Cracks in the Crystal Ball: TCJA and Other Tax Law Changes to Watch Out For

While every new year brings new opportunities and possibilities, during the first six weeks of 2021 we have already seen a seismic shift in the political (and tax law) landscape. With the Democratic Party winning unified control of Congress and the White House for the first time in 12 years, taxpayers can safely expect major tax law changes are coming. However, how imminent the tax changes are, whether they will include tax increases, and how many revenue measures Congress will consider in the next two years (and under what procedures) are all open questions right now.

Due to the uncertainty surrounding the immediate future, we thought it would be helpful to highlight the changes we know are coming this year and next, as well as to consider how additional changes might come to fruition and what preemptive steps taxpayers can take to mitigate the risk of any upcoming tax increases.

Specifically, this alert covers the following topics:

- Pre-Inauguration TCJA Regulations

- Expiring TCJA Provisions

- COVID-Related Tax Relief and Other Provisions

- Legislative Tax Changes

- New Treasury Personnel and The Potential Impact on Regulations

In this ever-changing tax environment effective and efficient tax planning requires taxpayers to stay abreast of current political and legislative developments. Fortunately for you, this task is made easier with the help of your trusted A&M advisor, who can provide you with the latest insights and assist you with your decisions.

Pre-Inauguration TCJA Regulations

Before leaving office, the Trump Administration worked feverishly to complete nearly all regulatory projects under TCJA provisions that have already taken effect. However, now that the Democrats have control of both houses of Congress and the White House, they could use the Congressional Review Act (CRA) to review many of these regulations. The CRA gives Congress 60 working days, keyed to the lesser of House legislative days or Senate session days, to overturn major regulations through a joint resolution of disapproval, signed by the President. Major regulations are regulations that have an annual effect of $100 million or more on the economy. When a CRA joint resolution of disapproval is enacted, it has the effect of not only striking the regulation in its entirety, but also preventing the federal agency from issuing a substantially similar regulation in the future.

While it is notable that a CRA resolution has never been used to nullify a tax rule, likely owing to the prohibition on reissuance of substantially similar rules, given the flurry of activity coming out of Treasury the past few months, the CRA could have significant implications for a number of recently finalized tax regulations.

A&M Insight: Senate Democrats have not yet discussed using the CRA to overturn TCJA, or other tax, regulations. But the Democrats’ broader approach will be guided by floor-time constraints, post-COVID tax plans, and the bluntness of the CRA instrument itself. Given their ambitious legislative agenda, it is unlikely that Democratic leaders will want to burn working days repealing regulations implementing tax statutes that could themselves be modified or repealed shortly – or, for provisions unlikely to be repealed, whether they want to throw the baby out with the bath water by tying Treasury’s hands with respect to issuing revised regulations.

Democrats have made clear that they intend to undertake their own version of tax reform. However, what Democratic tax reform will consist of, and to what extent it will entail repeal of the Trump Administration’s signature piece of tax legislation, the TCJA, remains to be seen. Regardless of whether Democrats choose to repeal all or parts of the TCJA, if no other action is taken, a number of key TCJA provisions will take effect or expire over the next few years.

80% Limitation on Post-TCJA NOLs

TCJA allowed post-TCJA net operating losses (NOLs) to offset no more than 80% of taxable income in the year to which they are carried, and disallowed carrybacks. As a result, it is likely that taxpayers that have NOLs, but current taxable income, will have to pay some amount of tax in the coming years. The CARES Act delayed the implementation of the 80% limitation to taxable years beginning after 2020, so that post-TCJA NOLs that were deducted prior to 2021 were not subject to the limitation. The CARES Act also allowed taxpayers to carry NOLs from 2018, 2019, and 2020 back to the five taxable years preceding the loss year. Among other benefits, this allowed some NOLs to be carried back and deducted against income subject to the 35% corporate rate in effect before TCJA. However, beginning this year, post-TCJA NOLs are subject to the 80% limitation, and new NOLs may not be carried back.

A&M Insight: The use of corporate NOLs has become a hot-button political issue for congressional Democrats, and extension of the CARES Act’s NOL relief provisions seems unlikely. With that in mind, taxpayers that are preparing their 2020 tax returns should determine if it is possible and advantageous for them to accelerate deductions into 2020, possibly creating an NOL that can be carried back. However, the extent, if any, to which a taxpayer would benefit from an NOL carryback requires modeling, as it can impact many different tax return items.

R&D Amortization

Through 2021, taxpayers are allowed to take an immediate deduction for specified research and development (R&D) expenses. However, starting in 2022, taxpayers will no longer be able to deduct these costs immediately. Rather, under a change enacted in the TCJA, they will be required to capitalize R&D costs and deduct them over a five-year period (fifteen-years for research conducted outside the United States) beginning with the midpoint of the taxable year in which the expense occurs.

