Tax Reform Winners and Losers - Everyone Gets Complexity

As anticipated, on Friday evening the ongoing Conference Committee between the House and Senate came to a close, and their final version of the Tax Cuts and Jobs Act was released to the public. Though the Conference adhered heavily to the Senate version of the act because of the Senate’s narrower majority of Republicans, the Conference made significant compromises in a number of key areas in the bill.

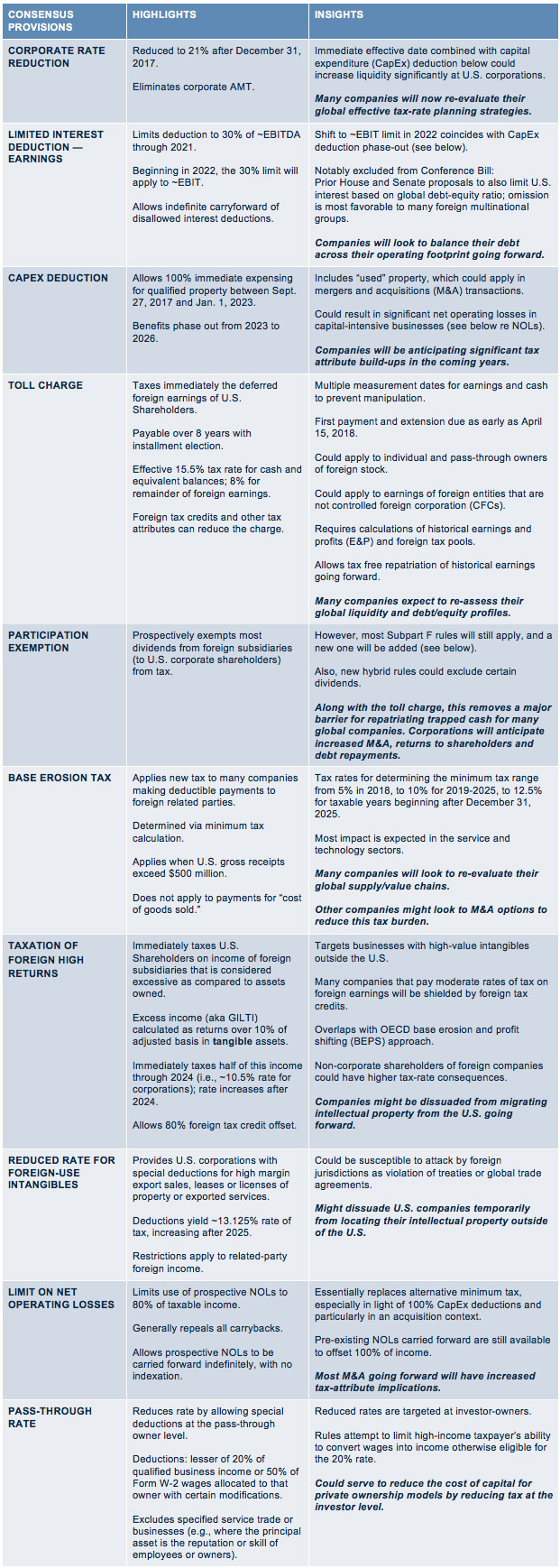

This edition of Tax Advisor Weekly highlights the key corporate provisions along with some initial insights. See below for:

- a chart of the core provisions affecting corporations

- a handful of other noteworthy changes

- an important list of notable omissions from the Conference Committee bill

Next steps: Both the House and Senate are planning to vote on the bill this week, and if all goes according to plan, this bill could find its way to the President’s desk by the end of the week. It looks as if the GOP will likely come through on their promise of passing tax reform before year-end.

The first order of business for many companies will be to complete their toll-charge calculations. See this edition of Tax Advisory Weekly for tips and more information.

We will of course be sending more detailed updates and insights. In the meantime, don’t hesitate to reach out to your A&M team about details of the bill or our views on its impact.

Key Business Provisions

(Unless otherwise stated, these provisions are effective for tax years beginning after December 31,2017.)

Other Notable Business and International Rules:

For multinationals with intra-company debt and licensing arrangements, new hybrid transaction rules may disallow deductions for interest and royalty payments to related parties where the related recipient is not subject to local tax on the corresponding income.

- This coincides with the similar base erosion and profit shifting (BEPS) initiative.

- Many U.S. companies will look to restructure their internal debt and licensing arrangements.

