The Electric Transition Continues Despite Persisting Supply Chain Challenges

Production shutdowns and delays continue to mount as COVID, war, and a variety of supply chain issues hamper the industry. Automotive inventory is at its highest level since June of 2021, but March sales were underwhelming.

In this issue, A&M analyzes how shortages and rising prices in chips and raw materials may slow the electric vehicle (EV) transition as the selected topic for the April Industry Focus.

Automakers continue to use transactions to bolster supply chains and enhance their electric, autonomous, and connected capabilities.

In regulatory news, the U.S. government implemented stricter fuel regulations for vehicles and is seeking to implement policy to enhance domestic chip supply.

Additional April insights are included below.

Financial Performance

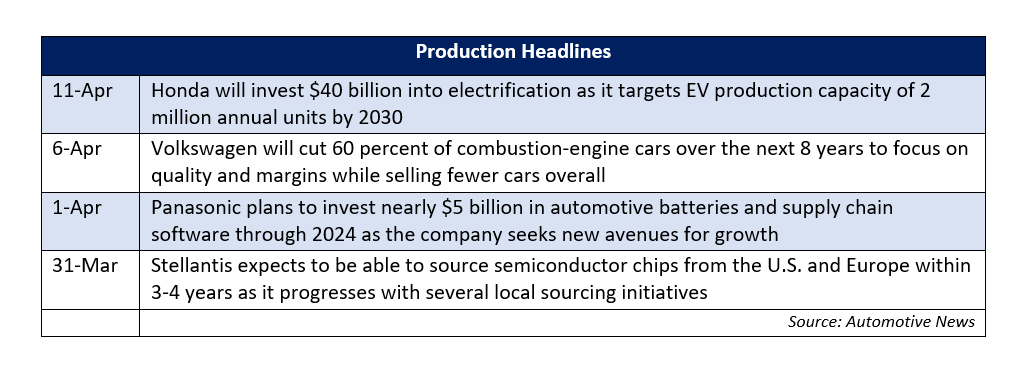

Auto Forecast Solutions’ (AFS) latest numbers show that shutdowns and delays have resulted in 1.5 million lost vehicles globally during calendar year 2022 in addition to the 10.5 million lost units in 2021. European manufacturers have accounted for a majority of the industry’s recent cuts and over half of all 2022 production losses. The latest AFS estimates suggest approximately 2.25 million total cars and trucks will be affected by chip-related disruptions in 2022.

Upcoming vehicle production remains uncertain as a variety of issues will likely push inventory recovery into 2023. China has been in lockdown under the nation’s COVID-Zero policy, and estimates show an additional 1.5 million units may be lost globally if the policy remains in place. In addition to the ongoing pandemic, Rivian has stated that the war between Russia and Ukraine continues to add disruptions and delays to operations. According to LMC Automotive, initial estimates show that 150,000 units were lost by German automakers in March due to supply shortages stemming from the conflict.