A&M Insight: Assuming the law is unchanged, taxpayers are incentivized to accelerate R&D expense into 2021 to the extent possible. It is important to note that this is an area of the tax law that is currently highly unstable because the change in law was not based on policy, but rather on the need to raise revenue to satisfy the TCJA reconciliation instructions. Bipartisan support exists on both tax-writing committees for repeal of the 2022 change. Commentators have suggested that further R&D reforms could be considered as part of Democratic tax reform or in connection with the various onshoring proposals. Failing that, that implementation of the amortization provision could be postponed until the economy has recovered from the current pandemic, which would convert the deduction into a tax extender.

Change from EBITDA to EBIT for Purposes of the Limitation on the Business Interest Deduction

The TCJA imposed restrictions on the deduction of business interest expense. Before the enactment of the TCJA, only interest paid to a foreign (or tax-exempt) related party was limited, and then only when the taxpayer was thinly capitalized – that is, their debt to equity ratio exceeded 1.5 to 1. If they were, their related party interest deductions were limited to 50% of earnings before interest, taxes, depreciation, amortization, and depletion (EBITDA). The TCJA eliminated the requirement that interest be paid to a related foreign person and the debt-to-equity safe harbor, and lowered the limitation to 30% of adjusted taxable income (ATI). The TCJA generally allows a taxpayer’s ATI to be measured based on EBITDA through 2021. Thereafter, the measurement of ATI will be based on a tighter metric – generally earnings before interest and taxes (EBIT).

The CARES Act provided more generous relief. Congress understood that the economic downturn would require companies to borrow more, and for some companies to increase their debt loads substantially. Therefore, Congress temporarily increased the limitation on business interest expense deductions from 30% to 50% of ATI for 2019 (for all taxpayers other than partnerships) and 2020 (for all taxpayers).

A&M Insight: From a policy perspective, there may be a direct relationship between the section 163(j) business interest expense limitation and the corporate income tax rate. If Congress increases the corporate tax rate, as Democrats have said they will, they could leave in place a taxpayer-friendly provision, such as the EBITDA standard, to soften the impact of the tax rate increase.

Phaseout of 100% Bonus Depreciation

The TCJA temporarily put in place immediate expensing of the cost of assets with recovery periods of 20 years or less, such as machinery and equipment. The cost of assets placed in service after September 27, 2017, is 100% deductible in the year of purchase through 2022 (decreasing by 20% every year after 2022).

A&M Insight: Like R&D amortization, 100% bonus depreciation is a provision that can be considered in two contexts—Democratic tax reform or revitalization of domestic manufacturing. A number of Democratic lawmakers have previously supported 100% bonus depreciation, and it seems to be something they could easily support again.

The TCJA's “Fiscal Cliff”

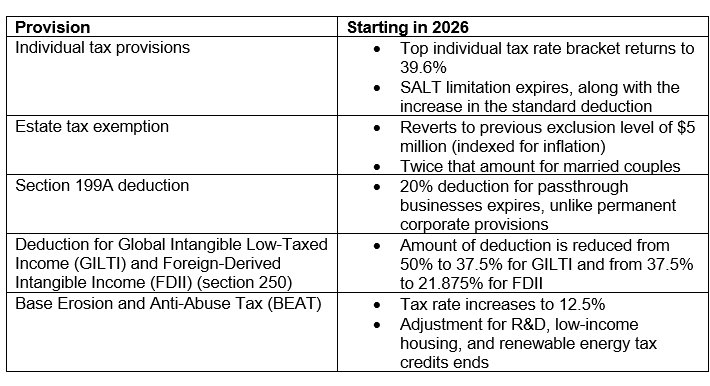

While 2026 seems so far away, we would be remiss if we did not mention that there are a number of provisions within the TCJA that are slated to phase up, down, or out after December 31, 2025. Unfortunately, many of these already scheduled changes will mean bigger tax bills. Particular attention should be paid to a number of provisions, including:

A&M Insight: If the Consolidated Appropriations Act, 2021 (CAA), the year-end omnibus spending and COVID-relief package, is any indication, congressional leaders and tax-writers will increasingly look toward December 31, 2025, as the expiration date for all temporary tax provisions, setting up an even bigger cliff for their future selves to deal with. While it is hard to predict with any certainty what a future Congress may do, it is safe to assume that there will be considerable political pressure to delay or eliminate many of the tax increases scheduled under current law.

