Poor ESG performance increases likelihood of targeting by activist investors

A&M analysis finds a compelling link between companies’ ESG ratings and activist targeting

Global professional services firm Alvarez & Marsal (“A&M”) today announces the findings of its latest analysis and predictor of shareholder activism in Europe, the “A&M Activist Alert”, or “AAA”. Expanding on the previous inclusion of corporate governance (notably boardroom diversity) as a significant factor, for the first time, the AAA includes an in-depth analysis of the increasing importance of wider environmental, social and governance (ESG) factors for activist investors. This analysis shows that companies ranked in the bottom 50 percent of ESG performance are significantly more likely to attract activists’ attention.

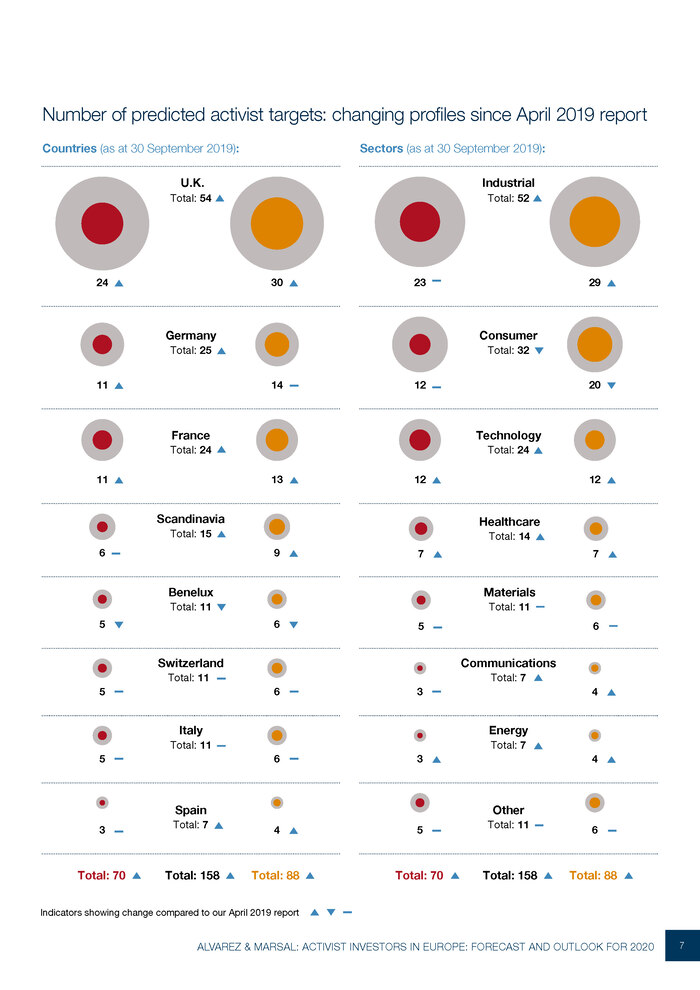

The study also predicts that the wave of activism across Continental Europe will continue to increase in 2020 as activists adapt their tactics to different markets and sectors, with tech companies a key growing target sector for activist shareholders. The U.K., however, remains the largest market for activists and is home to 54 of the 158 European companies which are predicted to face imminent risk from public activist campaigns.

Since the publication of the last AAA report in April 2019, 33 of A&M’s predicted targets have faced public activist campaigns.

ESG spotlight

Using data on c.1,300 European companies’ ESG ratings from Refinitiv, A&M created a ranking of four quartiles based on ESG performance. A&M then analysed how many companies in each quartile had been the subject of activist campaigns since 2017, with the results suggesting that poor ESG scores are an early warning sign that a company may come under activist pressure.

- 62 percent of activist targets across Europe since 2017 fall into the bottom two ESG quartiles; companies in these groups are on average 24 percent more likely to face an activist campaign.

- For U.K. and Italian companies, being in quartile three roughly doubles the probability that they will be targeted by activists.

- The opposite is true in Spain, where companies in the bottom quartile are two times more likely to face an activist approach.

- This divergence may be explained by the differing levels of adoption of ESG investment practices across Europe.

Malcolm McKenzie, Managing Director and Head of European Corporate Transformation Services, said: “As the focus on ESG grows in the minds of investors and the wider public, ESG performance has now clearly entered the sights of activist investors. This compelling link between ESG ratings and the likelihood of activist targeting should serve as a wakeup call to boards across Europe. Those who have overlooked ESG issues risk activist wolf packs closing in.”

