Inventory and Sales Volumes Continue to Decline as Chip Shortage Woes Persist

Inventory and sales volumes continue to decline as chip shortage woes persist

The semiconductor chip shortage is expected to be felt into 2022 as the industry continues to work through production shutdowns and delays. Total vehicle inventory remains depressed and is constraining sales numbers as a result.

Automakers are using the M&A market to enhance capabilities related to vehicle electrification and automated driving technology. Meanwhile, semiconductor chip manufacturers are entering the automotive market as industry demand for the products expands.

Automakers have reinstated mask mandates as COVID continues to affect the industry. Meanwhile, the Biden administration has set zero-emission vehicle sales targets for 2030, and the U.S. senate passed a $1 trillion infrastructure package that includes support for the transition to electric vehicles.

Additional August insights are included below.

Financial Performance

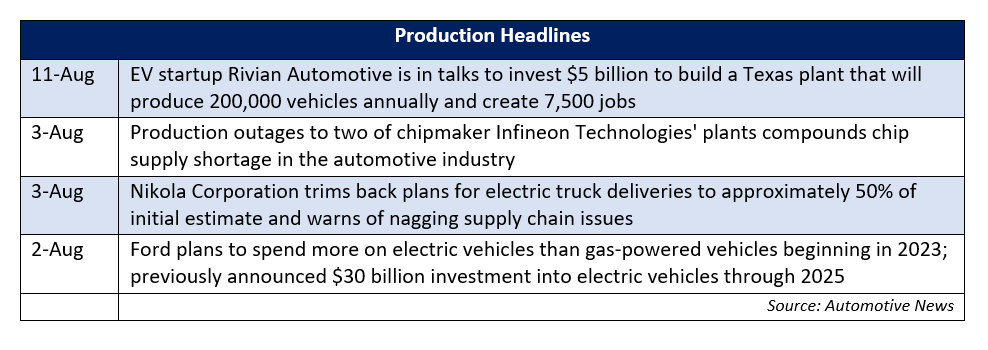

Production levels are not expected to stabilize until at least the fourth quarter of 2021, and meaningful restocking of lost inventory will not occur until 2022 as a result of the ongoing chip shortage. The latest Auto Forecast Solutions’ (AFS) numbers show 6.0 million vehicles have already been lost due to shutdowns and delays, and AFS estimates approximately 7.2 million cars and trucks will be affected by chip-related supply disruptions.

However, COVID and a variety of other daily challenges also continue to impact industry performance. Manufacturers are facing delays moving factory tools across the Canadian border, a primary location for the tool industry. Raw material prices continue to be elevated and some are facing shortages of their own. Additionally, work forces are still missing people due to the pandemic as well as competitive unemployment benefits.

The semiconductor shortage and COVID pandemic continue to weigh on the automotive industry as uncertainty persists.

