The Rise of the Co-Investment: Key Tax Considerations for Fund Managers and Investors

Over the last 24 months, we have seen a significant increase in the number of co-investment transactions in the private equity (PE) and infrastructure sectors globally.

This growth reflects a strategic response from fund managers and investors to the tougher dealmaking environment and financial turbulence of the past few years. Co-investments provide a vital option for funds at a time when higher interest rates make debt financing for buyouts expensive and hard to come by. The strategy also helps managers continue to deploy capital and build their portfolios in today’s difficult fundraising landscape.

Capital raised for co-investment products has increased rapidly in recent years, bucking wider fundraising trends in the private capital market. In 2022, estimated commitments to dedicated co-investment funds totalled approximately £21 billion.

We expect this growth to continue at least in the medium term. A recent market survey found that nearly two thirds of institutional investors are monitoring opportunities in the co-investment space and plan to make acquisitions in the next 12 months. Appetite from larger fund managers in particular should also help fuel further growth in the area.

In this article, the latest in our series on current strategic trends for fund managers, we examine the key differences between co-investment transactions when compared to traditional M&A and Limited Partners (LPs) investments, and highlight the tax considerations that need to be acknowledged as part of the process.

What is a co-investment and what are the key tax considerations?

How do co-investments work?

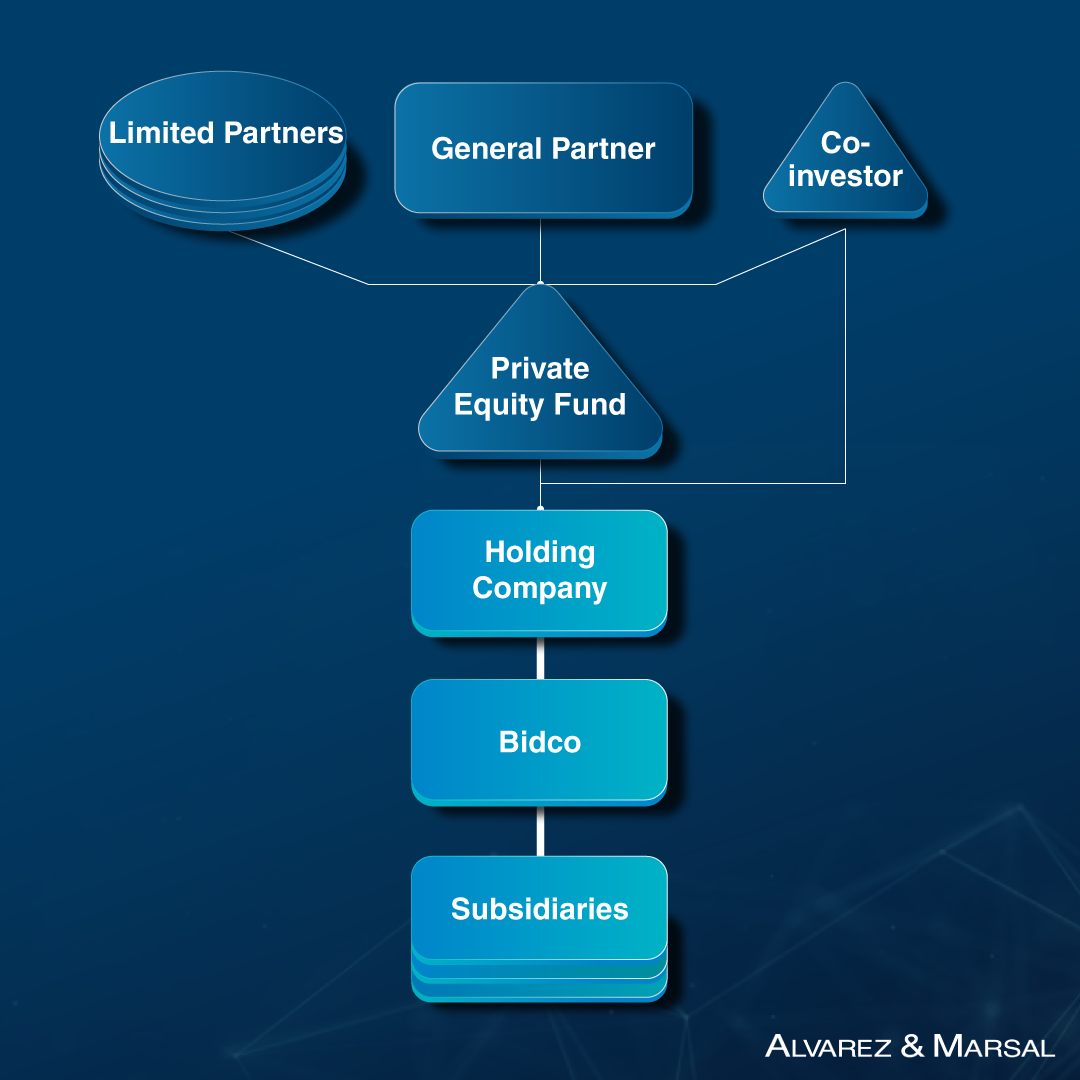

In a co-investment transaction, a private equity or infrastructure fund will invite investors to acquire a direct interest in the underlying asset being purchased as part of the buyout process. The co-investors may be a mix of existing investors in the lead PE or infrastructure fund making the acquisition, which are seeking to increase their exposure to the particular asset, or specialist funds set up for the purpose of making co-investments.

A co-investment strategy has the following unique features that differentiate it from a typical LP strategy:

- By acquiring a direct interest in the underlying asset, a co-investor increases its potential upside in the event of a successful exit. Conversely, there is greater exposure to potential losses when things do not go to plan.

- Capital can be deployed in a quicker and more agile way than in a closed-ended investment fund. Because the co-investor retains full discretion on co-investment decisions on a deal-by-deal basis, capital also remains more liquid.