Industry Update

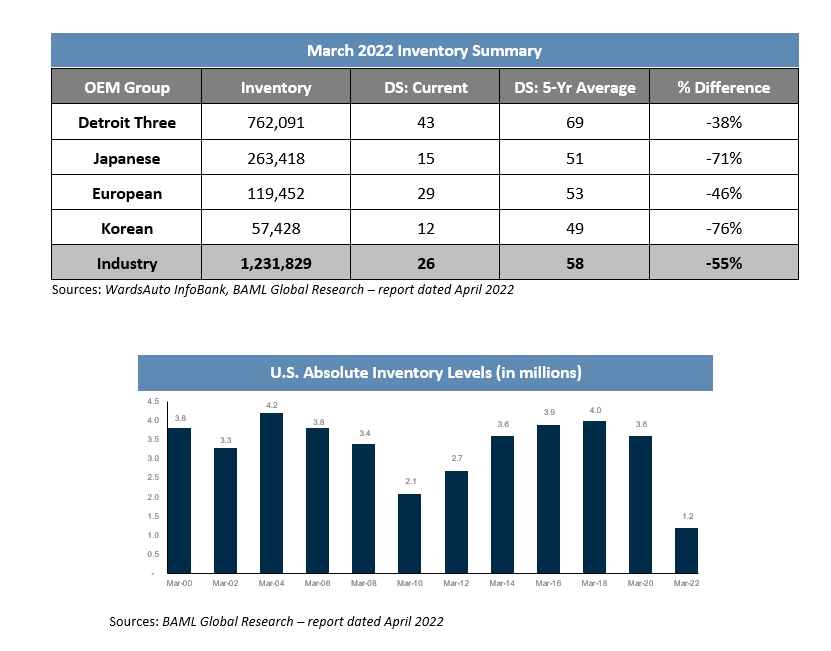

Automotive inventory increased by 165,000 units in February, resulting in approximately 1.2 million total units. This translates to a days’ supply (DS) that is 55 percent below the five-year average at 26 DS. March inventory is the highest level since June of 2021, and the monthly change is the largest month-over-month increase in inventory since 2018. While the increase is encouraging, inventory levels remain historically low and supply chain disruptions have intensified recently.

New light vehicle sales in the U.S. declined 25 percent year-over-year in March with a 13.3 million seasonally adjusted annualized rate (SAAR) of sales. The continued decline in SAAR is concerning as the higher volume sales season is arriving as uncertainty in sales persists. Macroeconomic volatility, geopolitical tension, and supply chain issues are expected to impair production through the remainder of 2022, and these issues may reverberate back into demand as consumer confidence has rapidly deteriorated since mid-2021.

Industry Focus – Chip Shortage, Batteries and Metal Prices: EV Impact

As the automotive industry is transitioning to EVs, there are a variety of obstacles to overcome for a successful shift. For the April Industry Focus section, A&M explores the effects of continued semiconductor shortages and heightened demand for raw materials.

Semiconductor Shortage: EV Impact

The EV transition may be hampered by the current semiconductor shortage, as EVs require significantly more semiconductors. The average EV being manufactured contains approximately 2,000 chips, which is roughly double the amount used in combustion-engine vehicles. Semiconductors are used in many parts of the vehicle, including vehicle cameras, touchscreens, infotainment and connected features, safety features, and, for EVs, chips are critical to batteries. Given EVs reliance on the battery for vehicle performance, advancements in chip technology will be critical to improving functionality. Automotive demand for semiconductors is expected to double over the next five years as more EVs with connected features are released to the market. The production and consistent output of semiconductors is critical to the EV transition, but chip demand is increasing globally, and supply has struggled to keep pace in the ongoing shortage.

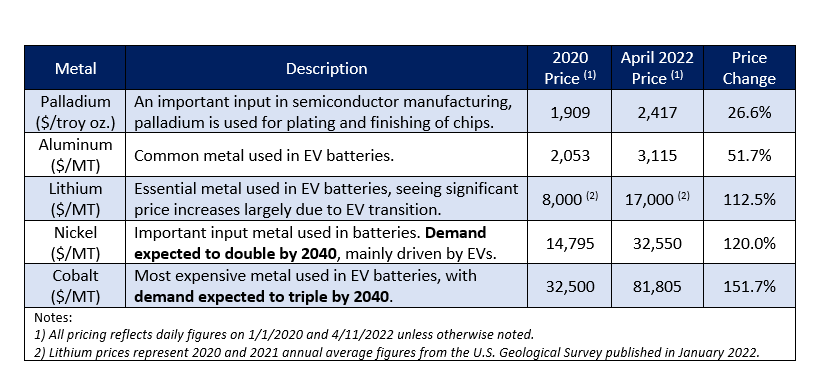

Easing of the ongoing chip shortage is necessary for EVs to flourish. The latest forecasts expect the shortage to extend into 2023, and there are few signs of normalization in the supply environment to meet the rising demand for chips. Another variable for the ongoing shortage is the Russia and Ukraine war, as both neon gas and palladium, two essential inputs for semiconductors, are abundantly found in the region. Chip manufacturers presently have supply reserves, but ongoing conflict presents risk of further delays, price increases, and supply constrictions for chip makers.

Automakers and the U.S. government alike recognize that solidifying the semiconductor supply chain is critical to an electric future. Currently, semiconductor manufacturing is dominated by the Chinese mainland, Taiwan and South Korea, which accounted for more than 85 percent of outsourced semiconductor manufacturing in both 2020 and 2021. To mitigate the shortage and decrease reliance on these three countries, automotive companies and the U.S. Government are each working to ease the chip crisis through different channels. Automakers are looking to secure supply chains by obtaining chips domestically, partnering directly with chip makers through supply agreements, or developing their own chips to use in vehicles. The U.S. Senate approved $52 billion in subsidies for domestic semiconductor manufacturing. The legislation aims to revamp American chip manufacturing, compete with China, and secure the vital supply chains. Efforts continue to mount to move past the shortage and time will tell if EVs can successfully overcome the current challenge.

