Viewpoint: How Private Chinese Hospitals Succeed in a Post-Pandemic World

The COVID epidemic and the resulting downward economic pressure have caused private hospitals in China to struggle. Under the current economic conditions, private hospitals need to build differentiated service capabilities, establish quality healthcare teams, strengthen financial analytics and cost control, and increase asset utilization to achieve profitability. In addition, stronger private hospitals and investor groups should consolidate high-quality assets through mergers or acquisitions to position themselves to reap the dividends of economic recovery.

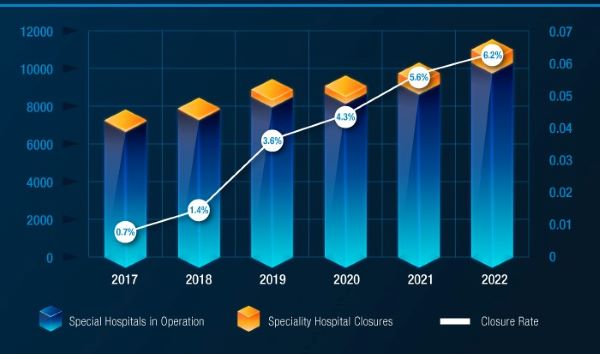

China's private healthcare industry once experienced a roaring boom in development, however their development was generally hit by the huge impact of the three-year Covid epidemic. Using specialty private hospitals as a bellwether, the number of private specialty hospitals going bankrupt or reorganizing each year has grown year by year from 316 (3.7% of total) in 2019 before the epidemic to 681 (6.2% of total) in 2022, a compound annual growth rate of 20%.

|

|

Source: Qcc.com,The indicators are enterprises that apply for cancellation each year |

At the same time, the government's strong support for public hospitals has compressed the playing field for private hospitals. Against this backdrop, investment in, financing of, and M&A within the private healthcare market has been active over the past few years. The size of transactions has increased year-on-year, and control acquisitions have become a principal investment theme.

Faced with these challenges, how should private hospitals optimize their strategies, improve their operations and enhance their financial performance to remain competitive in this fiercely competitive industry?

In Alvarez & Marsal’s view, the critical success factors for private healthcare institutions are: (1) differentiated services; (2) talent management; (3) efficient operations, including detailed financial analysis and control; and (4) targeted mergers and acquisitions. Alvarez & Marsal provides comprehensive improvement services for healthcare organizations, including general/specialty hospitals and outpatient clinics, integrated healthcare institutions, health management centers, senior care businesses, and maternal centers.

Providing differentiated services with precise positioning is the foundation of private hospitals. Private hospitals customers are highly price sensitive; thus, providing differentiated services within a reasonable price range and according to the hospital’s own positioning is the core capability for private hospitals to attract patients. In Alvarez and Marsal's industry, private hospitals provide differentiated services mainly through patient-centered one-stop integrated treatment models. Private hospitals need to provide personalized and convenient services for diagnosis, treatment, rehabilitation, and wellness in conjunction with the patient's disease cycle. For example, in maternal health, pregnancy planning, infertility, obstetric examination, delivery, postpartum recovery and other diagnosis and treatment should be integrated into a unified women's health service center, instead of being scattered in different departments and areas, and instead of being provided using different clinical pathways. Service differentiation also means exploring other modalities of diagnosis and treatment, potentially done through telemedicine or “hospital-at-home” type services.

Adopting attractive talent incentive management practices is critical for private hospitals. In building a talent pipeline, private hospitals should implement more innovative talent incentive policies, by linking healthcare pay to performance and giving generous compensation to high-performing healthcare staff. High performing clinicians will meet both financial and quality benchmarks. For example, hospitals must actively engage with clinicians, giving them appropriate autonomy in adopting clinical pathways and evidence-based medical approaches. In addition, training and career development opportunities different from those available in public hospitals, such as opportunities for cross-border collaboration and exchange, as well as supporting research resources, teams and funding, can also attract high-quality medical specialists to join the organization.

