China Introduces Due Diligence Checks on Tax-Related Matters of Non-Residents’ Financial Accounts

Financial institutions established in China are now required to perform due diligence procedures on non-Chinese residents who hold financial accounts with the institutions, as well as to collect and submit requested financial account information to the Chinese authorities.

On May 19, 2017, the People’s Republic of China State Administration of Taxation (SAT), Ministry of Finance, People’s Bank of China, China Banking Regulatory Commission, China Securities Regulatory Commission, and China Insurance Regulatory Commission jointly released the “Announcement on Promulgation of the Administrative Measures on Due Diligence Checks on Tax-related Information of Non-residents’ Financial Accounts” (referred to as “Announcement 14”), which will be enforced starting July 1, 2017. The first reporting to be made under Announcement 14 by the financial institutions would be before May 31, 2018.

The enforcement of Announcement 14 signals the localization of the Common Reporting Standard (CRS) in China, following the SAT’s signing of the “Multilateral Competent Authority Agreement on Automatic Exchange of Financial Information in Tax Matters” with the Organisation for Economic Co-operation and Development (OECD) in December 2015, committing to mutually exchange the financial account information of foreign tax residents with other countries/jurisdictions starting September 2018.

What Is the CRS?

The Common Reporting Standard was approved by the OECD Council in July 2014. The CRS calls on countries/jurisdictions to obtain information from their financial institutions and automatically exchange that information with other countries/jurisdictions on an annual basis. It sets out the financial account information to be exchanged, the financial institutions required to report, the different types of accounts and taxpayers covered, and common due diligence procedures to be followed by financial institutions.

As required by the CRS, the financial institutions shall collect information (such as name, taxpayer identification number, tax residency country/jurisdiction, account year-end balance, and information in relation to interest income, dividends and capital gains) from non-resident account holders and report to local tax authorities on an annual basis. Such information will be exchanged with the tax authorities where the account holders are tax residents of those countries/jurisdictions.

Currently, over 100 countries/jurisdictions have already committed to the automatic exchange of information, of which 50+ countries/jurisdictions implemented the standard with effect from January 1, 2016, while others (e.g., China) will generally implement the standard from January 1, 2017.

Who Are the Reporting Entities?

Financial institutions established and operating in China should follow the Chinese CRS compliance rules by conducting due diligence checks on non-tax residents holding financial accounts in China and reporting to the Chinese authorities. These financial institutions include:

- Commercial banks and other policy banks that accept deposits from the public;

- Securities companies;

- Futures companies;

- Securities investment fund management companies, private equity fund management companies and partnerships;

- Insurance companies and insurance asset management companies;

- Trust companies; and

- Other qualified organizations.

It is worth noting that branches of overseas financial institutions operating in China are equally required to follow the Chinese CRS requirements. On the other hand, overseas branches of Chinese financial institutions and overseas investment funds raised by Chinese firms shall be subject to local CRS rules in their respective countries/jurisdictions where they operate.

Who Are the Targets of Due Diligence Checks?

Due diligence checks will be conducted on financial accounts that are held by non-Chinese tax residents (i.e., organizations and individuals) and/or passive non-financial institutions controlled by non-residents. Financial accounts mainly include three types:

- Deposit accounts;

- Escrow accounts: brokerage accounts, wealth management products, funds, trust plans and other financial products that are managed by financial institutions;

- Other accounts: partnership interest and trust beneficiary rights of private equity funds, as well as insurance contracts with cash value.

The above-mentioned financial accounts include both existing and newly opened accounts.

The following types of companies are excluded from the above-mentioned due diligence checks to be conducted by financial institutions in China:

- Listed companies and their affiliates;

- Government agencies or organizations performing public service functions;

- Holding companies established for the sole purpose of holding equity shares in non-financial institutions or providing financing and services to non-financial institutions;

- Companies established for less than 24 months that have yet to commence business;

- Companies undergoing asset liquidation or reorganizations;

- Companies undertaking financing and hedging transactions with related parties (all members of the group shall be non-financial institutions); and

- Non-profit organizations.

