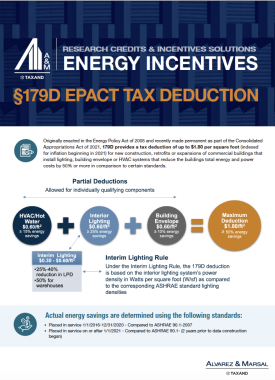

Energy Incentives: §179D EPact Tax Deduction

Originally enacted in the Energy Policy Act of 2005 and recently made permanent as part of the Consolidated Appropriations Act of 2021, 179D provides a tax deduction of up to $1.80 per square foot (indexed for inflation beginning in 2021) for new construction, retrofits or expansions of commercial buildings that install lighting, building envelope or HVAC systems that reduce the buildings total energy and power costs by 50% or more in comparison to certain standards.

Review the Energy Incentives document below to learn more about the qualifying deductions.

CLICK HERE TO READ THE FULL ARTICLE.

For questions, reach out to Kathleen King or Stephanie Doughty.

FOR MORE INFORMATION:

Extension Granted for the EPAct 179D Tax Deduction