Regional trends

- The U.K. remains the largest European market for activists, with 54 U.K. companies now at risk, up from 52 in April 2019.

- However, the U.K.’s dominance is eroding as activism across Continental Europe gathers momentum. A key driver is activists honing their approaches to better align with specific market dynamics, exemplified by Elliott Management’s successful campaign against Pernod Ricard.

- Companies in France and Germany are likely to attract much greater attention from activist investors in 2020 and beyond. 25 German companies are predicted to be at risk (compared to 23 in April 2019), while the number of French companies at risk has jumped to 24 (up from 20 in April 2019).

- As activism becomes more entrenched in European markets, shareholders are increasingly employing activist tactics against boards they disagree with, with traditional institutional investors also taking more vocal stances.

Sector trends

- Industrials retain the position as the most at-risk sector, with 52 companies predicted to be targeted (vs 51 in April 2019). This is in part due to many operating under conglomerate structures with underperforming divisions ripe for sale.

- But other sectors are also gaining attention, with activists increasingly setting their sights on technology firms, following recent campaigns in the U.K. (JustEat) and Germany (Scout24). 24 tech companies are now at risk, up from 21 in April 2019.

- Activist interest in tech companies may increase further if European stock exchanges move to relax rules on dual-class shares – a common feature of U.S.-listed tech companies – in order to attract more international listings.

- Calls for companies across all sectors to address underperformance through M&A activity continues to grow. 18 percent of demands made by activists in 2019 related to potential M&A, a jump from 12 percent in both 2017 and 2018.

- Once the top sector for activists, consumer companies fall further out of favour, with firms at risk sliding from 35 in April 2019 to 32 now. This reflects sustained challenges in retail and the impact of digital disruption.

Malcolm McKenzie, Managing Director and Head of European Corporate Transformation Services, added: “As activism gathers momentum across Europe, activist investors are increasingly pushing the boundaries of what constitutes a ‘traditional’ target. No longer are tech firms or tightly held dynasties out of scope. As activist pioneers start to prove their worth in new markets, we can expect many more attacks on historical ‘safe havens’ going into 2020.”

-ENDS-

Notes to Editors

A&M Activist Alert

The AAA is the most comprehensive statistical analysis of its kind. The analysis focuses on 1,597 corporates with a market capitalisation of US$200 million or more, listed and headquartered in the U.K., Germany, France, Scandinavia, Switzerland, Benelux, Italy and Spain. The resulting predictive model successfully predicted the majority of corporates publicly targeted by activists since January 2015. The report is published twice yearly and individual companies can check their position on the Alert List by contacting A&M.

The AAA model

Numbers of predicted activist targets

Quarterly refreshes

The A&M Activist Alert model is fully reassessed and refreshed every three months including a fully updated review of all known activist actions. This allows us to see how the key variables, timescales, country and industry factors have moved in terms of relative importance. A&M also reviews which companies have moved in or out of the Red or Amber Lists.

This December 2019 analysis is accompanied by a focused report that explains the methodology plus the key findings and clear messages of importance to corporates and their boards seeking to avoid the high potential financial and reputational costs associated with a public activist programme. Individual companies can check their position on the Alert List by contacting A&M.

Red and Amber Lists

The AAA model calculates a score for all analysed corporates that predicts the likelihood of public activist action. Companies with high AAA Scores, and therefore with a higher predicted likelihood of public targeting, are classified as either Red or Amber. These classifications are based on the level of AAA Score and how sustained it has been over the past two years.

Corporates with high AAA Scores on both the two year and one year bases are considered to be at high short term risk (next six to 12 months) of public activist action and may already be subject to non-public approaches. Such high-risk corporates feature on the Red List. Companies with a high AAA Score on either the two year or one year basis are likely to be being monitored by activists. Such companies are considered to be at medium risk which will only increase if corrective action is not taken within 12 to 18 months. Such medium risk corporates feature on our “Amber List”.

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) when conventional approaches are not enough to drive change and achieve results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services.

With over 4,000 people across four continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, help organizations transform operations, catapult growth and accelerate results through decisive action. Comprised of experienced operators, world-class consultants, former regulators and industry authorities, A&M leverages its restructuring heritage to turn change into a strategic business asset, manage risk and unlock value at every stage of growth.

To learn more, visit: AlvarezandMarsal.com. Follow A&M on LinkedIn, Twitter and Facebook.