The Shape of Retail

A new era in retail is upon us, but change has not happened overnight. Driven by aggressive acquisition of commercial space coupled with the growth of online, physical retail in the U.K has been suffering from long-term, straight-line decline which has only been exaggerated by wider economic and political uncertainty. Similar trends can be observed elsewhere, but in no other country does this have more resonance.

Click here to view the full report.

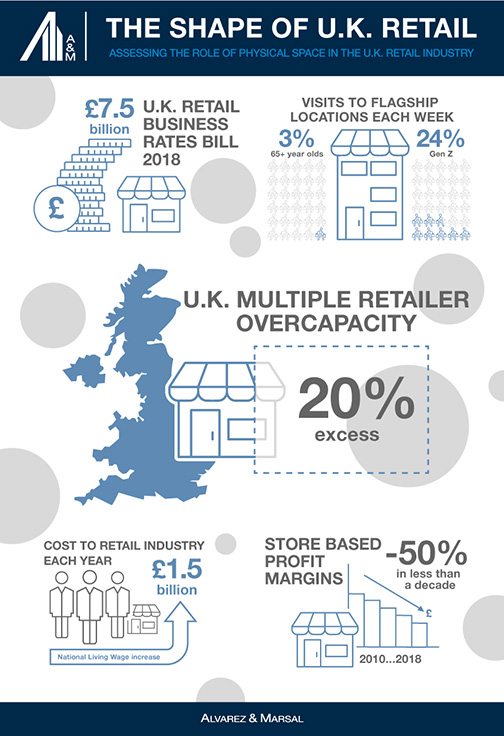

To better understand the future of physical space in U.K. retail A&M has partnered with Retail Economics to provide new data-backed insights into the ‘perfect storm’ sweeping through the industry.

Here are a few of the key findings from our report:

Despite the industry upheaval, our research found grounds for optimism. Our consumer panel has shown that shops remain the bedrock of retail. Flagship destinations and high streets in particular, remain hugely relevant among Millennials and Generation Z groups who value the role of physical stores more than the older generations across every stage of the customer journey. This is important because Millennials and Generation Zs will make up the majority of adult consumers in the next 10 years as they approach their peak spending years.

From our research, five major trends emerged as those that retailers need to address across the customer journey and to keep stores fit-for-purpose, presenting opportunities for forward-thinking incumbents, entrepreneurs and investors. Retailers now need to assess the value and purpose of physical stores as a media channel, not just a profit centre solely focused on distribution. This involves taking a more data-driven approach, closely associating store performance with ‘engagement’ and ‘impressions’ that enhance brand favourability and drive sales across the entire customer journey.

Click here to view the full report.