COVID-19 Impact Predicted to Prompt Swell of Activist Interest in U.K. Corporates

Global professional services firm Alvarez & Marsal (“A&M”) today announces the findings of its latest analysis and predictor of shareholder activism in Europe, the “A&M Activist Alert”, or “AAA”.

The sixth edition of the study predicts that, following a resetting of the battlefield for activist investors due to the pandemic, there will be a renewed interest in U.K. targets through 2021. Despite a lull in activist campaigns during the first wave of COVID-19, the disruption wrought on the corporate landscape means that “crunch time” is fast-approaching for many companies that have underperformed during the crisis. The AAA also predicts that technology, healthcare and industrials will be the most targeted sectors.

Since the publication of the last AAA report in December 2019, 44 of the predicted targets have faced public activist campaigns.

Regional trends

- Given the corporate reset prompted by COVID-19, the increased activist interest in Continental European companies over recent years, whilst remaining a significant force, is predicted to cool somewhat, with a shifting focus back towards the U.K.

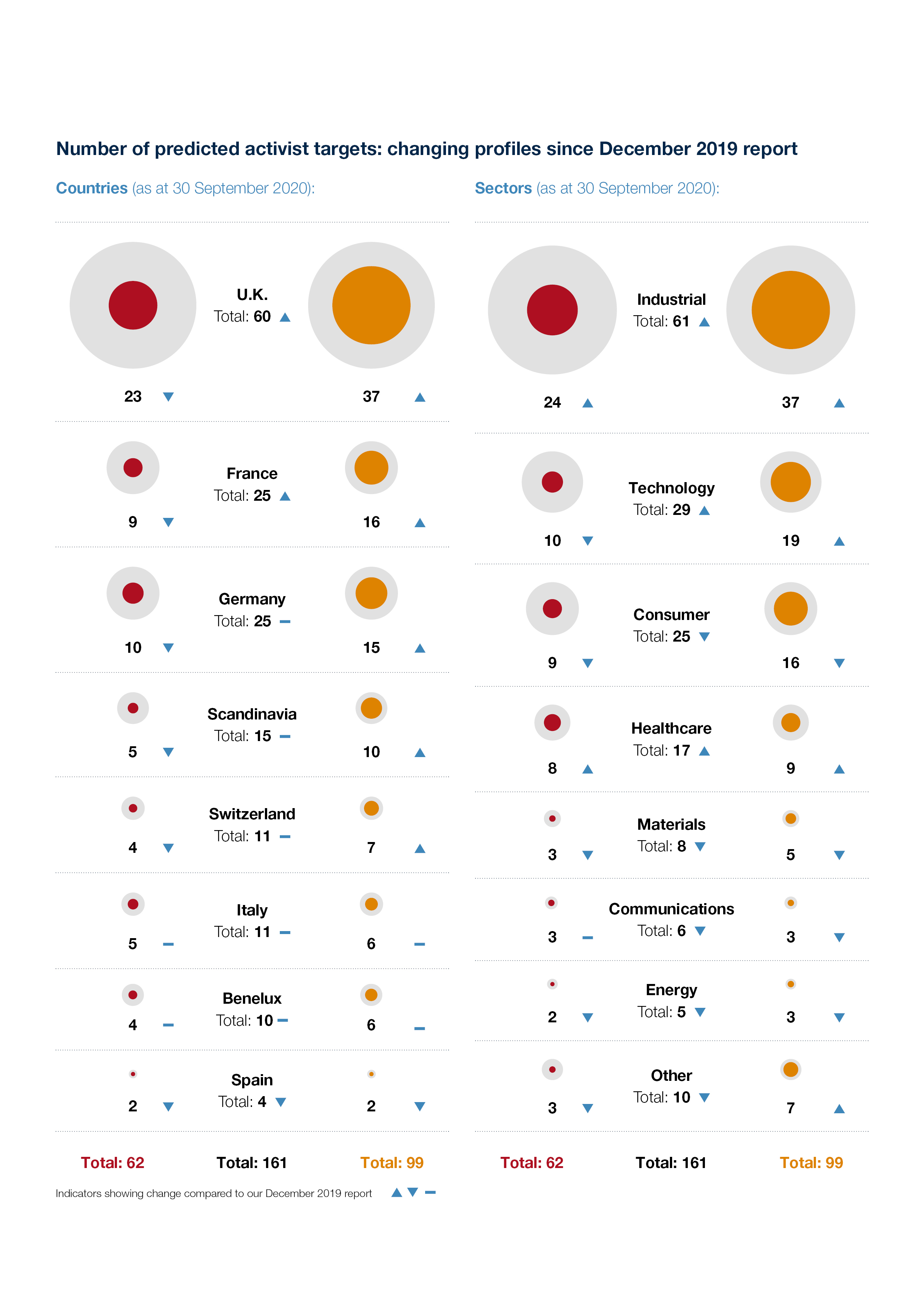

- The U.K. is therefore predicted to see the largest increase in public activist campaigns, with 60 companies now predicted to be at risk compared with 54 in December 2019, accounting for 37% of all at-risk companies.

