Proposed Tax Reform for High-Net-Worth Individuals

The momentum behind tax reform took a back seat to healthcare the last few months, except for some debates surrounding border adjustments. That changed to a large degree on Friday, March 24, when the House of Representatives decided not to vote on the Republican healthcare bill. After deciding to move on from healthcare as the primary focus, President Trump said “now we’re going to go for tax reform, which I’ve always liked.” Kevin Brady, the chairman of the House Ways and Means Committee, said that he was “moving full steam ahead with President Trump on the first pro-growth tax reform in a generation.”

As these quotes show, the political spotlight has shifted from healthcare and is now shining brightly on tax reform. With the tax deadline this week, individuals and families have been focused on their own tax filings. This is a good time to focus on what tax reform might look like for individuals.

Throughout Trump’s campaign, his announced positions on tax reform moved towards the House Republicans’ Blueprint. Therefore, this article focuses on the House Republicans’ Blueprint when discussing tax reform and points out where Trump has differed in his views. Nevertheless, the White House and Senate Republicans have each said they will eventually release their own tax reform proposals, and those proposals will certainly influence any tax reform bills that become law.

Individual Tax Rates

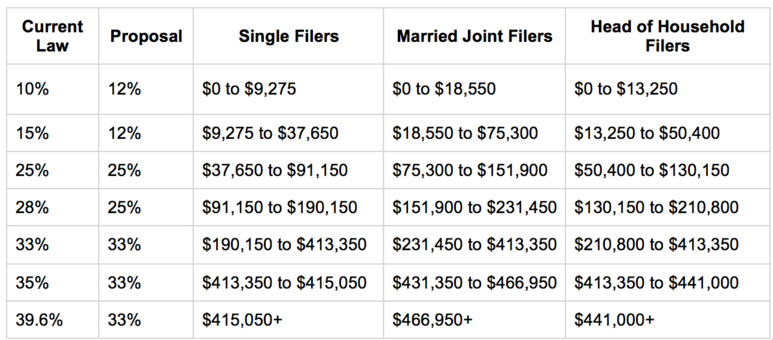

Tax rates are an area where there has been a lot of agreement among Republicans. Currently, there are seven tax brackets, with the top bracket having a marginal tax rate of 39.6 percent for individual incomes greater than $415,050. The House Blueprint proposes to reduce the number of tax brackets to three, with the highest tax bracket having a marginal tax rate of 33 percent for individual incomes greater than $190,150. The other two brackets would be 12 percent and 25 percent.

A selling point of tax reform has been a lower tax bill for middle class Americans, and the House Blueprint tries to accomplish this through reduced rates. However, the impact of reduced tax rates and the reduced number of tax brackets driving down tax bills may have an even bigger impact for top earners. This chart shows the income brackets for the various filing types under current law and the Blueprint.

Capital Gains and Dividends

While a reduction in ordinary tax rates is beneficial, we know that not all income is created equally. Currently, there are special rates for long-term capital gains and qualified dividends. Long-term capital gains and qualified dividends are currently taxed at 20 percent. The House Republicans have proposed to tax interest, dividends and capital gains at 50 percent of individual tax rates (half of the three proposed rates mentioned above). This will be accomplished by allowing a deduction for 50 percent of these items, effectively creating tax brackets of 6 percent, 12.5 percent and 16.5 percent for this type of income. Trump has proposed to keep the capital gains tax rate at 20 percent.

The House Blueprint also assumed the repeal of the 3.8 percent net investment income tax (NIIT) as part of healthcare reform. After the House failed to pass a repeal of the American Care Act (“Obamacare”), it is unclear whether tax reform would include a separate repeal of the 3.8 percent NIIT.

Income from Pass-Throughs

As described in past editions of Tax Advisor Weekly, the corporate tax rate is expected to be reduced to 20 percent. To minimize disparities in the entity form used to conduct business, the House Republicans have proposed to tax income from pass-through entities at a 25 percent rate. Currently, income from pass-throughs retains its character and is taxed at the applicable individual tax rate.

While the reduced rate on pass-through income is welcome, the House Blueprint also proposes to require pass-through members to pay themselves “reasonable compensation” for services provided to the pass-through. This reasonable compensation would be taxed as ordinary income, and only pass-through income in excess of this reasonable compensation amount would be subject to the reduced tax rate. The House Ways and Means Committee staff are working on how pass-throughs will compute this reasonable compensation amount (e.g., by using some type of formula or another method to determine reasonable compensation).

Trump has proposed to allow large pass-throughs to elect to pay a unified business tax rate of 15 percent on their income, but distributions from a large partnership would then be taxed as a dividend. Trump’s proposals during the campaign did not specify what would constitute a “large” partnership for purposes of this election.

Alternative Minimum Tax

Another aspect of the Blueprint relates to the alternative minimum tax (AMT). For high-net-worth individuals, AMT was a tax that eliminated the majority of their itemized deductions and increased their overall tax liability. The House Republicans are proposing to permanently repeal AMT. On the face of it, this proposal may seem like another favorable tax cut, but coupled with the repeal of AMT are proposed limits on itemized deductions discussed below. The result of limiting and disallowing itemized deductions is that the House Blueprint seems to mitigate the cost of repealing the AMT by making its regular tax calculation more like the current AMT computation.

Itemized Deductions

Trump has proposed capping itemized deductions at $100,000 for single filers and $200,000 for those married filing jointly. In contrast, the House Republicans have proposed eliminating all itemized deductions except for mortgage interest and charitables. The primary deduction that will be removed here will be the deduction for state taxes. Other types of deductions that have previously been permitted and would be disallowed under the House Blueprint include medical expenses, 2 percent floor deductions, personal property and real estate taxes.

