Earnings-based thin cap rules – state of play

Update as of 9 April 2024

Thin capitalisation - the Treasury Laws Amendment (Making Multinationals Pay Their Fair Share) Bill 2023 finally passes

The Australian Parliament recently passed the Treasury Laws Amendment (Making Multinationals Pay Their Fair Share—Integrity and Transparency) Bill 2023 with minor amendments. The Bill will come into force once it receives Royal Assent, which we expect to occur shortly.

The new legislation introduces some new rules which may be applicable to Australian inbound and outbound companies.

Snapshot of the Bill

-

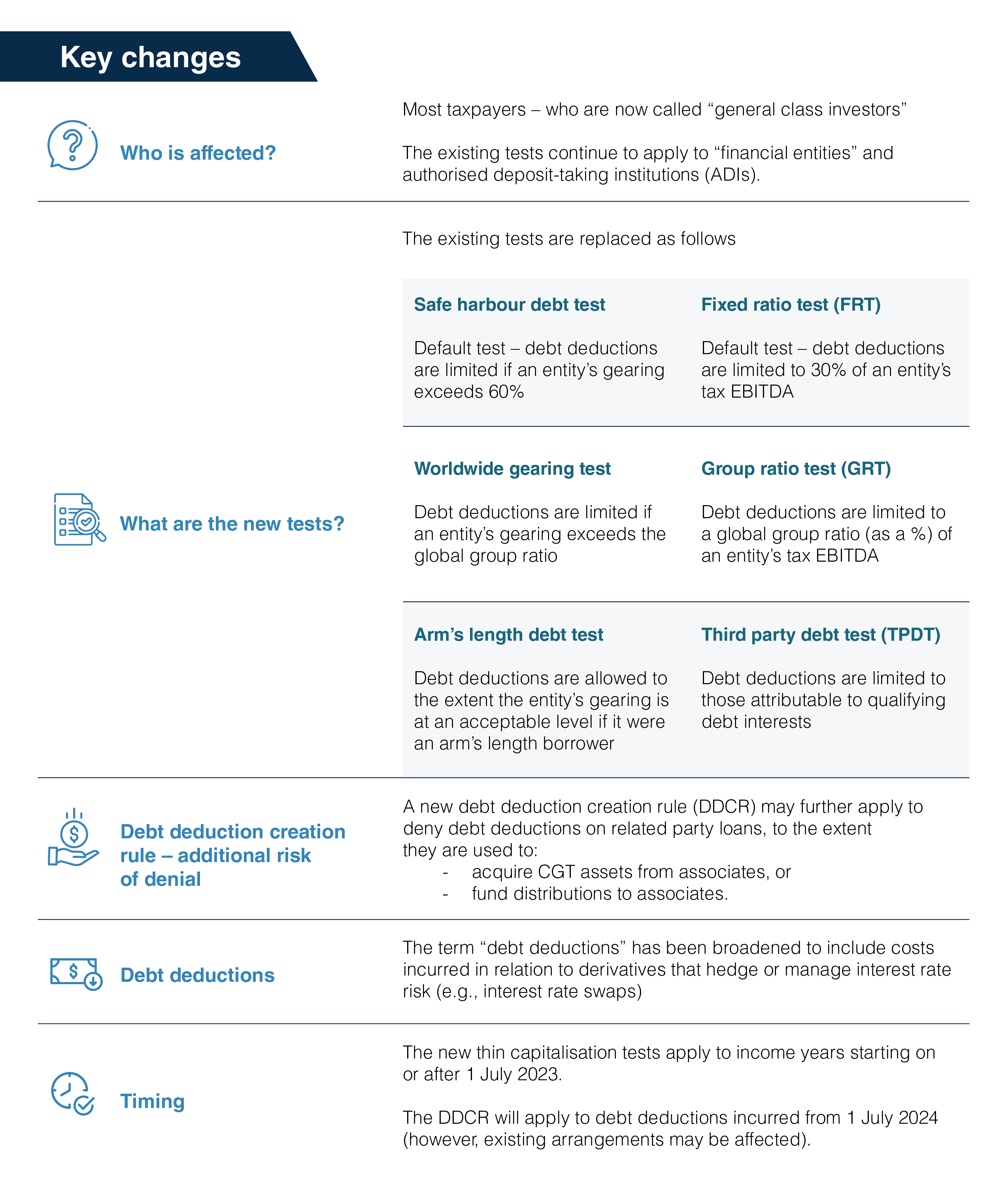

A new thin capitalisation regime in Australia. This includes earnings-based rules to limit debt deductions (replacing the existing safe harbour and balance sheet based gearing limits).

-

A new debt deduction creation rule that may deny debt deductions where related party debt is used to fund certain activities including returns of capital, dividends and recapitalisations.

-

Multinational tax transparency measures. A new regime requiring Australian public companies to disclose details of their subsidiaries in their financial reports.

Key takeaways from the thin cap legislation

-

Start dates - the new thin cap rules will take effect from 1 July 2023 (1 July 2024 for the debt deduction creation rule) as originally announced.

-

Multiple tests - the new thin cap rule may allow taxpayers to apply one of three new tests, the default test being a 30 percent of tax EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation) measure. If not performed already, we highly recommend modelling the impact of these tests (and consideration of your eligibility for the elective tests).

-

Amendments - the final legislation incorporates important amendments to the thin cap rules, proposed by the Government in November 2023. Further (minor) amendments were made to the Bill in the last 24 hours before it was passed, including a requirement for a post-implementation review to occur, and a carve-out for Australian plantation forestry entities (allowing those entities to apply the old rules going forward).

-

Compliance and guidance - the Australian Taxation Office (ATO) is currently developing new disclosures for 2024 tax returns (likely to be released in June 2024), which will include new disclosures and calculations relevant to the earnings-based tests. The ATO is also developing guidance material on key aspects of the new legislation; though, it is unclear when this material will be available. For any burning questions on contentious matters, we are very happy to discuss and/or assist with ATO engagement.

