Major U.K. retailers operate at 20 percent over-capacity

- Store-based profit margins have halved in eight years, pushing swathes of the U.K. retail sector to ‘breaking point’

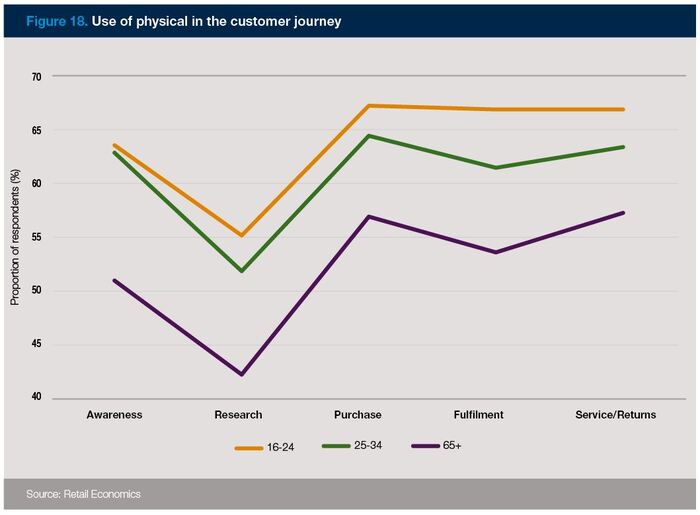

- Yet stores are set to remain the bedrock of the customer journey, with Gen Z and Millennials valuing the role of physical space more than older generations

- Experiential stores and independent brands most relevant to local communities are predicted to thrive

London – A new report by global professional services firm Alvarez & Marsal (A&M), in partnership with Retail Economics, has found that store-based profit margins for the top 150 U.K. retailers have more than halved in less than a decade – dropping from 8.8 percent as seen in 2009/10 to 4.1 percent in 2017/18.

Driven by ballooning operating costs[1] (increasing by 10.8 percent since 2014), a legacy of inflexible lease structures and changing shopping habits, A&M estimates that large multiple retailers now occupy up to 20 percent more store space than they need and can financially justify.

Business rates remain a significant burden for retailers that are overly exposed to property. These rose to £7.5 billion last year following a government revaluation, and in some parts of the country they now exceed retailers’ rental values.

Consecutive wage increases, and the impact of the Apprenticeship Levy have further accelerated labour costs and placed intense pressure on profitability. Each hike in the National Living Wage is estimated to cost the retail industry around £1.5 billion per year.

As a result, retail rental and capital value expectations have fallen to 10-year lows as investors lose confidence in the market. Demand for U.K. retail space is at its lowest since 2007, with secondary locations (local shopping centres and high streets) experiencing the steepest declines in footfall. This has translated into a 60 percent decline in the total volume of retail transactions at these locations over the last two years.

The large multiple retailer space has been most acutely affected with a consistent store decline in each year since 2013, culminating in a net loss of 2,481 stores in 2018 alone.

Following a flurry of CVAs[2], landlords have been met with growing resistance when proposing increased rents on new lettings. Their ability to achieve higher rents has declined steadily and proved successful on just 30 percent of retail units in 2017.

Retailers focused on the value, convenience and luxury segments remain generally resilient, while mass market operators, particularly mid-market fashion retailers, are most exposed to upheaval in the sector. Those mid-market fashion brands have experienced around six times the number of net store closures compared to its value and luxury counterparts.

Richard Fleming, Managing Director and Head of Restructuring Europe, A&M, said: “Most of the U.K.’s biggest retail brands are in the midst of a fight for survival. We have already seen some high-profile casualties, and many more are on life support. But reports of the ‘death of the High Street’ have been greatly exaggerated.

“We’re entering a new era of retail, presenting opportunities for forward-thinking incumbents, entrepreneurs and investors. Those that collaborate with landlords and local authorities will be the big winners going into the next business cycle. This needs to involve striking the right balance between retail and leisure through strategic partnerships, nimble pop-up schemes, agreeing temporary rent cuts that allow companies to reshape their debt and operational structure, or adopting turnover-based rents where retailers and landlords stand or fall together.”

Store browsing remains the bedrock of the shopping experience

The A&M research found grounds for optimism, despite the industry upheaval. Physical store browsing remains a significant component of the shopping experience – currently accounting for over 80 percent of total retail sales and expected to remain at 65 percent over the next five years.

Shops, particularly flagship destinations, remain hugely relevant among Millennials and Gen Z groups who value the role of physical stores more than the older generations across every stage of the customer journey. A quarter (25 percent) of 16-24-year-olds visit a flagship shopping destination at least once a week compared with 45-54-year-olds who visit on average just once every six months. Importantly, Millennials and Gen Zs will make up the majority of adult consumers in the next 10 years as they approach their peak spending years.

From “distribution hubs” to escapism

Growth continues to be driven by a relentless engine of small independent firms, such as beauty salons, new social activity bars (such as darts, crazy golf and ping pong), health clubs and restaurants. The increase in new leisure units since 2012 stands at 5.2 percent versus a 1.8 percent increase in new traditional retail units over the same time period.

As the economic value attached to material possessions diminishes, customers increasingly expect to be entertained and educated through experiential store formats. Gen Z and Millennials are twice as likely to note that they spent less on retail products and more on experiences (e.g. holidays and eating out) over the last 12 months than those in their 50s.

Fleming added: “Retailers now need to assess the value and purpose of physical stores as a media channel, not just a profit centre. This involves taking a more data-driven approach, closely associating store performance with ‘engagement’ and ‘impressions’ that enhance brand favourability and drive sales across the entire customer journey.”

Notes to Editors

Methodology

- The report was carried out by A&M, in partnership with Retail Economics, an independent consultancy providing economic data, statistics and trends for an outlook on UK retail. The research was carried out in July-September 2019.

- The overcapacity estimate of 15-20% is based on regression analysis that tested over 30 individual economic variables including total retail sales, online retail sales, store-based retail sales, profitability metrics, rental expectations, footfall, vacancy rates, available retail space and many others. The regression model selected had a R-squared of 67%. The three variables most correlated to the decline in multiple retail stores included: in-store retail sales, store-based profitability and footfall.

- For profitability estimates, Retail Economics collected data on the top 150 retailers in the U.K. by turnover. Data for each financial year was taken from 2013 to 2018 from the latest annual reports and/or company filings with Companies House. Pre-tax profit margins were calculated and weighted by turnover for each of the years covered

- The consumer panel covering over 2,000 nationally representative households in the U.K. was conducted in July 2019. The survey provided detailed segmentations across age, income, region and socio-economic breakdown. The data was used to provide information on the relative importance of the different stages of the customer journey.

[1] Business rates, the National Living Wage, the National Minimum Wage, logistics, utilities and other central costs

[2] Company Voluntary Arrangements, a life raft for businesses that can only be considered when the alternative is administration

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) when conventional approaches are not enough to drive change and achieve results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services.

With over 4,000 people across four continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, help organizations transform operations, catapult growth and accelerate results through decisive action. Comprised of experienced operators, world-class consultants, former regulators and industry authorities, A&M leverages its restructuring heritage to turn change into a strategic business asset, manage risk and unlock value at every stage of growth.

To learn more, visit: AlvarezandMarsal.com. Follow A&M on LinkedIn, Twitter and Facebook.