Before They Knock: A Proactive Approach to Activist Defense

Boardrooms are under a historic level of pressure from activist investors.

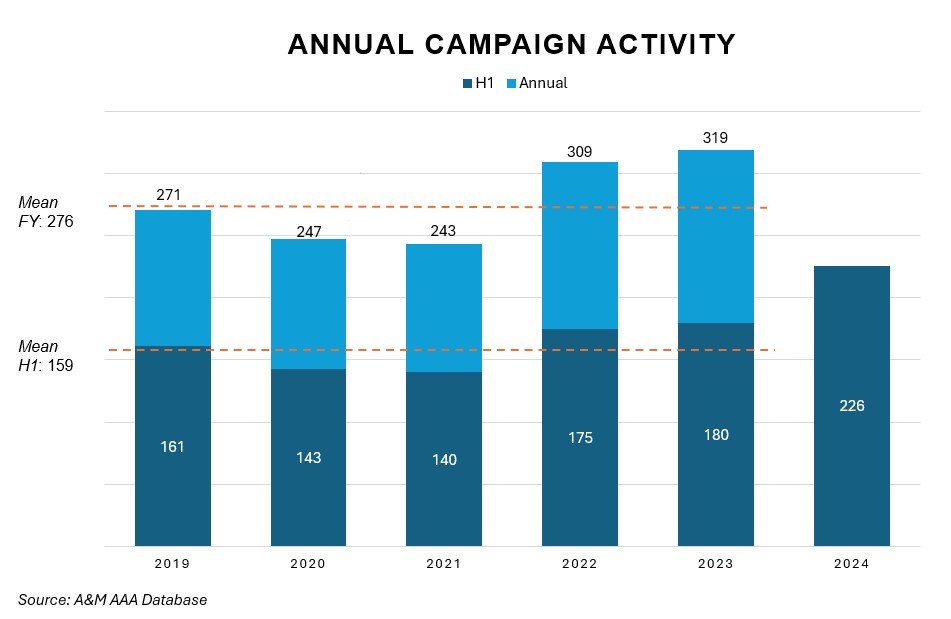

In H1 2024 alone, investor activism surged 42 percent above the past five-year average, and more than half of the 147 campaigns targeted companies valued more than $10 billion.[1]

How can directors better equip organizations to handle these threats? Rather than playing defense and reacting to threats, boards need to be much more proactive in identifying and addressing vulnerabilities before activists come knocking. As activist investor and Pershing Square Holdings CEO Bill Ackman declared,

"In a disruptive world, you have to disrupt yourself, because if you don't, someone else will." [2]

Activism Rising

Boards play the central role as guardian of shareholder value and stakeholder interests. And with the threat of activism rising, boards must actively engage to protect the organizations they serve.

We recommend three critical pillars for proactive activist defense: a rigorous focus on critical financial metrics, strategic engagement with management and a strengthened board. These interconnected measures form a framework for identifying and addressing vulnerabilities before they become a problem.

- Monitoring a Set of Key Financial Metrics

Effectively predicting vulnerabilities to activist threats hinges on tracking a focused set of essential KPIs that provide actionable insights into a company’s financial health: cash flow, liquidity, EBITDA margins and return on invested capital.

Boards should monitor and benchmark these financial metrics against industry peers to proactively address potential weaknesses:

- Cash is still king. Monitor cash flow, including up-to-date accounts payable and accounts receivable trends.

- Elliott Management's recent $2.5 billion investment in Texas Instruments highlighted the importance of cash flow monitoring, as the activist firm targeted the company's declining free cash flow per share, which had dropped from $6.40 in 2022 to an expected $1.83 in 2024 due to rigid capital expenditure policies.[3]

- Review corporate liquidity position. Conduct rigorous, regular analysis of debt levels, covenant terms and effects on the business’s financial position.

- Focus on EBITDA margins at the product and customer segment level to proactively identify issues looking at YoY quarterly trends.

- Elliott Management's campaign against Southwest Airlines in 2024 highlighted concerns over declining profit margins. Southwest's profits fell by nearly two-thirds due to rising operational costs, prompting Elliott to pressure the airline for strategic changes to enhance profitability.[4]

- Evaluate return on invested capital (ROIC). Analyze ROIC performance at product and customer segment levels, including historical performance, trends and projected outcomes.

