The Role of the CFO in Transformations: Communicator, Conductor, Collaborator

Executing a transformation is a team effort and requires the buy-in of the whole organisation, particularly in the C-suite. While the Chief Executive Officer (CEO) is accountable to deliver the transformation ultimately, the rest of the executive team play vital supporting roles. Following on from our article on the CEO’s role in the first 100 days of a transformation, here we will examine the responsibilities of the Chief Financial Officer (CFO), who typically will need to adopt multiple hats – Communicator, Conductor and Collaborator – as a transformation is executed.

Numbers and narratives

In a transformation, the CFO needs to pay attention to much more than just numbers, but when it comes to supporting the work of the CEO, a detailed understanding of financials and operations is essential. In a lot of situations these days, as well as ‘traditional’ CFO responsibilities the CFO can also undertake something close to a Chief Transformation Officer (CTO) role, due to how closely EBITDA and cash generation is linked to the transformation’s implementation. During the transformation itself, much of the CEO’s time will be spent telling the transformation’s ‘story’ to the board, employees, investors, creditors and other key stakeholders. It is critical for the CFO to support this work, helping steer the CEO’s advocacy by owning and controlling the numbers that underpin the narrative and generate both EBITDA and cash.

The CFO needs to primarily manage the financial implications of the transformation’s different workstreams on an ongoing basis, giving the CEO the ammunition to take a compelling story to market. In some respects, it is the CFO who plays the role of conductor ensuring the entire ensemble plays together in harmony, while the CEO functions as Pavarotti, vocalising the vision and shaping the story. The CFO should also take on a risk management role whereby his or her team must think through the potential financial implications of the transformation as it moves forward. This ensures that reputational, financial and operational risks can be identified in advance, and risk mitigation measures can be applied to ensure the transformation is robust and delivered to plan.

What do transformations today entail?

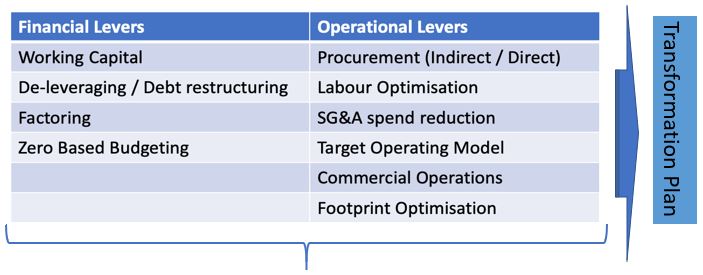

Transformations in today’s world are complex and competitive. A new owner needs to find the quickest route to achieve sustainable value creation. Private equity owners increasingly expect bigger returns and delivered more quickly. Where there is a will, there is a way, but understanding the art of the possible is a key weapon in the CFO’s armoury. The transformational CFO has to use every trick and tool they can, as all the below levers – and sometimes more – need to be addressed to execute a transformation to its full potential.

Balancing the boardroom and the ‘shop floor’

In pushing to deliver a transformation, the CEO will more often than not seek to take a bullish message to market. Private equity (PE) or activist investors are also likely to be pushing for more growth and to achieve results faster. In this context, the CFO should be a constructive counterweight, making sure that the plan is realistic and achievable as well as being challenging and ambitious. With that being said, some productive tension is desirable when the CEO and CFO are debating the right approach and message for the market. Strong CFOs should be able to confidently and empirically argue their case while understanding the CEO’s need to focus on growth. A helpful dialogue here can create a transformation plan that works well for all stakeholders.

For a portfolio company CFO, understanding the motivations of investors can help deliver a successful transformation. PE investors want to remove costs and grow the top line over the investment lifecycle before readying the business for a profitable exit. A transformation taking place soon after an investor comes on board may feel quite different to one being carried out after an investor has been in place for four or five years and is occurring due to ongoing market changes, where a sale or other transaction might be on the horizon. Balancing the short-term transformation goals with the longer-term interests of the business is part of the CFO’s remit.

With regards to both external and internal stakeholder management, some subtlety is required: the CFO needs to understand what is happening on the ground without interrupting or obstructing the work of the Chief Operating Officer (COO) and other functional leaders, while at the same time knowing what should be communicated externally. Knowing a little about a lot, and challenging colleagues intelligently about the progress of initiatives while making sure to let people do what they do best, could serve the CFO well in these situations. When most people think of the CFO, they immediately think of finance and accounting. While every CFO should possess a solid knowledge of these topics, a true CFO leader will build a high-performing team and culture so as being able to rely on such individuals for and adopting a ‘jack-of-all-trades’ mindset allowing CFOs to leverage their communication and collaboration skills as well as their financial acumen.

In conclusion: support by challenging, collaborating and communicating

In a transformation, the CFO is instrumental in giving the CEO the playbook to do his or her job well, but their role certainly does not stop there. To reiterate, as an important conduit between the board and the many different functional workstreams, the CFO must communicate regularly and thoroughly without being overly intrusive and stepping on functional leaders’ toes. The CFO should seek to facilitate constructive conversations that keep sight of the main goal: delivering transformations that improve results and drive sustainable value for all stakeholders.

A&M: Leadership. Action. Results.

A&M’s private equity-focused professionals understand the need for agility and the importance of speed to execution in order to prioritise the key areas of improvement that will positively impact EBITDA and ensure sustainable cash generation at the portfolio company level. Ensuring a successful transformation requires strong leadership at the top that can then be exemplified and reproduced throughout the organisation. Leadership requires definitive action, which then leads to positive results for all.

About the author

Bob Rajan brings more than 20 years of experience in interim management and NED positions, advising companies with their financial and operational challenge. He is currently advising management teams of companies in the retail, hospitality, manufacturing and automotive sectors as they cope with Covid-19. In 2019, he was interim CFO of a private-equity backed multi-billion cosmetics retailer focusing on business transformation; before that, he was interim CFO of a private-equity owned global market research company transforming the organisation to become an agile predictive data analytics company while executing a multi-country carve-out.

Bob has also served in many NED roles and has operationally advised portfolio companies on their target operating models and negotiating with works’ councils, cost reduction, merger integration and financial restructuring. In addition, he has served as interim CFO of a global fashion retailer, assisting with the preparation of their transformation plan; interim CFO/CRO of a large retail apparel chain building its value creation plan in Europe and Asia; and Interim CFO/CRO and Board member of a global tier-one automotive supplier, working through a complicated turnaround that closed and consolidated operations in Germany, Spain and Italy.

If you have any questions regarding issues covered in this article, please get in touch with our key contact.