Industry Update

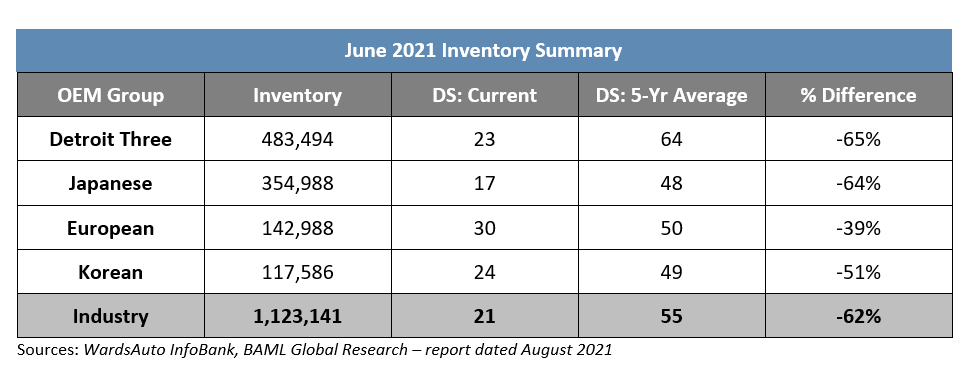

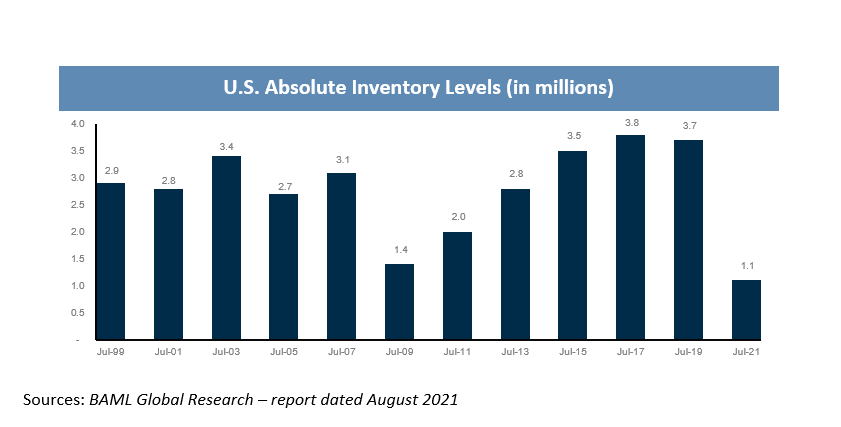

Total auto inventory decreased by 270,000 units in July, resulting in approximately 1.1 million total units. The monthly pace of inventory decline reaccelerated in July after inventory declined only 115,000 units in June. This is the sixth sequential month of declining inventory units and translates to a days’ supply (DS) 62% below the five-year average at 21 DS. Prior supply chain disruptions have not been alleviated and COVID restrictions in certain countries, such as Malaysia and Thailand, are once again pressuring semiconductor output.

The low inventory numbers continue to drag on sales as evidenced by the 14.8 million seasonally adjusted annualized rate (SAAR) of sales in July. This is a 4% year-over-year sales increase, but July marks the third consecutive month of decline in the SAAR. Bank of America continues to conservatively forecast a 15.6 million SAAR in 2021, a 7.5% year-over-year increase, as the decline in sales was anticipated due to the supply crunch. IHS projections do not expect production to stabilize until at least the fourth quarter of 2021 and inventory levels are expected to remain depressed, which will likely hurt sales performance in the coming months.

Despite the recent negative developments in supply and sales, the industry environment is setting up for a favorable 2022 and beyond. This is due to constrained inventory creating additional pent-up demand which is expected to be released over a multi-year cyclical recovery.