In addition to these limitations to itemized deductions, both Trump and the House Republicans have proposed increasing the standard deduction while eliminating personal exemptions. For single filers, Trump has proposed a $15,000 standard deduction, while the House Blueprint proposes a $12,000 standard deduction. For married filing jointly taxpayers, the proposals are $30,000 and $24,000 respectively. In contrast, under the current tax law, individuals who claim an exemption with the standard deduction receive $10,400, while those who file using a married filing jointly status (and have no children) receive $20,700 of personal exemptions and the standard deduction. The standard deduction under the House Blueprint for a single taxpayer with no children and a married filing jointly taxpayer with no children would be greater than the combined personal exemption and standard deduction under current law. In contrast, the House Blueprint’s proposed standard deductions are less than the combined personal exemptions and standard deduction under current law for a single taxpayer with one child and married filing jointly taxpayers with two children (ignoring the potential phase-out of personal exemptions under the current law).

Net Operating Losses

The treatment of net operating losses is unclear at the individual level under both the House Blueprint and Trump’s proposals. Currently, net operating losses at the individual level can be carried back two years and forward twenty years.

We can glean some insight on how net operating losses may be treated by looking at the House Blueprint’s proposed treatment of corporate net operating losses. Under the House Blueprint, net operating loss carrybacks will be eliminated and the carryforwards will be indefinite. Additionally, the House Blueprint would allow net operating losses to offset only 90 percent of corporate taxable income each year. If a similar limitation were applied to individuals, this would be another change that would make regular income taxes more like the current alternative minimum tax, which already limits net operating loss deductions to 90 percent of an individual taxpayer’s alternative minimum taxable income.

Carried Interest

Carried interest has often been a target of tax reform. The House Blueprint proposes to treat the carried interest as compensation. On March 24, 2017, Treasury Secretary Steven Mnuchin provided some insight into the Trump administration’s view on carried interest. He said that carried interest will be taxed differently for hedge funds, but that the taxation of carried interest may not change for other types of partnership investments. In particular, Mnuchin said the Trump administration may not try to change the treatment of carried interest relating to real estate, infrastructure and energy investments. The topic of carried interest is one to keep an eye on. As details emerge, we will go into further detail in a future article.

Estate Tax

The House Blueprint also proposes significant changes to the estate tax. Currently, an individual is not subject to tax on the first $5,450,000 of their estate’s value. In any year where a taxpayer makes gifts to an individual that exceed the annual exclusion amount ($14,000 in 2016), the $5,450,000 exclusion for their estate is reduced by the amount of that excess. Absent some other exclusion such as tax-free transfers to your spouse, the taxable portion of an individual’s estate can be quite costly. Current estate tax rates have a bracket structure similar to income taxes, with the highest bracket calculating tax of $345,800 plus 40 percent on the taxable value of an estate in excess of $1,000,000.

The House Blueprint proposes to repeal the estate tax completely. In contrast, President Trump has proposed to treat death as an income recognition event for estates that exceed $10,000,000. President Trump’s proposal would result in a deemed sale of assets in a taxpayer’s estate in excess of $10,000,000 and tax any appreciation in those assets to income and capital gains tax rates on a deceased individual’s final tax return. Although President Trump is not proposing a full repeal of the estate tax, his proposal would represent a significant cut in the tax rate that applies to large taxable estates because the income tax rates are much lower than the current estate tax rates.

One benefit of the current regime is that the basis of assets transferred to the beneficiaries of an estate is equal to the fair market value of the assets. The House Blueprint does not specify how it would treat the basis of assets in the hands of an estate beneficiary after repeal of the estate tax. Many commentators expect that there would be a carryover basis for these assets (similar to the treatment of gifts under current tax law). This approach would preserve an asset’s appreciation in the hands of the beneficiary such that the appreciation would be subject to tax when or if the beneficiary transfers the asset.

However, certain members of the House Ways and Means Committee staff have commented that it is possible that the House Blueprint’s repeal of the estate tax may preserve the tax law that gives beneficiaries a fair market value basis in assets that they receive from an estate. This approach would mean that any appreciation in an asset at the time a taxpayer dies would never be subject to tax.

In contrast with the House Blueprint, President Trump’s plan would give beneficiaries a fair market value basis in assets that they receive from an estate, but only after the individual who passed away has paid tax at regular income or capital gains rates on any appreciation inherent in an asset’s value at the time of death. For obvious reasons, the proposed changes to the estate tax law could have a significant impact on complicated estate plans in place and any future planning high-net-worth individuals may be considering. This is another topic we will cover closely when President Trump releases his tax plan in the upcoming weeks, as it merits its own article as well.

Alvarez & Marsal Taxand Says:

While it may seem that tax rates are going down overall, by how much and whether taxes might increase for certain taxpayers remains to be seen. Although the House Blueprint’s proposed repeal of the AMT is welcome news, it appears that the House Blueprint may accomplish this repeal by making the regular income tax structure more like the current AMT regime with reduced capital gains rates. Several of the deductions that AMT currently disallows (including state income tax deductions) would no longer be deductible for regular tax purposes under the House Blueprint.

When President Trump issues a more complete description of his tax plan in coming weeks, we will provide further updates on how his proposal might affect individual income tax rates, itemized deductions, the carried interest controversy, potential wholesale change to the estate tax and, most importantly, how you can take advantage of it all.

Disclaimer