A Look Into Tariffs and the Impact on Suppliers

This edition of the Automotive Industry Spotlight will focus on the impact of pending tariffs across the North American supply chain.

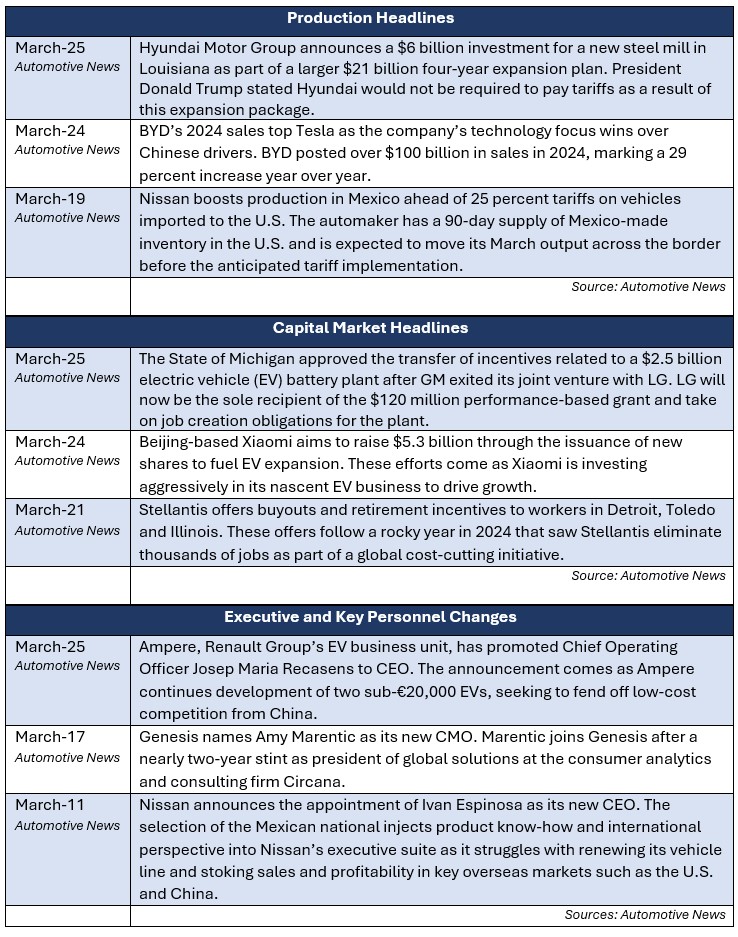

In industry news, Hyundai Motor Group announced a $6 billion investment for a new steel mill in Louisiana as the company moves forward with U.S. production expansion. Stellantis offered buyouts and retirement incentives following a year of layoffs and cost-cutting initiatives. Renault Group’s EV business unit appointed a new CEO as the company seeks to fend off low-cost competition from China.

In regulatory news, Tesla recalled nearly all Cybertrucks built during the first 15 months of production related to issues with an exterior panel. Toyota’s Hino Motors was ordered to pay $1.6 billion in penalties related to a multi-year emissions fraud scheme in the U.S. The National Highway Traffic Safety Administration (NHTSA) opened a preliminary investigation into nearly 1.3 million Ford F-150s, citing unexpected gear downshifts at high speeds.

Industry Focus: Tariffs in the U.S.

