Fuzzy Crystal Ball Forecast for Funds and Their Managers if Democrats Control D.C.

While taxpayers are still adjusting their organizational structures and transactions to address the weekly (almost daily) TCJA and COVID-19 guidance issued by the Treasury and IRS, they need to be cognizant that inauguration day is less than six months away. With that in mind, if there is anything that the 2016 election has reinforced, it is that there are no certainties when it comes to politics. This alert sets out to highlight some of the potential tax implications for funds and their managers if Democrats should acquire control of both the White House and Congress. At the outset, it is important to note that former Vice President Biden, the presumptive Democratic nominee, has not released a detailed tax policy document. However, it is likely that the tax plank of the Democratic platform will reflect the joint efforts of the Biden and Sanders teams [1]. Of course, even if Democrats control both the White House and Congress, there is no guarantee that any of these proposals would be adopted. To highlight the potential tax implications, we have developed a summary of the more significant income tax changes Biden has proposed (based on previously issued press reports and institutional white papers)[2].

Impact on Corporations

For corporations, the most impactful proposed change is to the tax rate, with:

- An increase in the standard rate from 21% to 28%, and

- The imposition of an alternative minimum tax of 15% on global book income (while still allowing net operating losses and foreign tax credits), for corporations with more than $100 million in book net income.

A&M Insight: While it is obvious that tax liabilities of corporations would increase under the proposal, the proposed rate increase could have collateral consequences beyond the mere rate differential. For example, it could reduce the amount of tested income or subpart F income of a controlled foreign corporation that is eligible for the high tax exceptions. The higher rate could also raise the cost of restructuring multinational corporations, as it will be harder to offset the full U.S. tax cost with foreign tax credits.

The proposed alternative minimum tax could also impact the expected return on investment from capital intensive projects (because it would reduce the benefit of bonus depreciation), start-up companies and other corporations whose taxable income is likely to be materially lower than their book income. Therefore, for these businesses in particular, we encourage taxpayers to factor in the potential 15% minimum tax.

Another proposed change involves the Foreign-Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI) deduction. Currently, corporate taxpayers are generally entitled to a deduction equal to 50% of their GILTI inclusion. This stays in effect until 2026, when the deduction will be reduced to 37.5% of GILTI. Biden proposes to reduce the amount of the deduction to 25% of the GILTI inclusion.

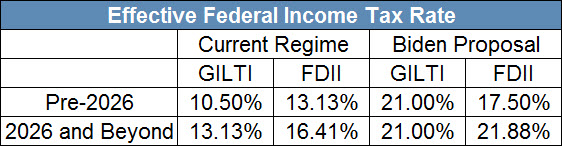

A&M Insight: Currently, the baseline effective U.S. tax rate on GILTI (net income from foreign operations of a controlled foreign corporation) is 10.5% (21% tax rate * GILTI net of 50% deduction). But the combination of the proposed tax rate increase and decreased GILTI deduction would cause the effective tax rate to increase to 21% (28% tax rate * GILTI net of 25% deduction). The combination of the proposals would cause the effective tax rate on GILTI to double. Interestingly, Biden has not proposed to change the 37.5% deduction for FDII, which will be reduced to 21.875% in 2026. The following chart illustrates the effective tax rate on GILTI and FDII under the current regime and under the Biden proposal.

Because the effective tax rate on GILTI is 3.5% higher than the rate on FDII for taxable years before 2026, and only 0.88% less for taxable years after 2025, funds may want to consider restructuring their operations and investments to be less sensitive to GILTI.

Impact on Individual Investors and Fund Managers

For individuals, the most impactful proposed changes are to the tax rates, as:

- The top marginal income tax rate would be increased from 37% to 39.6% for taxpayers with incomes above $400,000, and

- The tax rate on long-term capital gain and dividends would be increased from 20% to 39.6% for taxpayers with income above $1 million.

A&M Insight: The increase in the top marginal tax rate will raise the cost of taxable investments, adding pressure on Funds to generate increased returns. This could be challenging considering the current economy. Individuals with highly appreciated assets may consider hedging the tax rate by selling some of those assets now, before any rate increase comes into effect.

Furthermore, as we await the proposed carried interest regulations, which cleared OIRA on July 16 but have yet to be released, it is also important to note that the Biden proposal could affect fund managers’ carried interests. Under current law, carried interest is eligible for lower long-term capital gain tax rates if held for more than three years. However, most carried interests are held by individuals with income of more than $1 million. As a result, their carried interest income will be subject to ordinary income rates, which will eliminate the tax benefit of capital gain treatment of carried interest and reduce their after-tax proceeds. With that said, Trump has continued to advocate against carried interest. Therefore, fund managers may want to consider their contractual relationships and determine whether the tax advantages of carried interests can be preserved regardless of who wins the White House.

Impact on Partnership Portfolio Companies and Funds

Biden has not proposed any changes to the taxation of partnerships.

A&M Insight: Even though no changes have been proposed for partnerships, this does not mean that partnerships would not be affected by the proposed changes. For example, many partnership agreements allow for tax distributions to offset partners’ tax liabilities on their shares of partnership income. These tax distributions are traditionally (although not always) calculated based on the highest combined U.S. federal, state and local marginal tax rate applicable to a U.S. corporation, individual or tax resident (as applicable) in a high tax state or local jurisdiction (generally New York, NY or California). Increased tax rates for partners would require increased tax distributions.

A&M Taxand Says

As 2016 has shown, the results of an election are impossible to predict. It is equally difficult to foresee which of a candidate’s proposals would see the light of day if he or she is elected. Still, it is important for taxpayers to consider the potential ramifications of candidates’ tax proposals for their current structures, as well as for deals that they are considering. Trump has not outlined any tax proposals for the next term, so it is difficult to compare his policies with Biden’s. As noted above, Biden’s policies lack detail, but it has been reported that he intends “to get rid of the bulk of Trump’s $2 trillion tax cut” (i.e. TCJA). Funds, their managers and portfolio companies should monitor these proposals and quantify their potential impact on current and future investments. A&M Taxand is available to discuss the proposed policies and their implications for your structures and transactions.

[1] See https://joebiden.com/wp-content/uploads/2020/07/UNITY-TASK-FORCE-RECOMMENDATIONS.pdf.

[2] See, e.g., Tax Policy Center, An Analysis of Former Vice President Biden’s Tax Proposals, https://bit.ly/TPCBiden; Tax Foundation, Details and Analysis of Former Vice President Biden’s Tax Proposals, https://taxfoundation.org/joe-biden-tax-plan-2020/; Kiplinger, Election 2020: Joe Biden's Tax Plans, https://bit.ly/KipBiden.