A Growing Appetite for Restaurant Acquisitions

Restaurant Transaction Trends

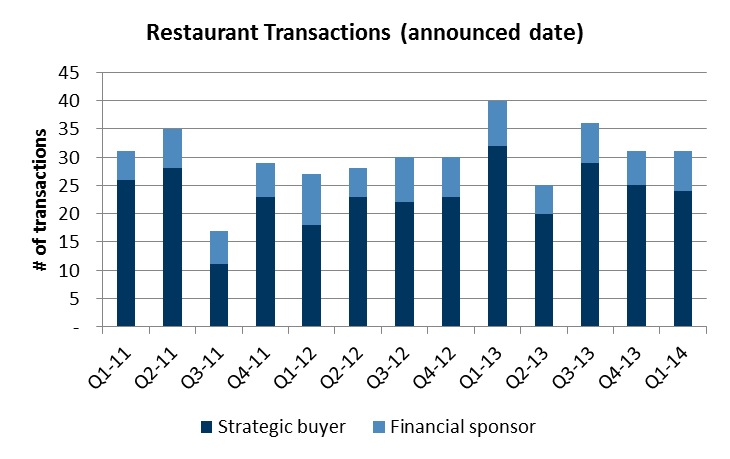

Restaurants continue to be attractive targets for investors and strategic acquirers as many eateries offer appealing ways to deploy capital and diversify. In fact, there were 132 announced restaurant transactions in 2013; and activity remained strong throughout the first quarter of 2014 with 31 announced restaurant transactions, according to S&P Capital IQ.

However, savvy investors (i.e., private equity firms, corporate owner / operators, franchisors and franchisees) must understand the unique accounting considerations associated with restaurants and carefully include operational improvement and other initiatives into any investment thesis.

Understanding the Franchise Fee Revenue of Your Potential Investment

Franchisors typically generate revenue through multiple revenue streams, including initial franchise fees, area development fees, continuing franchise fees and sales of product to be used by the franchisee. These fees grant franchisees the right to use a brand and the associated trademarks in order to operate a restaurant branch.

When purchasing a restaurant franchisor, it is important to understand the extent to which initial franchise fees and area development fees are included in reported revenue. The nature of those fees and associated accounting will have an impact on the normalized earnings of the business. For example, new restaurant concepts experiencing rapid growth may have assessed a significant level of franchise fees. Prospective investors should understand the magnitude, nature and timing of those fees in determining the extent to which they will continue prospectively.

In particular, investors should consider whether the magnitude of those fees is one-time in nature or will continue on a prospective basis, and whether the target has properly recognized revenue for the fees. Franchise fees should not be recognized as revenue until the franchisor has substantially completed its obligations to the franchisor. Additionally, if franchise fees have been deferred, investors must know how much cash has already been collected by the seller. This should be considered in valuation, particularly when a substantial obligation is inherited to perform services for fees that have already been paid for by franchisees.

Various factors can complicate a prospective investor’s understanding of franchise fees, including the franchisor guaranteeing the borrowings of a franchisee, options for the franchisor to purchase the franchisee’s business, and the extent to which the franchisor provides more than just services (for example, tangible property, inventory, signs).

A careful examination of franchise fee revenue during due diligence will prevent surprises following the completion of a restaurant transaction.

Enhancing EBITDA in Restaurant Investments through Internal Customer Service

Back-office operations in the restaurant industry are often perceived as a necessary evil, subject to piles of local, state and federal regulations. Unfortunately, the processes, systems and controls used to manufacture all of the required data is seldom understood or even looked at beyond the office of the Controller. However, this data provides valuable insights. To improve EBITDA in your restaurant investments, while concurrently increasing service levels for the internal customers of the back office – look to the restaurant operations teams.

Organizational design of back-office functions, personnel capabilities, transaction processing, and systems and controls over cash and reporting are often overlooked in restaurant pre-acquisition due diligence and left to be “figured out” later. Furthermore, in situations where an acquisition represents an add-on to an existing restaurant portfolio, the buyer may even incorporate synergistic savings attributable to back office general and administrative expense, the specifics of which have yet to be identified or substantiated.

In order to avoid unpleasant post-acquisition surprises, capture any assumed synergies and mine back-office functions to drive value through the acquired business, management and owners should consider back-office transformation in finance, accounting, payroll, IT and HR. This transformation can take the form of a consolidated shared-service platform to deliver these services, outsourcing of certain functions and processes, streamlining, standardizing and automating processes and reporting, and eliminating work and costs for which little or no benefits are being realized or in any combination.

The concept of shared services and outsourcing is nothing new. However, advances in communications and technology have made for an even more compelling business case, particularly in the transaction-intensive restaurant industry, and in growth and acquisitive environments where scale-ability is critical. Consider how back office transformation can lower overhead, while at the same time increasing internal customer service to drive value in restaurant investments.

Restaurant M&A Activity Summary for 2013

Source: CapitalIQ. Note: the data above excludes transactions characterized as the

transfer of land, transfer of assets between individuals and other similar transactions.

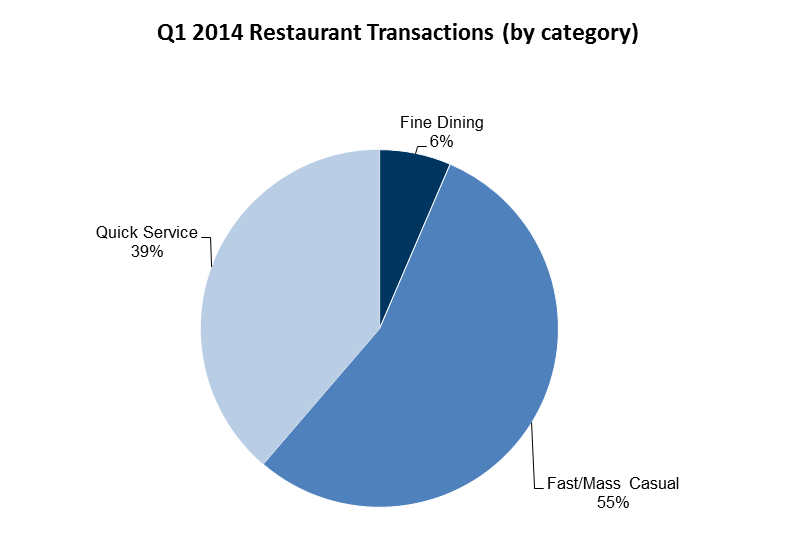

Restaurant M&A activity in 2013 reflected 132 announced transactions, up from 115 in 2012. Although first quarter 2014 restaurant transactions are down slightly from last year (with 31 announced transactions in Q1 2014 as compared to 40 in the prior year), interest in the category remains strong. A majority of these deals involved strategic buyers, with Fast / Mass Casual restaurants the most recent target of choice. As we look forward, savvy investors eyeing a menu of restaurant investment options will be sure to answer two critical accounting and operational questions before moving forward: Do franchise fees account for a material component of EBITDA? Can investments in internal customer service (i.e., shared services and back office operations) enhance EBITDA?

For More Information:

Paul Aversano

Managing Director

Transaction Advisory Group

+1 212 328 8709

Rino Nori

Managing Director

Transaction Advisory Group

+1 212 763 9666

Paul Ruh

Managing Director

Performance Improvement

+1 303 667 6761