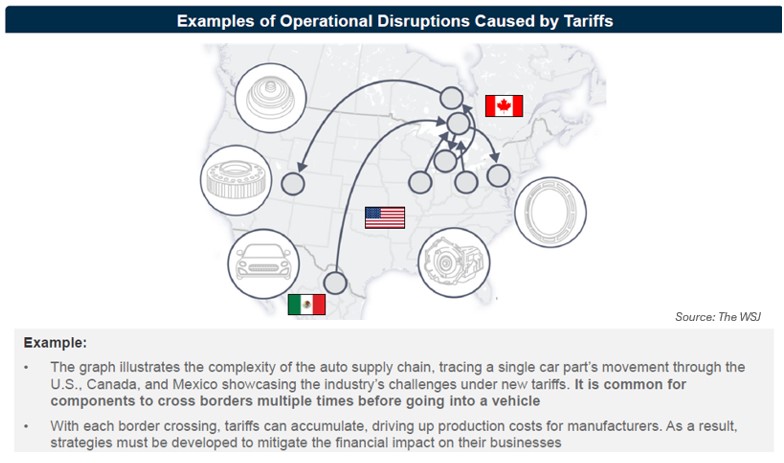

In recent months, the Trump Administration has introduced a series of tariffs targeting the automotive industry, aiming to bolster domestic manufacturing and address trade imbalances. Over the past thirty years, the U.S. automotive supply chain had been built with open trade borders in mind, meaning sudden increases in tariffs can disrupt operations, raise costs and create unintended consequences that ripple through the entire ecosystem. Suppliers, who already operate on tight margins, now face higher prices for imported parts, uncertainty in contract negotiations and pressure to adapt to shifting trade policies. As the industry grapples with these challenges, businesses must explore strategies to remain competitive and resilient in this evolving landscape.

Tariff Update

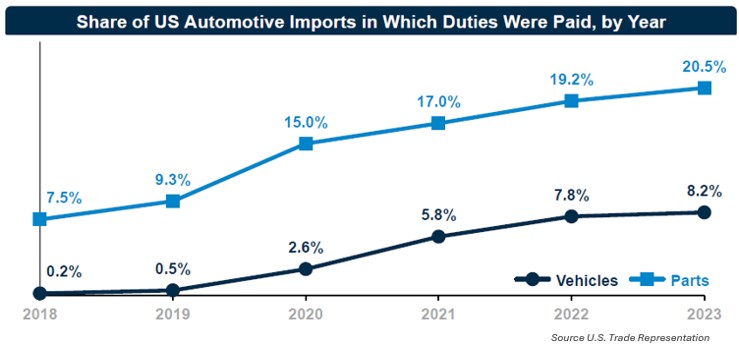

In February 2025, President Donald Trump announced a 25 percent tariff on imported vehicles and vehicle components from Canada and Mexico, set to go into effect in early April. As of the time of this publication, that is still the case. The administration argues these tariffs, along with tariffs already implemented on Chinese imports, are necessary to level the playing field with countries like China and Mexico, which have long been major suppliers of auto parts and finished vehicles to the U.S. market. Automotive imports have played an increasingly important role in U.S. production over the last decade, with imports on which duties were paid increasing significantly since 2018, [1] and Mexico has served as a key base for automotive manufacturing operations.

Many auto suppliers rely on raw materials and components sourced internationally, including steel, aluminum and specialized electronic components such as semiconductors that are difficult to procure domestically at competitive prices. With the threat of higher import duties, suppliers are being forced to reassess their sourcing strategies and plan for increased costs. While some suppliers may attempt to pass these costs onto automakers, fierce competition and long-term fixed-price contracts may limit their ability to do so. Additionally, retaliation from trading partners could lead to additional barriers for U.S. companies looking to export parts and vehicles abroad, further complicating the roadmap for suppliers.

Suppliers – What Can Be Expected

With a 25 percent increase in costs for imported parts and raw materials, suppliers could see significant margin compression if they cannot pass these expenses on to their customers. Depending on contract terms, Tier 2 suppliers with footprints in Mexico and Canada may have to negotiate with their Tier 1 suppliers over who bears the cost of these tariffs. Then, Tier 1 suppliers may have to negotiate with the original equipment manufacturers (OEMs) they supply to mitigate the impacts of tariffs they absorbed from lower tier suppliers and possibly tariffs on their own products from Canada or Mexico. Negotiations between tiered suppliers and OEMs that aren’t resolved quicky may result in interruptions of supply.

In addition to operational disruptions, suppliers can expect adverse impacts to working capital and liquidity as tariffs take hold. The increased costs resulting from tariffs will be felt nearly immediately while contract negotiations and alternative sourcing strategies take place. Tariffs also create uncertainty, which could prompt automakers to delay orders and production, and disrupt the cash conversion cycle for suppliers. Longer payment cycles from customers combined with increased working capital requirements for higher-cost inventory can further strain liquidity.

