IPO Readiness: Preparation Makes Going Public Less Taxing

I’ve lived through both the highest highs and lowest lows of the IPO market since I first began working in Silicon Valley in the late 1990s. I’ve experienced both the manic days of the dot-com boom’s seemingly daily S-1 filings (remember Pets.com and Webvan?) and the darkest days of the Great Recession (and everything in between).

More recently, due to a variety of economic and political factors, we’ve seen somewhat of a pause in the IPO market. According to a recent Harvard Law School 2017 IPO report, the IPO market produced 98 IPOs in 2016, the second down year in a row, coming in 36 percent below the tally of 152 IPOs in 2015. In the 12 years preceding 2015, which saw an annual average of 138 IPOs, there were only three years in which IPO totals failed to reach the 100-IPO threshold.

Nonetheless, the U.S. capital markets maintain sustained strength. Public markets hover around record highs, and the pool of venture-capital-backed IPO candidates remains large and opportunistic, including about 150 private tech companies valued at $1 billion or more. Private equity firms are also sitting on record levels of committed capital after four consecutive years of increased fundraising. Combined with solid 2016 performance of VC-backed IPOs and the need of private equity firms to utilize their reserves, all the pieces are in place for increased future IPO demand. As of August 2017, there had already been over 100 IPOs priced in 2017.

Given these favorable IPO conditions, companies in the IPO pipeline should be well prepared for the numerous demands that accompany going public, such as audit and tax assistance in preparation of financial statements. In doing so, companies will be looking to their tax departments and advisors to manage and lead the pre- and post-IPO transformation process, as navigating the labyrinth of IPO complexities extends beyond normal compliance areas and into structural considerations, compensation and benefits planning, and financial statement presentation.

As taxes continue to be a high-risk area resulting in a disproportionate percentage of reported public company internal-control weaknesses, perhaps the most important advice that a company should follow in preparing its tax function for an IPO is to “act public before going public.” From perfecting the tax teams and refining internal controls to establishing a quarterly close process and preparing interim tax provisions, it is important that the pre-IPO company operate for a year or more as if it is public with respect to all key facets of its tax functions to best ensure a smooth and successful transition to public status.

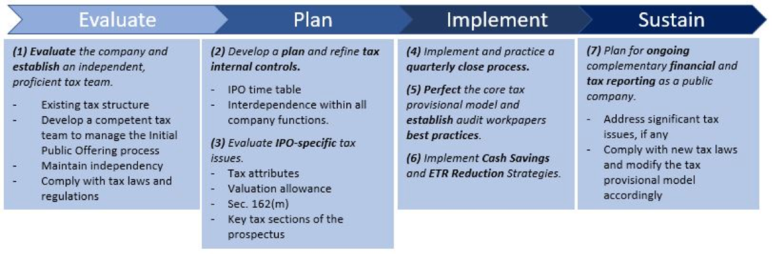

In working closely with company management and auditors through numerous public transitions, we’ve established the seven-step process illustrated below for private companies on how to approach “acting public” with respect to their tax functions before starting and executing the IPO process.

Exhibit 1: “Acting Public” Approach Guide

Step 1: Establish an Independent, Proficient Tax Team

Step 1: Establish an Independent, Proficient Tax Team

According to a recent benchmarking analysis of newly public and pre-IPO technology companies, over 40 percent of companies do not maintain dedicated in-house tax personnel. Those that do will typically continue to rely on outside service providers to prepare the ASC 740 tax provision and advise on other tax matters.

While the enactment of the Sarbanes-Oxley Act of 2002 (SOX) significantly increased the complexity of going public, more recent Public Company Accounting Oversight Board (PCAOB) requirements have placed further pressure on tax resource expertise. Accordingly, pre-IPO companies may find that their current tax resources are no longer adequate for a public company. Therefore, a private company should review internal resources and external advisors to ensure they employ the necessary technical and public company expertise before initiating the IPO process. Most companies will experience some level of increased costs associated with their tax accounting and should prepare for that outlay.

Pre-IPO companies that previously relied on their external audit firm to provide many tax services for the company, including the tax provision preparation, should take measures to ensure continued auditor independence in the years leading up to the IPO. Certain of these services may be permissible services under the private company AICPA independence rules; however, they may be considered an impermissible managerial service under PCAOB/SEC requirements.

Step 2: Develop and Refine Tax Internal Controls

Based on a study by Audit Analytics for 2015, 15 percent of all financial reporting restatements related to tax control issues. This seems to indicate an abnormal proportion of tax control issues escalating to financial restatements. Some of the challenges and significant risks in tax provision processes that need to be addressed are:

- Tight close cycle

- Legal-entity-level data

- Rework of financial data

- Accounting, tax law update and business transactions

- Embedded evidence of review & sign-off

Although SOX is not expressly applied to private companies, many private companies have adopted its best practices in some form. Because of the Jumpstart Our Business Startups (JOBS) Act, certain emerging growth companies (EGCs) may be exempt from Section 404(b) of SOX for the first five years after going public. However, EGCs still need to follow 404(a) and document and assess internal controls annually. Therefore, we recommend developing and refining tax internal controls more than 12 months prior to the IPO to facilitate the transition from private to public status.