- A key driver for this heightened interest is that the performance of U.K. corporates has been worse hit by the crisis than many of their Continental European counterparts*, therefore more opportunities exist to drive increased shareholder value. The country’s activist-friendly governance and regulatory environment also make the U.K. more conducive to activist targeting.

- Meanwhile, the predicted targeting of Continental European corporates is flat year on year. Companies in France and Germany are the top targets for activists looking outside the U.K., with 25 corporates in each country predicted to be at risk. This is followed by Scandinavia, where 15 companies are also similarly at risk.

Malcolm McKenzie, Managing Director and Head of European Corporate Transformation Services, said: “Before the pandemic hit, activist targeting of Continental European corporates was growing rapidly, as investors became increasingly confident and ambitious in their campaigns. But the COVID crisis has reconfigured the landscape for activism across Europe. In the face of systemic shock, corporate performance has varied greatly, particularly in the U.K., which has created an attractive hunting ground for activists, exposing weaker companies that offer a compelling route to increased shareholder value. Management who have ignored the early signs must act now, or may soon be forced to confront the uncomfortable scenario of an activist attack.”

Sector and developing trends

- Consumer-focused companies will continue to fall out of favour, representing 25 predicted targets, down from 32 in December 2019 and 43 in December 2018. The COVID-19 disruption to areas such as hospitality, physical retail and travel has left much of the sector too deeply damaged to be of immediate interest to activist investors.

- Instead, we expect more activist campaigns to target industrial, technology and healthcare companies. The number of predicted targets among industrials increased again in this latest analysis to 61 (up from 52 a year ago), and this sector now accounts for 38% of all “at risk” companies.

- Activists will increasingly turn their focus to the technology-sector with 29 companies now predicted to be at risk, up from 24 a year ago. The pandemic has increased the gap between the strongest and weakest performers offering opportunities for activist intervention.

- Healthcare companies are also expected to attract activist attention, with 17 predicted targets against the 14 identified 12 months ago. Although sentiment towards the sector has generally been positive during the pandemic, companies that have let their underlying profitability slip cannot expect to escape scrutiny during 2021.

- There are strong indications that ESG issues will play an increasingly important role in activist campaigns. Environmental and social issues have become much more prominent during the COVID-19 crisis, and these issues are now behind a growing number of campaigns against boards by mainstream institutional investors. Our research also shows the importance of diversity on company boards: companies with more even gender balance on their boards are at lower risk of being targeted.

- Activist campaigns focused on operational improvement (see A&M’s October research) are expected to continue to drive more favourable share price returns, versus other types of activist campaign.

Malcolm McKenzie, Managing Director and Head of European Corporate Transformation Services, said: “Crunch time for some sectors is fast approaching. Surprisingly, even sectors deemed to be ‘COVID winners’ such as technology and healthcare are not immune from activist attention; they will in fact find themselves on the activist ‘most wanted’ lists for 2021. Meanwhile, the increased scrutiny the pandemic has prompted around ESG issues will not go away. The signs are that this focus will translate into many prominent environmental and social focused campaigns next year, so it is critical that boards don’t let standards slide when it comes to ESG.”

* This disruption is evidenced by the return on capital employed dropping 0.8 percent for the average U.K. company over the six months to the end of September 2020, compared with a 0.4 percent decline across Continental Europe.

-ENDS-

Notes to Editors

A&M Activist Alert

The AAA is the most comprehensive statistical analysis of its kind. The analysis focuses on 1,601 corporates with a market capitalization of US$200 million or more, listed and headquartered in the U.K., Germany, France, Scandinavia, Switzerland, Benelux, Italy and Spain. The resulting predictive model successfully predicted the majority of corporates publicly targeted by activists since January 2015. The report is typically published twice yearly and individual companies can check their position on the Alert List by contacting A&M.

The ESG analysis used ESG ratings obtained from Bloomberg and Refinitiv for the 1,601 European corporates analysed. These ratings were split into four quartiles for the entire sample, and for each of the countries/regions. A&M then identified those companies in each quartile that had been targeted by activists since 2017 in order to identify which quartiles contained the largest numbers of targeted companies.

Key findings

Red and Amber Lists

The AAA model calculates a score for all analyzed corporates that predicts the likelihood of public activist action. Companies with high AAA Scores, and therefore with a higher predicted likelihood of public targeting, are classified as either Red or Amber alerts. These classifications are based on the level of AAA Score and how sustained it has been over the past two years.

Corporates with high AAA Scores on both the two year and one year bases are considered to be at high short term risk (next six to 12 months) of public activist action and may already be subject to non-public approaches. Such high-risk corporates feature on the Red Alert list. Companies with a high AAA Score on either the two year or one year basis are likely to be being monitored by activists. Such companies are considered to be at medium risk which will only increase if corrective action is not taken within 12 to 18 months. Such medium risk corporates feature on our Amber Alert list”.