Industrials Now #1 Target Sector for Activist Investors in Europe

U.K. is European target market of choice; consumer and energy companies fall out of favor – but for different reasons; board diversity continues to be a statistically significant factor: age range now identified as a consideration.

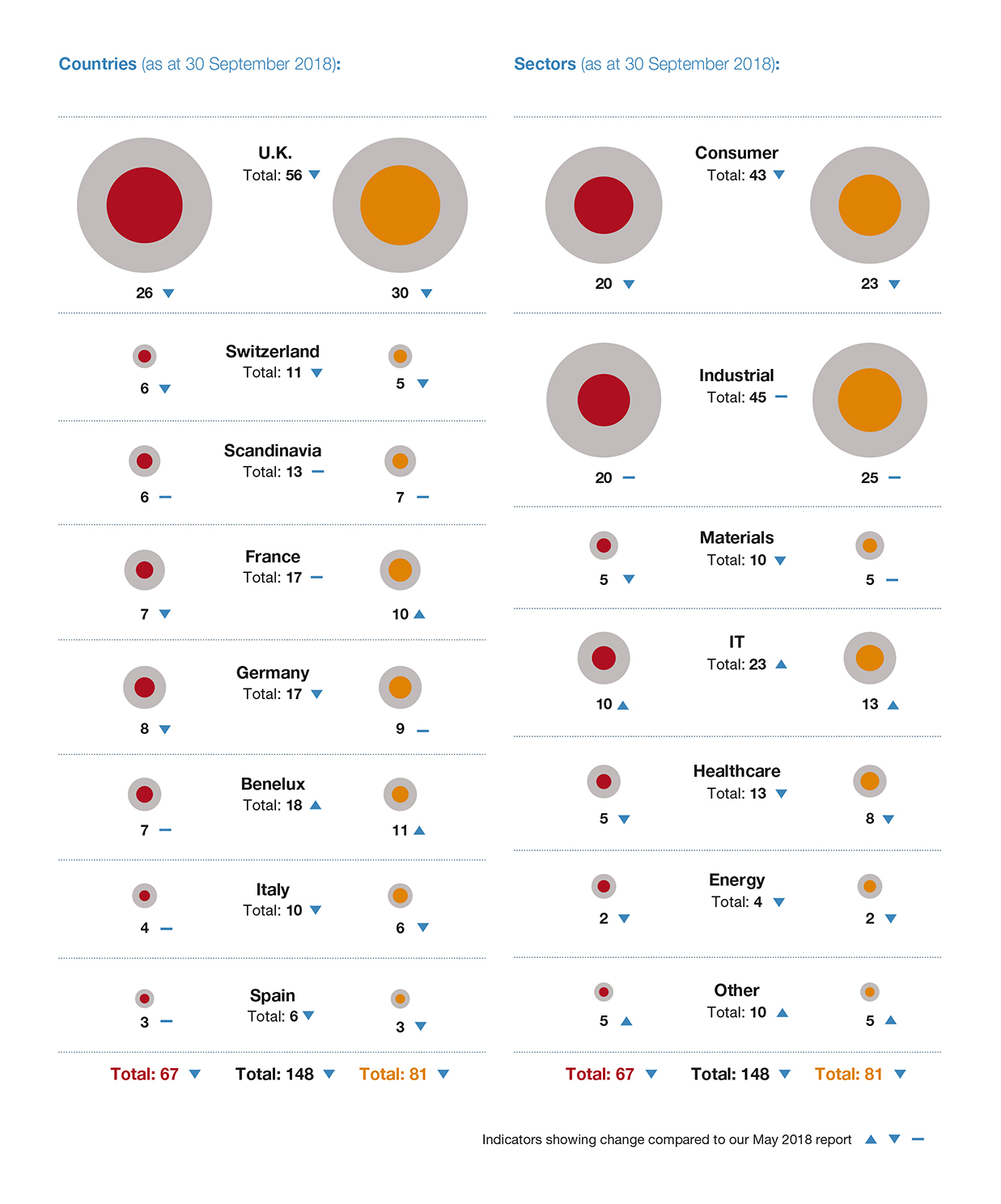

Global professional services firm Alvarez & Marsal (“A&M”) today announces the findings of its latest analysis and predictor of shareholder activism in Europe, the “A&M Activist Alert”, or “AAA”. The study shows that Industrial companies are now predicted to be most in demand from activist investors. In addition, of the 148 European companies predicted to be under threat from public activist targeting, 56 of these are U.K. companies. This cements the U.K.’s status as the most attractive market in Europe for activists.