Other EV Materials: Batteries, Pricing, and Looking Forward

In 2022 alone, EV battery plants have seen $13.5 billion in capital investment to build out the U.S. supply chain. The capital expenditures figure includes projects funded by Stellantis, Ford, Volkswagen, and others.

There are several precious metals used in EV batteries that are experiencing price increases and concerns about supply constraints that may be outpaced by a rise in demand. EV manufacturer, Rivian, recently stated that, “there have been very sizable increases in recent months in the cost of key metals, including lithium, nickel, aluminum, and cobalt with volatility in pricing expected to persist for the foreseeable future”. While aluminum is used in combustion-engine vehicles as well, it is presenting another issue restricting the development and production of batteries. See the chart below for certain price increases the industry has experienced.

In addition to price increases, several of the metals used for batteries are expecting substantial increases in demand over the next decade, mainly due to rising sales in EVs. These metals include those in the table above, as well as graphite. The demand for graphite is expected to triple by 2030, representing a $50 billion opportunity and increasing the global need to approximately 4 to 5 million tons per year. Nickel is another metal of concern for EV manufacturers, as the global demand is anticipating a 20 percent increase in 2022. Additionally, the EV market accounts for 80 percent of lithium-ion battery demand, and the metal is expected to see much bigger increases in demand when compared to the supply.

Sourcing strategies for OEMs have largely involved a transactional or partnership approach to secure supply of metals for the subsequent increase in demand for EV batteries. OEMs including Tesla, Ford, and GM, among others, have moved forward in securing nickel, lithium, and cobalt supply deals. Another approach to navigate the metal pricing surge is to recycle batteries and reuse the contents. The battery recycling company, Li-Cycle, is preparing for the opportunity and has already partnered with GM, Ford, and Volkswagen in the U.S.

Transaction Activity

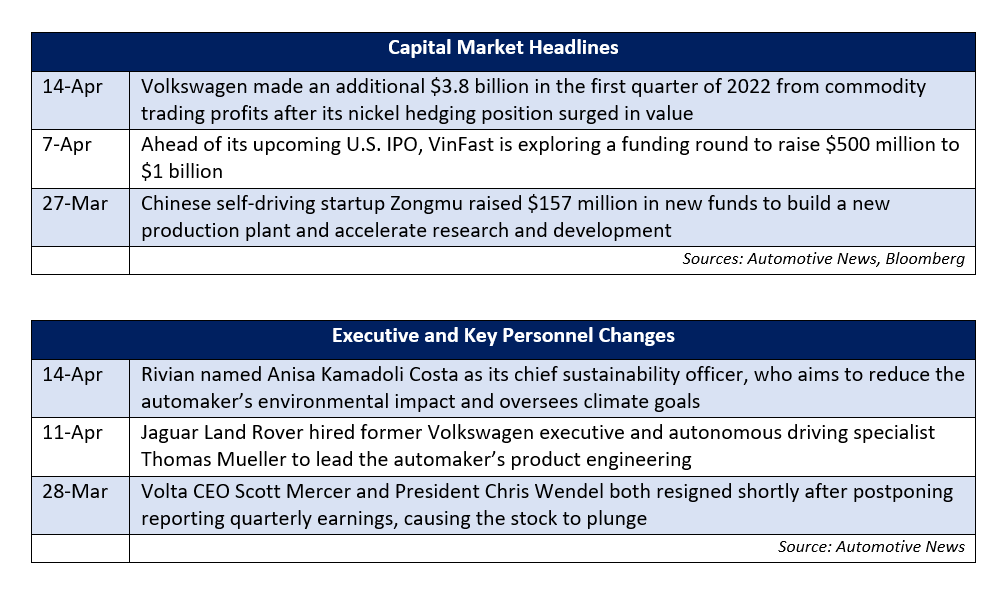

In recent transaction news, Vietnamese EV company VinFast has filed confidentially for a U.S. IPO in a share sale that is expected to raise approximately $2 billion. Automakers continue to strike new deals securing raw materials, as GM reached a cobalt supply agreement with Glencore and Ford inked a lithium supply deal with Lake Resources. Additionally, Porsche is investing $75 million in a startup which is aiming to harness wind power to develop a gasoline substitute. Lastly, Renault is exploring a transformational company change which would include a separation of its EV business from legacy assets and a potential IPO for the EV business in 2023.

