Tax Requirements for Private Equity Funds in Germany: What You Need to Know

Background

Private equity (PE) funds with at least two German tax resident investors are required to file an annual partnership tax return in Germany, even if they do not have taxable presence in the Germany.

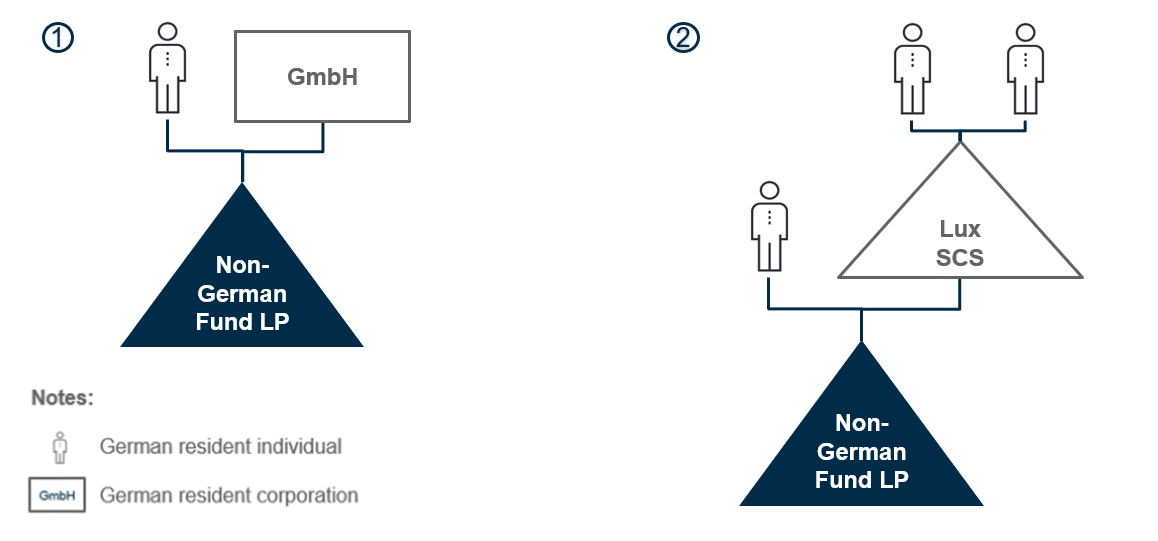

From basically 2023 onwards PE funds (not the German investors) are liable for filing a partnership tax return – comparable to a K-1 tax form in the U.S. – in the following scenarios:

- Two German residents (individual or corporate) directly invested in the fund.

- German tax residents invested in the fund via transparent non-German entities (e.g. Lux SCS).

Failing to file the required annual partnership tax return in Germany may result e.g. in the fund’s late filing penalties or in the tax authorities’ tax estimate at the German investor level.

While funds with only one German investor are not required to file a partnership tax return, they might still need to assist German investors with their tax reporting to support side-letter agreements, for example by providing the German investor with a pro forma tax reporting in order for the investor to include the fund income in the his individual (corporate) income tax return.

Key considerations for PE funds

Preparing the partnership tax return requires an in-depth analysis of the fund structure in order to:

- Qualify the fund as a (deemed) business partnership or asset management partnership;

- Qualify the entities within the structure as opaque (corporation) or transparent (partnership);

- Qualify and quantify the German investor’s income according to German tax law.

In addition to analyzing investment structures carefully, funds must verify:

- Whether a distribution within the fund structure qualifies as a tax neutral Return of Capital (RoC) for German tax purposes which requires an application with the German tax authorities by the distributing entity. In the absence of such application the RoC is treated as a (fully) taxable dividend at the level of the German investors; and

- Whether corporate entities within the fund structure have net passive income (e.g. interest income): German investors have to file a a tax return in case of CFC / PFIC income (in addition to the partnership tax return).

How A&M can help

A&M Tax Germany has extensive experience in German tax compliance for PE funds. Our one-stop shop service helps clients minimize their tax efforts, maximize efficiency, manage risk and save costs when dealing with German tax reporting issues.

We work closely with our A&M offices around the world to obtain the information necessary for the filing with the German tax authorities in order to minimize client input. With the support of our tools, we ensure timely and comprehensive preparation, filing and submission of tax returns. Our services include:

- Fund structuring: fund structure solutions tailored to the specific needs of the German investors.

- Tax return preparation and filling: analysis of the fund structure and financing to determine the taxable income of German investors according to the German tax law.

- Tax audit assistance: support during tax field audits, including communication with tax auditor and processing of tax auditor’s information requests.

- Side-letter review: review side letter agreements with German investors, in close collaboration with the fund lawyers to verify practicability and consistency.

- RoC application: preparation and filing of return of capital (RoC) application, as well as liaising with the tax authorities on follow-up requests.

- Investor communication: communication with German investors and their (tax) advisors regarding the German tax compliance process, in line with confidentiality rules.

If you want to learn more about the tax compliance issues affecting PE funds in Germany, please get in touch with our team.