Due Diligence Procedures and Timing Requirement

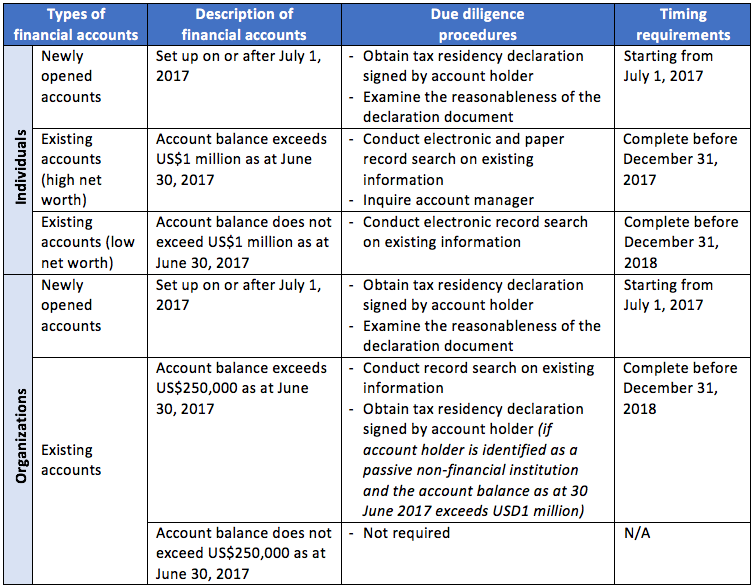

Due diligence procedures and reporting timing requirements for different types of financial accounts are as follows:

Note: Financial institutions shall complete registration through the SAT website before December 31, 2017, and report the information of non-resident accounts to the SAT as required before May 31 every year.

Alvarez & Marsal Taxand Observations

Financial Institutions

Compliance Management

Non-compliance with CRS may result in reputation damage and the revocation of operating permits in the countries/jurisdictions of operation. Therefore, it is significantly challenging but important for financial institutions to implement CRS successfully. Generally, we have observed that in the financial industry, centralization and streamlining processes are broadly recognized and implemented to manage complex compliance obligations. We believe the CRS implementation should follow a similar path to effectively protect the best interests of the financial institutions.

A noteworthy point for multinational financial institutions is that the diverse detailed CRS implementation guidance for 100+ participating countries/jurisdictions will create more complexity for centralized management. Therefore, keeping up with the updates of local CRS requirements is another challenge for multinational financial institutions.

CRS and FATCA

CRS regulations are built on the blueprint of the U.S. Foreign Account Tax Compliance Act (FATCA). In 2014, China and the United States reached an “in substance” inter-governmental agreement on cooperation with respect to FATCA. Although both countries are actively negotiating on the inter-governmental agreement, Chinese regulatory authorities have not yet rolled out detailed implementation guidance for FATCA. It is foreseeable that both the CRS and FATCA compliance burden will be imposed on Chinese financial institutions. Although the CRS and FATCA rules are similar in nature, the gaps between them still need to be identified and handled properly. It is envisaged that additional implementation costs will be incurred and even separate compliance teams may have to be established.

Financial Account Holders

As the SAT emphasizes, automatic exchange of information (AEOI) among countries/jurisdictions is an approach to strengthen cross-border tax compliance management and risk assessment. The AEOI standard, which was built upon FATCA, was developed by the OECD to provide guidance on the collection and exchange of financial account information. The AEOI standard includes two parts: Multilateral Competent Authority Agreement and CRS. No additional tax obligations shall arise for taxpayers. Therefore, it is important for PRC tax residents with overseas financing accounts to pay attention to their global tax compliance status, as over 100 countries/jurisdictions agreed to implement the AEOI standard and to develop local CRS rules.