Suppliers – Risk Mitigation

To navigate these challenges, suppliers must take a proactive approach in evaluating and adapting their business strategies. One of the most immediate responses is to evaluate tariff exposure through a review of the bill of materials, sourcing strategy, material composition and manufacturing of each component. By dissecting the supply chain components, suppliers can identify areas of risk and opportunity from tariff exposure. Following a supply chain assessment, suppliers can begin to consider different strategic options to mitigate tariff risk. Strategic options can include sourcing from alternative countries, shifting production back to the U.S., optimizing production costs through footprint rationalization and tax planning and implementing other operational improvements. Based on the area of strategic focus, suppliers may also consider an in-depth business unit review to evaluate product areas most susceptible to tariff risk and long-term options for those business units. An in-depth understanding of the details of tariffs and legal review of impacted contracts is critical for suppliers undertaking these analyses.

Throughout all of this, liquidity management will be critical as higher import costs put additional strain on working capital. By conducting thorough supply chain assessments and cash flow forecasting, exploring alternative sourcing options and leveraging scenario planning, suppliers can better position themselves to weather these disruptions. The road ahead will be complex but can be navigated with a proactive approach.

Sources:

[1]. Opportimes: Tariffs on Auto Parts Imported to the U.S. are on the Rise. https://www.opportimes.com/tariffs-on-auto-parts-imported-to-the-u-s-are-on-the-rise/

Additional March insights are included below.

Industry Update

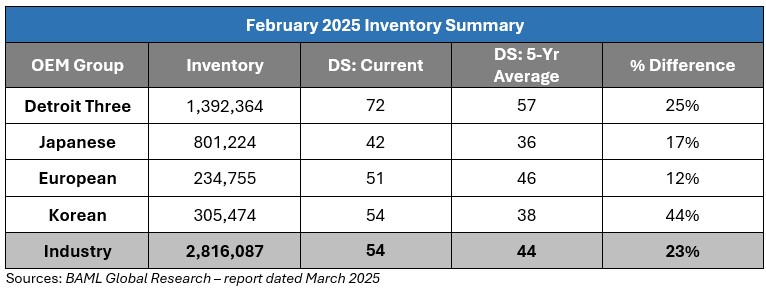

February inventory levels ended at 2.82 million units, a 34,000-unit increase from January. Days’ supply closed at 54, approximately 23 percent above the five-year average. The increase in inventory levels was primarily driven by the Korean and Japanese OEMS, offset by inventory decreases across the Detroit Big Three and European OEMs.

Regulatory Landscape

Cybertruck Recall: Tesla announces a recall of over 46,000 Cybertrucks in the U.S. to fix an exterior panel that could detach while driving. The recall represents nearly all Cybertrucks built during the first 15 months of production. [1]

Toyota’s Hino Motors Pleads Guilty to Emissions Fraud: Hino Motors, a subsidiary of Japanese automaker Toyota, pleads guilty to a multi-year emissions fraud scheme in the U.S. As a result of the plea, the automaker must pay $1.6 billion in penalties. [2]

Ford F-150 Investigation: The NHTSA is investigating nearly 1.3 million Ford F-150 pickup trucks in the U.S. over reports of an unexpected gear downshift accompanied by a temporary rear wheel lock up. NHTSA is opening a preliminary evaluation into the issue and must decide whether to update the probe to an engineering analysis before it could seek to require a recall. [3]

Regulatory News Source:

[1]. Automotive News: Tesla to recall about 46,000 Cybertrucks in U.S. for exterior panels that can fall off. https://www.autonews.com/news/an-tesla-cybertruck-new-recall-0320/

[2]. Automotive News: Toyota’s Hino Motors pleads guilty to U.S. emissions fraud, fined $1.6 billion. https://www.autonews.com/toyota/an-hino-penalized-emissions-0319/

[3]. Automotive News: U.S. opens probe into nearly 1.3 million Ford F-150 trucks over unexpected gear shift. https://www.autonews.com/ford/an-ford-f150-gearshift-recall-0324/

Stay connected to industry financial indicators and check back in April for the latest Auto Industry Spotlight. View more A&M insights into the latest international trade and tariff developments on our website.

Automotive Industry Spotlight Archive