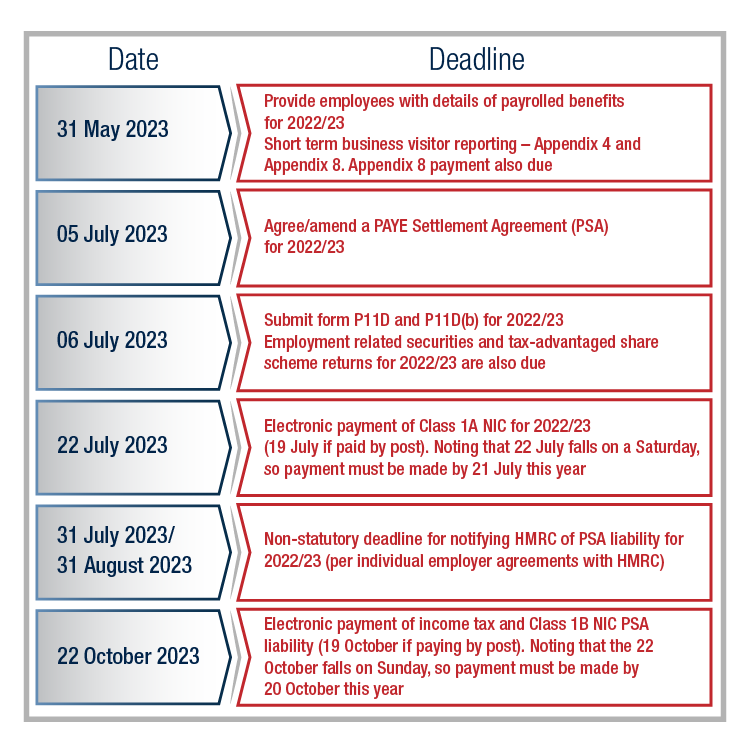

We have also set out below some of the key employment tax deadlines coming up for employers, in relation to employee expenses and benefits.

Spring Statement 2023 – update for employers

The proposed employer National Insurance measures announced in the Autumn Statement have been confirmed to take effect from 6 April 2023. This will freeze the rate at which employers start to pay Class 1 Secondary NICs for their employees at £9,100 per year from April 2023 until April 2028. Whilst seemingly innocuous this is a significant revenue raiser estimated to be worth up to £5.7 billion a year to the exchequer.

Following on from the closure of the Office of Tax Simplification, a consultation has been issued on simplifying tax to support modernisation and business growth. The consultation is seeking views on HMRC’s income tax services, in particular the interaction between Pay As You Earn and the Income Tax Self-Assessment tax regime and how digitalisation can help. This closes on 7 June, please therefore let us know if you would like to have your views incorporated into an A&M response.

Employers will be encouraged to support people back to work through the expansion and improvement of employer occupational health provisions. A consultation is to follow, which will include options for increasing investment in occupational health and tax incentives. There are limited tax exemptions in existence, so we welcome any additional tax incentives but are mindful this is likely to fall as an additional cost burden to employers.

Employment Tax Key Deadlines

Forms P11D and P11D(b)

Employers are required to report details of certain taxable benefits provided to employees, by 6 July 2023, using Forms P11D and P11D(b) (where the benefits are not already covered by a payrolling arrangement with HMRC or under a PSA).

A copy of the form P11D must be provided to each employee, and Employers must submit their forms P11D and P11D(b) to HMRC by 6 July 2023. Employer’s Class 1A NIC is payable at a rate of 14.53% on certain P11D benefits and must be paid by 22 July 2023.

HMRC have confirmed that from 6 April 2023 paper P11D and P11D(b) forms will not be accepted, even in the case of an amendment.

PAYE Settlement Agreement (PSA)

A PSA is a formal arrangement with HMRC whereby employers choose to settle the tax due (on a grossed-up basis) on certain employee benefits. Typical benefits we see included in PSAs are staff entertaining, gifts and taxable long service awards. Employer’s Class 1B NIC is also payable at a rate of 14.53% this year, on the value of PSA benefits and must be paid by employers by 22 October 2023.

A PSA must be agreed with HMRC by 5 July following the end of the tax year to which it relates, however, it is best practice to agree to this before the benefits covered are provided to employees. Once a PSA is agreed with HMRC, it will remain in place for future tax years (or until amended by the employer/HMRC).

Common issues

Some of the most common errors/issues we see arising in relation to forms P11D and PSAs include:

- Not reporting all taxable P11D /PSA benefits, including staff entertaining, gifts and non-cash awards e.g the application of the trivial benefit exemption

- Benefit values incorrectly calculated under the Optional Remuneration Arrangement rules.

- Incorrectly recording/not reporting fuel provided for company cars.

- Using the wrong tax rate on PSAs, particularly if there are Scottish and/or Welsh taxpayers included.

- Using costs exclusive of VAT.

Penalties

Late P11D(b) filing will incur a penalty of £100 for every 50 employees. HMRC will also charge statutory interest on late paid Class 1A NIC. Additional percentage-based penalties can also be applied for incorrect forms of P11D, based on whether HMRC considers that the employer has taken reasonable care and whether the mistake is deemed to be careless, deliberate and/or concealed.

Furthermore, where HMRC uncovers errors as part of a review they will often seek recovery on a grossed-up basis often covering several tax years.

This can all result in significant liabilities for an employer because of reporting benefits incorrectly.

Key dates to remember – summary

How can we help?

At Alvarez & Marsal Taxand, our Reward and Employment Tax team has extensive experience in advising employers on their ongoing employment tax and NIC obligations. Our team of very experienced professionals has expertise across tax, HR and finance, including in-house roles and status specialist roles within HMRC. Please contact your usual A&M point of contact or Louise Jenkins, Kathy Lloyd, Tracey Norton, Linda Cameron, Monica Houston or Scott Hutchison.