Corporate Transaction Tax and Advisory

Corporate Transaction Tax and Advisory – Market Leading Global Transaction Tax Advisors

The complexity of the global tax environment is constantly evolving due to constant regulatory changes, geopolitical complexities and legislative changes worldwide. Companies must navigate these challenges to ensure compliance and to coordinate and optimize their tax positions across different jurisdictions.

Managing corporate mergers and acquisitions (M&A) entails multi-faceted tax implications. The most efficient way to navigate this intricate process is through an integrated approach that addresses all tax aspects of your M&A transaction life cycle, ensuring that tax is providing value as part of a transaction.

In-depth knowledge and a seamless, integrated approach

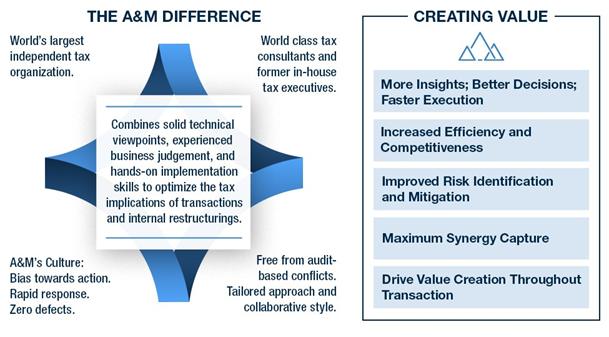

Our global tax advisors are expertly equipped to handle M&A transactions, internal restructurings, legislative changes, effective tax rate (ETR) and cash tax planning, supply chain considerations, and divestiture planning. With extensive experience leading more than $500 billion of strategic acquisitions and divestitures, A&M Tax works to optimize tax-related cashflows both during and after transactions, as well as for companies undergoing internal restructuring to enhance operational performance. By owning the full process of an M&A transaction or internal restructuring, A&M Tax eliminates inefficiencies that often arise from traditional advisors whose viewpoints are siloed. Our breadth of experience and expertise delivers better value and faster, holistic results for your business.

Strategic tax advice and actionable planning reduce tax burdens and optimize cash flow

During any M&A transaction or internal restructuring, your company should aim to decrease tax liability and capitalize on opportunities to improve its long-term tax position. A&M Tax collaborates with you to develop strategic tax planning that aligns with your business realities. We meticulously implement tailored strategies, addressing day-to-day tax needs to help reduce initial tax costs, improve cash flow, and optimize tax rates.

Our expert team

When you partner with A&M Tax, you gain access to leading M&A tax experts with more than 100 years of specialized experience in federal and international tax, state and local tax, compensation and benefits, transfer pricing, and valuation. Connect with our experts today to learn more about how we can support your corporate transaction tax advisory needs.