Regular reviews with the CFO to assess these indicators against industry benchmarks will be instrumental in developing specific action plans for issues and risks identified. These plans should include clear timelines for addressing suboptimal performance across core financial performance indicators to preempt activist demands.

- Strategic and Transparent Dialogue With Management

Well-run, successful boards utilize frameworks and tools to promote a higher level of engagement with management. As an example, McDonald’s Corporation’s enterprise risk management framework emphasizes ongoing dialogue between directors and senior leadership on activism threats. Why? Mitigating activist risks requires strategic, transparent engagement between board and management. Through McDonald’s Public Policy & Strategy and Sustainability & Corporate Responsibility Committees, the board engages closely with management to align on strategic oversight and adapt governance practices to evolving external pressures.[5]

Boards should follow suit to:

- Establish routine activism risk reviews. Directors and management can identify vulnerabilities before they become activist targets by jointly evaluating potential entry points and staying up-to-date on the activism landscape.

- Hold regular coaching sessions for management. Prepare management to handle activist interactions effectively and maintain positive stakeholder relationships in the event of a campaign. Use coaching sessions with directors to guide management in best practices for activism defense, shareholder communication and public relations.

- Conduct activism readiness drills. Somewhat like a war game, activism readiness drills simulate activist threats to help management and boards rehearse coordinated responses. Practiced regularly, these drills will reinforce alignment and preparedness across all levels of leadership.

- Board Composition

Universal proxy card rules dramatically amplified the threat of activism. Under this 2022 SEC regulation, all director nominees must appear on a single proxy card, enabling activists to precisely target board members they consider vulnerable.

In 2024, changes in board composition have been the most common activist demand, with 49 percent of campaigns targeting seats and with activists winning 80 percent of targeted seats.[6]

Yet, boards appear unconcerned. Corporate Board Member Magazine found that:

29 percent of surveyed directors believe their boards have no weaknesses,[7] while a staggering 95 percent of board members are typically reelected each year.[8]

In today’s environment, this is tantamount to lighting a beacon in enemy territory.

- Conduct regular board evaluations. Boards must ensure their members have the necessary skills to guide the company effectively and address their strategic challenges. Implementing regular evaluations against robust skills matrices will enable the qualifications and competencies required for each board position to be assessed consistently and systematically.

- Scrutinize board retirement policies. The status quo is riskier than ever. Boards that aren’t making room for fresh perspectives and new ideas are asking for closer scrutiny. Take a hard look at retirement policies and be prepared to revise the age or tenure limits for members in order to promote regular board refreshment.

- Implement routine performance evaluations. All members must be demonstrably contributing to the board’s goals. Put a structured evaluation process in place to assess individual director contributions, deal with underperformance and identify areas for improvement.

Conclusion

To safeguard against activist threats, boards must take a page from the activist playbook. They must be willing to disrupt the status quo before it is done for them.

Continuous monitoring of risk indicators, strategic engagement with management and assessment of board vulnerabilities can ultimately transform potential threats into collaboration, criticism into catalyst, and the challenge of activism into opportunity.

[1] Rebecca Sherratt, “A 2024 proxy season review: 3 themes for boards and investors,” Diligent, July 31, 2024, Accessed November 5, 2024

[2] Bill Ackman, “An activist investor on challenging the status quo,” TED Talk, April 2024,

[3] David Faber, “Activist Elliott takes $2.5 billion stake in Texas Instruments, urges company to improve free cash flow,” CNBC, May 28, 2024, updated May 29, 2024

[4] David Koenig, “Southwest settles proxy fight with hedge fund as Q3 profit shrinks. American loses money,” AP News, October 24, 2024

[5] McDonald’s Corporation, Financial information, annual reports and SEC filings, Accessed November 5, 2024

[6] Jim Rossman, “Shareholder activists take aim at Boards,” Barclays IB, May 16, 2024

[7] “What Directors Think: Governing in the Age of Disruption,” Corporate Board Member and Diligent Institute 2024 Report, Corporate Board Member, January 31, 2024

[8] Edna Twumwaa Frimpong, “Director Elections under the Microscope,” Harvard Law School Forum on Corporate Governance, October 22, 2023