Need help understanding the new legislation?

The new thin cap legislation has retrospective effect and a broad reach. Our Australian team is ready to help.

Published 26 February 2024

This A&M Tax Brief summarises the current state of play for the new Australian thin cap rules, noting that the most recent amendments (circulated by the Government in November 2023) were approved by the senate committee and recommended to be passed as-is.

The new rules are already in effect, although they have not been formally passed by parliament – that is, for taxpayers whose income years have commenced on or since 1 July 2023.

Our analysis below reflects the state of the new thin cap rules, including the latest Government amendments.

|

A&M Perspective

Under the rules (as drafted), a key issue including for corporate Merger & Acquisition (M&A) transactions will be the DDCR, which is a targeted new rule that can deny deductions on many kinds of common commercial arrangements between related parties, such as:

-

Acquiring property from an associated developer for long-term holding purposes (even where both seller and buyer are in Australia);

-

Acquiring trading stock from an associate for use in the ordinary course of business, but leaving a related party payable outstanding;

-

Using a mixture of common funds to pay a dividend to an offshore parent that has provided shareholder debt;

-

Paying an associated entity under a distribution rights agreement with the use of shareholder debt.

What is unclear and how can A&M help you navigate these new rules?

Do taxpayers now need to “trace” funds from related party debt (or other sources) to their ultimate use, to determine whether the DDCR is triggered?

Will the restructuring of existing related party debt arrangements be subject to Australian Taxation Office (ATO) scrutiny, or allowed a transitional period to ensure compliance with the new rules?

Overall, the DDCR could have a significant compliance burden and may require substantial planning to ensure ordinary commercial dealings do not trigger unwanted consequences.

The A&M tax team are well-equipped to help navigate these complex classification rules and how they apply to all kinds of ownership structures. Contact us to discuss your particular circumstances further.