COVID-Related Tax Relief and Other Provisions

Taxpayers have even more balls to juggle outside the context of the TCJA. On the one hand, they need to worry about pre-2017 tax provisions springing back to life. On the other hand, they need to keep track of a host of COVID-related tax relief provisions. These provisions, which were enacted last year, are set to expire over the next two years. It is important for taxpayers to carefully manage cash flow to ensure that the expiration of these provisions, which were intended to provide additional liquidity, does not end up causing them an unforeseen cash crunch.

2021

There is truly no time like the present. Section 864(f), which provides an elective regime for the apportionment of worldwide interest, was added to the code in 2004. However, after numerous delays, 2021 marks the first year that the provision is effective (barring another delay). Currently, for their first taxable year beginning after December 31, 2020, existing worldwide affiliated groups are required to opt-in or out of worldwide interest apportionment under section 864(f), possibly forever. However, legislative text from the House Ways and Means Committee, which was released as part of a COVID bill, would eliminate the elective regime. If the regime remains, commentators expect preliminary guidance could allow taxpayers until late 2022 to decide whether to opt-in or stay out.

A&M Insight: Leveraged companies, in particular those more highly leveraged outside the United States, would be wise to explore the potential benefits of an election under section 864(f). However, as the provision has been inapplicable since 2004 and the international tax landscape has been dramatically altered, many hope that further guidance will be provided to assist with the complex modeling necessary to appreciate the potential interactions of the election on various provisions, including GILTI and the foreign branch rules, the foreign tax credit limitations that apply to those baskets, and the subpart F and GILTI high tax exceptions.

Additionally, a few provisions of the Families First Coronavirus Response Act (FFCRA) and the CARES Act were extended by the CAA, but will expire during 2021, including:

- Employer tax credit for paid sick and family leave

- While the CAA did not extend the FFCRA’s mandatory paid sick and family leave program, it did extend the program on a voluntary basis, including extending the tax credit for employers who provide employees with paid leave through March 31, 2021.

- Partial plan termination grace period

- The CAA extended through March 31, 2021 the rule protecting against partial plan termination for employers who provide 401(k) or other qualified retirement plans and whose employee turnover exceeds 20%.

- Enhanced employee retention tax credit (ERTC)

- The CAA extended and enhanced the ERTC and made it applicable to compensation paid through June 30, 2021.

- Under the CAA, eligible employers that received a PPP loan are eligible for the ERTC, retroactive to the enactment of the CARES Act. So, taxpayers that were previously ineligible for the ERTC in 2020 due to receiving a PPP loan can now retroactively claim the credit. In fact, employers that did not claim the credit because they had received a PPP loan may treat the qualified wages they paid in the first three quarters as having been paid in the fourth quarter of 2020. This will enable those employers to claim the ERTC using a Form 7200 or Form 941, instead of having to file amended returns for the previous quarters.

Rounding out the year, taxpayers are reminded that there is a December 31st payment deadline for 50% of the employer Social Security payroll taxes that were deferred in 2020 under the CARES Act. The remaining 50% is due on December 31, 2022.

End of 2022

Thanks to the CAA, for the next two years, the business expense deduction for meals provided by a restaurant is increased from 50% to 100%. The enhanced deduction does not apply to entertainment expenses, and business meals not “provided by” a restaurant remains subject to the recently issued final regulations discussed in detail in a recent Coffee Talk.

A&M Insight: Considering the toll shutdown orders are taking on most restaurants’ bottom lines, and continuing displeasure with the TCJA changes, there will be continued pressure to extend the CAA provision beyond 2022. However, one of the key questions prerequisite to understanding the potential benefit of the increased deduction is what constitutes a “restaurant”.

During the 117th Congress, tax is likely to be a central component of many pieces of legislation, including the next stimulus bill, infrastructure legislation, and Democratic tax reform. President Biden originally said that he wanted to work on a bipartisan basis to complete additional stimulus legislation, which would obviate the need for the use of reconciliation. However, when Republicans pushed back against Biden’s $1.9 trillion American Rescue Plan and offered a $618 billion proposal of their own, Democrats dismissed the GOP proposal as insufficient and immediately began the budget reconciliation process. Whether the moment has passed or there is still an (albeit slim) opportunity to pursue bipartisan legislation is a question lawmakers are asking themselves this very moment.

Achieving bipartisan legislation not only would require Republicans to accept significantly greater spending than provided in their bill, but would also almost certainly force Democrats to exclude tax increases and to rely solely on deficit-financed spending. While neither party has shown much fiscal restraint lately, it remains to be seen whether there is a topline spending number between $618 billion and $1.9 trillion that can appease Democrats while also enabling Republicans to participate in the current COVID relief effort, similar to the dynamics we saw play out last year.

A&M Insight: If they see a political advantage, Republicans will likely continue to hold on to their recently rediscovered fiscal conservatism.