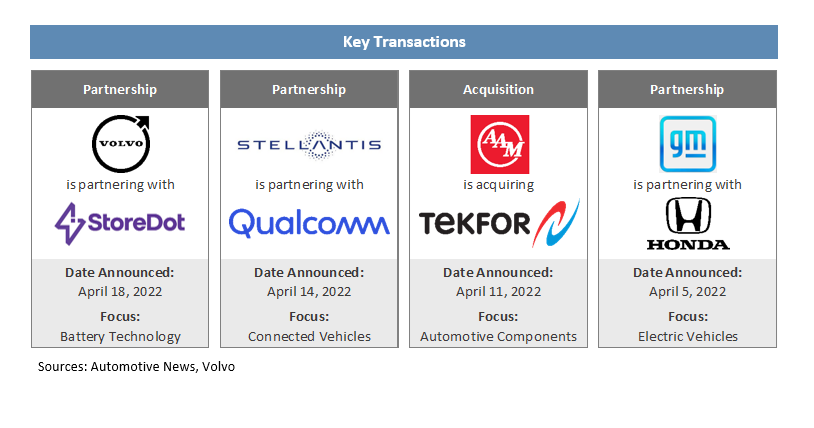

See below for additional detail on recently announced transactions.

- Volvo’s venture capital arm has invested in StoreDot, an Israeli company developing rapid charging battery technology for EVs. The collaboration gives Volvo exposure to new battery technology as it looks to sell purely EVs by 2030, while StoreDot hopes the partnership will accelerate its time to market.

- Stellantis is partnering with Qualcomm to integrate a variety of connected technologies across Stellantis brands by 2026. Key features of the Qualcomm technologies to be incorporated include 5G functions, in-car communication, and infotainment systems.

- Auto supplier American Axle is acquiring Tekfor Group, which specializes in automotive components used in powertrain and e-mobility applications, for $135 million. While American Axle intends to continue serving internal combustion engine vehicles, it is aiming to expand its electrification product portfolio.

- GM and Honda are partnering to jointly develop a line of affordable EVs by 2027. The collaboration will enable production of millions of vehicles as GM and Honda aim to standardize equipment and processes for higher quality and more affordable vehicles for consumers.

Regulatory Landscape

Biden Administration Fuel Regulations: The Biden Administration has released fuel-economy regulations that aim to accelerate EV development, but adversely leave room for ICE vehicles. Starting in 2024, the updates require car manufacturers to increase the average fuel efficiency by 8 percent, eventually equating to 49 mpg by 2026. Carmakers without sufficient EV models can purchase credits from competitors to meet these new requirements. The NHTSA expects U.S. gasoline consumption to decrease by more than 200 billion gallons through 2050 in alignment with these new standards.

EV Policy: The Biden Administration gathered with several of the industry’s leaders and executives to address EVs and charging stations. Major OEMs represented at the meeting included the Detroit Three, Tesla, Lucid, Hyundai, Toyota, and others. The consensus is to provide compatibility among charging stations and to deliver a simple and user-friendly experience irrespective of vehicle brand and location.

U.S. Semiconductor Legislation: The U.S. Senate recently approved legislation to grant $52 billion in U.S. subsidies for domestic semiconductor manufacturing. This approval sends the bill back to the House of Representatives, to hopefully agree on a final version. The legislative progress ultimately aims to limit semiconductor dependency on foreign nations, revive American manufacturing, increase jobs, and compete with China and the rest of the world.

California EV Sales: California is aiming for zero-emission vehicles to account for nearly 70 percent of new-vehicle sales by 2030. This is part of the state’s plan to achieve 100 percent zero-emission vehicle sales by 2035 and phase out gas-powered vehicles. The regulations are expected to cost automakers approximately $2 billion per year from 2026 to 2040.

Stay connected to industry financial indicators and check back in May for the latest Auto Industry Spotlight.