Private Equity: Incentivising management teams in uncertain times

Most of us are becoming inured to the plethora of articles that are hitting our inboxes lamenting the depressing business climate, the failing economy and the uncertain future. The economic damage is becoming palpable. The outlook is extremely uncertain, but there is one thing that is crystal clear. This crisis will end. We will come out the other side.

It’s easy to feel stuck during these unsettling times, but businesses have a huge amount to do to survive the crisis as they look to redefine their business processes.

Now is the time to consider what long-term changes to your business model may be necessary, and just as importantly, if not more so, the mindset of your management team when you need them.

Keeping your management teams engaged

If you asked your management team how they were, what would you want them to say? Healthy, happy, relieved? Uncertain, unfocused, demoralised? What about motivated, valued, incentivised, and ready to hit the ground running?

Private Equity (”PE”) firms are facing a situation where multiple portfolio companies are looking for guidance and support for their employees during this crisis. How can PE houses react to protect their investment and the individuals employed by them? One thing we know for sure is that people respond to incentives, and that the goal-based performance rewards historically provided by private equity houses to their management teams are amongst some of the most efficient incentive and retention structures seen in the corporate world.

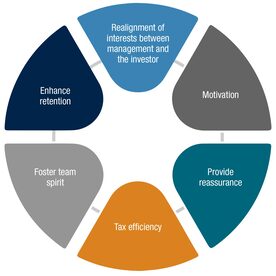

It is widely acknowledged that Management Incentive Plans (‘MIPs’) are a common tool applied by the PE houses. They deliver the alignment of managements’ interests with those of the shareholders by giving management a slice of the cake and skin in the game.

Do you already have a MIP in place?

As new post Covid-19 strategies and goals evolve, companies will need to reset budgets and perhaps exit plans to take account of the new environment. But how does this impact an existing MIP? A MIP that was based on ‘Growth Shares’ (i.e. management are entitled to a proportion of the equity value of the company over and above a ‘Hurdle’ – see below) is unlikely to fulfil its original purpose if this Hurdle is now unrealistic given the hit to the value of the business. The same would apply to sweet equity ordinary shares that rank behind a significant amount of preferred instruments. As such, now is the time to explore amending the parameters to ensure that management remain engaged and motivated to hit their targets. Care, however, is needed as making any amendments to existing rights of shares could have tax implications for both the manager and the company. Additional tax complications can arise if the shares were originally awarded under HMRC’s Employee Shareholder Status, a highly tax efficient scheme that was withdrawn in 2016 but widely seen in the PE world. Advice is key from both a tax and valuation perspective.

Many companies (especially those that are portfolio companies of PE houses) often have unallocated shares, reserved for members of management or for future hires. If an exit is planned in the short term, it is worth considering issuing the shares now, because using them as a transaction bonus can attract tax at a rate of 47% and on top of this, employer’s NIC, at rates up to 14.3%.

Why consider implementing a new MIP?

Benefits to the PE house

It is well known that implementing a MIP brings the PE house an enhanced relationship with the management team by giving them the opportunity to participate in the increase in value of the business that they help generate. This in turn can reignite a desire from management to hit the growth goals, especially if individuals have lost momentum during the lockdown period. The Hurdle, an indicative feature of a MIP, provides protection for the PE house on the value already achieved since their investment. This is because MIP shares often participate in the value of a business above a certain Hurdle. Therefore, management should not benefit from the MIP unless contributing to fund performance at a level that should award the PE house as well. An added benefit is that some of the MIP shares can remain unallocated to help attract new talent. This may be especially useful after this crisis when competitors may be seeking new hires also.

Benefits to management

The benefits of implementing a MIP, to management, would be to generate a new wave of motivation to show those individuals how much they are needed, now more than ever. They are likely to feel valued and have a desire to propel the business in the right direction, to seek value in their share awards, and as a result, value for the PE house too. A key use of a MIP is to aid staff retention. Vesting and leaver provisions are just two common features that usually attach to MIP shares to lock in your key management team. Of course, a huge part of the incentive is that management have an opportunity to receive tax-efficient returns with usually a low initial investment price (the “skin in the game”).

But is this really the time to be thinking about a new MIP?

Yes, absolutely. Historically we have seen cash-strapped start-ups as the biggest users of MIPs (usually using the Enterprise Management Incentives plan though rather than growth shares), followed by those companies focused on retention of key senior staff. In the current environment, as companies implement emergency measures to preserve cash and will be dreading the annual dance over promotion and across-the-board pay rises, MIPs can be seen as a tool to soften that debate, possibly broadening its applicability outside the C-Suite too. We foresee use of MIPs by a far broader range of companies in these difficult times.

One of the key challenges with MIPs is to ensure that they are affordable (and thus incentivising) for management. There are only a small number of companies in industries where the value of the business has not fallen due to the unfortunate circumstances around Covid-19. Therefore, why not make the most of this downturn, as MIPs have become that much more affordable. If the MIP shares have a low acquisition price, management can participate with little risk, while the PE house’s interests are protected by the Hurdle. Of course, even if immaterial amounts, now may be a difficult time to ask your management team to dig into their pockets. But that should not necessarily be a barrier- we can help you with tax efficient funding options.

Implementation

Implementing a MIP may sound time consuming for the business and an unnecessary burden right now. However, it also provides the right tool to galvanise teams, bring people together and re-create motivation. Providing appropriate advice is sought, MIPs do not have to be time consuming or complex.

How A&M can help

After taking steps to recover and stabilise from the Covid-19s crisis, portfolio companies should prepare for growth. It is an opportune time to either re-visit an existing MIP and/or implement a new MIP. Our Reward & Employment Tax Solutions team can help with the design, valuation, implementation, and ongoing maintenance of an equity-based incentive plan that is aligned to your corporate objectives. Furthermore, our Taxand network allows us to coordinate and provide advice in relation to a MIP for employees who are tax residents in various different jurisdictions. Of course, no MIP is going to work without effective communication to the participants about its value and mechanics, so we can also help with the communication of the plan to ensure it brings people together and leaves them feeling valued, incentivised, and motivated to hit the ground running when life eventually returns to a new normal. Please get in touch if you would like to discuss any of the above.