Assessment of Tax Resident Status

Different countries/jurisdictions have different definitions for tax residents. The criteria and standards to determine the tax resident status usually include length of stay for individuals and place of registration or place of actual management for organizations. Announcement 14 provides a set of sample self-certification forms for the reference of reporting financial institutions. For newly opened accounts of individuals, financial institutions would identify the tax residency status of the account holders based on the self-certification forms signed by the account holders.

Given that holders of high-net-worth accounts tend to develop international business and may possess overseas financial accounts, their duration of stay in each country/jurisdiction may vary, therefore making the assessment of their tax resident status in each country/jurisdiction even more complex. It is suggested that holders of overseas financial accounts consider seeking professional assistance from tax advisors about their tax resident status in different countries/jurisdictions where they hold financial accounts.

Management of Overseas Financial Accounts

Once the tax resident status is determined, holders of overseas financial accounts shall, per local CRS rules, cooperate in due diligence checks and submit requested information to the financial institutions where they hold financial accounts. As China will exchange information with other countries/jurisdictions for the first time in 2018, information in relation to overseas financial accounts held by Chinese tax residents (both individuals and organizations) will be exchanged and submitted to Chinese tax authorities by then. It is noteworthy that strengthened supervision would be placed on overseas income derived by Chinese tax residents (i.e., foreign investment, labor income, etc.), as they are subject to tax in China.

Having said that, the types of information to be exchanged under the AEOI standard are currently limited; for instance, real properties or active non-financial institutions held by non-residents are not included in the scope of information to be exchanged. As a result, there are potential opportunities for overseas financial account holders, especially those who are holding high-net-worth accounts, to manage and reasonably allocate their global assets through legitimate arrangements. It would be efficient to seek professional tax advice on analyzing the overall tax compliance risks and on making timely adjustments to lower the global tax burden.

Alvarez & Marsal Taxand Says:

It is significantly challenging but important for financial institutions to implement local CRS rules and for financial account holders to timely respond to requests from financial institutions to avoid non-compliance consequences. Financial institutions should be well prepared for the diverse detailed CRS guidance across 100+ participating countries/jurisdictions, which may be a challenging issue. Although there is a long way to go for CRS to be implemented for the purpose of cracking down on tax avoidance schemes or matters, non-resident entities and individuals, in particular financial account holders of high-net-worth accounts, should pay attention to their global tax compliance status and consider the impact of the local CRS rules with professional assistance from their tax advisors.

Disclaimer

The information contained herein is of a general nature and based on authorities that are subject to change. Readers are reminded that they should not consider this publication to be a recommendation to undertake any tax position, nor consider the information contained herein to be complete. Before any item or treatment is reported or excluded from reporting on tax returns, financial statements or any other document, for any reason, readers should thoroughly evaluate their specific facts and circumstances, and obtain the advice and assistance of qualified tax advisers. The information reported in this publication may not continue to apply to a reader's situation as a result of changing laws and associated authoritative literature, and readers are reminded to consult with their tax or other professional advisers before determining if any information contained herein remains applicable to their facts and circumstances.

About Alvarez & Marsal Taxand

Alvarez & Marsal Taxand, an affiliate of Alvarez & Marsal (A&M), a leading global professional services firm, is an independent tax group made up of experienced tax professionals dedicated to providing customized tax advice to clients and investors across a broad range of industries. Its professionals extend A&M's commitment to offering clients a choice in advisers who are free from audit-based conflicts of interest and bring an unyielding commitment to delivering responsive client service. A&M Taxand has offices in major metropolitan markets throughout the United States and serves the United Kingdom from its base in London.

Alvarez & Marsal Taxand is a founder of Taxand, the world's largest independent tax organization, which provides high quality, integrated tax advice worldwide. Taxand professionals, including almost 400 partners and more than 2,000 advisers in 50 countries, grasp both the fine points of tax and the broader strategic implications, helping you mitigate risk, manage your tax burden and drive the performance of your business.

To learn more, visit www.alvarezandmarsal.com or www.taxand.com