LIBOR Transition: Preparing for the Changes

The UK Financial Conduct Authority announced in 2017 that it would no longer support the calculation of the London Interbank Offered Rate (“LIBOR”), which has been a widely used benchmark rate used in calculating variable rate debt instruments. As certain LIBOR tenors are expected to be phased out by the end of 2021, and the remaining tenors will be phased out by June 30, 2023, some instruments that use LIBOR as a benchmark may have to be amended or terminated. Though some newer instruments have “fallback” language to account for the risk that LIBOR would become unavailable for use, older instruments may not have this flexibility-creating language.

Likely Replacement for LIBOR

The most likely candidate to “replace” LIBOR is the Secured Overnight Financing Rate (“SOFR”) which, unlike LIBOR, is transaction-based and backward-looking. Therefore, new and modified SOFR-based borrowings may reference historical averages of the rate, potentially making accrual of the interest income or expense more uncertain. In July 2021 the Alternative Reference Rate Committee (“ARRC”) released recommended conventions for the use of forward-looking SOFR rates as a substitution for LIBOR tenors prescribed in given debt instruments. As forward-looking rates are published, some of the uncertainty and volatility of the change in rates is mitigated.

Tax and Legal Considerations

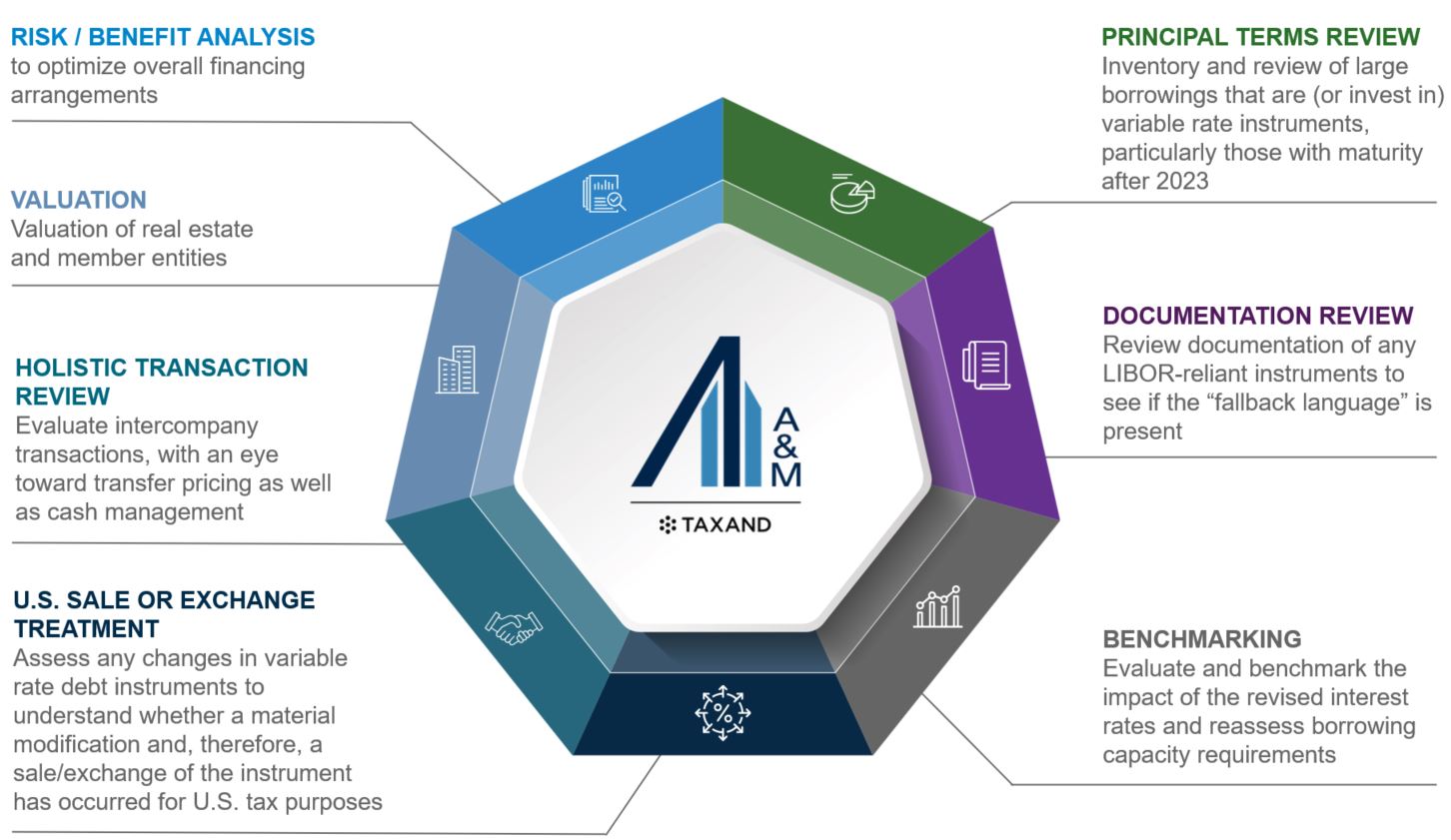

Existing agreements should be reviewed and amended to consider the changes and any clauses that could trigger potential risk (or opportunities to refinance). In the real estate space, there also may be opportunities to reassess the levels of borrowings as compared to updated values of real property. Considerations may include both the deductibility of interest as well as cash strategies and other commercial terms. Outside the real estate space, the pricing of intercompany debt and the benchmarks used in such variable pricing will have to be considered and chosen with an eye to volatility, practicality and market conditions.

Transfer Pricing Risk and Opportunities

The Base Erosion and Profit Shifting (“BEPS”) Action 4, which generally has become effective over the period from 2017 to 2019 for many non-U.S. jurisdictions, serves to limit the deduction of interest payable to another member of a multinational enterprise. The transition away from LIBOR, and the need for adjustments to the documents supporting a variable rate instrument, may offer opportunities to revisit inter-company agreements on a larger scale, with an eye to new requirements of BEPS 4 and other changes such as the recent focus on hybrid vehicles.

Existing and new financing arrangements with an international / intragroup component should be carefully considered to optimize the level of deductibility of the interest expense. Using a different variable rate that is market-driven is likely to generate more volatility and open opportunities for higher rates depending on the ability of deducting expenses (BEPS Action 4).

Refreshed Economic Arrangement

For U.S. tax purposes, a modification of an instrument to reference a different metric may not give rise to a “material modification” of the instrument. However, care must be taken that the changes are limited to those that would effectuate the change in rate reference and that no other terms of the instrument are changed if the sale / exchange treatment of a material modification is undesirable for the issuer or holder because of the acceleration of income or expense.

How A&M Can Help

|

Click here to learn more about our Global Real Estate Offering