Assuming the price tag remains a sticking point that prevents bipartisan legislation, Democrats have the option of using reconciliation to pass a stimulus bill or any other legislation affecting revenues, spending, and the debt limit by a simple majority vote in the Senate (with 51 votes instead of the usual 60 votes necessary to overcome the filibuster). Perhaps unsurprisingly, reconciliation has been Congress’ go-to mechanism for processing controversial legislation when control of the White House and both houses of Congress rests in the hands of a single party. Knowing this, perhaps even more unsurprisingly, reconciliation is where Democrats turned the minute they disliked Republicans’ negotiating posture on another round of COVID relief. (Whether this play was simply to gain additional negotiating leverage will become clear in the next couple of weeks.)

One unique feature this year is that Democrats may use reconciliation not once but twice. Glossing over some procedural details that are not important to our discussion, because Congress has yet to complete budget reconciliation for the current fiscal year, 2021, it may pass two tax and spending reconciliation bills this calendar year, one for fiscal 2021 and one for the following fiscal year, which starts on October 1, 2021.

A&M Insight: If Democrats in Congress use reconciliation to enact a Democratic COVID relief measure, they likely will not be able to impose partisan tax increases until at least October 1 of this year, the start of the next budget period for which revenues and spending would be reconciled. For this reason, Republicans may have an incentive to be unreasonable in the stimulus negotiations if they believe significant tax increases are unlikely to be included in a partisan relief measure (right now further tax cuts, such as repeal of the $10,000 cap on state and local tax deductions, seem more likely) and Democrats’ use of reconciliation to circumvent Republican obstruction will significantly delay Democratic efforts to increase taxes on wealthier taxpayers and corporations, efforts that were recently bolstered by the addition of Senator Elizabeth Warren to the Senate Finance Committee.

Another issue to consider is whether any of the tax law changes in these bills will be retroactive to the beginning of 2021. Tax legislation typically has one of three effective dates: the first of the year of, or the year following, enactment; the date of introduction; or the date of enactment. Sometimes effective dates are chosen based on fairness. If a tax law change is intended to induce or discourage certain behavior, Congress will choose a day on or before the change became public. Other times, effective dates are chosen based on what the politics of the situation will bear. For example, most of the TCJA did not become effective until January 1 of the year after its enactment. Similarly, in order to secure the votes necessary for passage, the Affordable Care Act’s 3.8% net investment income tax (NIIT) and Cadillac tax were given delayed effective dates. (The Cadillac tax never took effect. After many delays, it was repealed in 2019.)

A&M Insight: While taxpayers are right to be concerned, the Democratic majority in the Senate may be too slim to support major retroactive tax changes. That said, it is important to keep two points in mind. First, retroactive tax increases are generally constitutional, especially when made retroactive only to the beginning of the calendar year they are enacted. Looking at historical precedents, this was the approach taken in the Omnibus Budget Reconciliation Act of 1993 (the so-called Clinton tax increase), which passed under reconciliation in August of that year. Second, nonretroactive rate changes made midyear may have the effect of being retroactive if they are subject to tax rate blending under section 15.

New Treasury Personnel and The Potential Impact on Regulations

The Biden Administration has been busy staffing the Treasury Department with a number of tax world and Obama Administration veterans, including Kimberly Clausing, Itai Grinberg, Rebecca Kysar, and Tom West. The recent appointees join Mark Mazur, former Assistant Secretary for Tax Policy under President Obama, who rejoined Treasury last month. These personnel announcements are significant in that they provide initial insights into the administration’s potential approaches to tax policy. For example, Clausing has testified before Congress and, in a recent paper, advocated increasing the corporate tax rate and eliminating the deduction for foreign-derived intangible income.

A&M Insight: This is a highly skilled and knowledgeable crew, some of whom have a strong anti-TCJA bias. Because they know the regulatory process (West served as Tax Legislative Counsel at Treasury during the Obama and Trump Administrations), they will not have any trouble getting up to speed, which will enable Biden’s Treasury Department to start to release guidance sooner than other incoming Administrations. The appointment of these individuals also suggests we may see a continuation of many Obama-like policies, including the resumption of some regulation projects that were nearly complete but shelved because of policy differences with the Trump Administration.

A&M Taxand Says

While Ferris Bueller reminded us that life moves fast, over the next two years, the tax code may move even faster. However, with comprehensive modeling and intelligent planning, taxpayers need not be caught flat-footed by the changing tax environment. By engaging a trusted resource like A&M, which has the expertise needed to assist clients with their complex decisions, you will be well positioned to accomplish your goals. As highlighted in this alert, the tax law is in a perpetual state of flux, the pace of which is increasing. With the prospect of tax law changes (either legislative or regulatory) being around the corner, the time to plan is now.