- As a direct investor, the co-investor takes an active role in the investment, unlike investments in a fund that are typically on a passive basis. Co-investors must therefore have the capability to assess specific investment opportunities and manage each investment effectively. This requires more specialist investment management personnel as well as a greater need for external advisers. That said, work undertaken by the lead PE or infrastructure fund making the acquisition, including in tax and other workstreams, can bring a great deal of comfort to investors.

- While the co-investor is not subject to the same management fee and carried interest arrangements as the LPs in the lead fund, there may typically be other bespoke fees and carry, including arrangements between the co-investor and the lead sponsor to incentivise and remunerate the sponsor for their management of the asset on behalf of the co-investor.

Key tax considerations in co-investment arrangements

Additionally, there is typically a range of tax considerations that any co-investor should be aware of and address when making co-investments. The most critical ones based on our experience are highlighted as follows:

1. Selecting an entry point

In a co-investment process, it is not uncommon for multiple entry points to be made available to potential co-investors. In some instances, there will be a requirement to acquire shares and other instruments directly in a corporate entity. On other occasions, a deal-specific, co-invest partnership will be established for the purpose of the transaction. In certain situations, it will even be possible to select between the two entry points being offered. It is important for the co-investor to consider the implications of making the investment for both its own investment vehicle and its LPs. For example, does it expose the co-investor or its LPs to filing obligations in the underlying investment jurisdiction, or does it change their tax status (causing them to be treated as “trading”)? If so, the co-investor then needs to understand what steps can be taken to prevent this.

2. Information flow for LPs and the fund’s own filings

The LPs in the co-investing fund will have their own annual filing requirements (such as the Schedule K-1 US Federal Tax Form, as well as FATCA/CRS obligations) and in the co-investing fund’s Limited Partnership Agreement (LPA) they will have undertaken to provide them with this information within a certain timeline . It is important that close attention is paid to the underlying LPA or Shareholders Agreement (SHA) governing the co-investment, to determine whether it includes obligations to provide the co-investing fund with specific information on a timely basis and with a sufficient level of detail. In addition, it will be important to know upfront who will bear the cost of producing this information. If adequate comfort is not provided in the LPA or SHA, additional side letter requests may be required and agreed upon with the other side prior to signing the transaction.