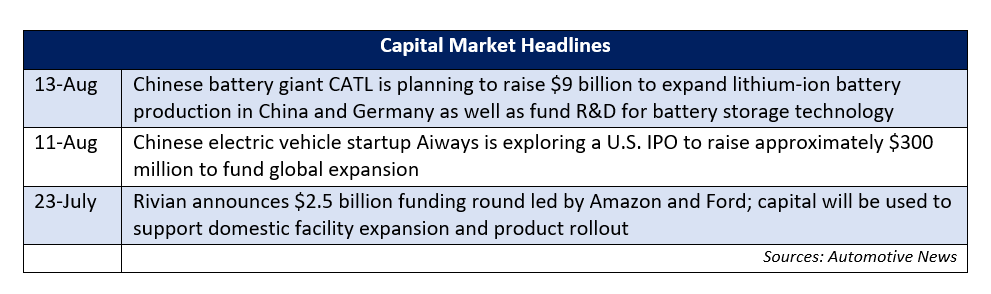

Transaction Activity

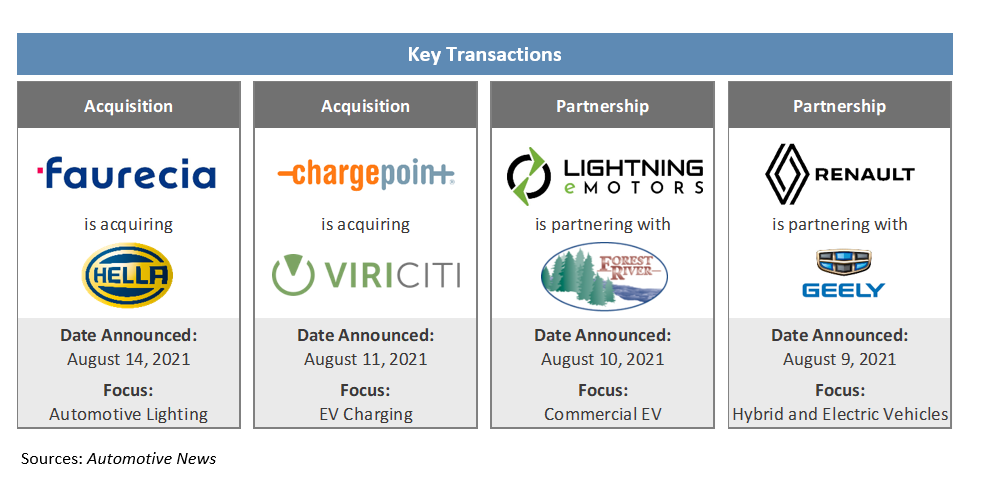

The recent automotive M&A market suggests companies continue to focus on acquiring innovation as the industry gears up for an electric future. The car-sharing marketplace startup Turo confidentially filed for a U.S. IPO earlier this month. After Ford announced an electric vehicle joint venture with SK Innovation in May, the venture is now expected to expand beyond the U.S. into the European market. Chipmaker Qualcomm offered to buy automotive technology supplier Veoneer for $4.6 billion, topping a prior bid from Magna. Additionally, electronics manufacturing conglomerate Foxconn purchased a chip plant from Taiwan chipmaker Macronix International for approximately $90 million as it moves into the electronic vehicle market.

See below for additional detail on recently announced transactions.

- Faurecia will acquire automotive lights maker Hella after winning a bidding war with industry rivals. Faurecia will acquire a 60% stake in Hella at a valuation of approximately $7.9 billion. The deal is expected to close in early 2022 and will better place Faurecia to provide electric mobility products and automated driving services to the industry.

- U.S. electric vehicle charging company ChargePoint acquired ViriCiti, a European provider of electrification solutions, for approximately $88 million. The move is ChargePoint’s second acquisition in the European market of late, as it acquired charging software company has.to.be for $295 million in late July. Combined, the two acquisitions expand ChargePoint’s European presence and integrate charging capabilities with other electrification solutions.

- Commercial electric vehicle company Lightning eMotors entered into a strategic partnership with Berkshire Hathaway company Forest River, the largest shuttle bus manufacturer in North America. The agreement includes plans to deploy up to 7,500 electric shuttle buses and has an estimated value of $850 million.

- Renault is partnering with Geely Holding Group to produce hybrid vehicles in China and South Korea. Renault is looking to revive its business in the Chinese market and the venture will allow the French automaker to use Geely’s technologies, supply chains, and manufacturing facilities for production.

Regulatory Landscape

Mask mandates: U.S. automakers reinstated mask mandates at all plants, offices, and warehouses on August 4, 2021. The decision is in response to the CDC's latest COVID guidance and applies to all workers, regardless of vaccination status.

Zero-emission vehicles sales target: President Biden established a national target to have 50% of all new vehicle sales in the U.S. to be zero-emission vehicles by 2030. The goal received a warm welcome from the automotive industry but is expected to require billions of dollars of government investment.

Infrastructure package: The U.S. senate passed a $1 trillion infrastructure package that includes a variety of automotive safety and electric vehicle provisions. While the $7.5 billion investment in electric vehicle infrastructure included in the package had a positive industry reaction, safety advocates believe the bill's safety provisions do not set enough compliance deadlines. The bill will move to the House of Representatives after passing through the senate.

Electric vehicle coalition: A variety of environmental and automotive trade groups are joining a newly launched electric vehicle coalition. The group is being formed in response to the latest infrastructure package and is seeking to develop a common framework for all stakeholders to accelerate the adoption of electric vehicles in the U.S.

Tesla autopilot investigation: U.S. vehicle safety regulators are opening a safety probe into Tesla Autopilot after identifying a series of related crashes around the country in which the advanced driver-assistance system was engaged. An estimated 765,000 Tesla vehicles could be affected from the years 2014-2021.

Stay connected to industry financial indicators and check back in September for the latest Auto Industry Spotlight.