Impact on Management Equity Plans in Transactions in Light of the Office of Tax Simplification’s Capital Gains Tax Review in the U.K.

In November 2020, the Office of Tax Simplification (“OTS”) published its review of the Capital Gains Tax (“CGT”) regime including a number of recommendations on its application in the U.K. Recommendations include aligning the CGT rates (currently up to 20% or 28% depending on assets) with income tax rates (currently up to 45%, or 46% in Scotland), reducing the Annual Exempt Amount and reviewing Business Asset Disposal Relief (“BADR”). [1] Please note that these recommendations have no legal force and may or may not be implemented by the U.K. Government. Any changes may be announced in the forthcoming Budget on 3 March 2021.

In this article, we have considered a number of potential impacts on equity held by management and we cover some key considerations for management sellers. Management selling shares on a transaction may consider whether and how they could ‘de-risk’ their position in advance of any potential CGT changes. The form of payment they receive at completion for their equity will have different tax consequences as set out below.

Cash

- Cash payments crystallise an immediate CGT event in the tax year of disposal.

- Sellers should be taxed at current CGT rates and may be eligible for BADR.

Earn-outs

- Earn-outs allow sellers to participate in future upside and buyers to tie up a portion of the sale consideration based on future performance for management to deliver. Deferred cash payments that can be quantified at completion should be subject to CGT in the tax year of disposal at current rates. However, if the cash earn-out is “unascertainable”, the treatment differs. The value of the earn outright is taken into account in the CGT computation in the year of the sale, then if the eventual payment is lesser or greater than the initial expected value there is an additional CGT event at the time the earn-out is paid.

- Therefore, in structuring earn-outs, sellers and buyers might want to consider putting caps and floors on earn-outs and hard-wiring amounts into the calculations, to ensure the earn-out right is ascertainable, and as such, all taxed under the current legislation.

Rollovers

- In many transactions, rollovers of equity are common to lock-in key managers.

- In general, where sellers exchange their shares in the target for new shares or loan notes in the acquisition vehicle, the exchange or “rollover” can be structured to be tax-neutral from a CGT perspective. Subject to conditions, the seller is treated as acquiring the newly issued rollover shares or loan notes in the acquisition vehicle for their base cost in the target shares and the CGT point will be deferred until the sale of the new shares/redemption of the loan notes.

- By deferring the tax point through a rollover, if CGT rates increase, or BADR is no longer available, the amount of CGT which will be chargeable on the gain would increase. Therefore, sellers may press for a cash-out based on current rules and then a re-investment of net proceeds in the acquisition vehicle.

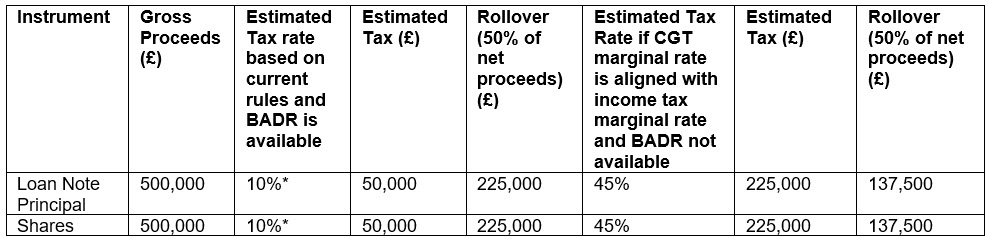

The example below shows the potential impact of cashing out and rollovers.

Example

P.E. Limited has offered £20 million to buy-out Target Limited. The equity value of Target Limited is £10 million after adjustments for debt and cash. Sarah, a management shareholder in Target and additional rate taxpayer, is a key manager who will be rolling into the new structure. Sarah holds 5% of the ordinary share capital of Target Limited and qualifies for a full BADR allowance of £1 million. She also holds £500,000 of shareholder loan notes that she rolled a previous capital gain into.

The table below illustrates the tax implications of cashing out the loan notes and Target shares at current tax rates and with BADR compared to the increased tax rates IF CGT rates are aligned with income tax rates and BADR is no longer available. It also shows the effect of increased tax rates on the amount available to rollover, where rollover is calculated based on 50% of after-tax (net) proceeds.

*(Assumes conditions for BADR are met at the time of disposal which would require detailed review)

Further considerations

Employee Ownership Trusts

- If changes to CGT proceed, the tax benefits to sellers of selling their businesses to an Employee Ownership Trust (“EOT”) will become more pronounced.

- An EOT provides a mechanism for company owners to sell all or a majority stake in their business to a trust established for the benefit of all the business’s employees. An EOT effectively involves an exit for shareholders with no third party making it an alternative to other exit options with low execution risk.

- Subject to conditions, sellers can receive payment for their shares free of CGT with no cap on value.

Private Equity Fund Manager Investors

- The tax regimes applicable to private equity fund manager investors are particularly complex and we recommend that further review is done on how the OTS’s report potentially may impact these arrangements.

- The report does not go into detail regarding carried interest, which is an incentive typically received by private equity fund manager investors, broadly defined as a share of profits paid. However, it does make clear that the special rate (28%) applicable to carried interest, adds complexity. Whether or not the Government chooses to change the regime applicable to such arrangements is yet to be seen.

Growth Shares

- Growth Shares are a method by which shareholders can participate in the growth in value of a company above a pre-determined hurdle. They are a commonly used method of incentivising management teams, with income tax payable on the initial value of the shares and any growth in value subject to capital gains tax.

- The OTS report describes Growth Shares as low value shares acquired by employees on terms that are unavailable to external investors. The report suggests that given the perceived low risk to employees the government should consider taxing any gains made on these shares as income.

- There is an increasing move towards stringent upfront valuations of Growth Shares however with employees often giving meaningful consideration for their shares on the acquisition, leading to increased risk on their part. Provided they are correctly structured, with a robust valuation on the issue, we consider that Growth Shares continue to play an important role in management incentives.

How A&M can help

Our Reward and Employment Tax Solutions team has significant experience in advising on all management tax implications leading up to and post transaction. We can help review legacy cash and equity based incentive arrangements, assist with modelling to estimate the potential CGT implications of transactions, structure management incentive plans, consider alternative structures such as employee ownership trusts and help navigate through the tax regimes applicable to private equity fund manager investors.

Should you require any assistance with the points raised above, please contact your usual A&M point of contact, Louise Jenkins, Samantha Lenox, Nikki Wells, Shirley Ly or Anita Eunson.

[1] BADR, known as Entrepreneur’s Relief before 6 April 2020, means an individual pays CGT at 10% on the first £1 million of lifetime gains on qualifying assets.