Similarly, the co-investing fund may have obligations to notify certain LPs where the underlying investment is disclosable under a relevant regime (e.g., DAC6, DOTAS). The provisions of the LPA or SHA should be reviewed to ensure that responsibilities and costs in this regard are appropriately covered.

3. Selecting an appropriate co-investment vehicle for optimal tax treatment

Depending on the nature and structure of the underlying investment, it may be desirable to make it using a certain type of vehicle to mitigate tax risks, tax filing or tax payment obligations that might otherwise arise for certain LPs.

For example, a corporate blocker (i.e. one treated as a corporation for US federal income tax purposes) may be used in the case of investments at risk of generating income effectively connected with the conduct of a US business of trade (ECI), in order to insulate non-US LPs from such income. If a blocker is not already offered by the structure implemented by the lead investor, the co-investing fund may have an obligation to utilise one and mitigate such risks, depending on the terms agreed with LPs. It is worth noting that while such a blocker may improve the tax efficiency of the structure, for certain LPs it will introduce an annual administrative cost to maintain it, which may not be beneficial in all instances. This decision will ultimately be dependent on the investor base.

Once a suitable co-investment vehicle has been determined, for co-investing funds with US LPs in particular, it is often important for an executed W-8BEN-E form to be submitted by the co-investing fund alongside its subscription documents for FATCA reporting purposes.

4. Side letter protections or items in the LPA/SHA

Most co-investing funds will have a standard list of tax side letter requests that supplement the terms already included in the LPA or SHA. They will seek to negotiate and agree on these with the other side as part of the investment process. In addition to these standard requests, it may be necessary to obtain further comfort through deal specific tax side letter requests based on a review of the underlying structure and transaction documents. This process should be undertaken as early as possible in the deal lifecycle to ensure they can be obtained.

5. Tax leakages and considerations for your valuation model

Based on a review of the underlying asset and investment structure it may be appropriate to include certain tax considerations in your valuation model. For example, depending on the level of substance in the underlying structure, withholding tax may be suffered on cash repatriated through the structure, thus reducing the level of cash received by the LPs. In addition, consideration should be given as to whether capital gains tax is expected to arise in the structure on any future exit from the investment. Of course, the impact of the co-investment structure on these considerations should be factored in.

We recommend that these points should be considered as part of a detailed review of the investment structure proposed by the lead sponsor, together with the tax advice they have received. This analysis will help identify any tax leakages expected on returns to the co-investing fund as well as any incremental tax risks for the co-investor. It may also indicate whether additional advice and/or modifications are needed to ensure maximum efficiency of the fund’s structure from a tax perspective, both for the co-investor and its LPs.

How can A&M help?

A&M’s Financial Investors Tax practice is a unique team of over 60 tax professionals dedicated to providing tax support and solutions to the asset management industry in the UK, led by Managing Director Jason Clatworthy. Our experts have particular expertise across all sectors of the alternative asset management landscape, as well as practical experience of collaborating with the UK government and ensuring that all tax compliance obligations are met.

We have a dedicated co-investments team focused on helping clients to navigate the complex tax issues outlined in this article. The co-investments team is led by Senior Directors John Bettley-Smith and Joe Macklin-Gray, who together have advised on over 250 co-investment and secondaries opportunities in the last five years. Our experience at the transaction level combined with deep knowledge of global fund structures make us uniquely placed to provide end-to-end support to clients in this area, from the initial review of the proposed structure through to implementation support.

If you would like to hear more about our offering in this area, please contact A&M Financial Investors Tax practice today.

Learn more

This article is part of a series on current trends in alternative fund management, looking at strategic responses of fund managers and investors to the challenging economic environment. You can read our first article on continuation funds here. In the next and final part of the series, we will cover secondaries transactions.