Step 3: Address IPO-Related Tax Issues

For many private companies, going public triggers tax issues that could significantly affect the company. Such issues should be evaluated prior to beginning the IPO process to allow sufficient time to fully understand and account for them. Common issues include:

Step 4: Implement and Practice a Quarterly Close Process

For numerous reasons, companies are expected to close the financial statement in fewer days post-IPO, with about two-thirds of public companies closing within 15 days relative to one-third of companies doing so pre-IPO. Further complicating this expedited close are additional expectations regarding a high level of accuracy in public company provision computations.

To successfully meet these requirements, as much of the work as possible should be frontloaded into the month prior to the close of the quarter. During this period, a kickoff meeting should occur between the company and its advisors to identify and discuss any complex or non-recurring issues during the quarter. The provision computation should also be completed to the extent possible using estimated financial data and annual projections.

Ongoing communication should be occurring between all parties (i.e., management, preparers, auditors) throughout the process, and key issues should be raised as they arise to provide management and the external audit firm with adequate time to research and obtain technical guidance early in the process.

Once the tax provision has been completed, a “close meeting” is recommended to ensure the company’s internal controls have been satisfied. A similar technical meeting with the external audit team can also greatly facilitate the timeliness of its review.

Step 5: Establish Tax Provision Workpaper Best Practices

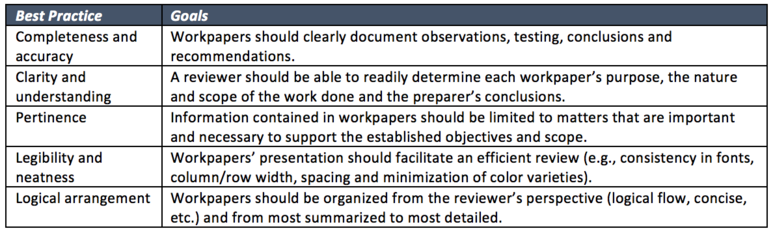

It is difficult to establish an efficient quarterly tax provision process without workpapers that follow established best practices. The primary challenge in standardizing workpapers relates to scalability and efficiency. Companies must be able to consistently replicate their provision workpapers on a timely basis and maintain integrity constraints, yet avoid inflexibility and rigidity that would disallow effective handling of different fact patterns and growth scenarios.

The supporting workpapers should incorporate all elements necessary to facilitate company and auditor review, thereby decreasing review time and fostering a smooth audit. At a minimum, the tax provision workpapers should follow audit workpaper best practices:

Step 6: Review Tax Planning Strategies

While private companies typically focus on cash saving opportunities, pre-IPO entities should review effective tax rate (ETR) reduction strategies as well due to the benefits to earnings per share (EPS) as a public company. This is particularly true for strategies that may result in short-term tax rate volatility. For example, optimizing a company’s global structure via transfers of intellectual property can reduce a company’s structural long-term ETR, but may cause a short-term rate spike. A private company that implements such a structure pre-IPO will be better positioned to enjoy a reduced ETR (and higher EPS) once it goes public.

Step 7: Plan for Public Company Reporting Requirements

In connection with their interim tax provision preparation, private companies anticipating an IPO should align their footnote disclosures with those required by public companies. For example, ASC Subtopic 740-10 disclosures are broader for public companies, requiring a quarterly tabular reconciliation of unrecognized tax benefits, as well as disclosure of whether those unrecognized tax benefits, if recognized, would affect the company’s ETR. Public companies are required to disclose in their footnotes an ETR reconciliation. Such additional disclosures should be incorporated into a private company’s footnotes on a quarterly basis prior to seeking an IPO.

A pre-IPO company should also consider how it will report non-GAAP tax expense in its public quarterly press release. The SEC has recently begun more greatly scrutinizing methodologies employed by companies for non-GAAP purposes.

Alvarez & Marsal Taxand Says:

With a return of normalized IPO market conditions, more private companies will likely seek public status as we move into 2018. Given the complexities, time constraints and significantly heightened public and regulatory scrutiny facing public companies, it is important that a private company begin acting public with respect to its tax accounting management well in advance of an IPO.

Disclaimer

The information contained herein is of a general nature and based on authorities that are subject to change. Readers are reminded that they should not consider this publication to be a recommendation to undertake any tax position, nor consider the information contained herein to be complete. Before any item or treatment is reported or excluded from reporting on tax returns, financial statements or any other document, for any reason, readers should thoroughly evaluate their specific facts and circumstances, and obtain the advice and assistance of qualified tax advisers. The information reported in this publication may not continue to apply to a reader's situation as a result of changing laws and associated authoritative literature, and readers are reminded to consult with their tax or other professional advisers before determining if any information contained herein remains applicable to their facts and circumstances.

About Alvarez & Marsal Taxand

Alvarez & Marsal Taxand, an affiliate of Alvarez & Marsal (A&M), a leading global professional services firm, is an independent tax group made up of experienced tax professionals dedicated to providing customized tax advice to clients and investors across a broad range of industries. Its professionals extend A&M's commitment to offering clients a choice in advisers who are free from audit-based conflicts of interest and bring an unyielding commitment to delivering responsive client service. A&M Taxand has offices in major metropolitan markets throughout the United States and serves the United Kingdom from its base in London.

Alvarez & Marsal Taxand is a founder of Taxand, the world's largest independent tax organization, which provides high quality, integrated tax advice worldwide. Taxand professionals, including almost 400 partners and more than 2,000 advisers in 50 countries, grasp both the fine points of tax and the broader strategic implications, helping you mitigate risk, manage your tax burden and drive the performance of your business.

To learn more, visit www.alvarezandmarsal.com or www.taxand.com