Ensuring efficient operations is a must for private hospitals. To survive fierce competition, private hospitals must operate leaner, smarter, and more efficiently than their competitors and public hospitals. Private healthcare organizations must establish an efficient corporate management system that simultaneously supports a high level of customer service while improving operational efficiency and driving corporate performance and financial growth. A sophisticated financial control and business analytics system is an essential tool for a private hospital. To boost profitability, private healthcare organizations need to track, analyze, control, and benchmark their operating costs, budget execution, and performance in real time. Different clinical departments have varied revenue structures and cost control metrics, so the financial analytics system must be detailed down to the department level. This can help managers develop targeted remedies for underperforming service lines. These tools support efficient operations and high asset utilization to help private healthcare operators compete in the difficult business environment.

Top private healthcare organizations can acquire high-quality assets to enhance their commercial footprint. Private medical institutions can scale using acquisitions if they have the ability to replicate successful models. Brand, synergy, replicable processes and standards, and management capability are critical factors to make acquisitions successful. In recent years, Aier Eye Hospital, Hygeia Healthcare, Arrail Dental and Jinxin Fertility have been continuously conducting M&A and implementing post-acquisition operational improvements to enhance the operational efficiency of acquired hospitals. In addition, some hospital groups have invested in or acquired upstream medical consumables, equipment, or technology companies to build vertically integrated systems and form competitive advantages over others in the sector. This includes insurance companies, large healthcare groups, MedTech players, and specialty hospital groups.

Alvarez & Marsal's team includes executives and experts from well-known healthcare institutions, providing hospital transformation and performance improvement services. We focus on the above areas of:

| 1. Differentiated Services | 2. Talent Management | 3. Efficient Operations | 4. Targeted Mergers and Acquisitions |

A&M closely integrates strategic planning and on-the-ground implementation to achieve rapid results. Our approach comprises five steps:

- Evaluate business core competency gaps, propose enhancement programs, quantify financial impacts, and design corporate development paths and milestones

- Improve the financial analysis system of healthcare organizations, establish analysis mechanisms down to the department level, and achieve more efficient operations by establishing business-financial integration.

- Provide full suite of performance improvement services to private healthcare organizations based on their stage of development and urgency of transformation to help them achieve their quantitative and qualitative targets

- Design analytical reports and dashboards to comprehensively track operational and financial key indicators. Help managers grasp the core drivers of corporate performance and use them as a starting point to drive the management team to implement performance improvement initiatives

- Support hospital groups during mergers and acquisitions through integrated due diligence including commercial, operational, financial and tax due diligence, identifying risks, analyzing operating and financial performance, and finding potential post-investment value-creation opportunities

Alvarez & Marsal believes that the next three years will be critical for the development of private healthcare organizations in China. The market will continue to face consolidation and reorganization in the short term, with weaker players exiting or being acquired. Thus, operational improvements will be the key to success or failure, and potential M&A opportunities will be abundant. Private healthcare organizations that can survive or thrive the short-term turmoil will see medium-term growth. And stronger players will position themselves now for long-term success as private healthcare organizations will play an important role in China's healthcare system as the population ages and healthcare needs become more universal.

Alvarez & Marsal works with private healthcare organizations to face the challenges of the post-epidemic era, helping clients to accurately position their differentiated service capabilities, optimize their human resources pipeline to attract and employ top talent, assess their operational capabilities, and strengthen the financial control and supervision to continuously improve efficiency. At the same time, we assist our clients with M&A and post-merger integration, so that they can make an early deployment in the increasingly competitive healthcare services market and capture new momentum in the industry.

Core members of A&M's healthcare organization services team:

|

Gao Huan Managing Director | Performance Improvement Services | Head of Healthcare and Life Sciences More than 18 years of experience in healthcare and life sciences industry in Asia Pacific, Europe and North America; extensive experience in business evaluation, business turnaround, investment and M&A and financial control. |

|

Runald Li Managing Director | Transaction Advisory Services Over 17 years of experience in healthcare and life sciences transactions and M&A in the Asia Pacific region; extensive experience in financial due diligence, transaction negotiation and financial advice. |

|

Joshua Kurtzig Senior Director | Performance Improvement Services 15+ years of experience working with private hospitals in Asia Pacific and North America; extensive experience in private hospital planning, operations and investment. |

|

Ryan Yu Director | Performance Improvement Services 12+ years of experience in healthcare industry; led teams in hospital process optimization and performance improvement project for a 3A grade hospital; led healthcare strategy planning project for a top five insurance group in China. |