Activism by sector & region

- Throughout Europe, conglomerates face heightened likelihood of activism. Uneven performance by division increases the likelihood of being targeted by activists seeking to improve the performance of weak business units or force their sale. A key driver of this trend are private equity firms eager to deploy capital on public to private spin-offs.

- Industrials companies make up the largest number of entries on the target list (45 in total). This sector has the greatest concentration of conglomerates in Europe (while Industrials account for 26% of the companies analyzed by AAA, they make up 37% of European conglomerates analyzed).

- The Consumer sector also scores highly on the activist radar (43 in total), but these companies are starting to fall out of favor, driven by two opposing forces. Many potential targets – particularly in Retail – have now simply become too weak to draw the interest of activists, while many others have already been publicly targeted.

- Energy companies are also dropping off the activist radar, but for a different reason. As commodity prices recover, profits and share prices are improving. Only four Energy companies are now at risk; a sharp reduction from the 10 which were predicted in May 2018.

- After the U.K., Germany, France, Italy and Benelux are also particularly attractive countries/regions for activists.

Malcolm McKenzie, Managing Director and Head of European Corporate Transformation Services, said: “The Industrials sector has become a magnet for activists. Many of its leading companies operate under a conglomerate structure, often reporting uneven divisional performance. At a time when private equity funds have record levels of dry powder to deploy, activists are well aware of the opportunities to spin-off underperforming business lines. Boards need to act fast in addressing such underperformance before the wolves come calling.”

Board diversity

- For the first time, A&M has included the age of Board Directors within the AAA model. While the average age of a Director does not influence the risk of an activist approach, the age range of the Board is a statistically significant factor. Indeed, greater age diversity on a Board can help deter activists – but only if the age range isn’t too great.

- Gender balance matters. There are continuing indications that increasing the number of women on a Board may be associated with a reduced risk of shareholder activism.

Mr McKenzie added: “A lack of diversity in the Boardroom leads to suboptimal decisions which in turn can prompt activist approaches. Our research shows that age range and gender are two factors to consider when appointing Directors. Boards that encourage diversity of thinking are likely to foster more resilient companies, armed with the right tools to stay ahead of the competition and avoid activist targeting.”

Review of activism by numbers in 2018*

|

Companies publicly |

Total no. |

Total no. of companies |

|

Europe |

130 |

90 |

|

UK |

36 |

20 |

*Data from Activist Insight

A&M Activist Alert

The AAA is the most comprehensive statistical analysis of its kind. The analysis focuses on 1,771 corporates with a market capitalization of US$200 million or more, listed and headquartered in the U.K., Germany, France, Scandinavia, Switzerland, Benelux, Italy and Spain. In this report, the analysis has been extended to examine how age diversity amongst Board members can be a factor in activist targeting. The resulting predictive model successfully predicted the majority of corporates publicly targeted by activists since January 2015. The report is published twice yearly and individual companies can check their position on the Alert List by contacting A&M.

Further Notes

The AAA model

Key findings summarized:

Quarterly refreshes

The A&M Activist Alert model is fully reassessed and refreshed every three months including a fully updated review of all known activist actions. This allows us to see how the key variables, timescales, country and industry factors have moved in terms of relative importance. A&M also reviews which companies have moved in or out of the Red or Amber Lists.

This September 2018 analysis is accompanied by a focused report that explains the methodology plus the key findings and clear messages of importance to corporates and their Boards seeking to avoid the high potential financial and reputational costs associated with a public activist programme. Individual companies can check their position on the Alert List by contacting A&M.

Red and Amber Lists

The AAA model calculates a score for all analyzed corporates that predicts the likelihood of public activist action. Companies with high AAA Scores, and therefore with a higher predicted likelihood of public targeting, are classified as either Red or Amber. These classifications are based on the level of AAA Score and how sustained it has been over the past two years.

Corporates with high AAA Scores on both the two year and one year bases are considered to be at high short term risk (next six to 12 months) of public activist action and may already be subject to non-public approaches. Such high-risk corporates feature on the Red List. Companies with a high AAA Score on either the two year or one year basis are likely to be being monitored by activists. Such companies are considered to be at medium risk which will only increase if corrective action is not taken within 12 to 18 months. Such medium risk corporates feature on our “Amber List”.

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) when conventional approaches are not enough to make change and achieve results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services.

With over 3000 people across four continents, we deliver tangible results for corporates, Boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, help organizations transform operations, catapult growth and accelerate results through decisive action. Comprised of experienced operators, world-class consultants, former regulators and industry authorities, A&M leverages its restructuring heritage to turn change into a strategic business asset, manage risk and unlock value at every stage of growth.

To learn more, visit: alvarezandmarsal.com. Follow A&M on LinkedIn, Twitter and Facebook.