For U.S. companies transferring assets to foreign subsidiaries, the exception for recognizing gains for active trade or business assets is being repealed. For example, this would typically apply when transferring a foreign branch to a foreign corporation.

- Companies contemplating outbound transfers of trade or business assets (including goodwill and going concern value) might look to accelerate any such transfers to occur in 2017.

More foreign corporations will be defined as controlled foreign corporations (CFCs) going forward, as the definition is expanding. Notably, domestic entities (i.e., corporations, partnerships, estates, trusts) would be deemed to constructively own any shares owned by their foreign shareholders, partners or beneficiaries for purposes of determining U.S. ownership.

- This will subject more U.S. persons to the toll charge than expected, as well as global intangible low-tax income (GILTI), Section 956 and other remaining Subpart F inclusions (even some for 2017).

- Companies will need to brace U.S. owners for significantly increased phantom income and compliance burdens going forward.

For companies restructuring or migrating their foreign businesses, the new rules will expand the definition of intellectual property and apply aggregation methods, resulting in increased values and exit taxation in most cases. Section 936(h)(3)(B) will be amended to specifically refer to goodwill, going concern value and workforce in place. Also, sections 367 and 482 will be amended to grant the Treasury Secretary the authority to require the valuation of intellectual property (IP) to be done on an aggregate basis or based on the realistic alternatives.

- These amendments tend to be unfavorable to taxpayers.

- Some companies may be accelerating intangibles transfers to occur prior to the effective date of the amendments, though such transfers should be undertaken cautiously in light of existing regulations.

Other Notable EXCLUSIONS in the Conference Bill:

For companies that might contemplate moving intellectual property back to the U.S., the Conference agreement does not include the Senate bill provision that would have permitted the tax-free distribution of intangible property held by CFCs.

- The Senate bill provision, coupled with the reductions in U.S. tax rates, would have created an incentive (or reduced the disincentive) for U.S. multinationals to bring IP back to the U.S.

- Combined with the other international provisions, many companies may not wish to move IP back to the U.S. as a result of this omission.

For multinationals, there are a couple of notable omissions pertaining to Subpart F. In prior versions of the bills, inclusions relating to investments in U.S. property (i.e., Section 956) would have been eliminated for corporate shareholders. Also in prior bills, the taxpayer favorable look-through rules (i.e., Section 954(c)(6)) would have been made permanent. Neither of these provisions survived in the consensus bill.

- It is not clear if this was intentional by the Conference Committee.

- Many taxpayers could be surprised by the effect, i.e., eliminating the participation exemption for foreign earnings. Note that the current look-through rules remain valid for most companies through 2019.

- Many companies will be immediately pursuing traditional planning to avoid these negative consequences.

For additional information and questions, please reach out to our Tax Reform Steering Committee: Albert Liguori, Adam Benson, Jill Harding, Doug Sayuk, Andrew Johnson and Brian Cumberland.

Disclaimer

The information contained herein is of a general nature and based on authorities that are subject to change. Readers are reminded that they should not consider this publication to be a recommendation to undertake any tax position, nor consider the information contained herein to be complete. Before any item or treatment is reported or excluded from reporting on tax returns, financial statements or any other document, for any reason, readers should thoroughly evaluate their specific facts and circumstances, and obtain the advice and assistance of qualified tax advisers. The information reported in this publication may not continue to apply to a reader's situation as a result of changing laws and associated authoritative literature, and readers are reminded to consult with their tax or other professional advisers before determining if any information contained herein remains applicable to their facts and circumstances.

About Alvarez & Marsal Taxand

Alvarez & Marsal Taxand, an affiliate of Alvarez & Marsal (A&M), a leading global professional services firm, is an independent tax group made up of experienced tax professionals dedicated to providing customized tax advice to clients and investors across a broad range of industries. Its professionals extend A&M's commitment to offering clients a choice in advisers who are free from audit-based conflicts of interest and bring an unyielding commitment to delivering responsive client service. A&M Taxand has offices in major metropolitan markets throughout the United States and serves the United Kingdom from its base in London.

Alvarez & Marsal Taxand is a founder of Taxand, the world's largest independent tax organization, which provides high quality, integrated tax advice worldwide. Taxand professionals, including almost 400 partners and more than 2,000 advisers in 50 countries, grasp both the fine points of tax and the broader strategic implications, helping you mitigate risk, manage your tax burden and drive the performance of your business.

To learn more, visit www.alvarezandmarsal.com or www.taxand.com