Alvarez & Marsal’s UAE Banking Pulse Report for Q1 2018 Analyzes Performance of Banking Sector

Dubai – Leading global professional services firm Alvarez & Marsal (A&M) today released its latest UAE Banking Pulse for Q1 2018, showing that UAE banks continue to perform well, with higher levels of profitability, and liquidity is expected to remain healthy for the remainder of 2018.

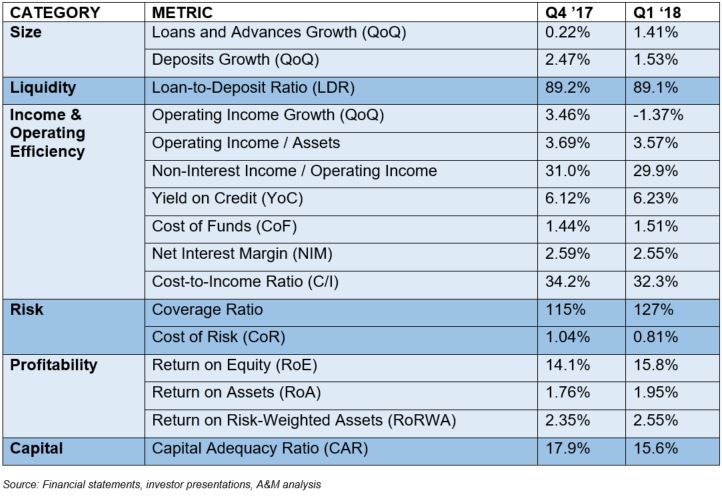

Comparing the data of the 10 largest listed banks in the UAE, this UAE Banking Pulse report looks at the first quarter of 2018 (Q1 2018) against the fourth quarter of 2017 (Q4 2017), identifying the prevailing trends throughout the intervening period.

Key trends for Q1 2018 were as follows:

- Deposits grew at a similar rate (1.41 percent) as loans & advances (L&A) (1.53 percent), resulting in a stable loan-to-deposit (LDR) ratio for Q1 2018, with nine of the top 10 in the LDR “green zone” of between 80 percent and 100 percent. However, on a standalone basis, deposits growth declined. Meanwhile, six of the top banks grew their deposits market share and five grew their L&A market share

- Operating income growth declined (from 3.46 percent in Q4 2017 to -1.37 percent in Q1 2018) along with non-interest income (from 31.0 percent in Q4 2017 to 29.9 percent in Q1 2018)

- Net interest margin (NIM) declined, despite a rise in yield on credit, driven by an increased cost of funds. Five of the top 10 banks witnessed a decrease in NIM

- Cost to income ratio (C/I) improved (falling from 34.2 percent to 32.3 percent), driven by a decrease in operating expenses of 45 basis points (bps). This reversed last quarter’s increase and continued the trend from previous quarters

- Cost of risk fell significantly (from 1.04 percent in Q4 2017 to 0.81 percent in Q1 2018), due to decreased loan loss provisions

- Return on equity (ROE) and return on assets (ROA) both increased due to a decrease in cost of risk and operating expenses. This came at the expense of a decrease in capital adequacy ratio (CAR). Nine out of 10 banks showed an increase in ROE

Alvarez & Marsal’s report uses independently-sourced published market data and 16 different metrics to assess the banks’ key performance areas including size, liquidity, income, operating efficiency, risk, profitability and capital.

The country’s 10 largest listed banks analysed in A&M’s UAE Banking Pulse are First Abu Dhabi Bank (FAB), Emirates NBD (ENBD), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB), Mashreq Bank (Mashreq), Abu Dhabi Islamic Bank (ADIB), Union National Bank (UNB), Commercial Bank of Dubai (CBD), National Bank of Ras Al-Khaimah (RAK), and the National Bank of Fujairah (NBF).

OVERVIEW

The table below sets out the key metrics, with the underlying theme being an increase in profitability, and stable liquidity.

A&M Managing Director in the firm’s Financial Institutions Advisory Services practice Dr. Saeeda Jaffar served as lead author. A&M Managing Directors Asad Ahmed and Neil Hayward, who specialize in turnaround and restructuring, co-authored the report.

Dr. Saeeda Jaffar commented: “In terms of liquidity, this quarter saw similar growth in both deposits and loans & advances. This resulted in a stable loan to deposit ratio (LDR), with nine out of the 10 banks in the “sweet spot” with what is typically considered to be a healthy amount of liquidity. On a standalone basis though, we saw a decline in the growth rate of deposits.”

Dr. Jaffar continued: “Looking at profitability for the period, we believe that the drivers for the increase in return on equity are threefold. Firstly, we have seen lower operating costs, which are decreasing at a higher rate than the previous quarter. Next, a decrease in cost of risk has been driven by significant decrease in provisioning, as banks were thinking ahead and made higher provisions during the previous quarter. Finally, we saw an increase in leverage of the banks’ balance sheets, aimed at getting the assets to sweat more.”

###

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) when conventional approaches are not enough to activate change and achieve results.

Privately held since 1983, A&M is a leading global professional services firm that delivers business performance improvement, turnaround management and advisory services to organizations seeking to transform operations, catapult growth and accelerate results through decisive action. Our senior professionals are experienced operators, world-class consultants and industry veterans who leverage the firm's restructuring heritage to help leaders turn change into a strategic business asset, manage risk and unlock value at every stage.

When action matters, find us at alvarezandmarsal.com. Follow A&M on LinkedIn, Twitter and Facebook.