Continued Appetite for Restaurant Acquisitions

Restaurant Transaction Trends

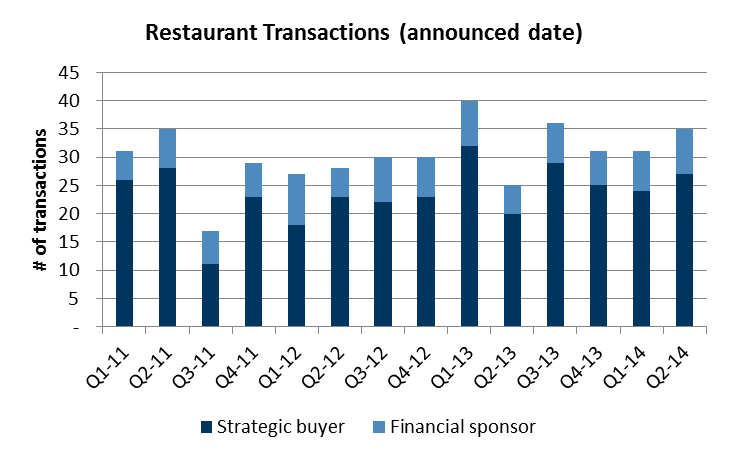

Private equity investors and strategic acquirers are still showing an appetite for restaurant targets. Investment activity has remained strong with 35 announced restaurant transactions during the 2nd quarter of 2014, according to S&P Capital IQ.

As outlined in our previous article, prospective investors should understand the unique accounting considerations associated with restaurants and carefully include operational improvement and other initiatives into any investment thesis.

Understanding Rebates Received from Vendors

Restaurants often receive rebates and other forms of consideration from food, beverage and paper supply vendors. Understanding the rebates received by a restaurant target is critical to assessing its overall profitability.

The timing of when rebates are received and how they are recorded can impact earnings. For example, some restaurants (either due to lack of sophistication or other factors) will record vendor rebates when received, resulting in an out-of-period benefit. This may impact the comparison of profitability when examining several periods.

Vendor rebate programs may be based on volume, growth or other performance metrics. Investors should consider the extent to which the benefit of such programs will continue on a prospective basis. For example, growth rebates may no longer recur if a restaurant’s future purchases do not exceed historical levels.

Vendors may provide pre-funding or other forms of advance consideration to a restaurant to offset its costs for equipment purchases (e.g., food preparation equipment or fountain beverage dispensers). The repayment of these proceeds may occur through the form of minimum purchase requirements, reductions of future rebates or other various repayment mechanisms. An understanding of the contractual terms governing these arrangements is important in determining the appropriate accounting. In certain situations, advance funding provided by a vendor may be considered debt and factored into a prospective investor’s valuation.

A careful examination of vendor rebates during due diligence will prevent surprises following the completion of a restaurant transaction.

Evaluating and Improving Underperforming Units

Any attempt to improve the performance of restaurant units that are believed to be lagging in comparison with their peers must first include methodologies that allow for an objective determination of where the most cost effective and substantial improvement opportunities reside, as well as the approach to be used to capture them.

Measurements and Scorecards

Most restaurants use financial results and various operational metrics at the unit level to measure performance in comparison with budgets, prior year results, sibling units and competitors. Often, specific conduct guidelines or scorecards that are believed to contribute to favorable results are used by operations personnel in managing restaurant activities within their four walls. Unfortunately, many times the degree of correlation between the scorecards used to manage and evaluate daily performance and the ultimate results isn’t as high as believed or may even be working against the objective. Consequently, the encouraged behaviors do not produce the desired results and stores identified as underperforming based on scorecard results may be inaccurate. In short, what you are intending to measure isn’t what is being measured.

Companies should take time to fully evaluate, test and prove correlations between scorecard metrics used in managing restaurant operations and the overall objectives of the enterprise. This will ensure alignment of daily activities to achieve desired results and accurately identify performance shortfalls. Scorecards should also have sufficient breadth to identify specific areas of operational opportunity that may otherwise be masked by stronger performance metrics within a unit.

Selection and Prioritization

Once ‘underperforming’ units have been defined through financial and scorecard metrics, other factors should be considered before investing time or resources to attack the issues. First, assess the reasons why each unit is underperforming to ensure that the underlying factors are controllable, such as poor labor management, excess waste or high returns and comps, as compared with non-controllables such as demographic or other location-specific or capital restrictive constraints. Many tools are available to assist in making these determinations.

Next, a determination must be made as to whether the current restaurant management team warrants the turnaround investment, if manager changes should be made prior to making such an investment or whether the effort can be achieved solely through a change in management. Finally, a quantification of the range of opportunity should be made to confirm a business case and assist in prioritizing the approach. As part of this step, alternative use scenarios including a sale of the property and/or lease rights versus going concern value should be considered.

Restaurant M&A Activity Summary

Source: CapitalIQ. / Note: the data above excludes transactions characterized as

the transfer of land, transfer of assets between individuals and other similar transactions

Summary

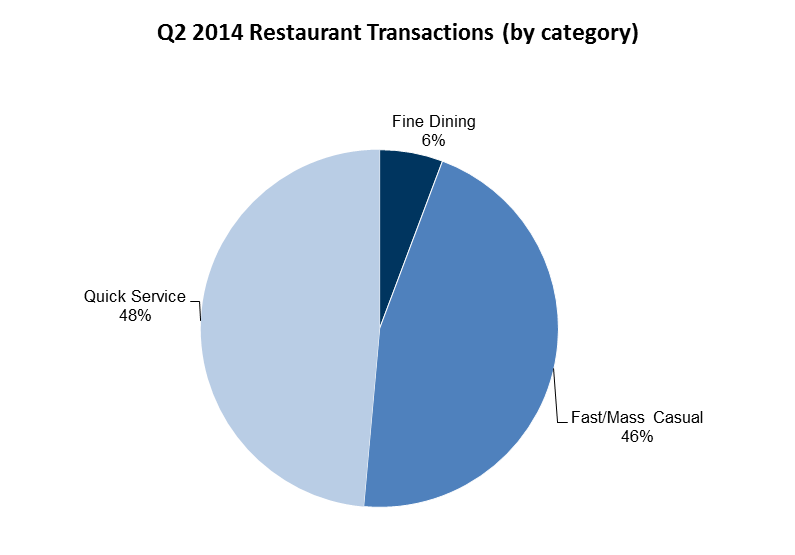

Strategic acquirers continued to drive momentum in restaurant transactions. During the 2nd quarter of 2014 there were 27 announced restaurant transactions involving strategic acquirers compared to eight transactions involving financial sponsors. Quick Service restaurants were the target of choice. Smart investors will be sure to understand the impact that vendor rebates have had on overall profitability and ensure the right tools are used when evaluating underperforming units.

In our next article, A&M will discuss best practice approaches and techniques used to achieve success in underperforming unit turnaround efforts.

For More Information:

Paul Aversano

Managing Director

Transaction Advisory Group

+1 212 328 8709

Rino Nori

Managing Director

Transaction Advisory Group

+1 212 763 9666

Paul Ruh

Managing Director

Performance Improvement

+1 303 667 6761